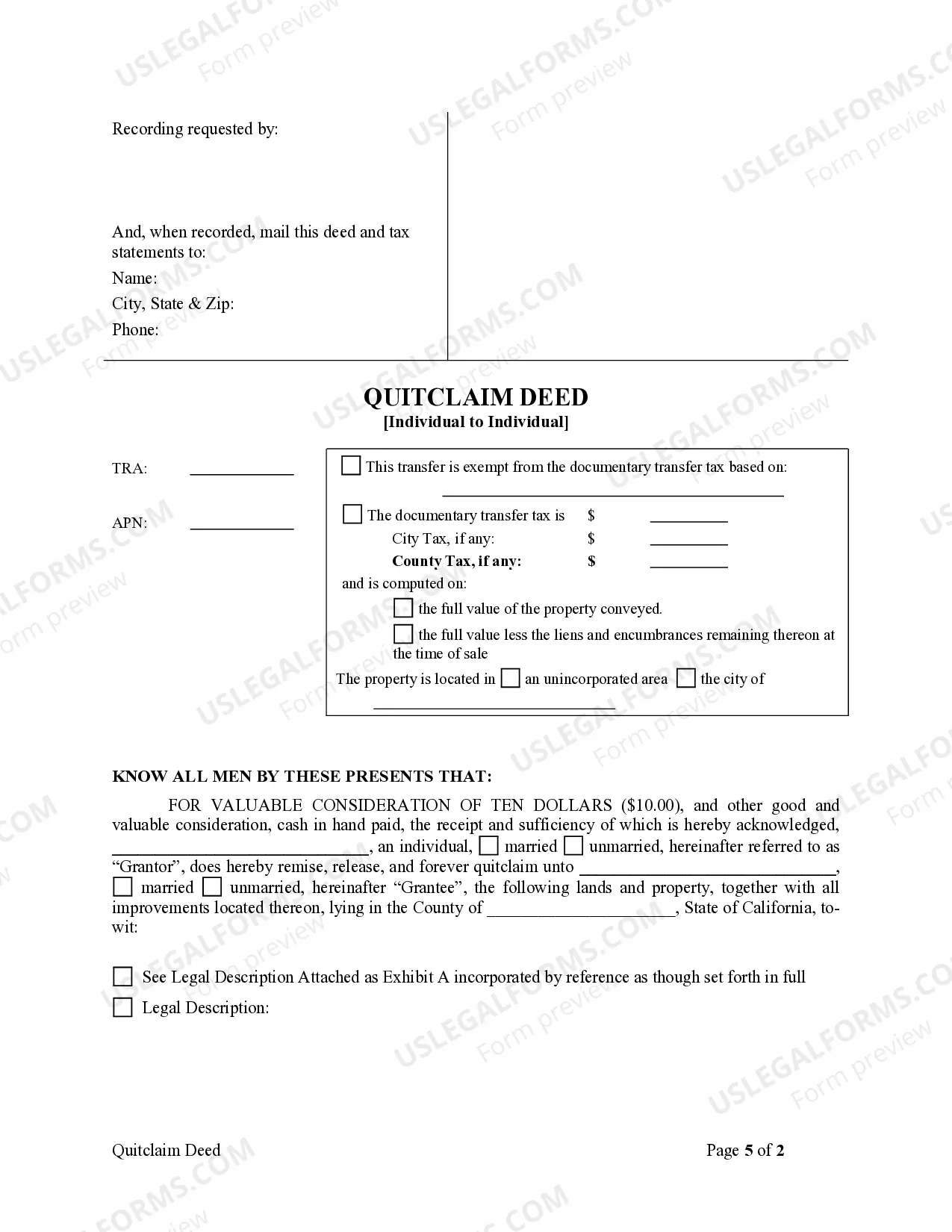

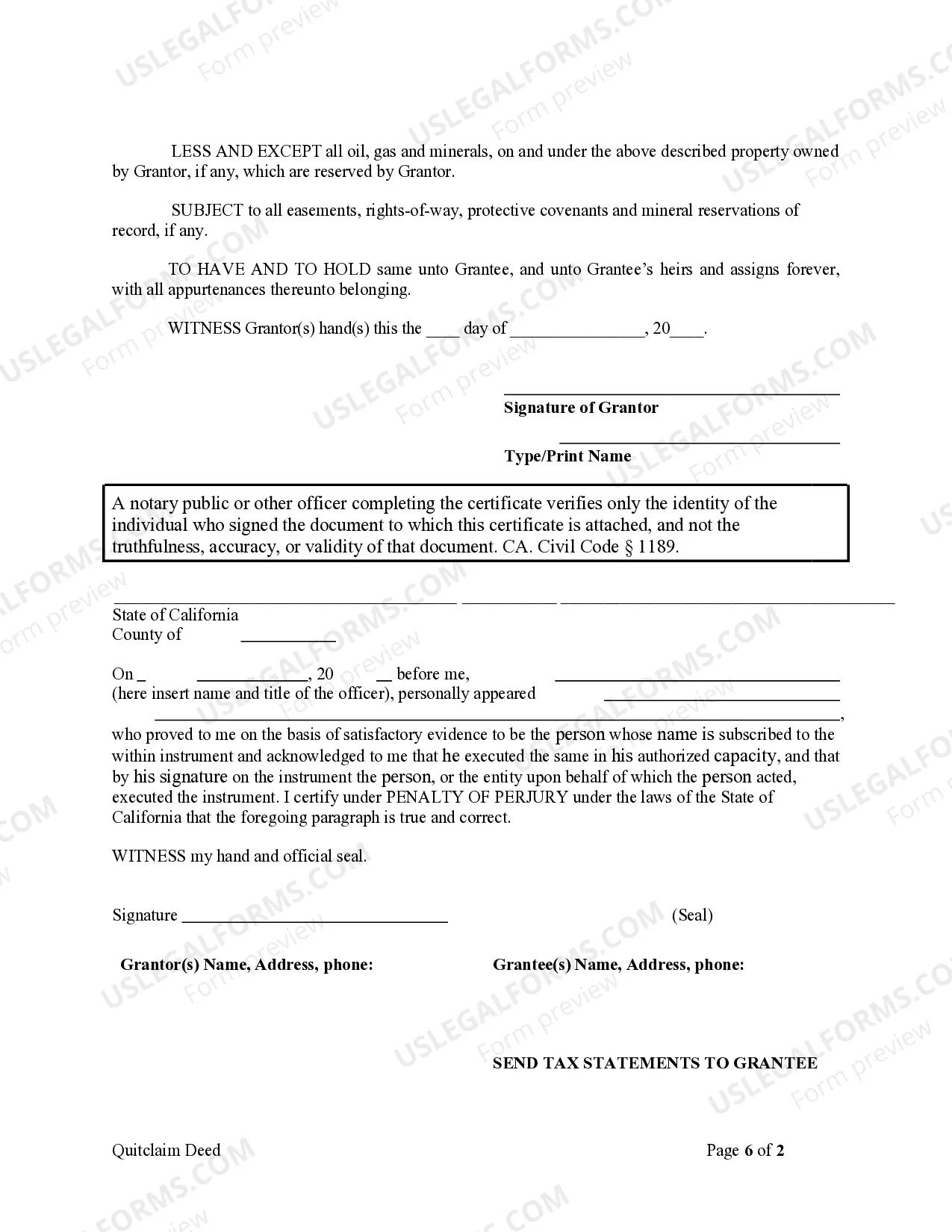

This Quitclaim Deed from Individual to Individual form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Antioch California Quitclaim Deed from Individual to Individual

Description

How to fill out California Quitclaim Deed From Individual To Individual?

We consistently aim to diminish or avert legal complications when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically very costly.

However, not all legal issues are of the same level of complexity.

The majority can be handled independently.

Take advantage of US Legal Forms whenever you need to locate and download the Antioch California Quitclaim Deed from Individual to Individual or any other document swiftly and securely.

- US Legal Forms is an online directory of current DIY legal documents covering a range of topics from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository enables you to manage your affairs autonomously without resorting to an attorney's services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are specific to states and regions, significantly simplifying the search process.

Form popularity

FAQ

To remove someone from a deed in California, complete a quitclaim deed that specifically mentions the parties involved and the property. After signing the deed, record it with the county recorder’s office to update public records. An Antioch California Quitclaim Deed from Individual to Individual serves this purpose well by providing clear documentation of ownership changes.

You can remove someone from a deed without refinancing by creating and filing a quitclaim deed. This method does not require adjustments to any mortgage and allows the current owner to transfer their stake in the property easily. The Antioch California Quitclaim Deed from Individual to Individual offers a straightforward solution for those seeking an efficient means of making such transfers.

Yes, you can remove someone's name from a property deed by executing a quitclaim deed. This process involves the individual who wishes to relinquish their ownership signing the deed, which is then recorded with the county. By using the Antioch California Quitclaim Deed from Individual to Individual, you ensure a clear transfer of ownership without complex procedures.

To remove someone from a deed in California, you will typically use a quitclaim deed. This legal document allows the current owner to transfer their interest in the property to another individual. Utilizing an Antioch California Quitclaim Deed from Individual to Individual simplifies this process and can prevent misunderstandings about ownership rights.

While it's not mandatory to hire an attorney for filing an Antioch California Quitclaim Deed from Individual to Individual, consulting one can be beneficial. An attorney can provide valuable advice on the implications of the deed and ensure that you complete all necessary steps. However, if you feel comfortable navigating the process on your own, using online resources can often suffice. Make sure you understand the specific requirements and local laws regarding property transfers in your area.

Filling out a quitclaim deed form requires several key pieces of information. Start by entering the names of the parties involved, followed by a detailed description of the property. It’s important to include the legal description, which you can obtain from prior documents or property records. Using platforms like uslegalforms can offer you a straightforward way to access proper formats and instructions for completing your Antioch California Quitclaim Deed from Individual to Individual.

To transfer a house deed to a family member in California, you can use an Antioch California Quitclaim Deed from Individual to Individual. Start by filling out the deed with accurate details of the current owner and the family member receiving the property. After signing the deed in front of a notary, you must file the document with the county recorder’s office to ensure proper recording. This process can help streamline the transfer and maintain a clear record of ownership.

The primary beneficiaries of an Antioch California Quitclaim Deed from Individual to Individual are often family members or friends engaged in property transfers. This form allows individuals to transfer property rights quickly and without a formal sale. It’s especially useful when dealing with real estate within families, simplifying ownership changes. However, clarity on the situation is essential to avoid potential disputes later.

Filling out an Antioch California Quitclaim Deed from Individual to Individual involves providing accurate information about both parties. You need to include the names of the granter and grantee, the property description, and the date of the transaction. Ensure that you sign the document in front of a notary to validate it. Using uslegalforms can simplify this process by providing templates and guidance.

To avoid taxes when gifting property, you should be aware of the annual gift tax exclusion limits and act within those guidelines. When using an Antioch California Quitclaim Deed from Individual to Individual, gifting property may not incur tax if it falls under the exclusion amount. Additionally, consulting with a tax professional can help you understand your options and implications. Making informed decisions ensures a smooth transfer while minimizing potential tax burdens.