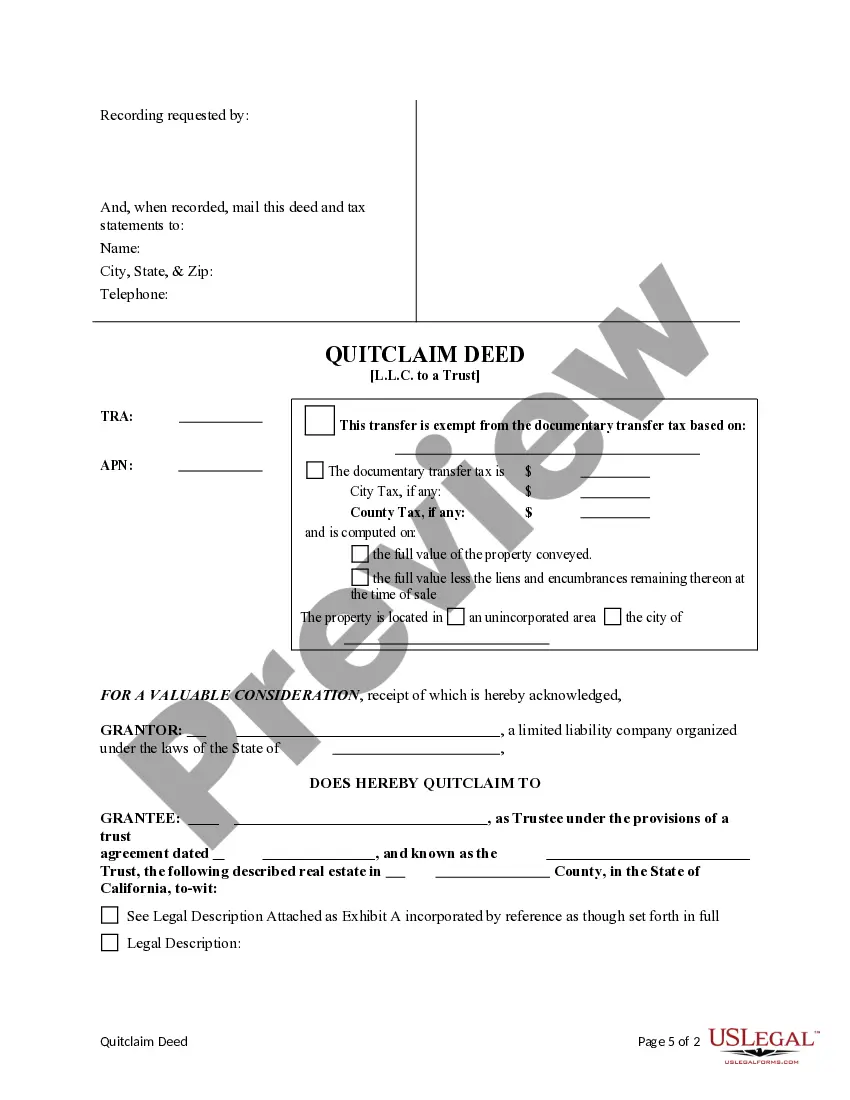

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

San Jose California Quitclaim Deed from a Limited Liability Company to a Trust

Description

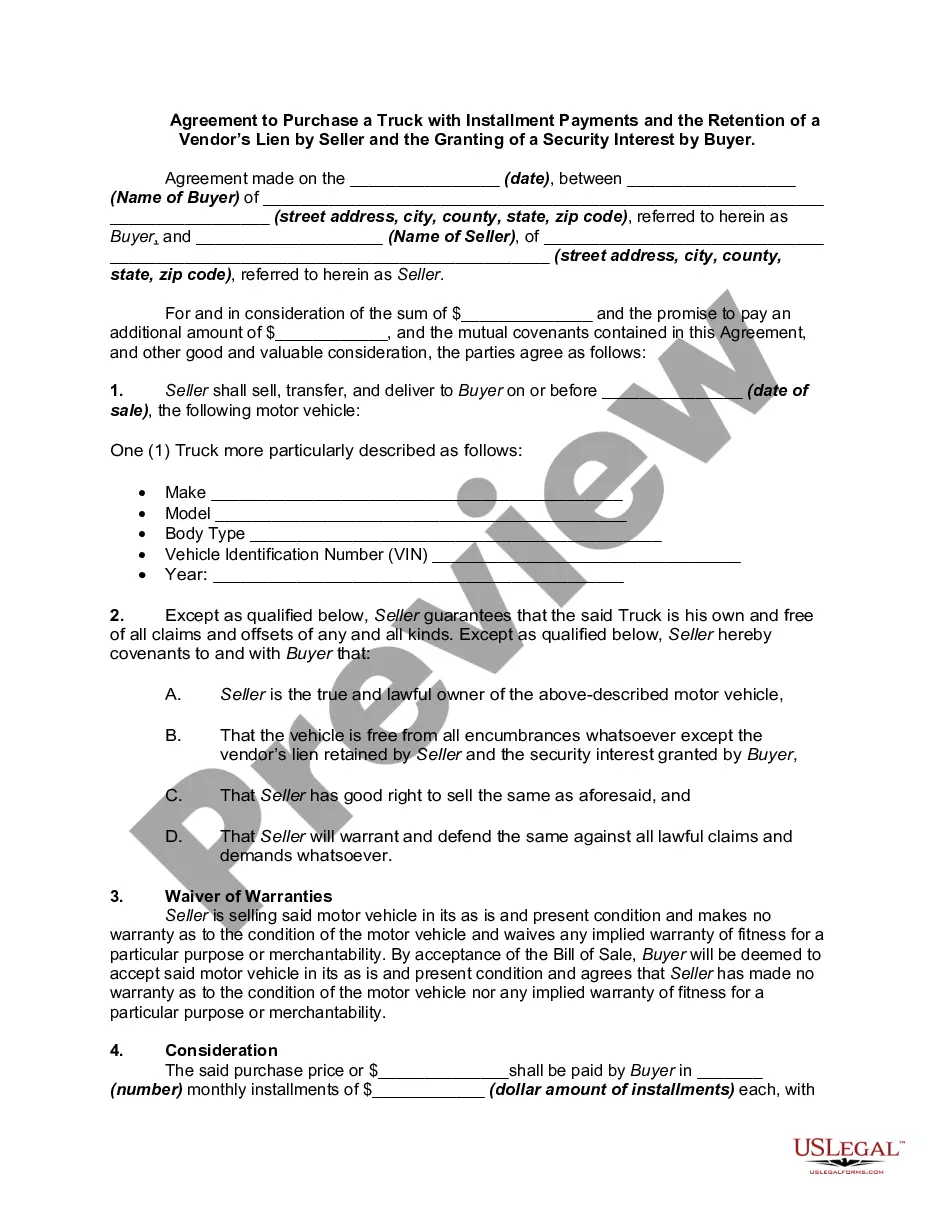

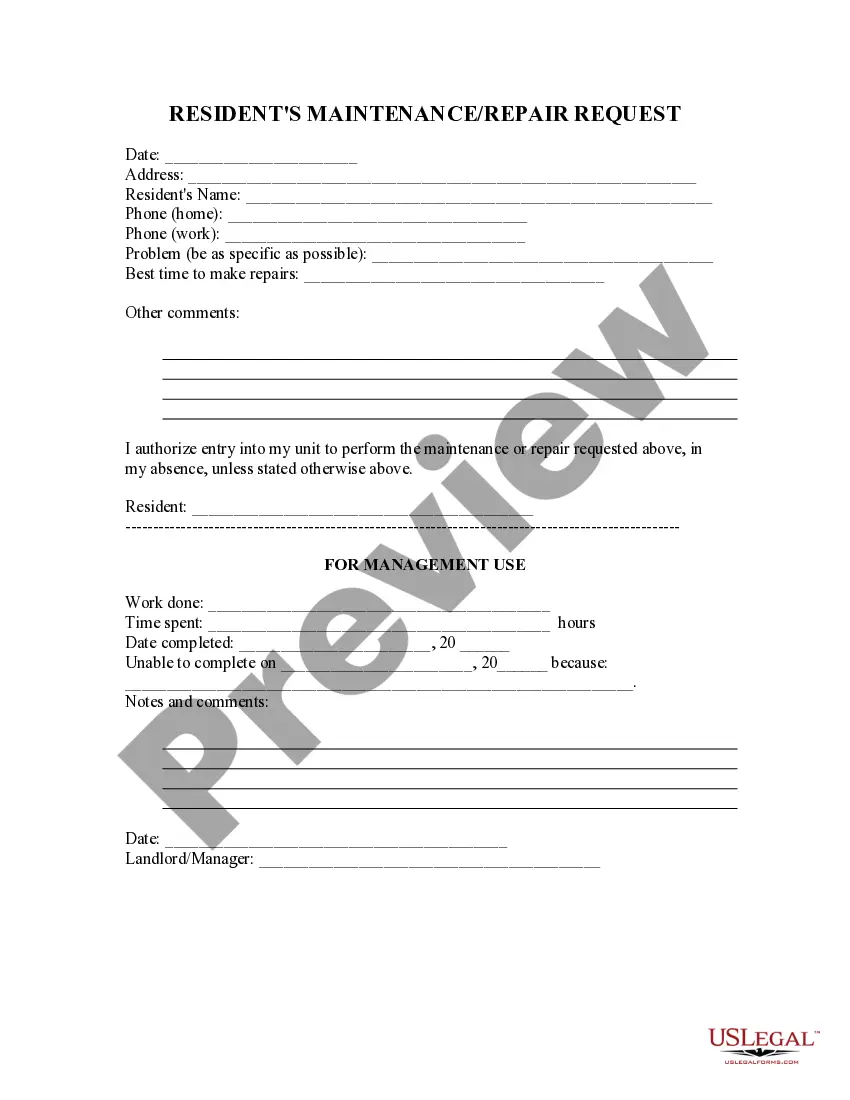

How to fill out California Quitclaim Deed From A Limited Liability Company To A Trust?

Irrespective of societal or occupational rank, completing legal documents is a regrettable requirement in the modern professional landscape.

Frequently, it is nearly impossible for an individual lacking legal education to produce such documents independently, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms can come to the rescue.

Verify that the template you have located is valid for your region, as the regulations of one state or county may not apply to another.

Review the form and read any brief description (if available) regarding the applications of the document.

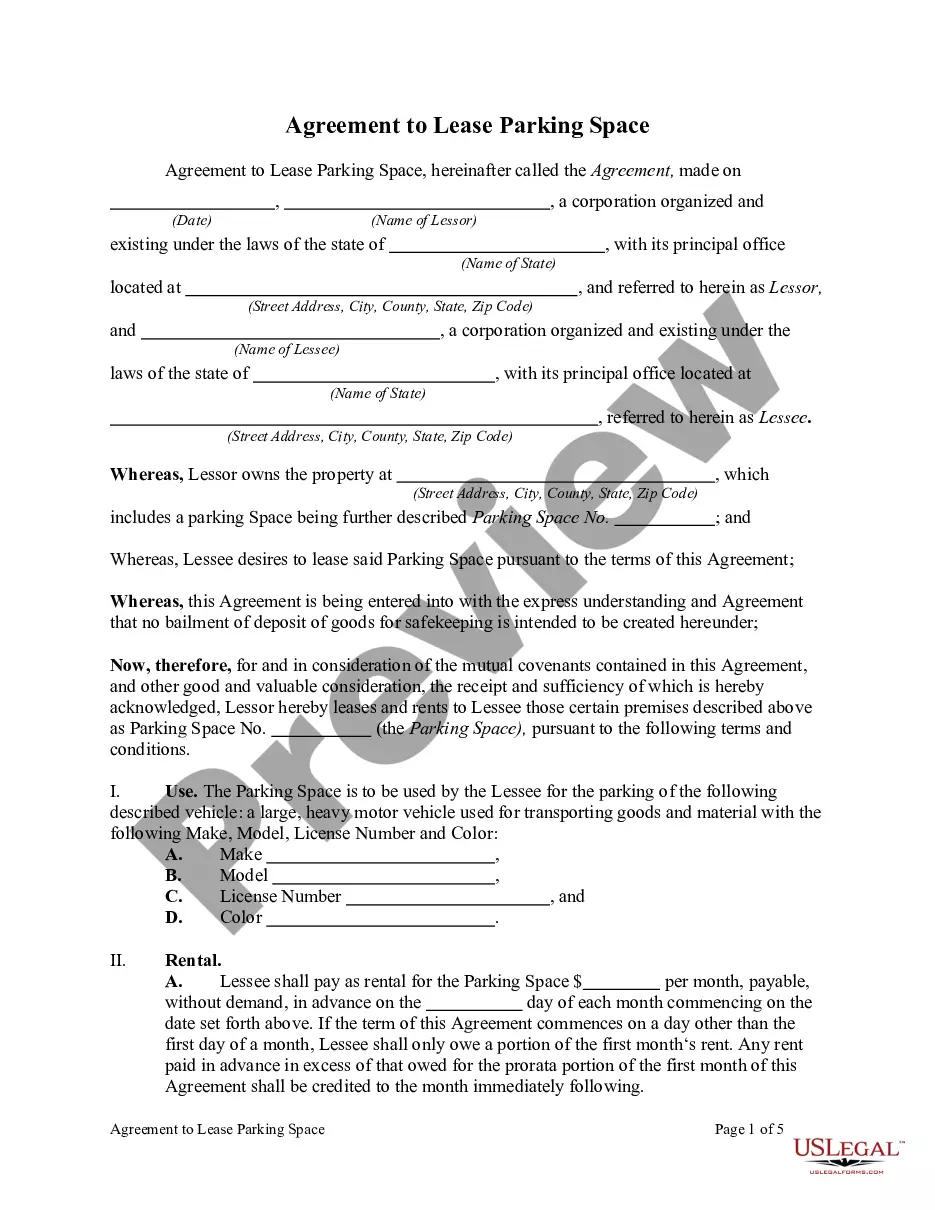

- Our platform offers an extensive array of more than 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms also serves as a valuable tool for associates or legal advisors seeking to enhance their efficiency by utilizing our DIY papers.

- Whether you need the San Jose California Quitclaim Deed from a Limited Liability Company to a Trust or any other document suitable for your state or county, US Legal Forms has everything readily available.

- Here's how to acquire the San Jose California Quitclaim Deed from a Limited Liability Company to a Trust in just minutes using our reliable platform.

- If you are currently an existing customer, feel free to Log In to your account to download the required form.

- However, if you are unfamiliar with our platform, please ensure to follow these steps before obtaining the San Jose California Quitclaim Deed from a Limited Liability Company to a Trust.

Form popularity

FAQ

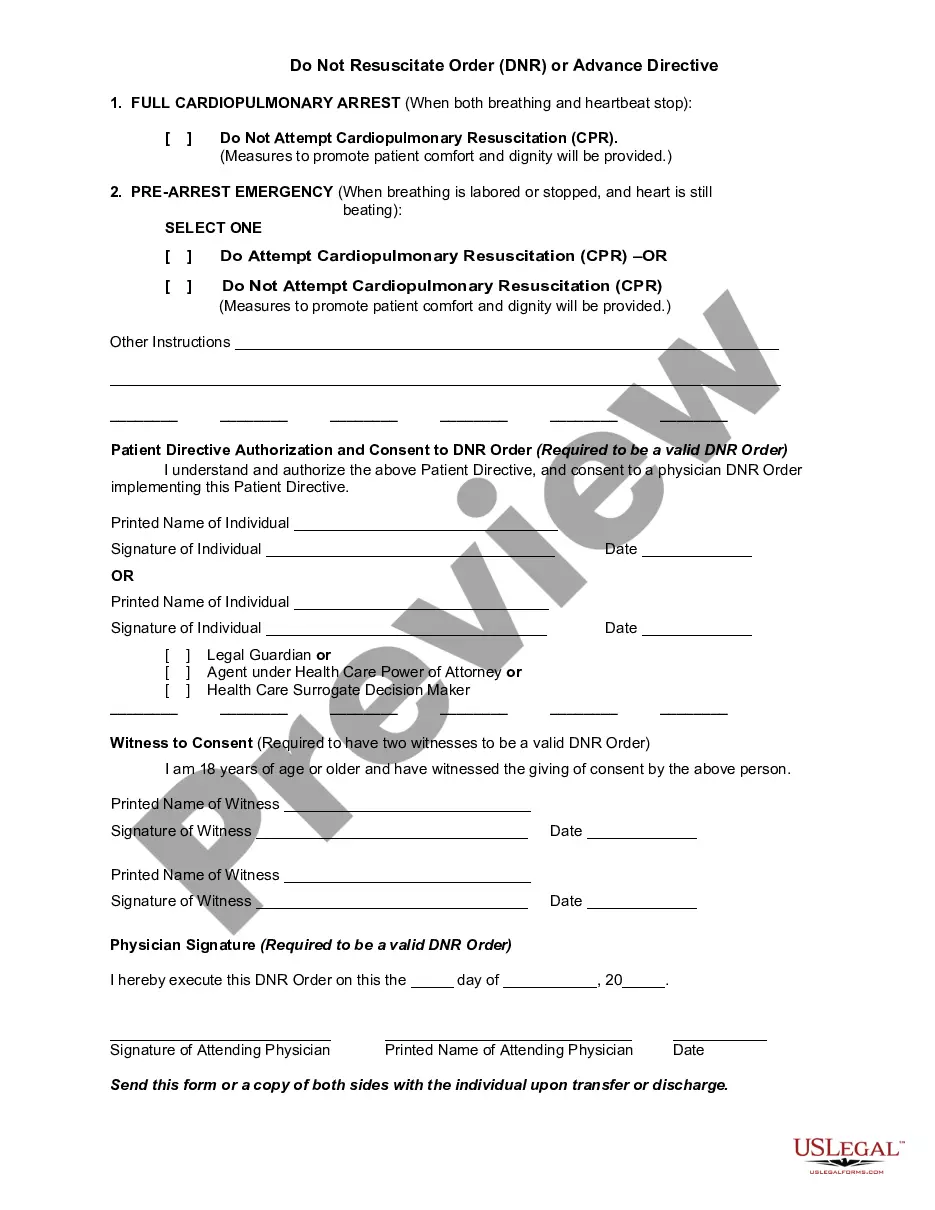

Both types of legal documents serve the same function of transferring ownership of real property. The fundamental difference between quitclaim deeds and grant deeds is the level of protection and warranty provided to the grantee.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

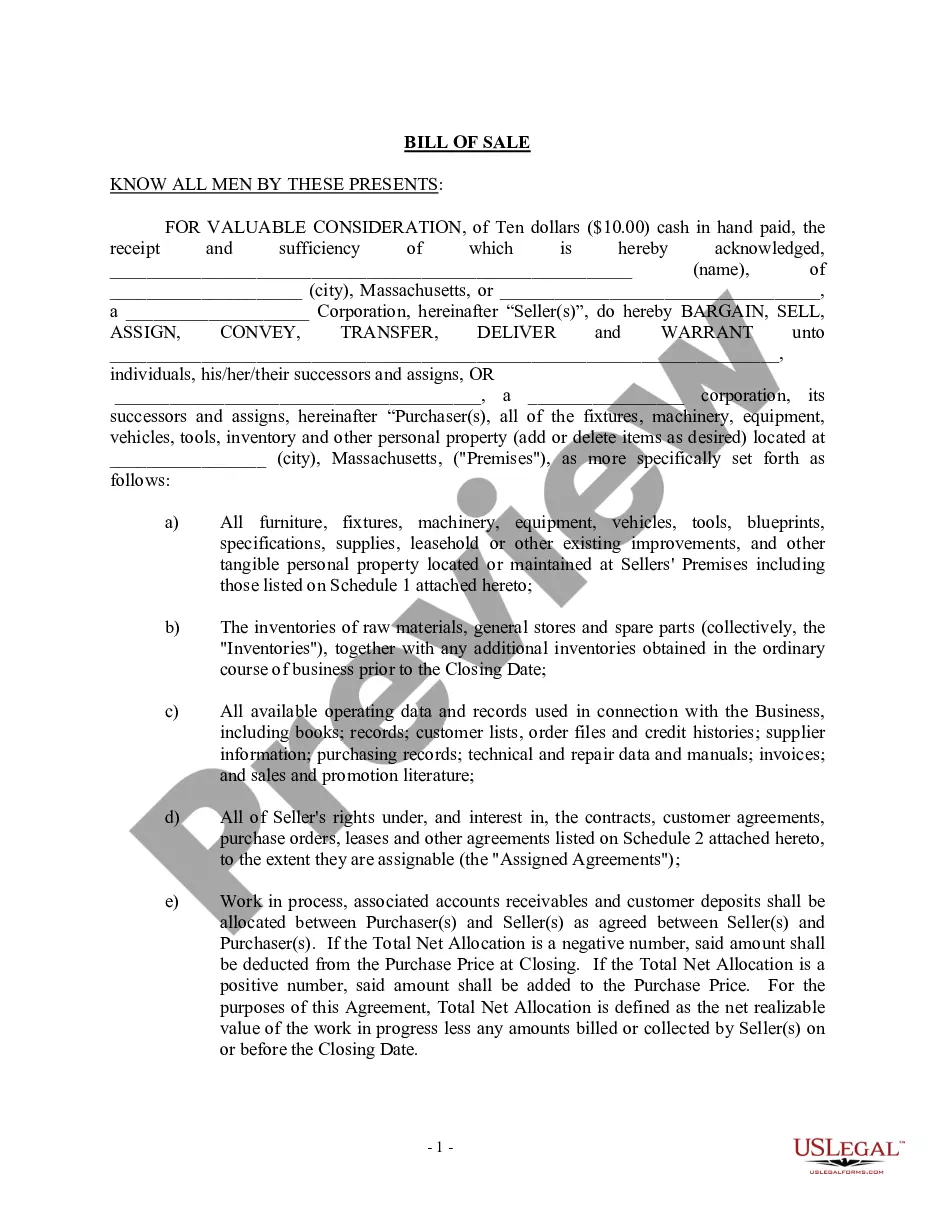

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

Recording Fee for Quitclaim DeedType of FeeFeeBase Fee G.C. § 27361(a) G.C. § 27361.4(a) G.C. § 27361.4(b) G.C. § 27361.4(c) G.C. § 27361(d)(1) G.C. § 27397 (c) Subsection 1$15.004 more rows

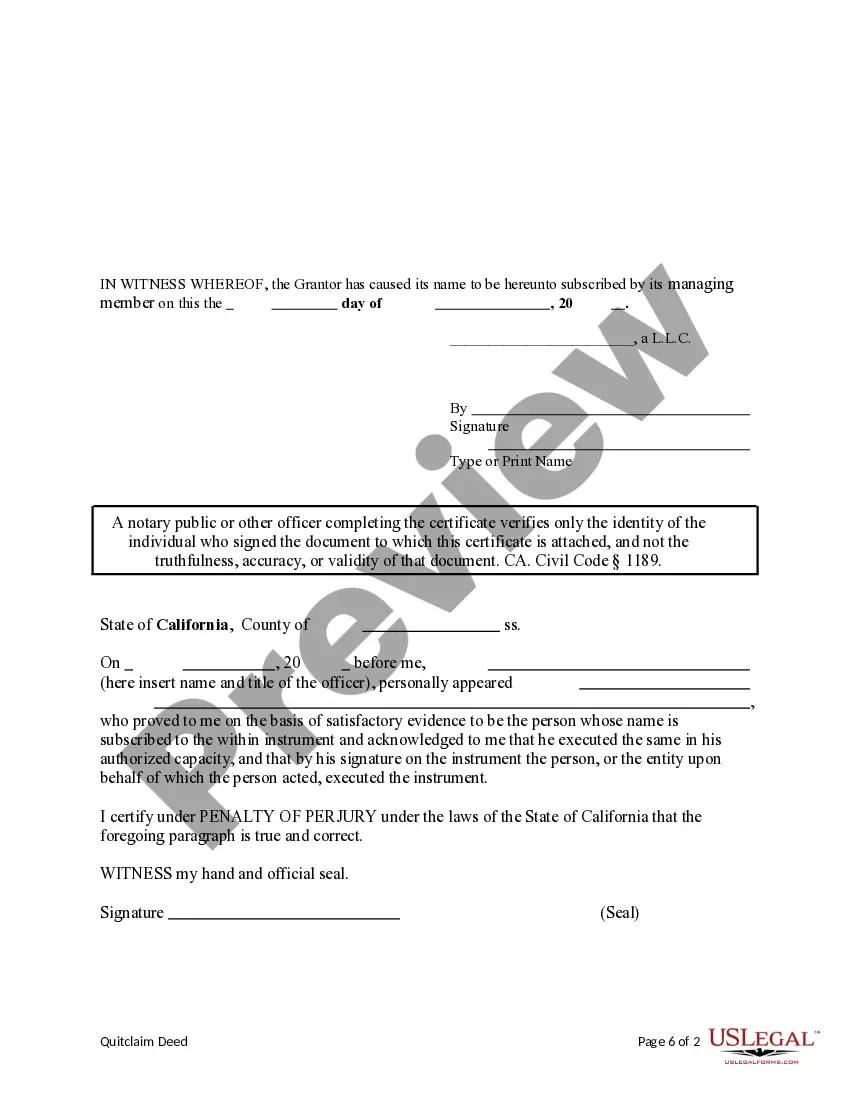

First, you need to make sure you fill out the quitclaim deed properly and get it notarized. Next, take the quitclaim deed to the County Recorder's Office. Make sure to file a Preliminary Change of Ownership Report and a Documentary of Transfer Tax or a Notice of Exempt Transaction.

Recording. Once the quitclaim deed is signed and notarized, it is a valid legal document. But the grantee must also have the quitclaim deed recorded in the county recorder's office, or with the county clerk -- whoever has the authority to record deeds and property transfers.

The California quitclaim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

File the forms. The recording fee will vary by county, but you can expect as a range to pay between $6 and $21 for the first page and $3 for any additional page. In Sacramento County, for example, the Recorder charges $21 for the first page and $3 for each additional page for recording.

In California, quitclaim deeds are commonly used between spouses, relatives, or if a property owner is transferring his or her property into his or her trust. A grant deed is commonly used in most arms-length real estate transactions not involving family members or spouses.