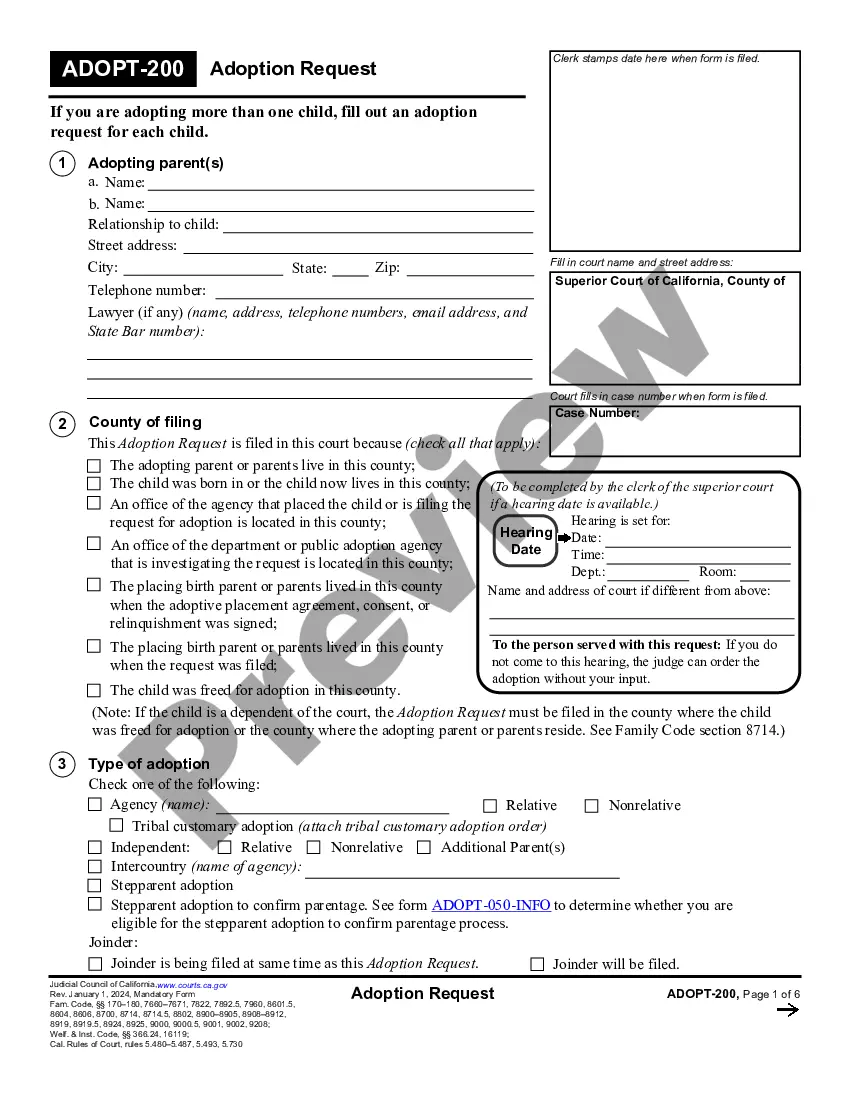

Accounting Report-Adoptions: This report lists all of the expenses incurred from adopting your child. This form is not necessary if one is adopting as a step-parent and/or domestic partner.

Carlsbad California Adoption Expenses

Description

How to fill out California Adoption Expenses?

Take advantage of the US Legal Forms and receive immediate access to any document you need.

Our convenient platform with a plethora of templates enables you to search for and acquire nearly any document sample you require.

You can save, complete, and validate the Carlsbad California Adoption Expenses in just a few minutes rather than spending hours online looking for a suitable template.

Using our library is a superb tactic to enhance the security of your document submissions.

If you do not yet have a profile, follow the steps below.

Locate the template you need. Ensure it is the document you are looking for: verify its title and description, and use the Preview option when it is available. If not, utilize the Search field to find the required one.

- Our knowledgeable attorneys frequently review all documents to guarantee that the templates meet the requirements of a specific area and are compliant with the latest laws and regulations.

- How can you obtain the Carlsbad California Adoption Expenses? If you have an existing subscription, simply Log In to your account.

- The Download button will be activated on all the documents you view.

- Additionally, you can locate all previously saved documents in the My documents section.

Form popularity

FAQ

You should report your adoption expenses when filing your federal tax return to take advantage of any available credits. For Carlsbad California Adoption Expenses, you can include qualifying costs on Form 8839. Seeking guidance from a tax expert can provide clarity on the process and maximize your benefits.

Many families that adopt in Carlsbad may be eligible for a monthly stipend to help cover the ongoing costs of raising a child. This financial aid aims to support adoptive parents, especially if the adoption involves a child with unique needs. Look into local programs to discover available options.

In Illinois, adoptive parents may receive monthly payments to help care for the child, particularly if the child has special needs. While this relates to Carlsbad California Adoption Expenses, it's crucial to understand the benefits vary by state and eligibility criteria. Always check with local adoption services for detailed information.

Generally, adoption subsidies are not considered taxable income. This means that if you receive financial support to cover your Carlsbad California Adoption Expenses, it should not impact your tax return. However, it's essential to verify the details with your financial advisor to ensure compliance with guidelines.

In some cases, adopting parents may receive a stipend to assist with ongoing costs, especially if the child has special needs. While this is not guaranteed for all adoptions, many families in Carlsbad often inquire about available financial assistance for adoption-related expenses. Research the resources in your area to find what support exists.

You may qualify for a tax credit for adoption expenses, which can help offset costs related to your adoption. This tax credit is designed for Carlsbad California Adoption Expenses, allowing you to claim eligible expenses such as legal fees and agency costs. Be sure to consult with a tax professional to determine your specific eligibility.

Qualified adoption expenses cover specific costs related to the adoption process. These may include agency fees, legal fees, and travel expenses that occur during the adoption journey. Understanding these expenses is crucial, especially when considering Carlsbad California Adoption Expenses, as many families can benefit from tax credits and other financial help. Utilizing resources like USLegalForms can simplify tracking and managing these costs effectively.

Adopting a child in California offers numerous benefits, including the joy of providing a loving home to a child in need. Additionally, families can experience emotional fulfillment and the opportunity to grow together. Financial assistance and tax credits often apply, specifically targeting Carlsbad California Adoption Expenses, helping to ease some of the costs involved. Moreover, strong community support and resources are available to assist families throughout the adoption process.

While there are no strict income limits to adopt a child, financial stability is essential in the process. In Carlsbad California, prospective parents often need to demonstrate that they can manage the costs associated with adoption expenses. Financial readiness not only reassures authorities but also prepares you for the ongoing costs of parenting.

Qualified expenses for the adoption credit typically include adoption fees, court costs, and attorney fees. In Carlsbad California, many families may face various costs associated with their adoption journey. Keeping detailed records of these expenses is key to ensuring you take full advantage of the available credit.