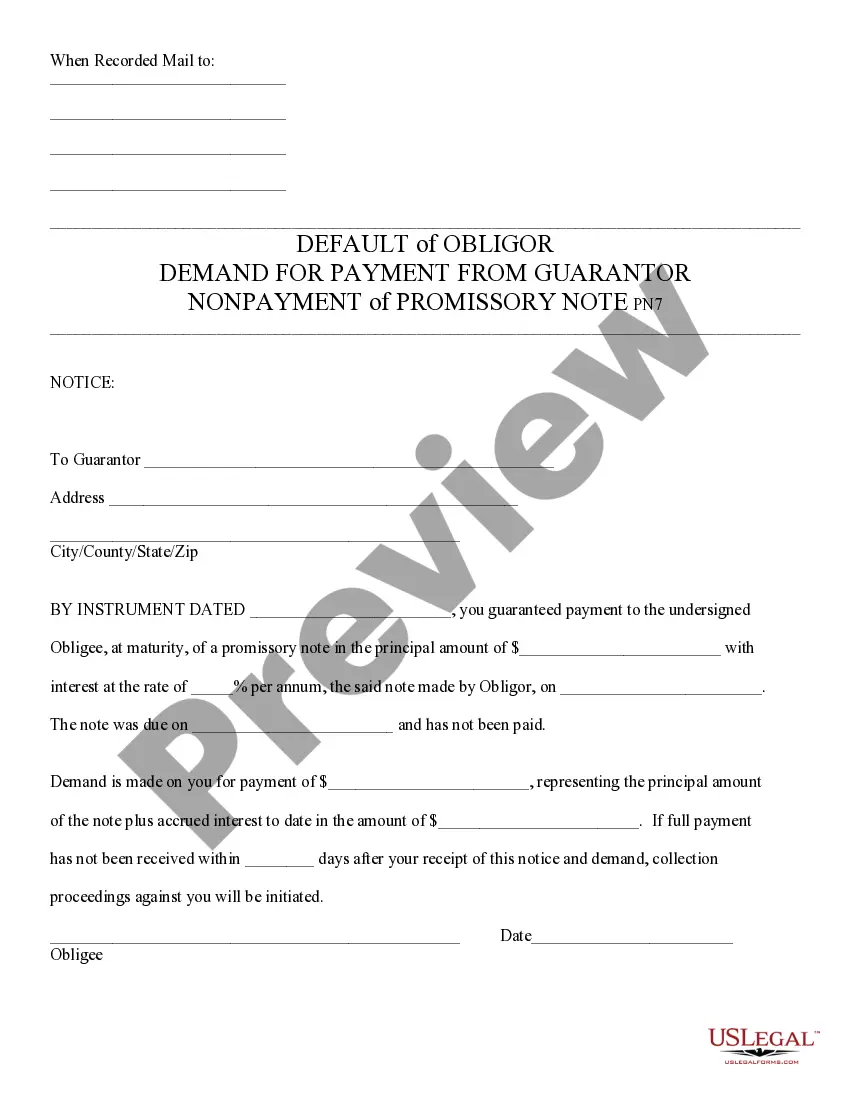

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Tucson Arizona Default of Promissory Note and Demand for Payment

Description

How to fill out Arizona Default Of Promissory Note And Demand For Payment?

If you have previously utilized our service, Log In to your account and retrieve the Tucson Arizona Default of Promissory Note and Demand for Payment onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it per your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you have identified an appropriate document. Review the description and utilize the Preview option, if offered, to determine if it suits your requirements. If it does not, use the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and process your payment. Utilize your credit card information or the PayPal option to finalize the purchase.

- Receive your Tucson Arizona Default of Promissory Note and Demand for Payment. Choose the file format for your document and store it on your device.

- Complete your template. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Steps in Filing a case: Verification of Limitation period of Promissory note. Sending Notice. File a suit in Civil Court. Paying Court Fee. After Filing of the suit.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

To enforce a promissory note, the holder must provide notice as is required per the note. If timely payment is not made by the borrower, the note holder can file an action to recover payment.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

In the unlikely event a borrower defaults on a promissory note, it is the lender's responsibility to execute the collection action necessary to claim the item(s) used as collateral. These actions may include: Foreclosure (for real estate investments) Repossession.