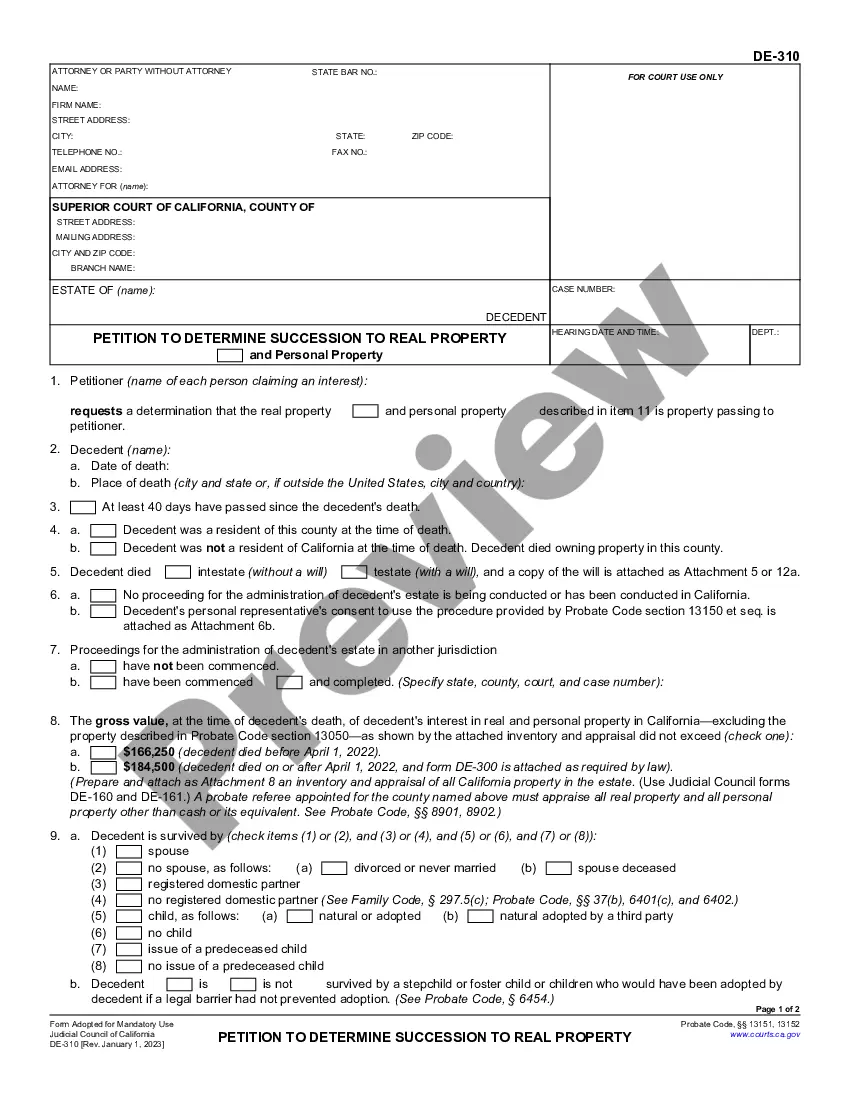

Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less

Description

How to fill out California Order Determining Succession To Real Property And Personal Property - Small Estates $184,500 Or Less?

We consistently endeavor to minimize or eliminate legal repercussions when engaging with intricate legal or financial issues.

To achieve this, we enlist legal services that are typically very costly.

Nevertheless, not all legal issues are of equal complexity. The majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always redownload it from the My documents tab.

- Our platform empowers you to handle your affairs without resorting to a lawyer.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

- Utilize US Legal Forms whenever you need to locate and download the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $166,425 or Less or any other document effortlessly and securely.

Form popularity

FAQ

While it is not mandatory to have a lawyer to file a small estate affidavit, having legal assistance can be beneficial. Lawyers can help clarify the process, ensuring adherence to the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less. For those seeking guidance, platforms like uslegalforms provide user-friendly resources and templates to facilitate the filing process.

Succession in real estate refers to the legal process through which property ownership is passed from the deceased to their heirs. This process ensures that all real and personal property is legally distributed according to applicable laws and the deceased’s wishes. When managing the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, understanding succession is essential for proper inheritance.

In New York, the rules for small estates permit a simplified procedure when the estate's value does not exceed $50,000. This allows heirs to inherit without undergoing a lengthy probate process. If you're dealing with the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, knowing your state's rules can streamline the inheritance process significantly.

To petition an estate means to formally request the court to approve the distribution of an estate's assets. This process includes detailing how property and personal items are to be allocated according to the law or the deceased’s wishes. Understanding this process is crucial when dealing with the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less to ensure compliance with state regulations.

Yes, you can file a small estate affidavit without a lawyer in California. However, navigating the necessary documentation and procedures can be complex, especially under the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less. Consider using legal services such as uslegalforms to simplify the process and ensure your affidavit meets all requirements.

To obtain a small estate affidavit in California, you must complete a specific form provided by the court. This affidavit serves to claim property of a deceased person whose estate qualifies as a small estate, particularly under the guidelines of the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less. You can usually find these forms at local courthouses or online legal platforms like uslegalforms.

A client may need to file a Heggstad petition when they discover property that should have been included in a trust but was not. This filing assists in determining the rightful succession of real property and personal property, particularly relevant for the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less. Utilizing this petition ensures that all property is distributed according to the deceased's wishes.

In Indiana, the limit for a small estate affidavit is $50,000. This amount refers to the total value of the deceased person's assets, excluding some exemptions. When considering the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, the limits differ by state. It's important to understand the specific laws in your area to navigate the estate effectively.

Not all estates must go through probate in California. Those with a total value of $184,500 or less can use the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less to avoid the standard probate process. This option simplifies the transfer of property and can be a significant relief for families dealing with loss, allowing for quicker access to assets.

In California, certain assets are exempt from probate, which includes small estates valued at $184,500 or less. By utilizing the Norwalk California Order Determining Succession to Real Property and Personal Property - Small Estates $184,500 or Less, you can facilitate a smoother transition for small estates. These exemptions help reduce the burden on your heirs, making the estate settlement process quicker and less burdensome.