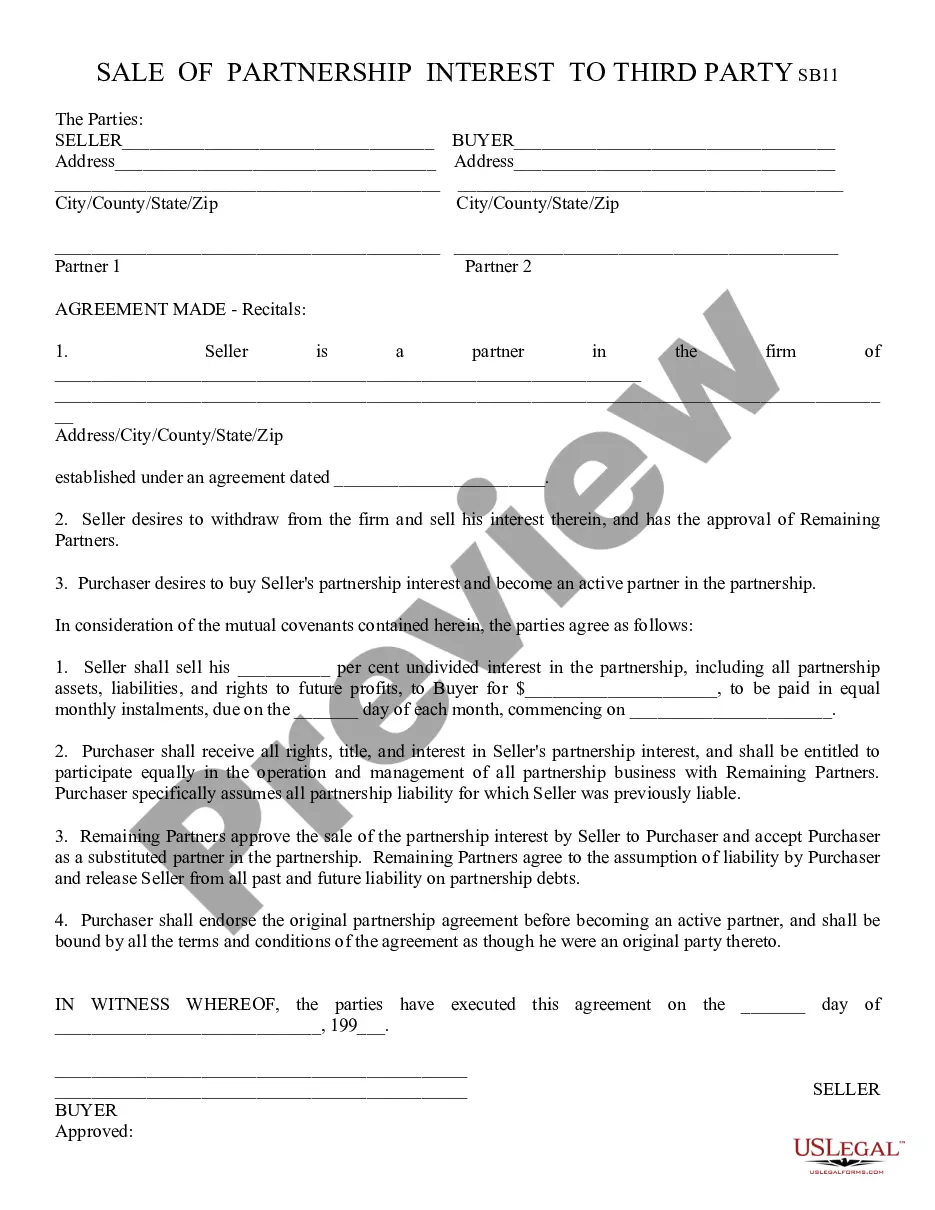

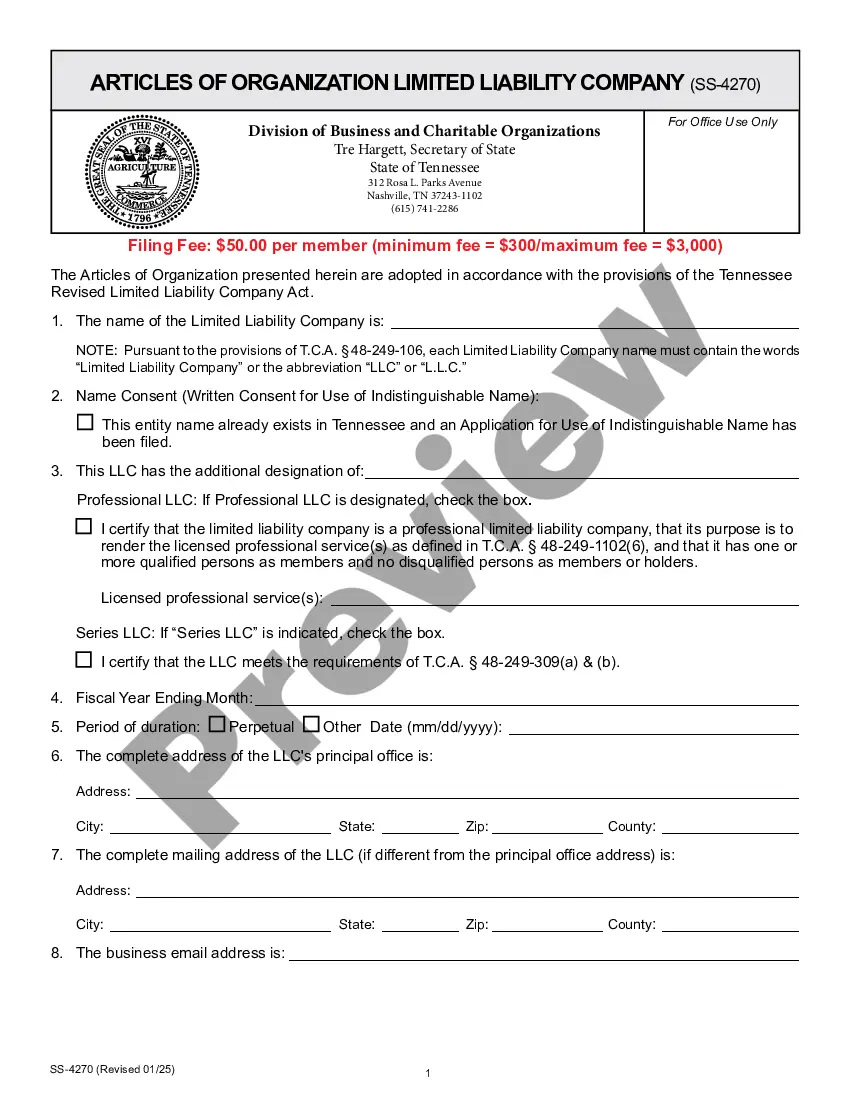

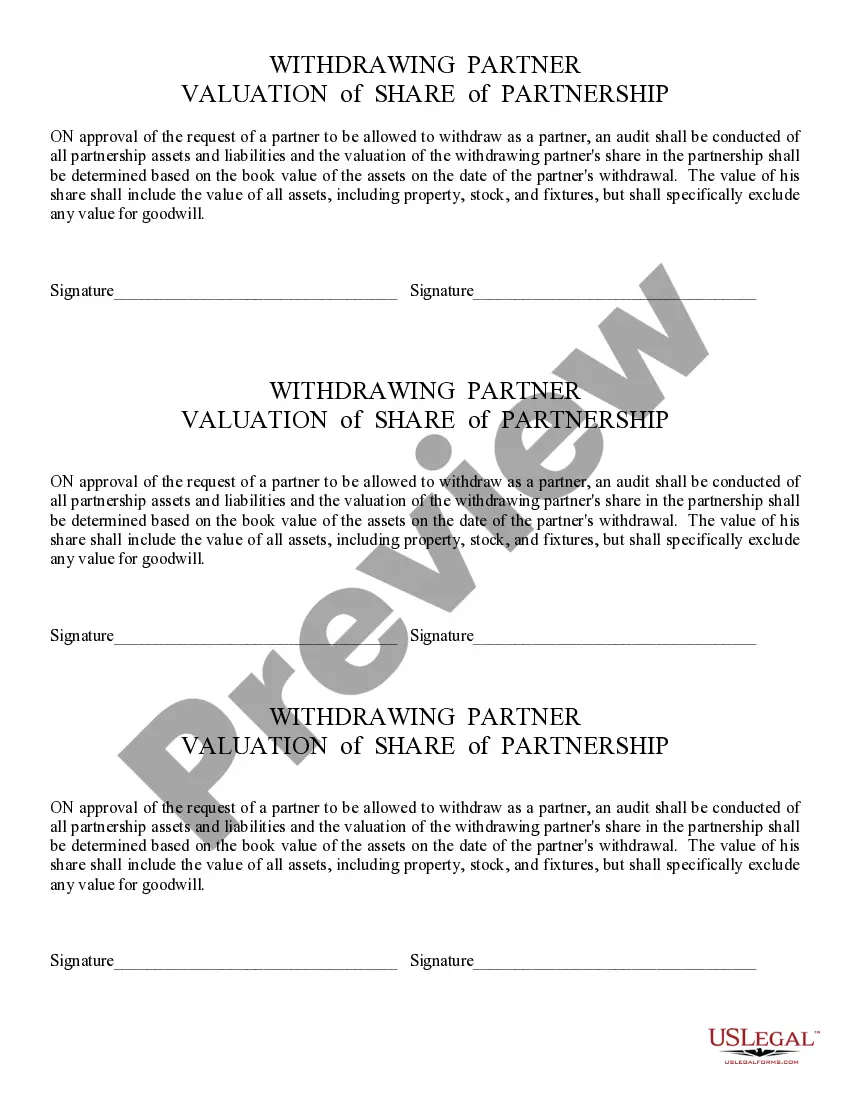

This form states that on approval of the request of a partner to be allowed to withdraw as a partner, an audit shall be conducted of all partnership assets and liabilities and the valuation of the withdrawing partner's share in the partnership shall be determined based on the book value of the assets on the date of the partner's withdrawal. The value of his share shall include the value of all assets, including property, stock, and fixtures, but shall specifically exclude any value for goodwill.

Phoenix Arizona Valuation of Share of Partner

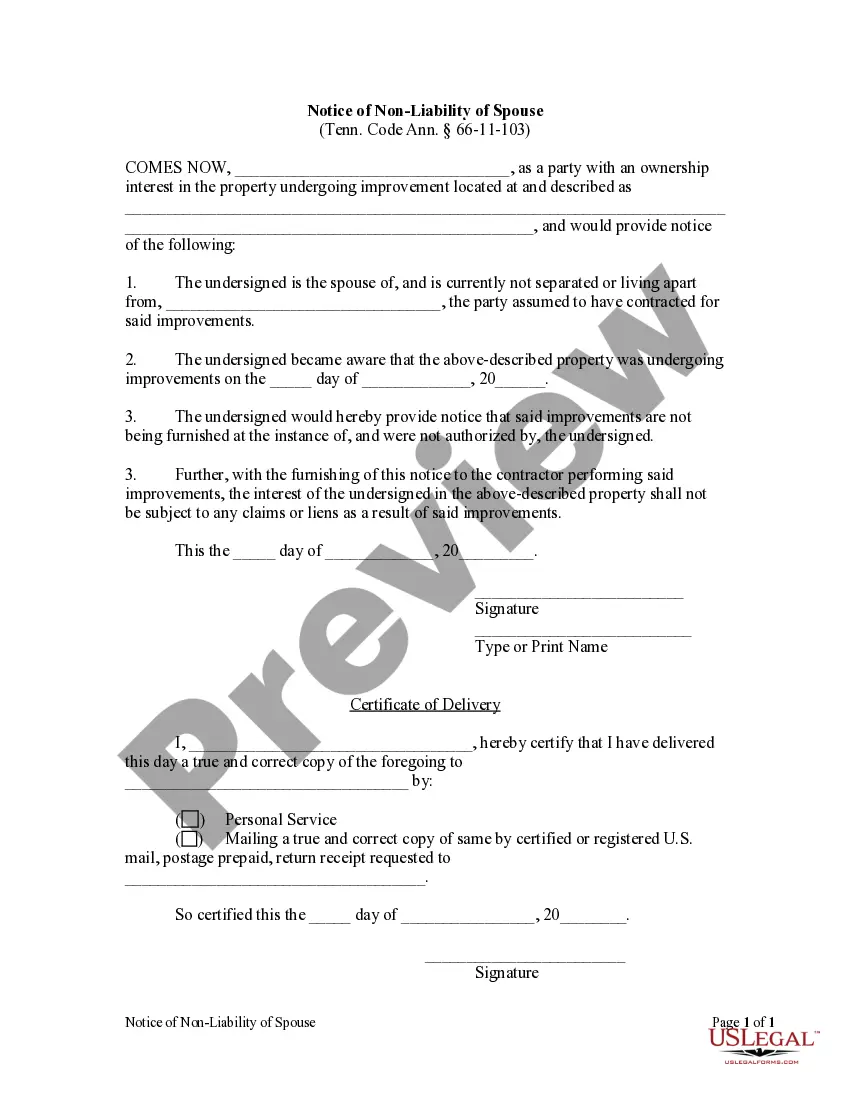

Description

How to fill out Arizona Valuation Of Share Of Partner?

If you are looking for a suitable document, it’s incredibly difficult to find a more appropriate source than the US Legal Forms website – one of the most extensive collections online.

Here you can obtain thousands of form examples for business and personal needs by categories and regions, or keywords.

Utilizing our advanced search feature, locating the latest Phoenix Arizona Valuation of Share of Partner is as simple as 1-2-3.

Obtain the document. Select the file type and download it to your device.

Make adjustments. Complete, edit, print, and sign the received Phoenix Arizona Valuation of Share of Partner.

- If you are already familiar with our service and possess an account, all you need to acquire the Phoenix Arizona Valuation of Share of Partner is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the guidelines outlined below.

- Ensure you have located the document you require. Examine its description and utilize the Preview feature to review its content. If it doesn’t satisfy your needs, employ the Search bar at the top of the page to find the suitable record.

- Confirm your choice. Click the Buy now option. Then, choose the desired pricing plan and provide details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Form popularity

FAQ

Class 3 property means Assessed Property that is or is intended to be developed as multifamily rental units under common management (e.g., apartments), including any ancillary uses thereto.

There are three types of property classifications in California law: community property, separate property, and quasi-community property. It is important to know the differences between them, because the definition of a property determines who has ownership and control of the property.

A.R.S. § 42-11001(5). Limited property value is a value calculated according to a statutory formula, designed to reduce the effect of inflation on property taxes.

Real and personal property that is used for residential purposes and occupied by a relative of the owner, as described in section 42-12053, as the relative's primary residence, that is not otherwise included in class one, two, four, six, seven or eight and that is valued at full cash value. 3.

42-12004 - Class four property. 1. Real and personal property and improvements to the property that are used for residential purposes, including residential property that is owned in foreclosure by a financial institution, that is not otherwise included in another classification and that is valued at full cash value.

42-12004 - Class four property. 1. Real and personal property and improvements to the property that are used for residential purposes, including residential property that is owned in foreclosure by a financial institution, that is not otherwise included in another classification and that is valued at full cash value.

The Assessed Value is based on the Full Cash Value, and the assessment ratio for the legal class of the property. The tax rates for the county and local governmental jurisdictions in which the business operates are applied to the Assessed value.

Class 1 is divided into the following subclasses. 1. Producing mines and mining claims, personal property used on mines and mining claims, improvements to mines and mining claims and mills and Page 5 smelters operated in conjunction with mines and mining claims that are valued at full cash value pursuant to § 42-14058.