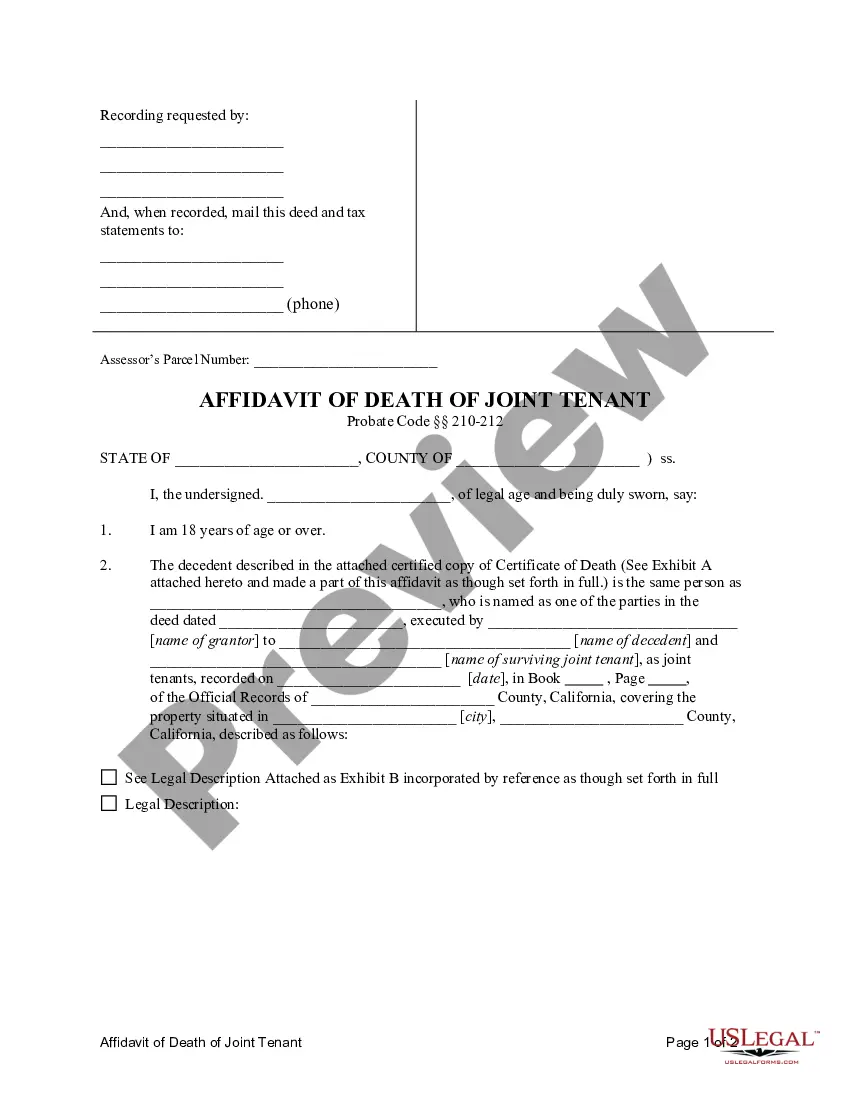

This form is an Affidavit of Death of Joint Tenant for use in the State of California. The form is used by surviving tenant with rights of survivorship, as part of the process of assuming full title to the property. The form is pursuant to California Probate Code Sections 210-212.

Burbank California Affidavit of Death of Joint Tenant

Description

How to fill out California Affidavit Of Death Of Joint Tenant?

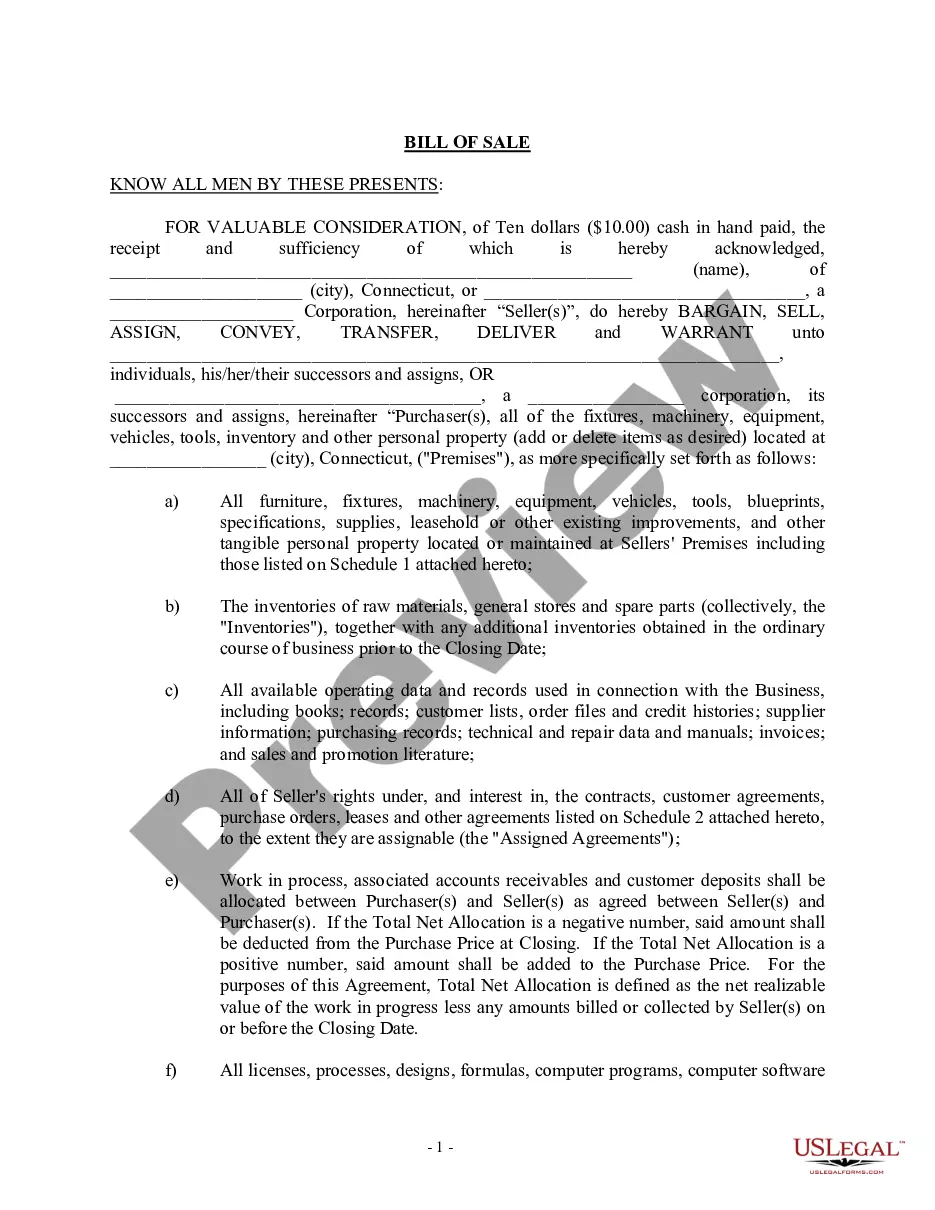

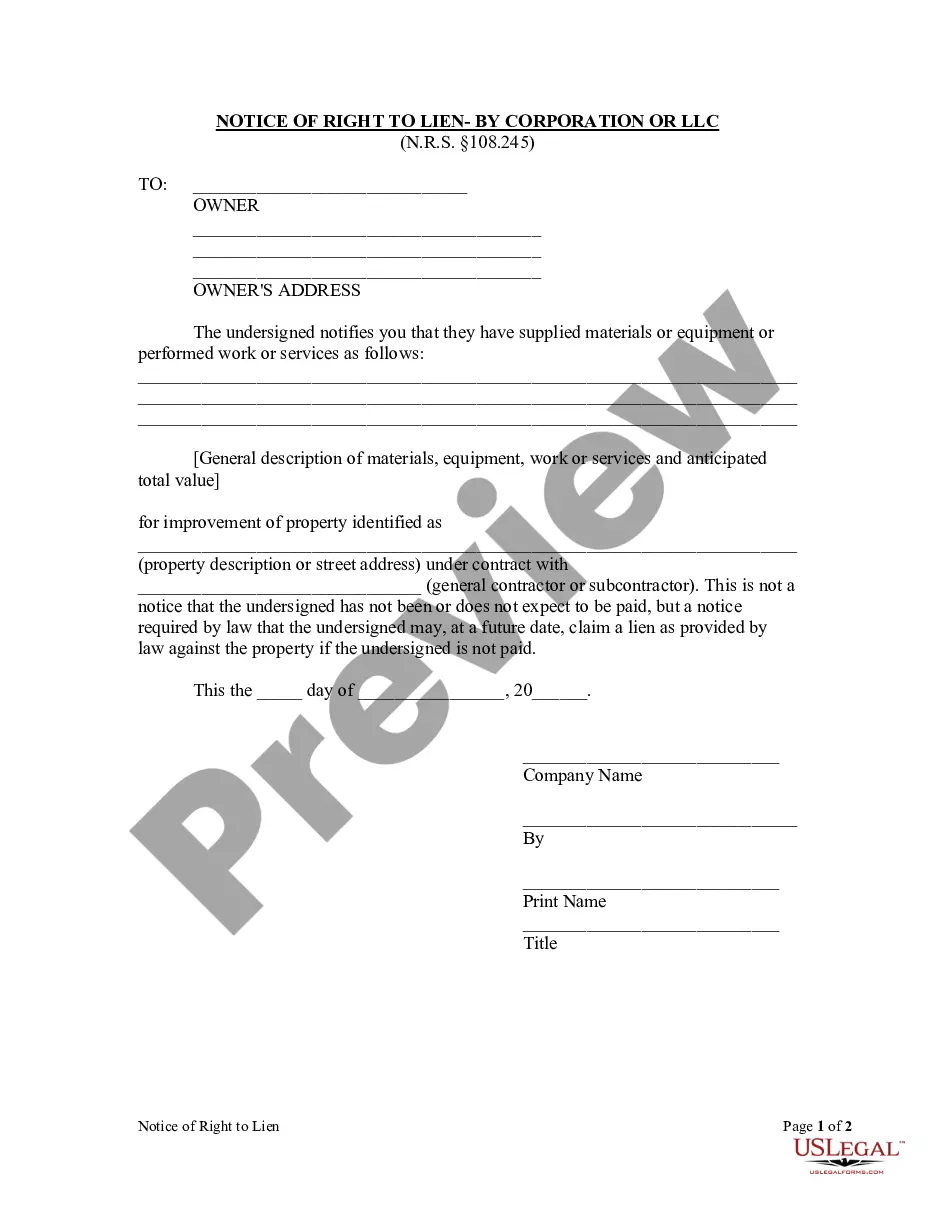

Acquiring validated templates that align with your local statutes can be difficult unless you utilize the US Legal Forms library.

It’s a digital inventory of over 85,000 legal documents for both personal and professional purposes as well as various real-world scenarios.

All the files are accurately organized by usage area and jurisdiction, making it easy to find the Burbank California Affidavit of Death of Joint Tenant in just a few steps.

Maintaining documentation organized and compliant with legal standards is of utmost importance.

- Examine the Preview mode and document description.

- Ensure that you have selected the correct one that fits your needs and adheres to your local jurisdictional requirements.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

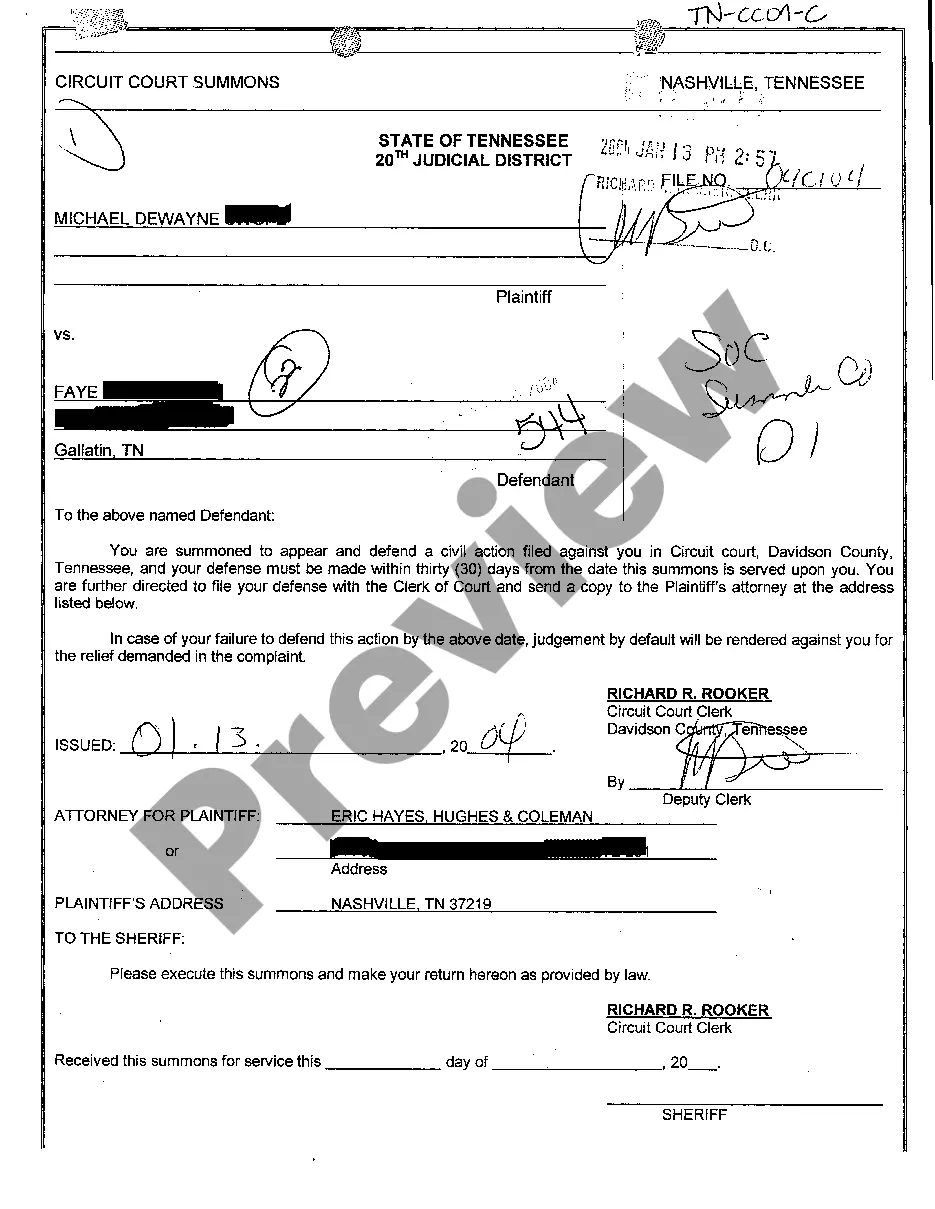

To remove a joint tenant from a deceased deed in California, you will need to file a Burbank California Affidavit of Death of Joint Tenant. This document allows you to assert that a joint tenant has passed away, thus enabling the transfer of their share of the property. You must gather necessary documents, including the original deed and the death certificate. Once completed, submit the affidavit to the county recorder’s office to officially update the property records.

Yes, when a joint tenant dies, the surviving tenant typically receives a step up in basis for tax purposes for the deceased's portion of the property. This means the properties' value resets to its fair market value at the time of death, which can reduce capital gains taxes if the property is sold later. The Burbank California Affidavit of Death of Joint Tenant can be an essential document in this process.

Upon the death of one of the tenants in common in California, their interest in the property does not automatically transfer to the remaining tenants. Instead, it becomes part of the deceased's estate and passes according to their will or, if there's no will, by intestate succession laws. If you're dealing with such a situation, consulting resources or professionals can clarify your next steps.

When a joint tenant dies in California, the deceased's share of the property automatically transfers to the surviving joint tenant. This process is typically seamless, especially with the Burbank California Affidavit of Death of Joint Tenant, which formalizes the change. Understanding this transfer can prevent confusion and ensure a clear property ownership transition.

To avoid property tax reassessment upon the death of a joint tenant in California, you may utilize the Burbank California Affidavit of Death of Joint Tenant. This document can establish the transfer of ownership to the surviving tenant without triggering reassessment, provided all legal guidelines are followed. Consulting with a legal advisor can also provide personalized strategies.

To remove a deceased joint tenant from a deed in California, you will need to file the Burbank California Affidavit of Death of Joint Tenant with the county recorder's office. This affidavit provides proof of death and allows for the necessary changes to the property records. Make sure to gather all required documents and properly fill out the affidavit for a smooth process.

In California, the death of a joint tenant may trigger reassessment of property taxes, depending on how the ownership is structured. However, if the surviving joint tenant inherits the deceased's share through the Burbank California Affidavit of Death of Joint Tenant, that may help in avoiding reassessment. It's best to consult a tax professional for specific cases.

If a tenant dies, the landlord should first reach out to the deceased tenant's family or personal representative. The landlord must verify the tenant's death and review the lease agreement for any specific provisions regarding tenant death. It's crucial to handle the situation with sensitivity. Additionally, understanding the implications for lease termination and property access can be simplified with guidance from resources like US Legal Forms.

When a joint tenant dies in California, you should first retrieve the death certificate. Then, the surviving joint tenant needs to file a Burbank California Affidavit of Death of Joint Tenant with the county recorder's office. This document serves to remove the decedent's name from the title. Engaging with resources like US Legal Forms can streamline this process, making it less daunting.

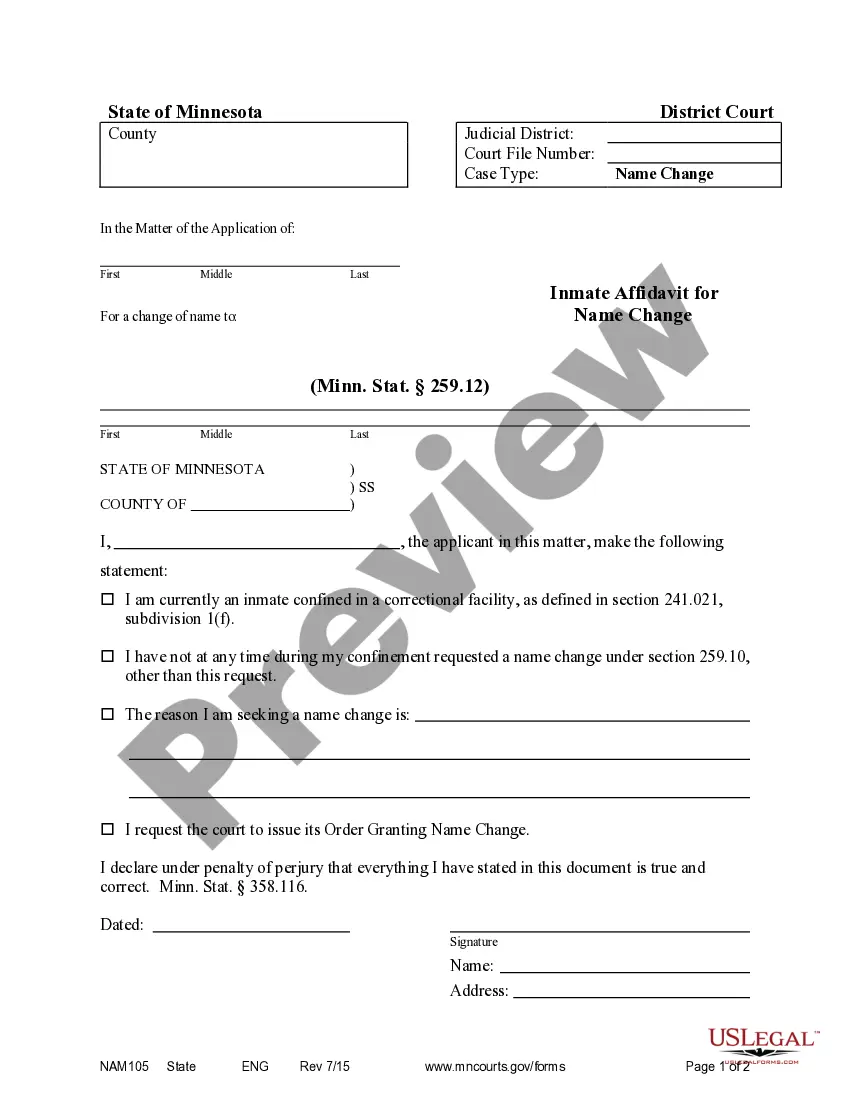

To fill out an affidavit of death form, you need to gather relevant information regarding the deceased and the property in question. Write down the decedent's full name, date of death, and details of the surviving owner. It’s advisable to utilize US Legal Forms, which offers step-by-step instructions to correctly complete the affidavit of death, including necessary legal terminology.