Salinas California Financial Account Transfer to Living Trust

Description

How to fill out California Financial Account Transfer To Living Trust?

Locating authentic templates tailored to your regional statutes can be difficult unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 legal documents catering to both individual and business requirements and various real-world situations.

All documents are accurately categorized by usage area and jurisdiction, making the search for the Salinas California Financial Account Transfer to Living Trust as simple as pie.

Ensure your documentation remains organized and in compliance with legal standards. Utilize the US Legal Forms library to have essential document templates readily available for any purpose!

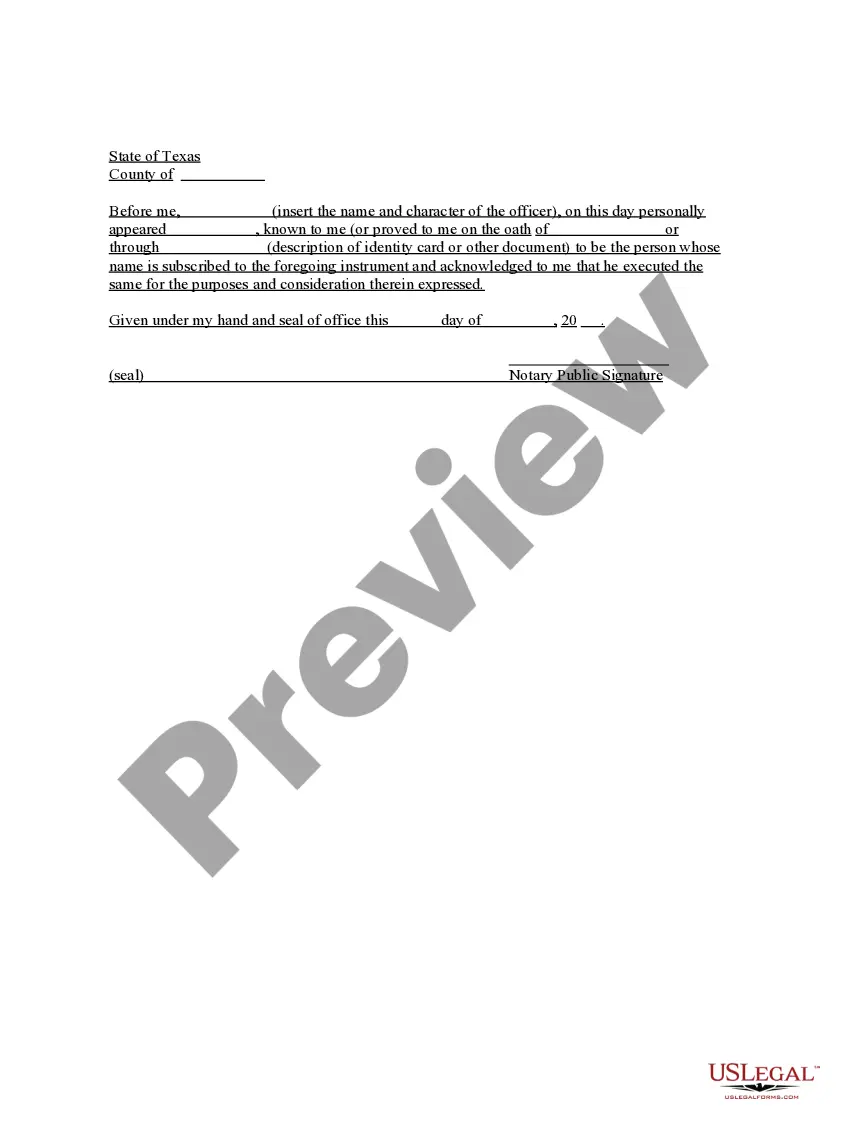

- Check the Preview mode and document description.

- Ensure you’ve selected the appropriate one that fits your needs and fully aligns with your local jurisdiction rules.

- Search for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

One major downfall of having a trust is that it can limit flexibility in asset management. Once assets are placed in a trust, accessing them may become more complicated compared to outright ownership. Furthermore, trusts require ongoing oversight, which can lead to additional administrative burdens. If you're considering the Salinas California Financial Account Transfer to Living Trust, it is essential to weigh these factors and seek professional advice to navigate the complexities involved.

Trust funds carry certain risks, including mismanagement or misuse of assets by the trustee, which can jeopardize the intended benefits for the beneficiaries. Moreover, if the trust is not properly set up, it may not provide the desired protection or tax advantages that were anticipated. Therefore, a thorough understanding of the Salinas California Financial Account Transfer to Living Trust process can help mitigate these risks, ensuring assets are safeguarded properly.

Determining whether your parents should put their assets in a trust depends on their financial situation and goals. A trust can help manage assets effectively while minimizing probate costs and protecting beneficiaries. If your parents are concerned about estate taxes or want to ensure a smooth transfer of assets, a Salinas California Financial Account Transfer to Living Trust could be a practical solution. Consulting with a professional can provide clearer guidance for their unique circumstances.

One downside of putting assets in a trust is the potential for increased administrative costs. This includes expenses for setting up the trust and ongoing legal fees, which can add up over time. Additionally, transferring assets to a trust can lead to complications in managing the trust if the terms are not clearly defined. Therefore, considering a Salinas California Financial Account Transfer to Living Trust requires careful planning to avoid unintended consequences.

To transfer property into a trust in California, start by creating the trust document with clear details about the property and the trustee’s authority. Next, you will need to execute a grant deed that names the trust as the new owner. This process helps ensure that your assets are protected and properly managed under the terms of your Salinas California Financial Account Transfer to Living Trust.

One disadvantage of placing your house in a trust in California is the potential tax implications. You may lose certain tax benefits, like the homestead exemption. Additionally, setting up a trust can involve upfront legal costs, which may be a consideration for some. Understanding these factors is essential when considering a Salinas California Financial Account Transfer to Living Trust.

Yes, putting bank accounts in a trust is generally a good idea as it can protect your assets, control distribution upon your death, and avoid probate. This approach allows your beneficiaries to access funds quickly in accordance with your wishes. Consulting with a platform like US Legal Forms can help clarify the specifics of the Salinas California Financial Account Transfer to Living Trust process, making it straightforward and beneficial.

A common mistake parents make when setting up a trust fund is failing to properly fund the trust. If assets are not transferred into the trust, it can negate the benefits of the trust in providing for heirs. It's crucial to ensure that all intended assets, including bank accounts, are included in the trust. For guidance on these nuances, consider leveraging US Legal Forms for your Salinas California Financial Account Transfer to Living Trust.

Changing a bank account to a living trust typically involves visiting your bank and requesting account re-titling. Bring your trust document and identification for verification. The bank will provide you with the specific forms needed to make this change. Utilizing resources from US Legal Forms can streamline the Salinas California Financial Account Transfer to Living Trust process, making it more manageable.

Yes, putting your trust name on checks is a sound practice if your accounts are held in the trust. This allows for proper management and disbursement of funds as outlined in your trust agreement. It also ensures that checks are properly issued under the trust's name, facilitating the smooth operation of your financial affairs. Proper documentation facilitated by US Legal Forms can ease this Salinas California Financial Account Transfer to Living Trust.