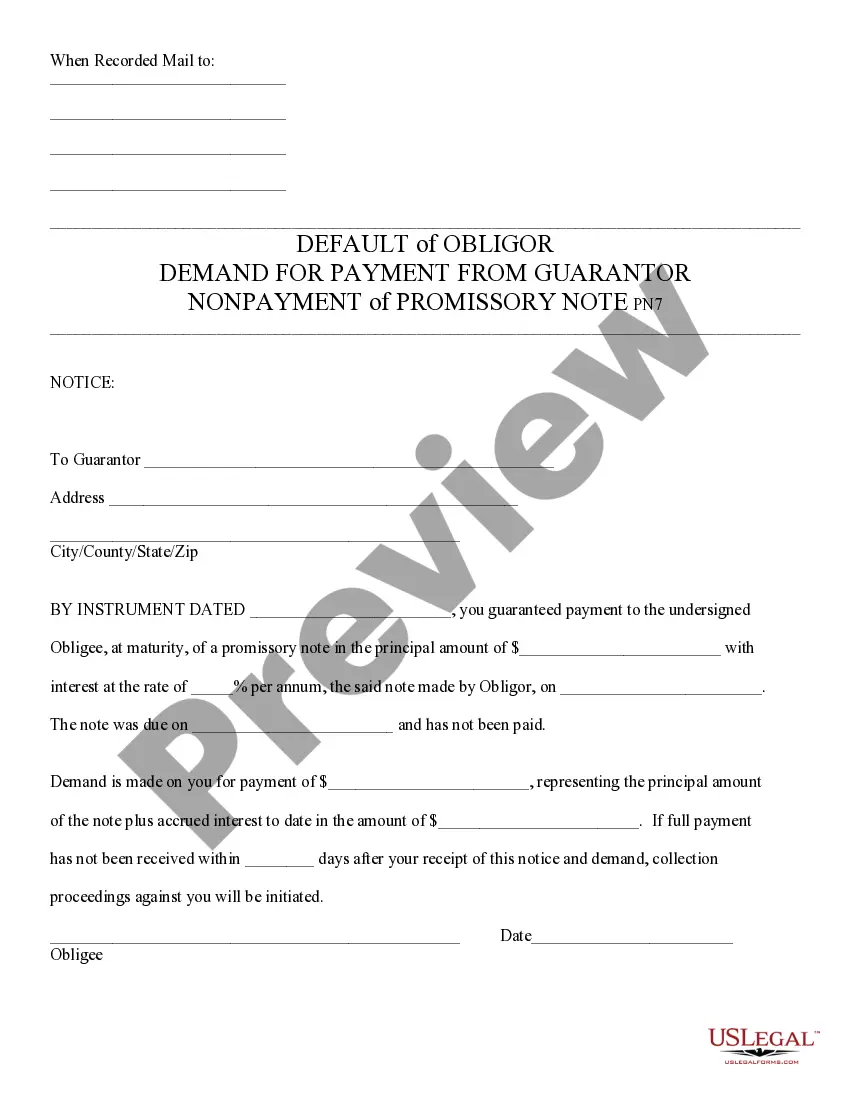

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Surprise Arizona Default of Promissory Note and Demand for Payment

Description

How to fill out Arizona Default Of Promissory Note And Demand For Payment?

If you have previously utilized our service, sign in to your account and store the Surprise Arizona Default of Promissory Note and Demand for Payment on your device by clicking the Download button. Ensure your subscription is current. Otherwise, renew it according to your billing plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your file.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to effortlessly locate and download any template for your personal or business requirements!

- Verify you've located the appropriate document. Review the details and use the Preview feature, if available, to see if it fulfills your needs. If it does not meet your criteria, employ the Search tab above to find the suitable one.

- Acquire the template. Click the Buy Now button and choose either a monthly or annual subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Access your Surprise Arizona Default of Promissory Note and Demand for Payment. Select the file format for your document and save it to your device.

- Complete your sample. Print it or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To demand payment on a promissory note, begin by crafting a formal demand letter outlining the amount due and referencing the original terms. This letter should affirm your intentions to pursue legal remedies if payment is not received. For scenarios involving Surprise Arizona Default of Promissory Note and Demand for Payment, ensure you follow legal protocols, and utilize uslegalforms as a useful resource in generating the necessary documents.

When someone defaults on a promissory note, begin by contacting the borrower to understand their circumstances. You may also seek a revised repayment plan that can benefit both parties. If necessary, consider initiating legal actions related to Surprise Arizona Default of Promissory Note and Demand for Payment, and utilizing a platform like uslegalforms can help streamline this process.

If someone defaults on a promissory note, your first step is to assess the situation by reviewing the original agreement. You might consider reaching out for a discussion or negotiation, which could lead to a resolution. For more formal action, look into the legal processes available for Surprise Arizona Default of Promissory Note and Demand for Payment, as this can guide you on how to claim what you are owed effectively.

Generally, not paying a promissory note leads to financial repercussions rather than jail time. However, if the default results from fraud or criminal activity, then legal consequences can escalate. It is important to understand the difference between civil and criminal defaults, especially in the context of Surprise Arizona Default of Promissory Note and Demand for Payment. If you're concerned, consult with a legal expert to explore your options.

In Arizona, the statute of limitations for collecting on a promissory note is generally six years. This timeframe begins when the borrower defaults or fails to make a required payment. Being aware of the implications of a Surprise Arizona Default of Promissory Note and Demand for Payment will enable you to take timely actions regarding any outstanding obligations.

Yes, a promissory note can be structured to be on demand, meaning repayment is due whenever the lender requests it. This type can be useful in situations where the lender may need immediate access to funds. To ensure your rights related to a Surprise Arizona Default of Promissory Note and Demand for Payment are clear, having legal documentation in place is essential.

Defaulting on a promissory note can lead to significant consequences, including legal action from the lender. This could result in wage garnishment, asset liquidation, or negative impacts on your credit score. To navigate a potential Surprise Arizona Default of Promissory Note and Demand for Payment effectively, consider consulting legal resources or platforms like UsLegalForms for guidance.

A promissory note not payable to a bearer on demand requires identification of the authorized payee, ensuring accountability and clarity in transactions. This structure helps prevent disputes and confusion regarding ownership. Understanding the implications of a Surprise Arizona Default of Promissory Note and Demand for Payment can safeguard your interests.

A demand promissory note requires repayment on demand, without a fixed schedule, while a standard promissory note typically outlines specific terms for repayment. The flexibility of demand promissory notes can be beneficial in urgent situations. However, clarity on the Surprise Arizona Default of Promissory Note and Demand for Payment is crucial to ensure your rights are protected.

A demand promissory note becomes invalid when it lacks essential elements such as a clear borrower and lender, a definitive payment amount, or a specified repayment date. Additionally, if the note does not adhere to local laws, such as those in Arizona, it may not be enforceable. Understanding the nuances of a Surprise Arizona Default of Promissory Note and Demand for Payment can help you avoid pitfalls.