Anaheim California Affidavit of Death of Trustee

Description

How to fill out California Affidavit Of Death Of Trustee?

Are you in search of a reliable and cost-effective provider of legal forms to obtain the Anaheim California Affidavit of Death of Trustee.

US Legal Forms is your best choice.

Whether you require a simple agreement to establish rules for living together with your partner or a collection of documents to facilitate your divorce through the legal system, we have you entirely covered.

Our platform offers over 85,000 current legal document templates for both personal and business purposes.

Verify if the Anaheim California Affidavit of Death of Trustee meets the laws of your state and locality.

Review the details of the form (if available) to understand who and what the document is meant for.

- All templates we provide access to are not generic and structured according to the specifications of particular states and regions.

- To download the document, you must sign in to your account, find the necessary form, and click the Download button beside it.

- Please remember that you can retrieve your previously acquired document templates at any time from the My documents section.

- Are you visiting our site for the first time? No problem.

- You can create an account easily, but prior to that, ensure to do the following.

Form popularity

FAQ

Once you die, your living trust becomes irrevocable, which means that your wishes are now set in stone. The person you named to be the successor trustee now steps up to take an inventory of the trust assets and eventually hand over property to the beneficiaries named in the trust.

If there is no named successor trustee, the involved parties can turn to the courts to appoint a successor trustee. If the deceased Trustee had co-trustees, the joint trustees take over the trust without involving the courts. Having many successor trustees can be cheaper than hiring multiple joint trustees.

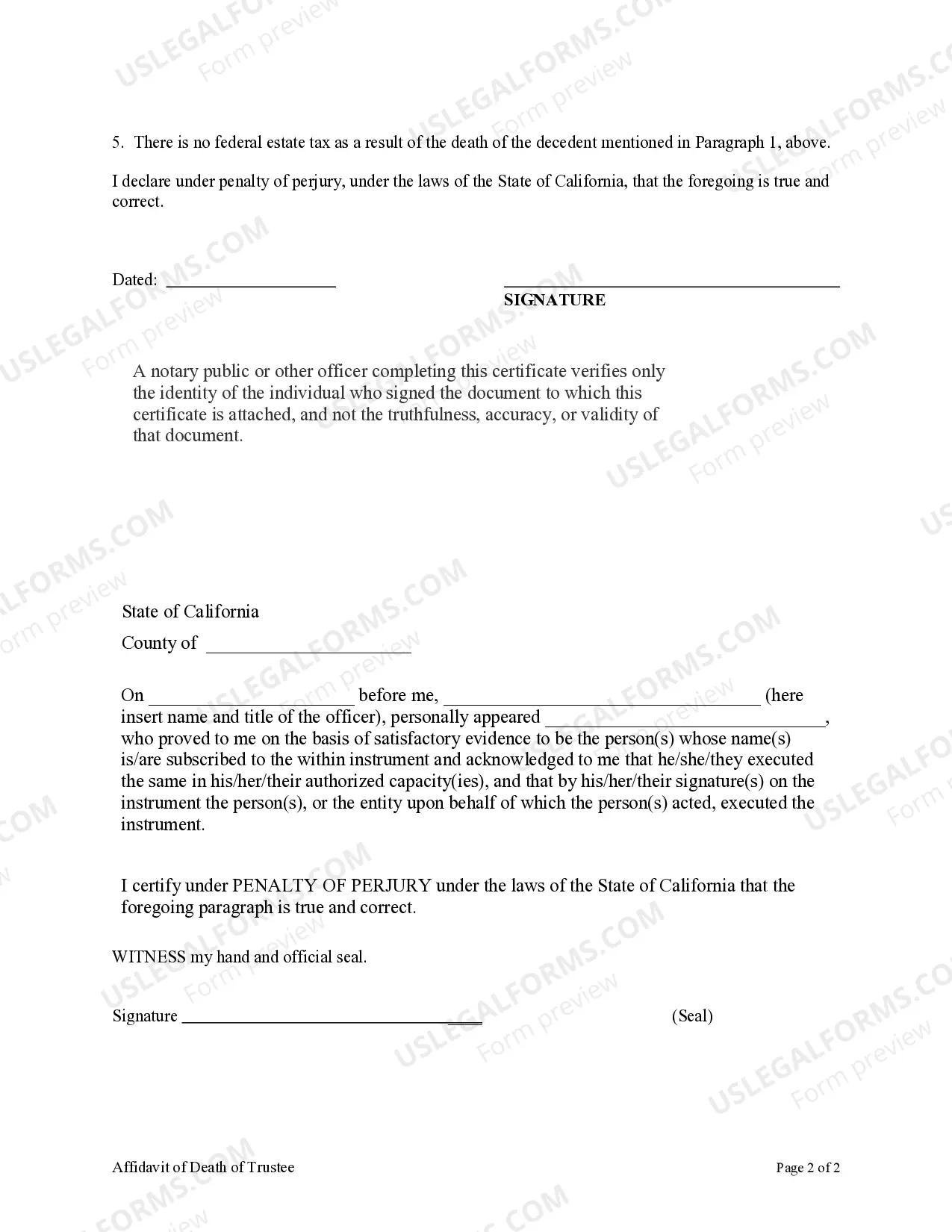

An original certificate of death must be submitted in support of the affidavit. When the affidavit is filed and recorded with the county recorder, the successor trustee can sell the property or transfer ownership to the decedent's children.

Under California's ?Rule Against Perpetuities,? an interest in an irrevocable trust must vest or terminate either within 21 years after the death of the last potential beneficiary who was alive when the trust was created or within 90 years after the trust was created.

To establish heir status in California, you may file an ?affidavit of heirship? in the Superior Court of the county where your deceased family member's property is located. California family code states that the petition must include the heir's basic information including a description of the property you are claiming,

If an irrevocable trust's trustee dies, then the trust agreement generally appoints a successor trustee which can be an individual, public trust company or a privately held trust company. If the trustee of a family trust dies then a successor trustee, which is generally determined beforehand, will be appointed.

The Trustee should include the following information in the notification package: The name of the Grantor and the date that the trust instrument execution date. Contact information for each Trustee, including name, address, county of residence, and phone number. Certified copy of the death certificate of the Grantor.

Upon death of the transferor, the beneficiary must file a Change in Ownership Statement with the county assessor within 150 days of date of death in accord with Revenue and Taxation Code section 480(b).

A living trust becomes irrevocable upon the death or incapacity of the last of the original trust creators. The trustee distributes assets to beneficiaries according to the decedents' instructions without having to go to court and without court supervision.

Under California's ?Rule Against Perpetuities,? an interest in an irrevocable trust must vest or terminate either within 21 years after the death of the last potential beneficiary who was alive when the trust was created or within 90 years after the trust was created.