This form is a generic example that may be referred to when preparing such a form.

Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

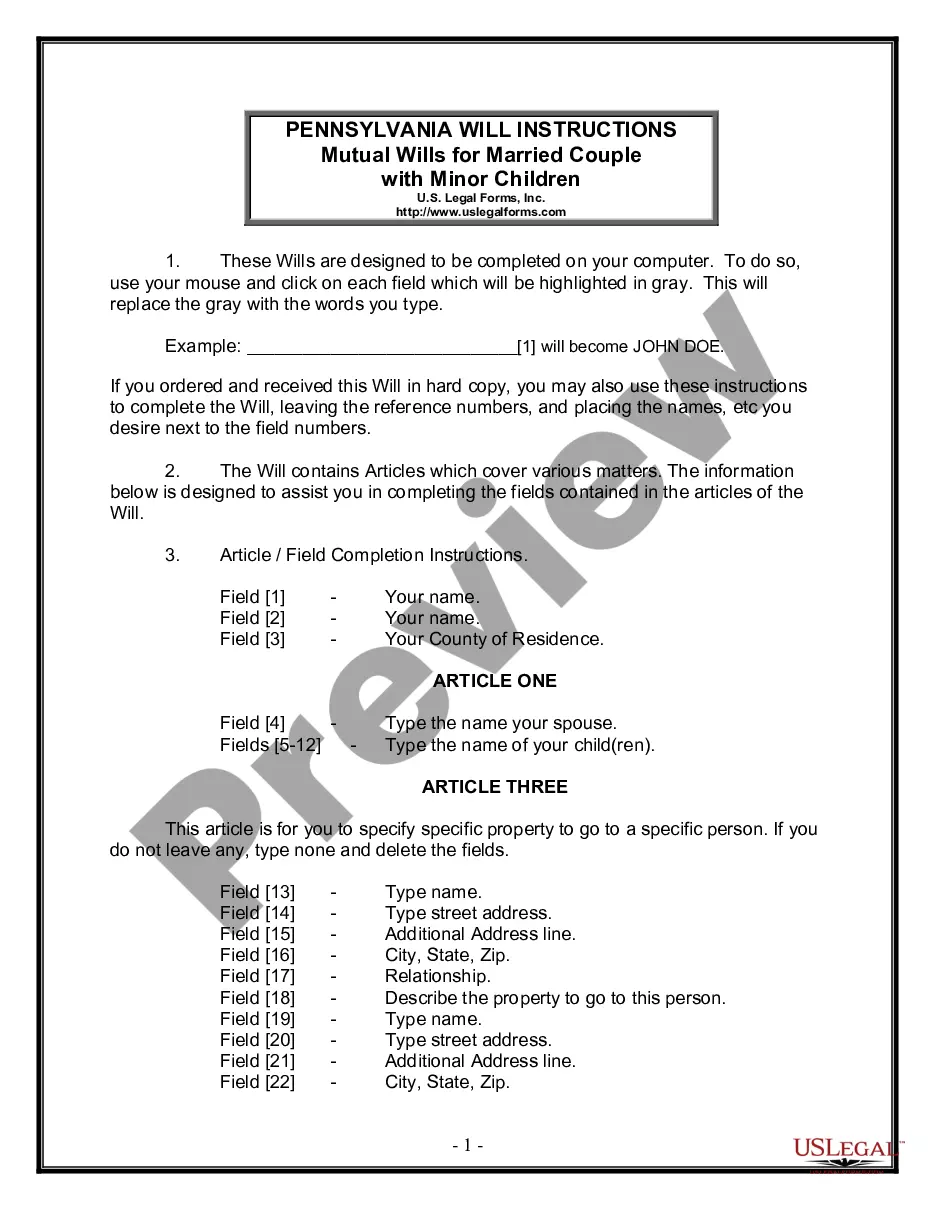

How to fill out California Deed Of Trust Securing Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

If you are looking for a legitimate form, it’s incredibly difficult to discover a more user-friendly service than the US Legal Forms website – one of the most extensive libraries online.

With this library, you can access thousands of document samples for business and personal purposes categorized by types and states, or keywords.

With the excellent search feature, locating the latest Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finish the registration process.

Retrieve the form. Specify the format and download it to your computer.

- Additionally, the significance of each and every record is validated by a team of experienced attorneys who consistently review the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to obtain the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the sample you require. Review its description and use the Preview feature to examine its content. If it does not satisfy your requirements, utilize the Search function at the top of the screen to find the necessary document.

- Verify your selection. Click the Buy now button. After that, choose your preferred pricing plan and provide information to create an account.

Form popularity

FAQ

People use a deed of trust for several reasons, including flexibility and potentially easier foreclosure processes. A deed of trust allows the borrower to secure financing while providing reassurance to the lender. This type of agreement also accommodates various payment structures, such as arrangements where no payment is due until maturity. Explore how a Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can meet your financial needs.

One disadvantage of a trust deed is that it might result in foreclosure if the borrower defaults. Unlike a mortgage, a deed of trust allows a trustee to manage the property during a default. This can lead to a more expedited process for lenders, which may not be ideal for the borrower. Understand the implications of a Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually before signing.

Yes, a promissory note can technically lack a specific maturity date, establishing it as open-ended. However, having a defined maturity date—such as in the case of a Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually—typically helps clarify repayment expectations for both parties. Lack of a maturity date can lead to uncertainty and increased risks for the lender. Therefore, it is usually best to include clear timelines in any promissory note.

One significant disadvantage of a deed of trust is the potential for foreclosure without court intervention if the borrower defaults. This means lenders can act quickly to claim their interests in the property, which may catch borrowers off guard. Additionally, the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually may have specific terms that could limit flexibility. Understanding these factors is essential before entering into such agreements.

The pros of a trust deed include security for lenders and potentially more favorable repayment terms for borrowers, especially when using a Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. However, the cons may involve complicated processes in the event of a default, as well as potential restrictions on the property's sale. Balance these factors carefully when considering if a trust deed aligns with your financial needs.

Yes, promissory notes are legally binding contracts in California, including under specific terms outlined for the Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. These documents outline the borrower's promise to repay borrowed funds, detailing the terms of repayment. If a borrower fails to fulfill the agreements, the note can serve as a basis for legal action. Therefore, it is crucial to fully understand the implications before signing.

A trust deed in California typically lasts for the duration specified in the agreement, often ranging between five to thirty years. When you use a Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the terms set forth in your document will govern the duration of the trust deed. It's essential to review the agreement for specific timelines and obligations. Trust deeds can be renewed or modified based on mutual consent.

To secure a promissory note, you can use a deed of trust as collateral. This involves creating a legal document that links the note to a specific property, allowing the lender to claim that property if necessary. Using a Temecula California Deed of Trust Securing Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides an effective way to secure financing while offering flexibility in payment schedules.