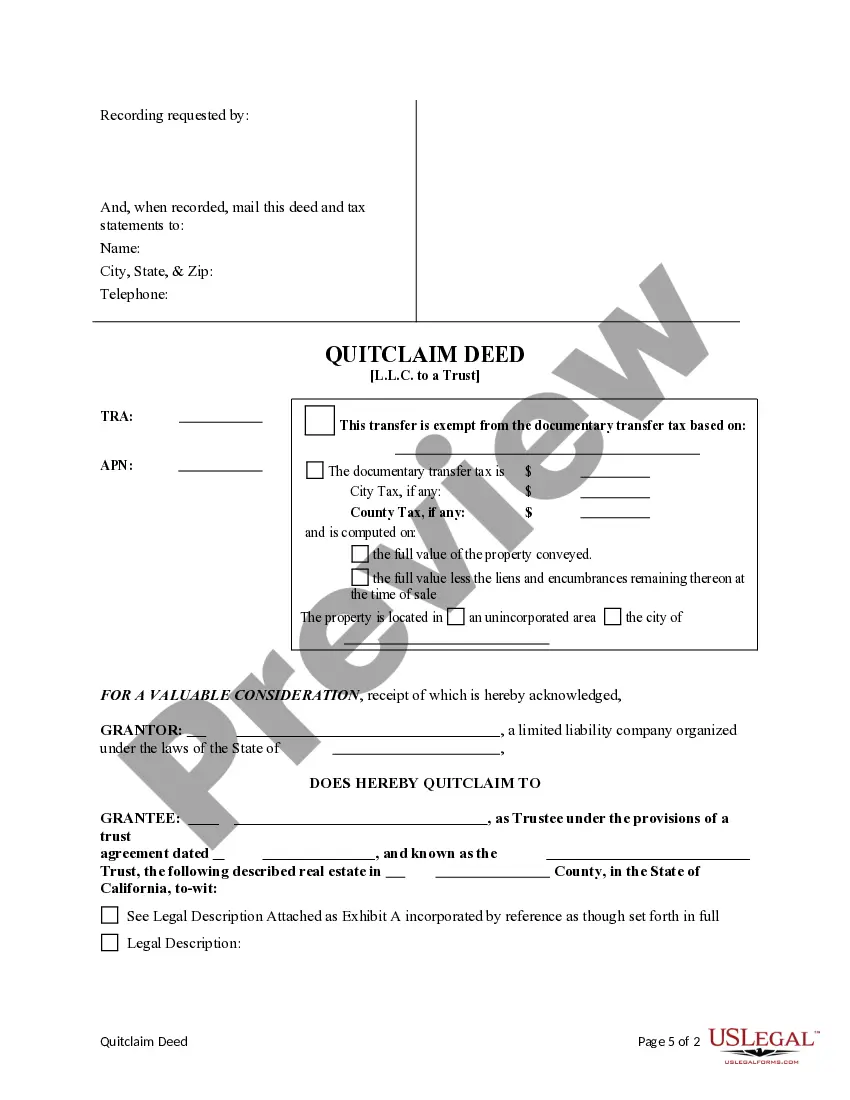

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Pomona California Quitclaim Deed from a Limited Liability Company to a Trust

Description

How to fill out California Quitclaim Deed From A Limited Liability Company To A Trust?

Do you require a reliable and cost-effective legal forms provider to acquire the Pomona California Quitclaim Deed from a Limited Liability Company to a Trust? US Legal Forms is your optimal choice.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a set of forms to navigate your separation or divorce through the court, we have you sorted. Our website features over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are tailored to meet the specific requirements of your state and region.

To download the form, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired document templates at any time from the My documents tab.

Are you visiting our website for the first time? No problem. You can create an account quickly, but first, ensure to do the following.

Now you can establish your account. Then choose the subscription option and complete the payment process. Once the payment is confirmed, download the Pomona California Quitclaim Deed from a Limited Liability Company to a Trust in any available file format. You can revisit the website whenever needed and redownload the form at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and put an end to wasting hours searching for legal documents online.

- Check if the Pomona California Quitclaim Deed from a Limited Liability Company to a Trust complies with the laws of your state and locality.

- Review the form’s description (if available) to understand who and what the form is designed for.

- Initiate the search again if the form does not suit your particular situation.

Form popularity

FAQ

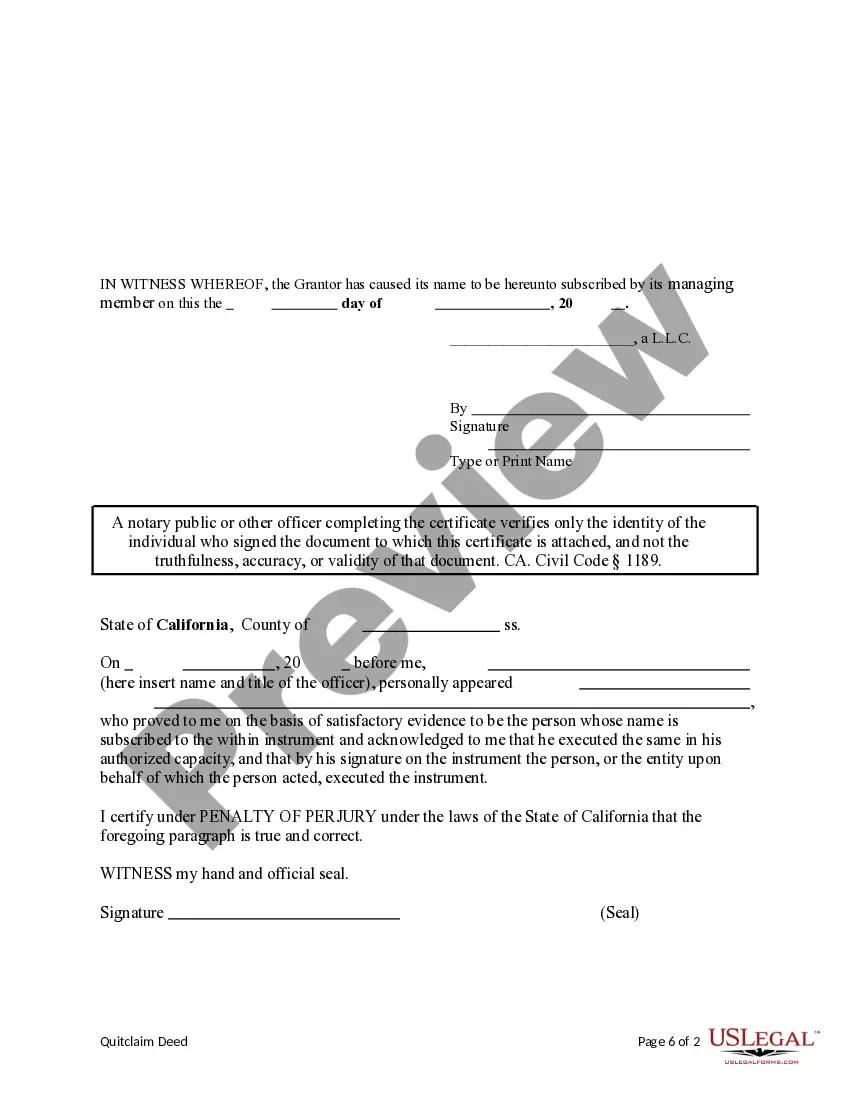

To transfer an LLC to a trust in California, you will typically use a Pomona California Quitclaim Deed from a Limited Liability Company to a Trust. First, you should draft the quitclaim deed, ensuring it outlines the LLC and the trust details accurately. Next, sign the deed in front of a notary public, and then file it with your local county recorder's office to officially document the transfer. Using platforms like USLegalForms can simplify this process by providing the necessary forms and guidance tailored to your needs.

One disadvantage of placing your house in a trust in California involves the initial costs, such as drafting the trust document and transferring the title. Additionally, using a Pomona California Quitclaim Deed from a Limited Liability Company to a Trust may trigger reassessment of property taxes. Furthermore, trust management requires ongoing responsibility, which can complicate finances. It's essential to weigh these factors before making a decision.

To put your property in a trust in California, you first need to create the trust document, outlining the trust's terms and beneficiaries. Once established, you can transfer the property using a Pomona California Quitclaim Deed from a Limited Liability Company to a Trust. This deed allows you to officially convey ownership to the trust. Consider consulting with an attorney to ensure the process meets California laws.

Putting your LLC in a trust can be a smart decision, as it offers potential protection from creditors and simplifies the transfer of interests upon death. A properly executed Pomona California Quitclaim Deed from a Limited Liability Company to a Trust can also help avoid probate, which streamlines the inheritance process. However, individual circumstances vary, so it's crucial to consult a legal expert to evaluate your specific situation.

To quitclaim deed to a trust, you first need to create a Pomona California Quitclaim Deed that clearly states the transfer of property from the LLC to the trust. Complete the form with the necessary property details, sign it, and then have it notarized. Finally, submit the deed to the local county recorder's office to officially record the change in ownership. This procedure secures the property’s legal status within the trust.

One disadvantage of putting property in a trust is the potential for added administrative costs, which can occur due to ongoing management and legal fees. Another concern is the complexity it introduces; handling the Pomona California Quitclaim Deed from a Limited Liability Company to a Trust requires careful documentation. Additionally, property in a trust may not have the same tax benefits as outright personal ownership, so it’s essential to consult a legal expert.

To transfer property from an LLC to a trust, start by drafting a Pomona California Quitclaim Deed from a Limited Liability Company to a Trust. This deed formally transfers ownership of the property. After completing the deed, sign it in front of a notary public, and then file it with the county recorder's office. This process ensures that the trust becomes the new owner of the property.

Yes, you can execute a quit claim deed from a trust to transfer property. The process is similar to other deed transfers, but it requires the trustee to sign the Pomona California Quitclaim Deed from a Limited Liability Company to a Trust. Make sure the deed includes clear information about the property being transferred. Additionally, consider using US Legal Forms to simplify your legal processes and ensure that your documentation is precise and compliant.

Transferring a deed to a trust in California involves a few key steps. First, you will need to prepare a Pomona California Quitclaim Deed from a Limited Liability Company to a Trust. This document must include specific details about the property and the entities involved. Once you complete the deed, sign it in front of a notary public, and file it with your local county recorder's office to ensure the transfer is officially recorded.