An estoppel affidavit enables a property owner, the grantor, to convey complete title of his property to the grantee so that the grantee assumes all obligations of the grantor. It can also act as a certificate in which a borrower certifies the amount owed on a mortgage loan and the rate of interest.

Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure

Description

How to fill out California Estoppel Affidavit Regarding Deed In Lieu Of Foreclosure?

If you are seeking an applicable form template, it’s impossible to select a superior venue than the US Legal Forms site – one of the most extensive online repositories.

With this collection, you can discover a vast array of templates for commercial and personal uses by categories and jurisdictions, or keyword phrases.

With the sophisticated search capability, locating the latest Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Retrieve the template. Select the file format and store it on your device.

- Moreover, the validity of each document is validated by a team of professional attorneys who routinely review the templates on our platform and update them per the latest state and local requirements.

- If you are already familiar with our service and possess a registered account, all you need to obtain the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, just follow the guidelines outlined below.

- Ensure you have accessed the sample you need. Review its details and employ the Preview feature to examine its content. If it does not satisfy your requirements, use the Search bar at the top of the page to locate the desired document.

- Verify your choice. Click the Buy now button. Subsequently, choose the desired subscription package and provide your information to register for an account.

Form popularity

FAQ

One significant disadvantage for lenders accepting a deed in lieu of foreclosure is the potential loss of value. The lender may need to sell the property at a discount, especially in a declining market. Moreover, managing properties that come from deeds in lieu can lead to additional financial strain. Understanding the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can provide clarity in such situations and help mitigate risks.

Receiving a deed in lieu of foreclosure usually takes similar timeframes as the process itself, around a few weeks to a few months. Factors like lender response time and required documentation play crucial roles. If you use the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure effectively, it may help speed things along. Stay in close communication with your lender to ensure a more efficient experience.

The process for a deed in lieu of foreclosure typically takes several weeks to a few months. This duration can vary based on specific lender procedures and property conditions. In Palmdale, California, timely submission of the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure can help expedite the process. Being proactive throughout will make the experience smoother for you.

When writing a foreclosure letter, clearly explain your situation and your intention to transfer the property back to your lender. Include essential details, such as financial hardships and any related documents, like the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, to support your request. Be respectful and straightforward, as this communication can play a vital role in whether the lender accepts your proposal.

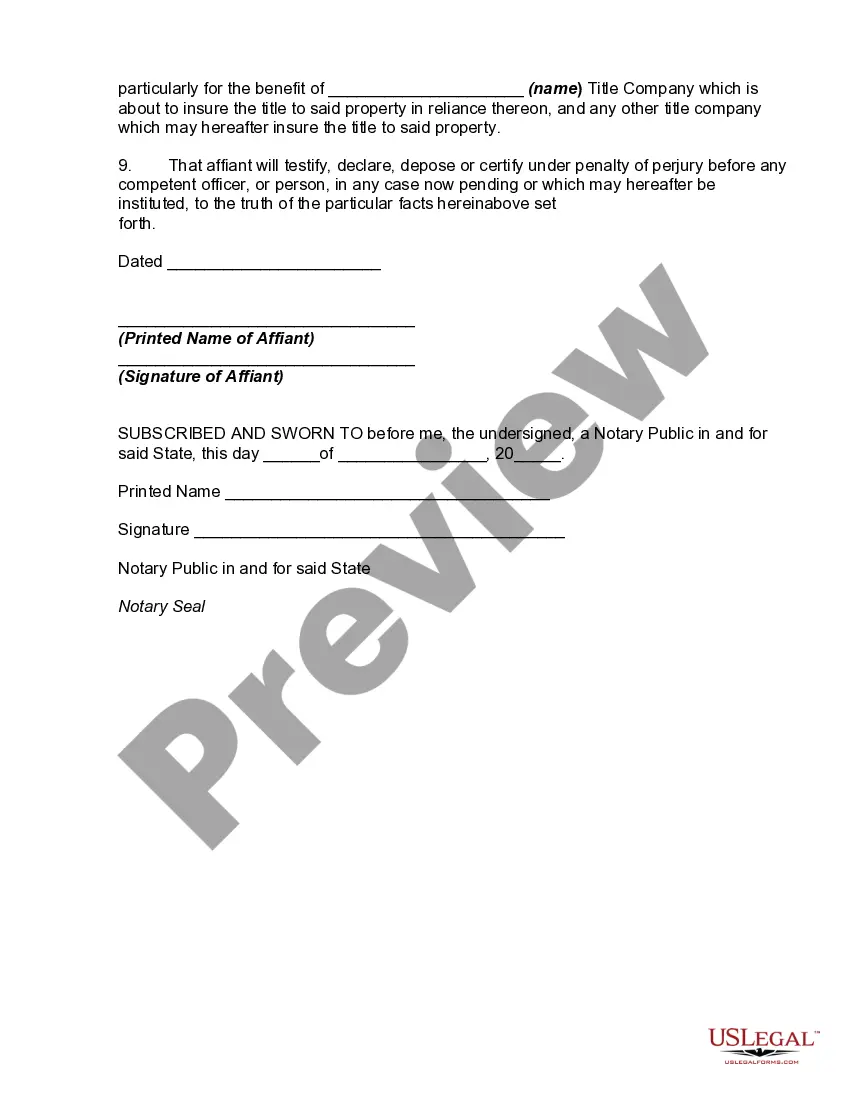

To file a deed in lieu, begin by securing consent from your lender to proceed with the transfer. Once you have this agreement, prepare the required documentation, including the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, to confirm no other claims exist against the property. Subsequently, take these documents to your county recorder’s office to finalize the filing, ensuring your transition is legally sound.

Filing a deed in lieu of foreclosure involves several steps, starting with discussions with your mortgage lender. After reaching an agreement, you will need to complete and sign the necessary documents, including the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure. Finally, submit these documents to your local county recorder’s office to officially complete the process and relieve yourself of the property obligations.

A deed in lieu of foreclosure example would be a homeowner who can no longer afford their mortgage payments. They may choose to transfer their property back to the lender, often while providing the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure. This document serves to affirm that there are no additional claims against the property, making the transfer clear and straightforward.

To execute a deed in lieu of foreclosure, you must first communicate with your lender. Together, you can agree on the terms that will allow you to transfer the property back to them. It's crucial to document this process thoroughly and prepare necessary paperwork, including the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure. Doing this can simplify the transition and avoid prolonged foreclosure proceedings.

A California deed in lieu of foreclosure allows a homeowner to transfer their property back to the lender to avoid the lengthy foreclosure process. This option can help you eliminate mortgage debt and protect your credit score. When considering this option, you may need to complete a Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure, which verifies your intentions and the circumstances of the property transfer. Using uslegalforms can streamline your process and ensure all necessary documents are completed accurately.

A major disadvantage to lenders of accepting a deed in lieu of foreclosure is the potential for financial losses. Lenders may incur legal fees, property maintenance costs, and potential depreciation of the property's value. They must also consider the implications of the Palmdale California Estoppel Affidavit Regarding Deed in Lieu of Foreclosure as it relates to their ability to secure future investments.