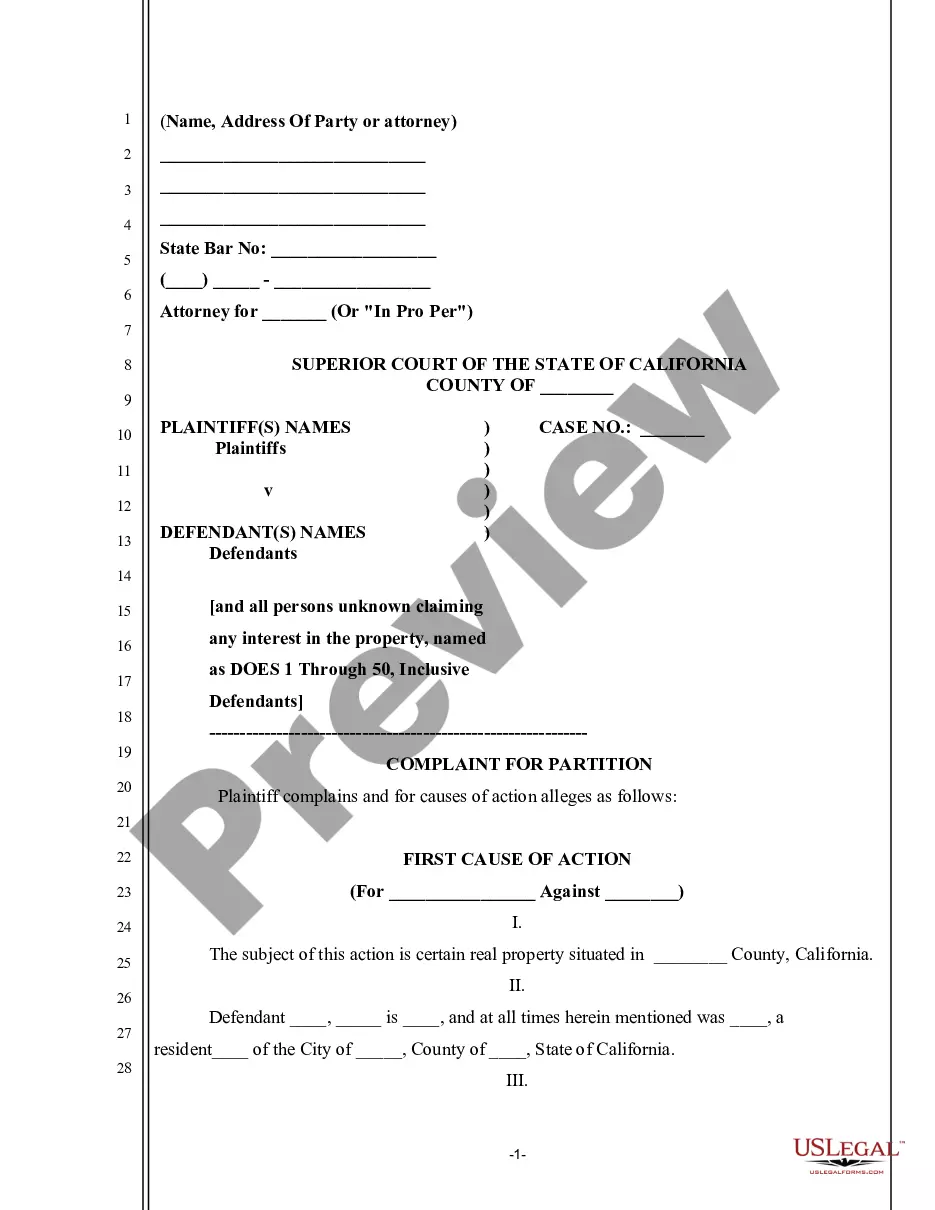

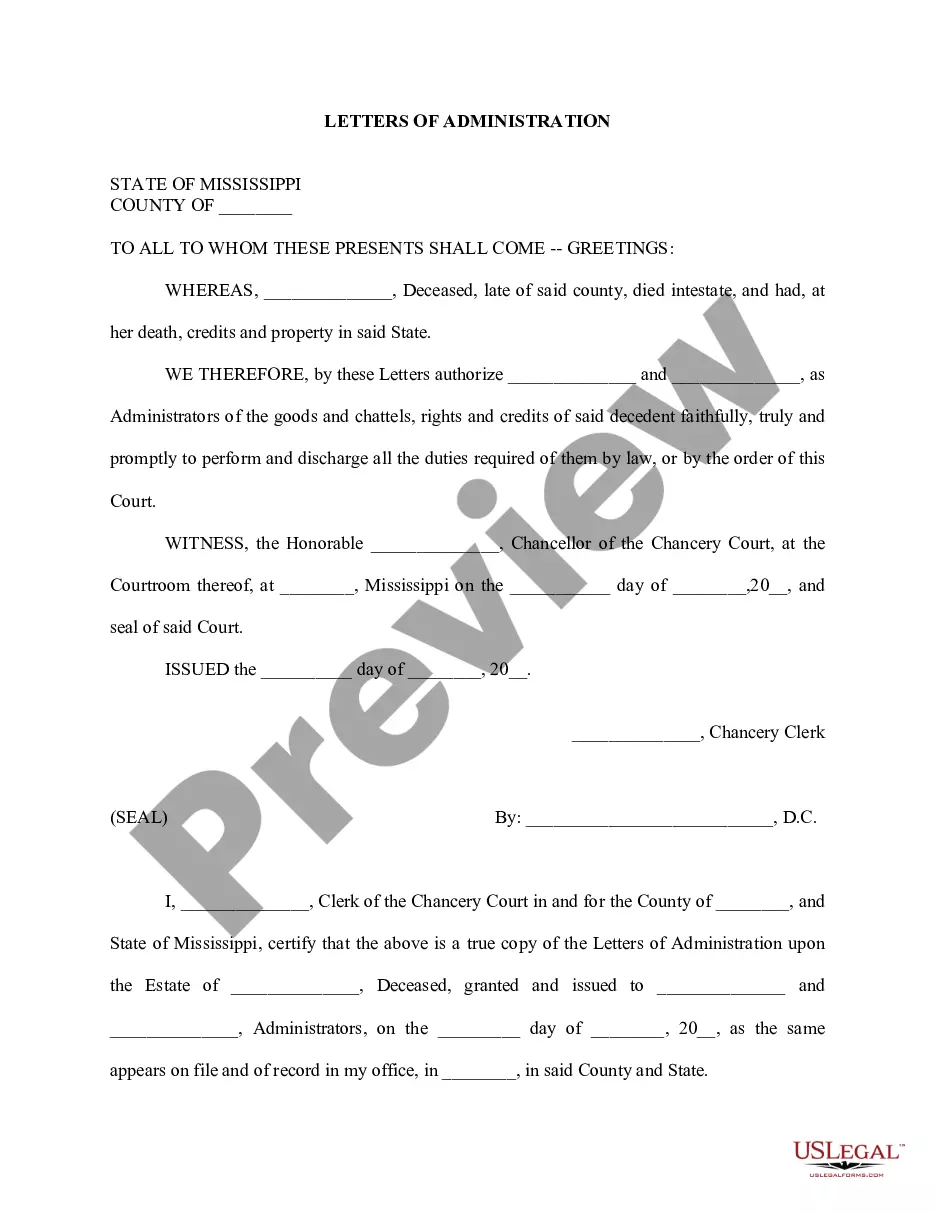

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Vallejo California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

Take advantage of US Legal Forms and gain immediate access to any form you desire.

Our user-friendly platform with a vast collection of documents streamlines the process of locating and obtaining nearly any document sample you need.

You can download, complete, and validate the Vallejo California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 in mere minutes instead of spending countless hours browsing the internet for a suitable template.

Utilizing our library is a fantastic method to enhance the security of your record submissions. Our skilled attorneys routinely examine all the documents to ensure that the templates are applicable for a specific region and comply with current laws and regulations.

Access the page with the template you need. Confirm that it is the specific template you are looking for: verify its title and description, and utilize the Preview function when available. Otherwise, use the Search box to locate the required one.

Initiate the saving process. Click Buy Now and select your preferred payment plan. Then, create an account and complete your order using a credit card or PayPal.

- How do you obtain the Vallejo California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64.

- If you have an account, simply Log In to your profile.

- The Download feature will be visible on all the samples you review.

- Additionally, you can retrieve all previously saved documents from the My documents section.

- If you haven't yet created an account, follow the steps outlined below.

Form popularity

FAQ

Stop Wage Garnishment in California Call the Creditor ? There is nothing lost in trying to talk to the creditor and work out a different arrangement to repay the debt back.File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption.

With the notice of garnishment, you should have been served with a form to claim the exemption for money necessary for support. To claim the exemption in wages, you need to also complete the form financial statement. Note that the financial statement asks for your monthly income.

Limits on Wage Garnishment in California Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

Here are some possible options: Debt Negotiation and Working with Your Creditor. One thing to remember, your creditors usually prefer not to go through the court system to try to recoup the money you owe.Filing a Claim of Exemption.Filing for Bankruptcy to Avoid Wage Garnishment.Vacating A Default Judgment.

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

The writ authorizes the Sheriff to serve a garnishment on the debtor's bank. The bank is required to remit monies from the debtor's account to the Sheriff or explain why funds will not be remitted.

Get form EJ-100 and fill it out. File it with the court and send a copy to the debtor. Keep a copy for your records. Notify the levying officer (i.e., the sheriff's department) that the judgment has been paid and ask them to release the garnishment.

The CCPA prohibits an employer from firing an employee whose earnings are subject to garnishment for any one debt, regardless of the number of levies made or proceedings brought to collect that one debt. The CCPA does not prohibit discharge because an employee's earnings are separately garnished for two or more debts.