To comply with the California legislature's intent to provide simplified modification, the Judicial Council has promulgated four forms. The forms needed in this situation are probably only these two:

" Notice of Motion and Motion for Simplified Modification of Order for Child, Spousal or Family Support Order (FL-390).

" Information Sheet " Simplified Way to Change Child, Spousal or Family

Basis for modification: The simplified procedure does not change substantive law respecting the predicate for a modification. Thus, the applicant must establish the reason for the change.

If the supported party is no longer in need, or a detrimental change in the obligor party's needs or ability to pay outweighs the other's need for support, proceedings to terminate (or reduce) support can be brought on the basis of "changed circumstances".

Provided the obligee was aware of an expectation that he or she become self-supporting (or reasonably endeavor to contribute to his or her support), support might be terminated on the basis of the obligee's failure to make good faith efforts toward self-sufficiency within a reasonable period of time;

Termination Of Spousal Support Orders: Except upon the parties' written agreement to the contrary or a court order terminating support, the court retains spousal support jurisdiction indefinitely where the marriage has been of "long duration."

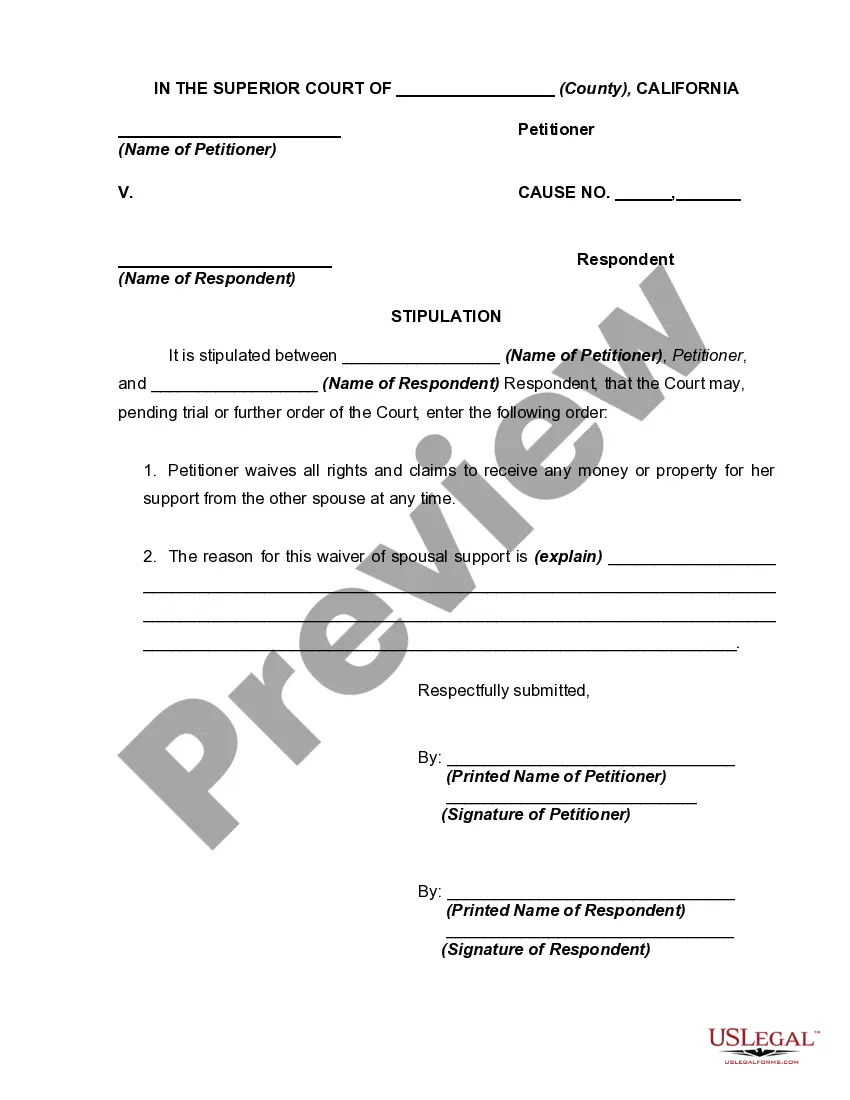

The parties may - and are encouraged to - enter into a written stipulation (agreement) on spousal support issues.