This form is a Revocable Transfer on Death Deed where the Grantor is an individual and the Grantee is an individual. The Grantor retains the right to revoke. The Deed must be recorded on or before 60 days after the date it is signed and notarized or it will not be effective. The Grantee must survive the Grantor or the conveyance is null and void. This deed complies with all state statutory laws.

Antioch California Revocable Transfer on Death Deed - Individual to Individual

Description

How to fill out California Revocable Transfer On Death Deed - Individual To Individual?

If you have previously taken advantage of our service, Log In to your account and retrieve the Antioch California Revocable Transfer on Death Deed - Individual to Individual onto your device by pressing the Download button. Ensure your subscription is active. If not, renew it per your payment plan.

If this is your initial experience with our service, adhere to these straightforward steps to acquire your document.

You maintain lifelong access to every piece of documentation you have acquired: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business needs!

- Ensure you’ve located the correct document. Review the description and utilize the Preview feature, if available, to verify it fulfills your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Set up an account and complete the payment. Input your credit card information or opt for the PayPal choice to finalize the transaction.

- Obtain your Antioch California Revocable Transfer on Death Deed - Individual to Individual. Select the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

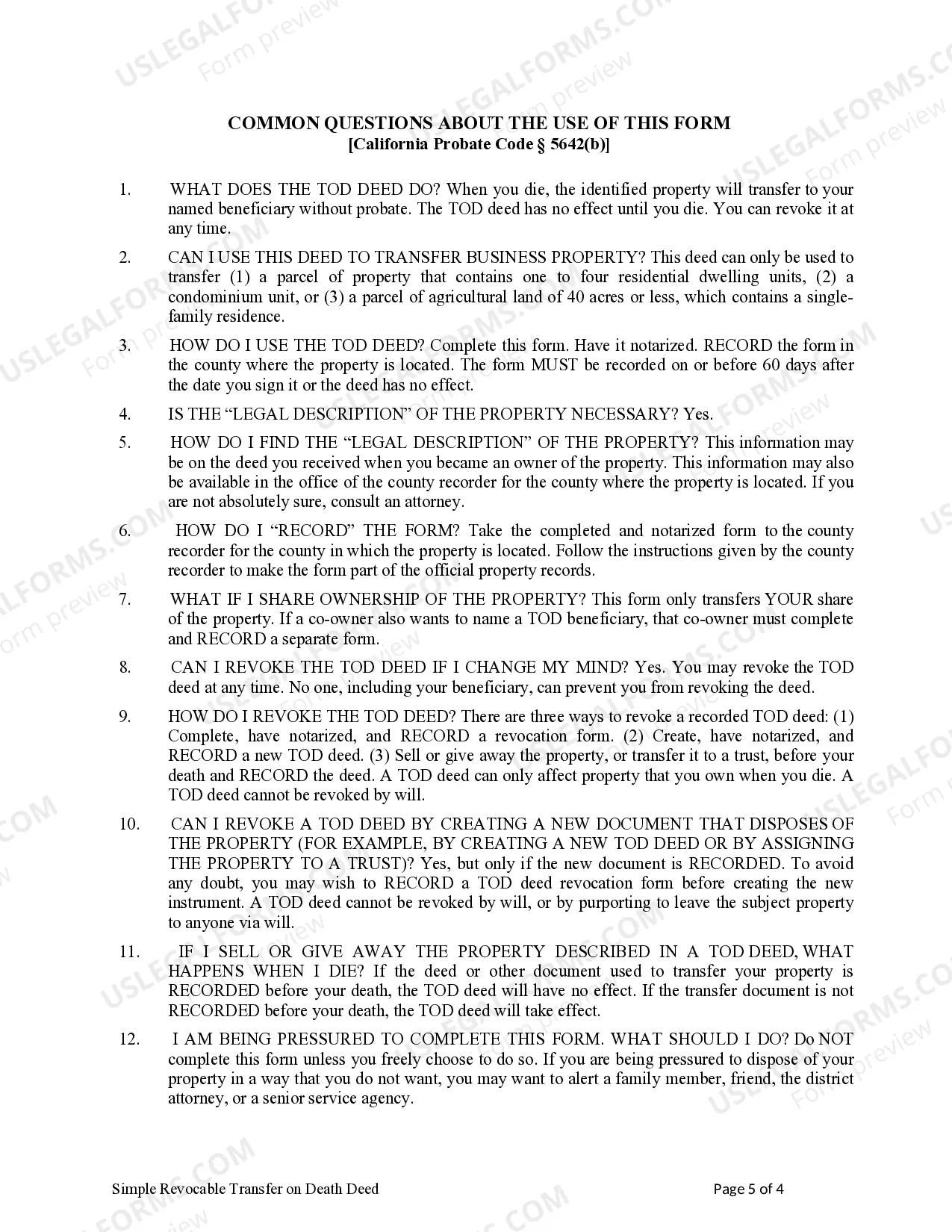

A transfer on death deed itself does not directly avoid inheritance tax in California. However, by using an Antioch California Revocable Transfer on Death Deed - Individual to Individual for property transfer, your beneficiaries may avoid some tax implications commonly associated with probate. It's crucial to consult with a tax advisor or legal professional to understand the specific tax responsibilities your beneficiaries may face. Platforms like US Legal Forms can also assist you with information on estate tax and planning.

While it is not legally required to have an attorney for a transfer on a death deed in California, consulting a legal professional can provide peace of mind. Using an Antioch California Revocable Transfer on Death Deed - Individual to Individual is typically simple, but an attorney can help you navigate any specific legal concerns or questions. If you prefer to handle it yourself, several online resources, like US Legal Forms, offer clear guidance to ensure compliance.

To transfer a deed to your house after death in California, you can use an Antioch California Revocable Transfer on Death Deed - Individual to Individual. This deed allows you to designate a beneficiary who will receive the property upon your passing without going through probate. It's a straightforward process that simplifies the transfer of ownership. Consider using resources on platforms like US Legal Forms to ensure you complete the deed correctly.

The Antioch California Revocable Transfer on Death Deed - Individual to Individual has several disadvantages to consider. For example, it may not account for changes in your circumstances, like marriage or divorce, unless updated. Moreover, if the owner becomes incapacitated, the deed does not provide guidance for managing their property during that period. Understanding these drawbacks can help you make informed decisions about your estate planning.

In California, you file the Antioch California Revocable Transfer on Death Deed - Individual to Individual with the county recorder's office where the property is located. This is crucial to ensure that the transfer is legally recognized and recorded. It's advisable to confirm any specific requirements with your local recorder's office to ensure a smooth filing process.

While it's not a legal requirement to have an attorney for an Antioch California Revocable Transfer on Death Deed - Individual to Individual, hiring one can be beneficial. An attorney can help ensure that the deed complies with California laws and that your intentions are clearly reflected in the documentation. Working with a legal expert can prevent future legal complications and provide peace of mind.

Choosing between a Transfer on Death deed and a beneficiary designation depends on your circumstances. An Antioch California Revocable Transfer on Death Deed - Individual to Individual allows you to transfer real estate directly, potentially avoiding probate. On the other hand, a beneficiary designation can apply to various assets, not just property. Assess your estate and consult with a professional for tailored advice.

Transfer on Death (TOD) accounts, like the Antioch California Revocable Transfer on Death Deed - Individual to Individual, may pose several issues. One major concern is that they can be subject to claims from creditors if the owner has outstanding debts. Additionally, these accounts can complicate matters if multiple beneficiaries have a claim, leading to potential disputes.

Contesting an Antioch California Revocable Transfer on Death Deed - Individual to Individual typically involves proving that the owner lacked the capacity to sign the deed or was subjected to undue influence. You can gather evidence such as witness statements or medical records to support your claim. It's advisable to consult with a legal professional who specializes in estate law to navigate this process effectively.

The Antioch California Revocable Transfer on Death Deed - Individual to Individual has its drawbacks. One main concern is that it may not always supersede other estate planning documents, such as wills. Moreover, if the property owner has debts, creditors may still claim the property, leading to complications for beneficiaries. Therefore, it is essential to consider how this deed interacts with other aspects of your estate plan.