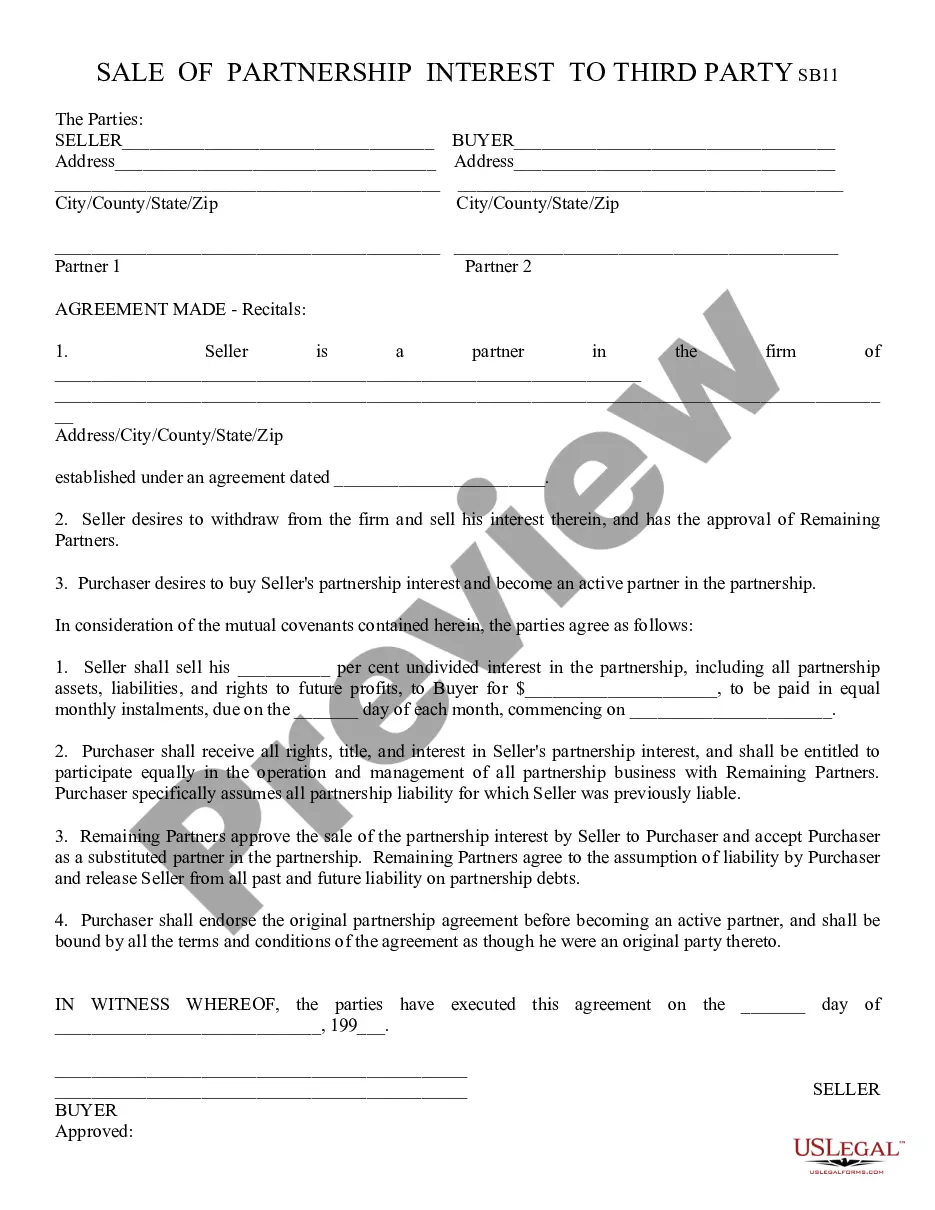

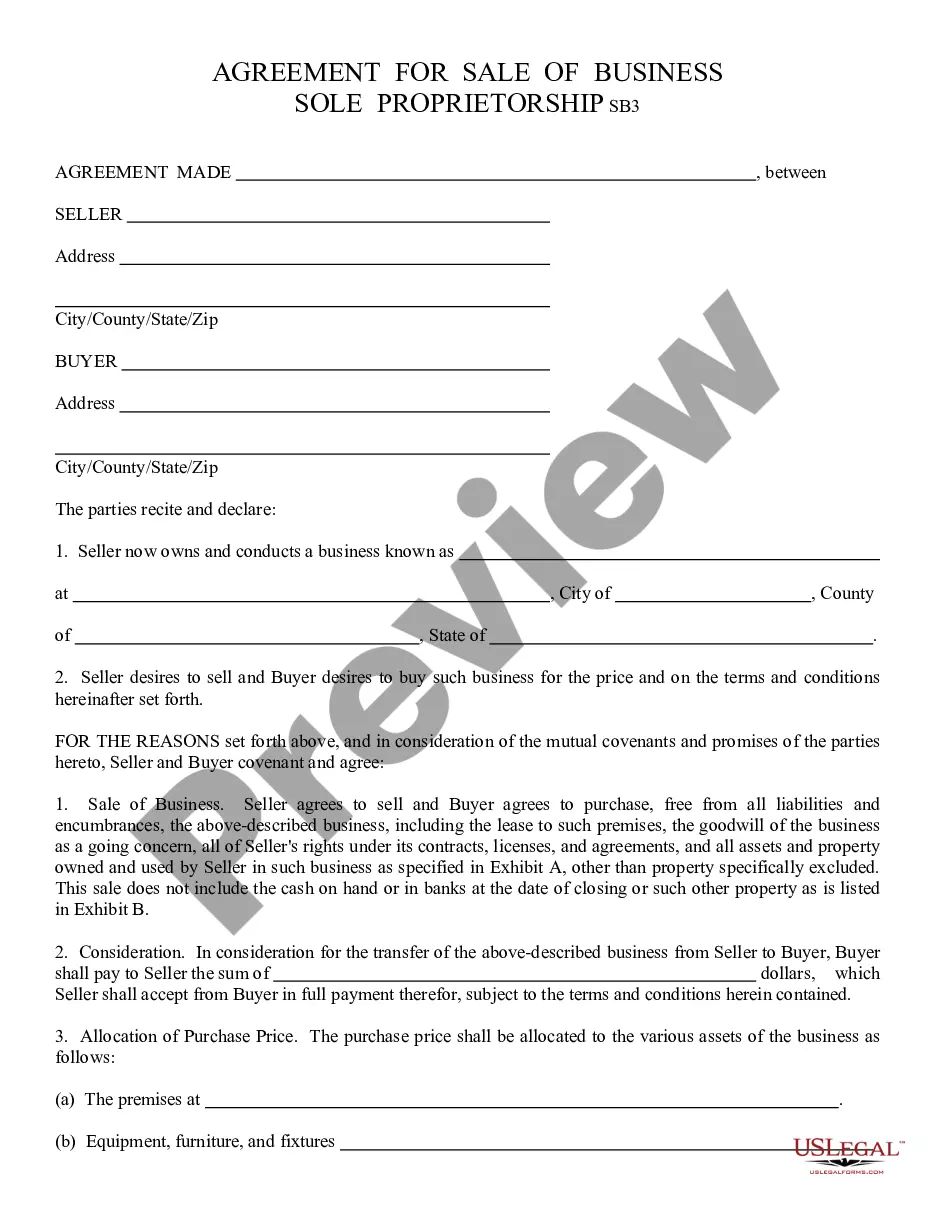

This is a contract between a Partner in a business and an intended Purchaser of his/her interest in the company. When a Partner wishes to sell his/her interest in a company, he/she must seek the approval of the remaining Partners. If they agree to the sell, the Partner may sell his/her interest to a Third Party. Both the Partner/Seller and the Third Party Purchaser must sign this form in front of a Notary Public, in order to be a valid agreement. This form is available in both Word and Rich Text formats.

Pima Arizona Sale of Partnership Interest to Third Party

Description

How to fill out Arizona Sale Of Partnership Interest To Third Party?

Utilize the US Legal Forms and gain instant access to any document you desire.

Our advantageous platform featuring a vast array of document templates enables you to locate and acquire nearly any document sample you need.

You can download, fill out, and validate the Pima Arizona Sale of Partnership Interest to Third Party in mere moments instead of spending hours online attempting to locate the correct template.

Using our library is an excellent approach to enhance the security of your form submissions. Our skilled attorneys frequently review all documents to verify that the templates are suitable for a specific jurisdiction and adhere to current laws and regulations.

US Legal Forms is likely one of the largest and most dependable template repositories on the internet.

Our organization is always eager to assist you with any legal matter, even if it's merely about downloading the Pima Arizona Sale of Partnership Interest to Third Party.

- How can you obtain the Pima Arizona Sale of Partnership Interest to Third Party.

- If you have an account, simply Log In to your profile. The Download button will be activated on all the samples you view.

- Additionally, you can find all previously saved documents in the My documents section.

- If you haven’t registered yet, follow the steps below.

- Access the page with the form you need. Ensure it is the form you intended to find: confirm its title and description, and use the Preview feature when available. If not, use the Search box to find the required one.

- Initiate the download process. Click Buy Now and choose the payment plan that fits you best. Then, create an account and complete your order using a credit card or PayPal.

- Store the document. Select the format to obtain the Pima Arizona Sale of Partnership Interest to Third Party and modify and complete, or sign it as per your specifications.

Form popularity

FAQ

When a partner sells their partnership interest in a Pima Arizona sale of partnership interest to a third party, it initiates a transfer of rights and responsibilities. The new partner assumes the sold interest, which can include profit shares and decision-making roles within the partnership. It's essential for all parties involved to understand the implications of this transfer, including tax liabilities and existing agreements. By utilizing uslegalforms, sellers can access comprehensive documents and guidelines to facilitate a smooth transition.

When a partnership interest is sold in Pima, Arizona, the capital account undergoes adjustments to reflect the sale. The selling partner's capital account is typically decreased by the value of the interest sold. This adjustment also considers any outstanding debts and liabilities associated with that interest, ensuring an accurate representation of the partner's equity. For those navigating this process, uslegalforms provides valuable resources to simplify the transaction and maintain compliance.

The sale of partnership interest is not directly reported on the K-1 form itself; the K-1 primarily shows your share of the partnership's income, deductions, and credits. However, you will have to report any gain or loss from the sale on your personal tax return. Utilizing professional assistance can ensure you accurately report these transactions, specifically for Pima Arizona Sale of Partnership Interest to Third Party.

You report the sale of your partnership interest to the IRS by using IRS Form 8949 to report capital gains or losses. This form helps you detail the date of sale and proceeds received. For thorough guidance, using resources like uslegalforms can simplify your reporting process related to the Pima Arizona Sale of Partnership Interest to Third Party.

To sell your limited partnership interest, review your partnership agreement for any conditions on transfer. Seek approval from other partners, as they may have rights of first refusal. Once approved, a formal sale agreement should be drawn up to finalize the transaction, ensuring compliance with Pima Arizona regulations.

To account for the sale of partnership interest, you need to determine your share of the partnership's basis, which includes any gains or losses. You will record the transaction in your financial statements. Engaging with a platform like uslegalforms can provide you with the necessary forms and information to keep your accounting accurate during this process.

When a partnership is sold, all assets and liabilities typically transfer to the new owner or owners. The partnership dissolves or continues under the terms of the sale, depending on the agreement. In Pima Arizona, this transition can affect ongoing projects and client relationships, so proper communication is vital.

When you sell your partnership interest, you report this transaction on your tax return using IRS Form 8949. You also provide details about the sale on Schedule D, which summarizes capital gains and losses. For clarity and compliance in Pima Arizona, consulting a tax professional can help you navigate this process effectively.

Yes, you can transfer your partnership interest to another person in Pima Arizona. However, you need to follow the terms laid out in your partnership agreement. It's crucial to ensure that all necessary consents are obtained from other partners. This step helps prevent any potential disputes during the transfer process.

Certain partnership agreements may impose restrictions on the Pima Arizona Sale of Partnership Interest to a Third Party. Common limitations include the right of first refusal, which allows other partners to buy the interest before outside parties. Review your partnership's governing documents and consider seeking legal advice to understand any specific provisions that may apply to your situation.