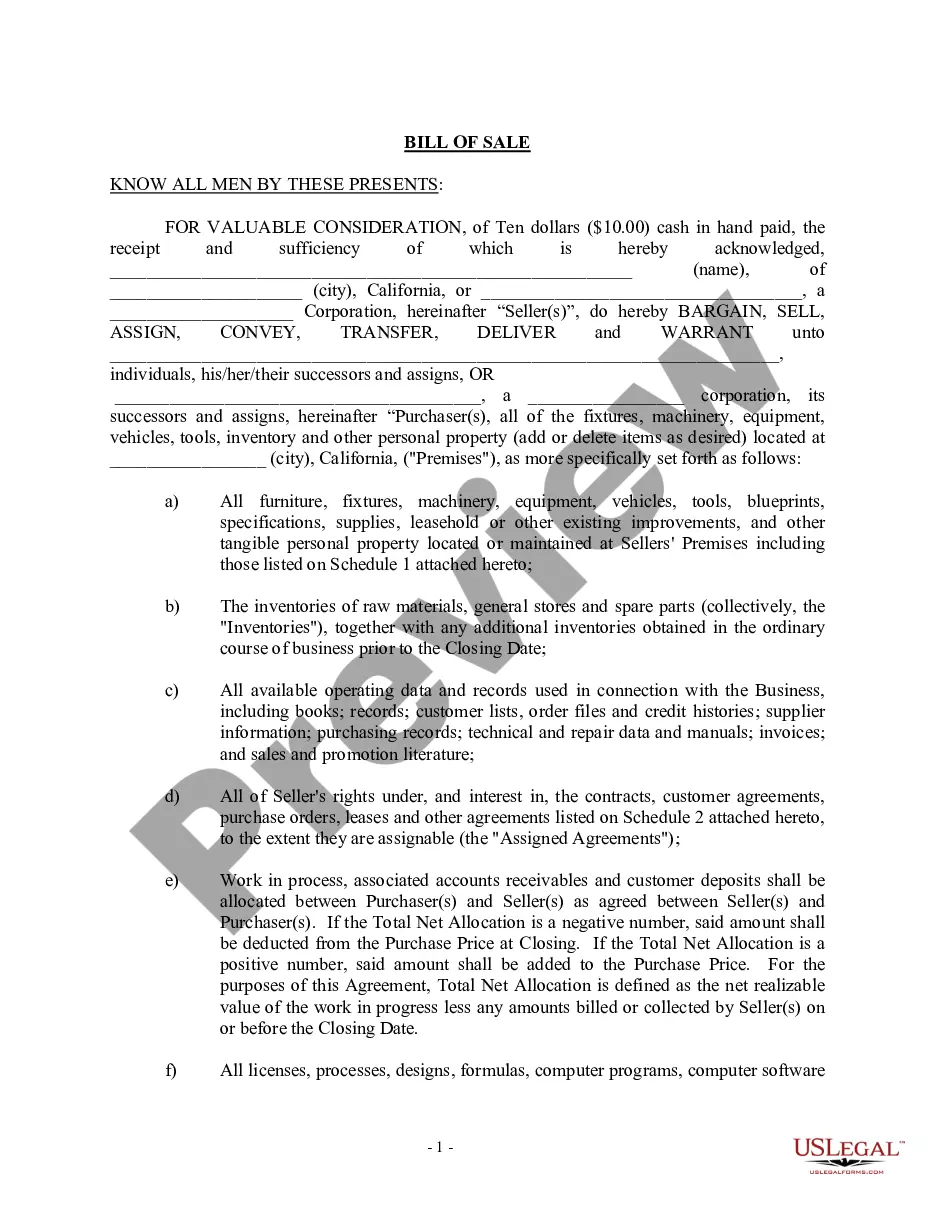

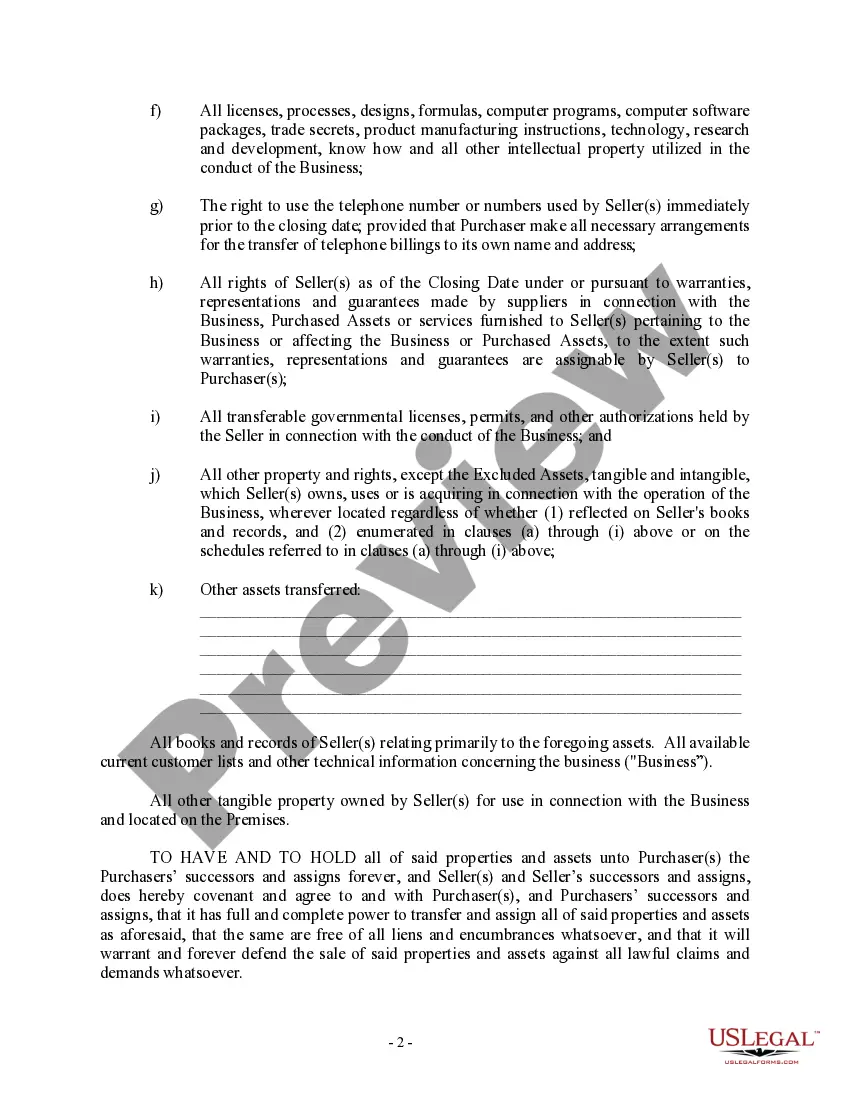

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out California Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

If you are looking for a legitimate form template, it’s incredibly challenging to discover a superior service than the US Legal Forms site – one of the most extensive libraries on the internet.

Here, you can locate thousands of templates for business and personal uses categorized by types, regions, or keywords.

Utilizing our sophisticated search feature, obtaining the latest Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Specify the format and download it to your device. Make edits. Complete, modify, print, and sign the acquired Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

- Moreover, the accuracy of each document is validated by a group of professional attorneys who regularly review the templates on our site and update them in accordance with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to acquire the Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is to Log In to your profile and click the Download option.

- If you are utilizing US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have located the form you desire. Review its description and utilize the Preview option to view its contents. If it doesn’t fulfill your requirements, use the Search option at the top of the page to find the necessary document.

- Verify your selection. Choose the Buy now option. Then, select the desired subscription plan and provide details to create an account.

Form popularity

FAQ

When writing out a bill of sale, be clear and concise. Begin by stating the parties involved and the date of the transaction. Then, provide a detailed description of the business being sold and outline the sale terms. Taking advantage of resources like the Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can guide you through this process and help create a legally sound document.

To properly fill out a bill of sale in California, you should gather all necessary information first. Include details such as buyer and seller names, a comprehensive description of the business, the transaction amount, and any relevant terms. To streamline completing this document, refer to the Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, which provides a convenient format and ensures you include all necessary elements.

In California, notarization is generally not required for a bill of sale to be legal. However, having it notarized can add an extra layer of security, especially in transactions involving a business sale. For the best practices and to ensure peace of mind, consider using the Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, which can be prepared with or without notarization.

Yes, a handwritten bill of sale can be legal in California as long as it contains all required information. This includes the names of the buyer and seller, the description of the business being sold, and any terms of the sale. It's important to note that while a handwritten document can be valid, using a formal template like the Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can provide clarity and prevent disputes.

When closing a business, the tax implications depend on various factors, including the structure of the business and any assets sold. Generally, any proceeds from the sale of business assets after liabilities are settled may incur capital gains taxes. To ensure comprehensive documentation of your closure, consider using a Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, which can help clarify financial details and responsibilities.

In certain situations, an LLC may be exempt from paying sales tax in California, particularly if it qualifies for specific exemptions such as reselling goods or providing certain types of services. However, the rules vary based on the business's activities. For clarity, using a Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can help outline the circumstances of the sale and any relevant exemptions.

No, a seller's permit and a business license are not the same in California. A seller's permit allows a business to sell tangible goods and collect sales tax, while a business license is a general permit issued by local municipalities to operate any business. When crafting a Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it's important to ensure compliance with both permits.

To mitigate capital gains tax on the sale of your business, consider strategies such as reinvesting the proceeds into a Qualified Opportunity Fund or structuring the sale to defer tax liabilities. It is also beneficial to consult a tax advisor about potential deductions and business structuring options. Utilizing a Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can help ensure proper documentation of the sale for tax purposes.

Yes, you typically need a bill of sale for a business. This document formalizes the transaction and ensures that both parties have a clear understanding of the terms and conditions associated with the sale. Using a Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can streamline the sale process and provide peace of mind. It serves as a crucial record that verifies the transfer of ownership and protects your legal interests.

No, Tennessee does not generally require a bill of sale for all sales; however, it is wise to provide one when selling a business. A Costa Mesa California Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller protects both the buyer and seller by clearly outlining the terms of the agreement. It helps to avoid misunderstandings and provides legal protection should disputes arise later. Always check state regulations for specific requirements.