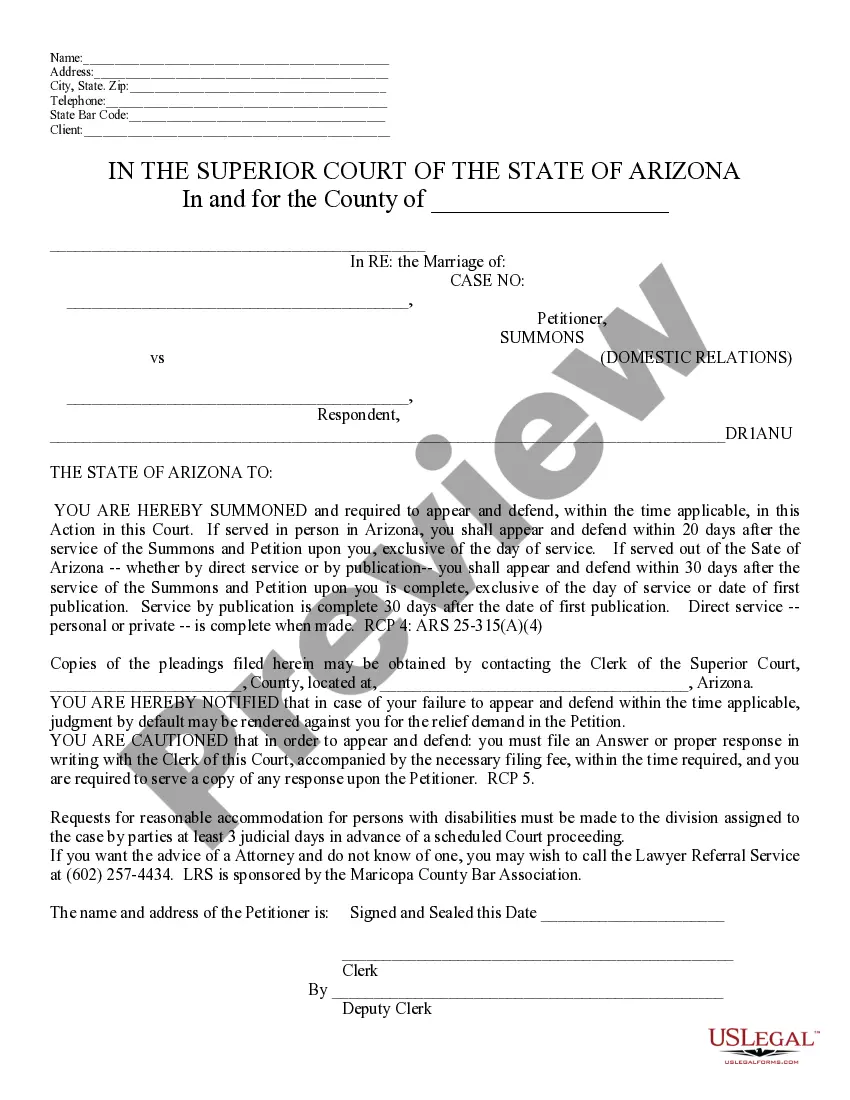

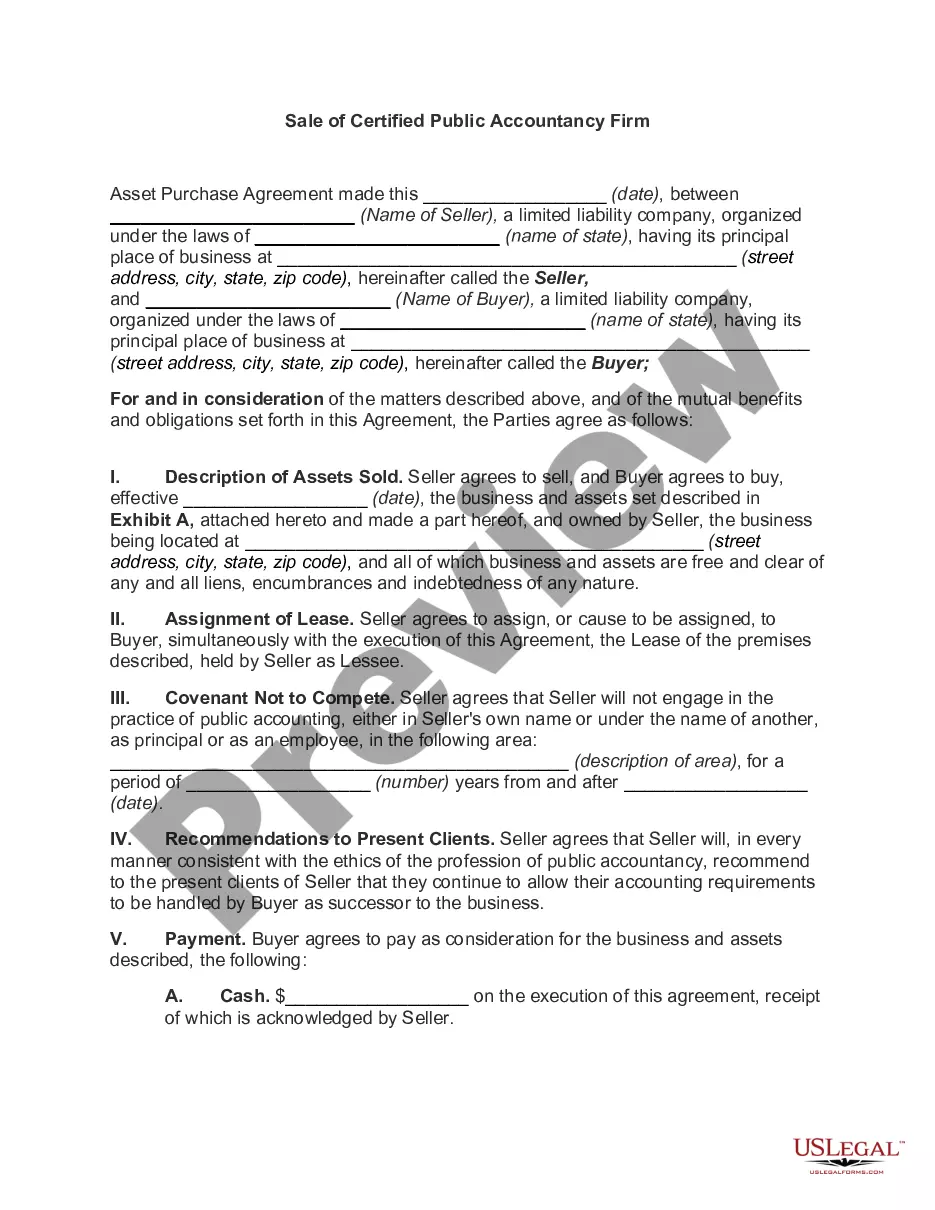

This form is a Grant Deed where the grantors are husband and wife and the grantee is a trust. Grantors conveys and grant the described property to grantee. This deed complies with all state statutory laws.

Oxnard California Grant Deed - Husband and Wife to a Trust

Description

How to fill out Oxnard California Grant Deed - Husband And Wife To A Trust?

If you’ve previously used our service, Log In to your account and retrieve the Oxnard California Grant Deed - Husband and Wife to a Trust on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it per your payment plan.

If this is your initial experience with our service, follow these easy steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Take advantage of the US Legal Forms service to effortlessly locate and save any template for your personal or professional purposes!

- Ensure you’ve found the relevant document. Review the description and utilize the Preview option, if available, to verify it meets your needs. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make a payment. Utilize your credit card information or the PayPal option to finalize the purchase.

- Get your Oxnard California Grant Deed - Husband and Wife to a Trust. Choose the file format for your document and download it to your device.

- Complete your document. Print it out or use online professional editors to fill it in and sign it electronically.

Form popularity

FAQ

For a married couple, using an Oxnard California Grant Deed - Husband and Wife to a Trust is often the best option. This type of deed allows for a smooth transfer of property into a trust, ensuring clarity and protection for the couple's assets. Additionally, a trust can help manage the property more effectively, particularly in estate planning. Considering your needs, uslegalforms can assist you in creating the right documentation for your situation.

You should hold the title to your home in California based on your financial goals and family needs. Joint tenancy or community property options each offer distinct advantages for married couples. Consider what feels right for your situation, and if necessary, consult legal resources or platforms like USLegalForms to complete an Oxnard California Grant Deed - Husband and Wife to a Trust.

In California, a married couple can hold title through joint tenancy, community property, or community property with right of survivorship. Each method has unique benefits, including tax implications and ease of transfer upon death. When considering how to structure ownership, using an Oxnard California Grant Deed - Husband and Wife to a Trust can be a strategic choice.

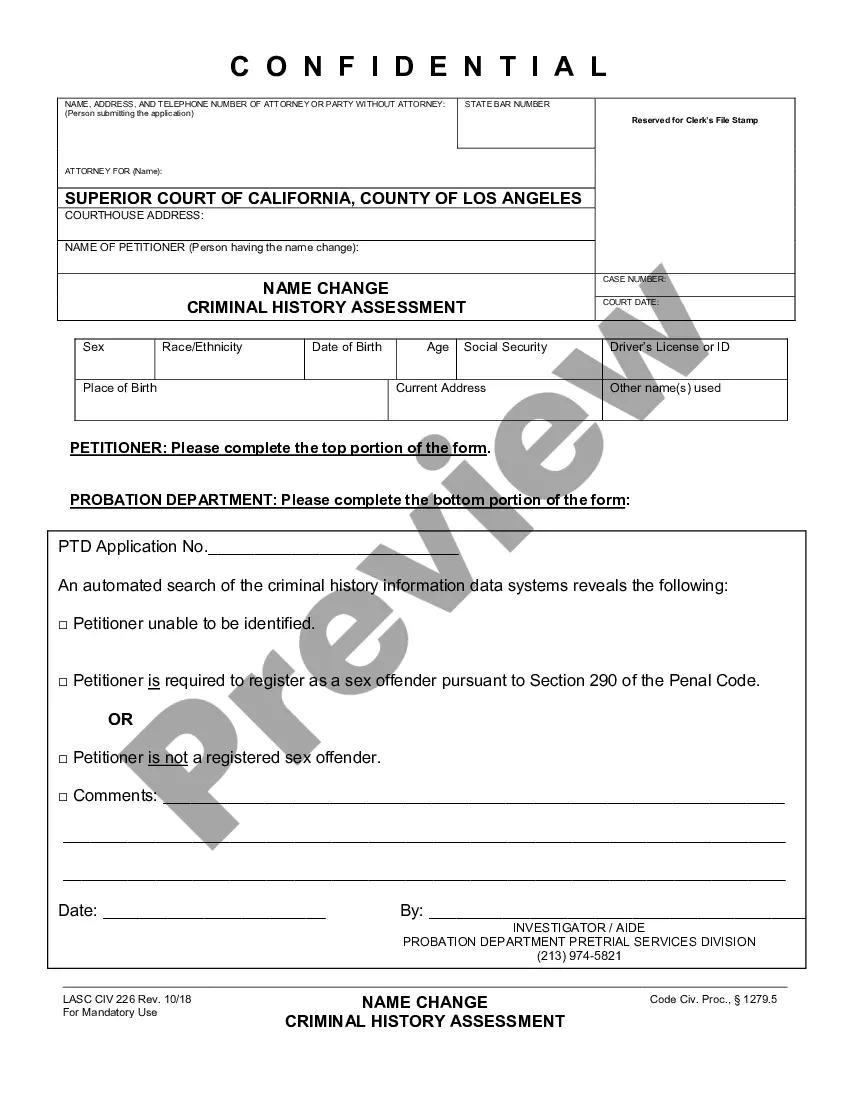

To fill out a deed of trust, include the borrower, lender, and trustee's details along with the property's legal description. Make sure all parties sign the document. Following a specific format for an Oxnard California Grant Deed - Husband and Wife to a Trust will ensure you have a valid deed. For assistance, services like USLegalForms can provide clear templates.

Husband and wife in California often choose joint tenancy or community property to hold title. Joint tenancy provides easy transfer of ownership upon death, while community property combines assets for tax benefits. It's important to know the implications of each choice before completing the Oxnard California Grant Deed - Husband and Wife to a Trust.

The best way to hold title as a married couple is usually through community property or joint tenancy. Community property allows for equal ownership and can provide tax benefits, while joint tenancy offers the right of survivorship. Each option has advantages, so consider your needs when drafting the Oxnard California Grant Deed - Husband and Wife to a Trust.

Filling out a trust transfer deed in California requires you to accurately fill in the details of the trust and the property's information. Include both spouses' names and ensure signatures match those on the original deed. Using a template for an Oxnard California Grant Deed - Husband and Wife to a Trust can simplify this process. Platforms like USLegalForms offer user-friendly solutions.

The best tenancy for a married couple is often joint tenancy. This arrangement allows both spouses to have equal ownership and provides a right of survivorship. In the event of one spouse's death, the property automatically transfers to the other. This makes it a fitting option for those pursuing an Oxnard California Grant Deed - Husband and Wife to a Trust.

To add your spouse to your deed of trust, you typically need to file a new deed with your county recorder's office. This process involves completing an Oxnard California Grant Deed - Husband and Wife to a Trust that includes both names. Ensure you provide necessary information and meet local regulations. You may want to consult a real estate attorney or use an online platform like USLegalForms for guidance.

To transfer a deed to a trust in California, you need to prepare an Oxnard California Grant Deed - Husband and Wife to a Trust, which effectively transfers ownership of the property to the trust. You will fill out the deed with accurate property information and the trust's details, and then have it signed and notarized. Finally, file the completed deed with the county recorder's office to ensure the transfer is legally recognized.