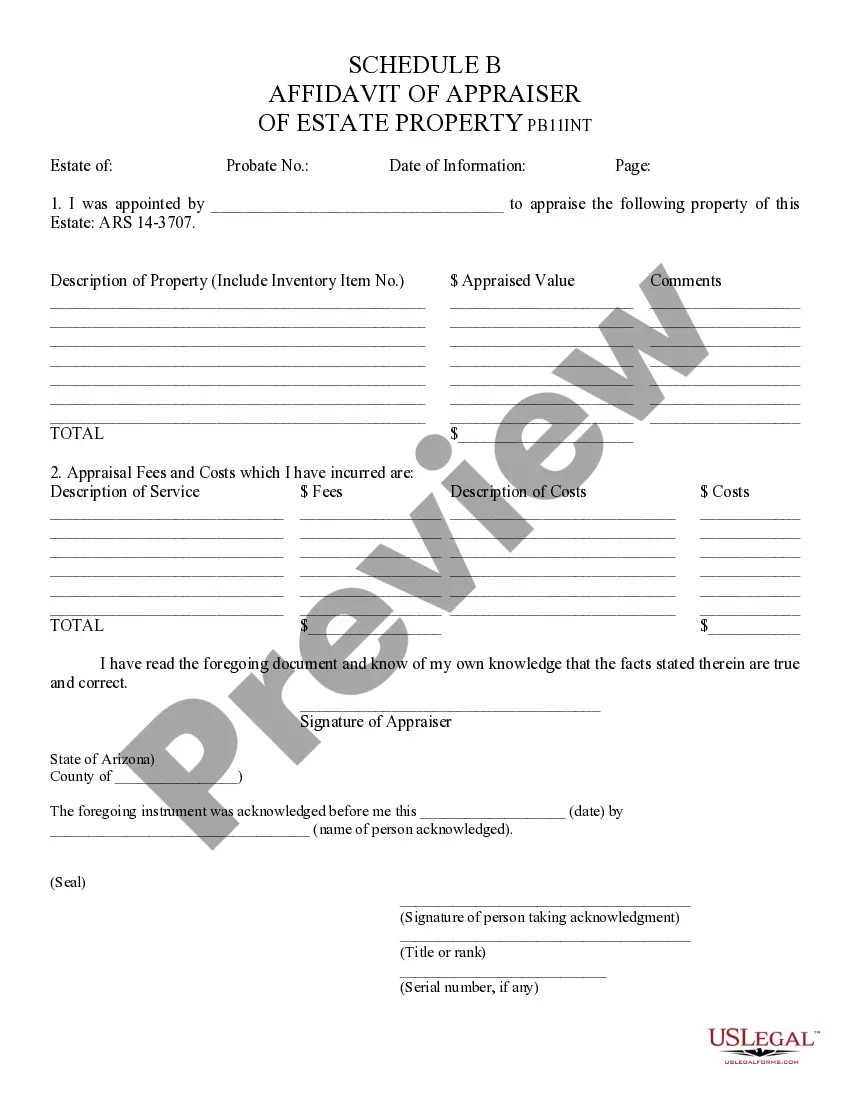

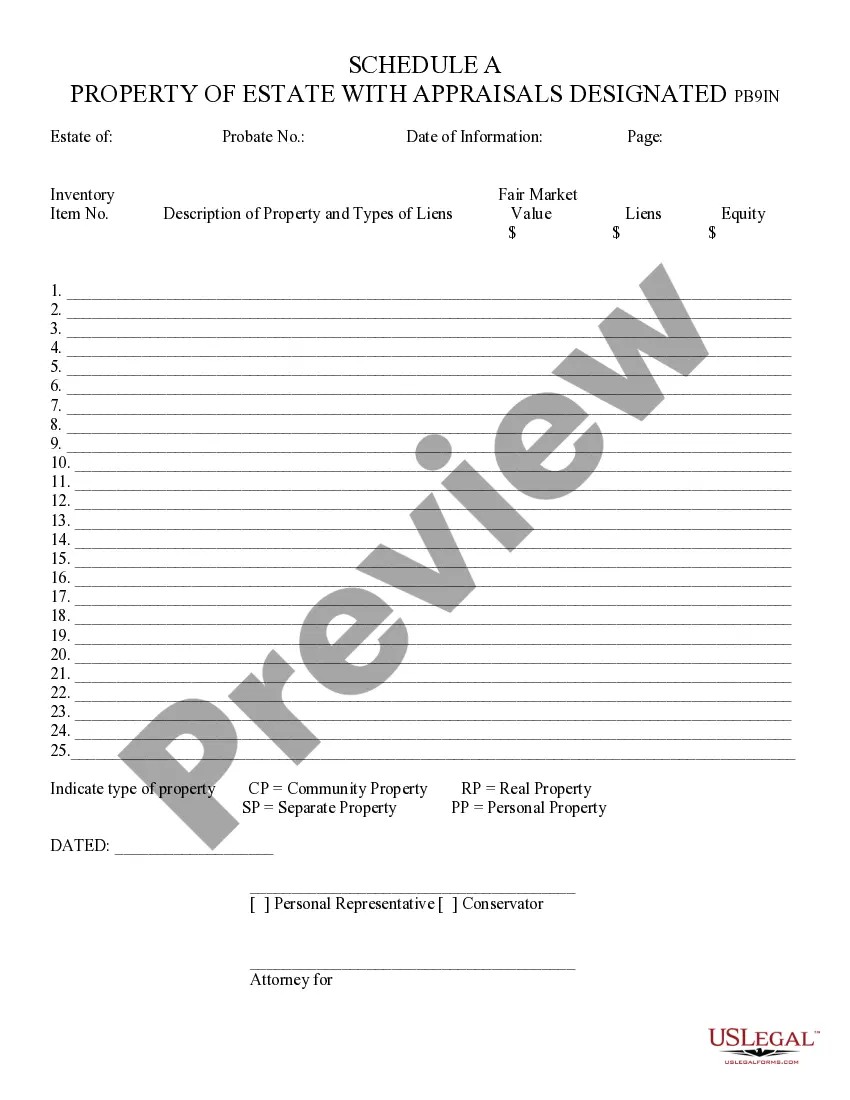

Property of Estate with Appraisals Designated - Schedule A - Arizona: This form is used when an administrator of an estate is called upon to list all the property, with appraisals of said property, of the estate. It is to be signed by the conservator, administrator in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Property of Estate with Appraisals Designated - Schedule A

Description

How to fill out Arizona Property Of Estate With Appraisals Designated - Schedule A?

If you are searching for a legitimate form template, it’s exceptionally difficult to discover a superior location than the US Legal Forms site – one of the most comprehensive collections online.

With this collection, you can obtain numerous document examples for corporate and personal purposes categorized by types and states, or keywords.

With our sophisticated search feature, finding the latest Phoenix Arizona Property of Estate with Appraisals Designated - Schedule A is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the format and save it to your device.

- Furthermore, the accuracy of each document is confirmed by a team of skilled lawyers who regularly examine the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Phoenix Arizona Property of Estate with Appraisals Designated - Schedule A is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have selected the sample you desire. Review its details and use the Preview feature to verify its content. If it does not satisfy your needs, utilize the Search option at the top of the screen to find the suitable document.

- Confirm your selection. Click the Buy now button. Then, select your preferred subscription plan and provide your information to create an account.

Form popularity

FAQ

Personal property is considered to be movable and not permanently attached to real estate. Although there are exceptions, personal property usually can be removed without causing damage to either the real estate from which it is removed or the item of property itself.

Property classified as Legal Class 4.1 is not listed as a registered rental but still does not receive the State Aid to Education Tax Credit. An example of a property in Legal Class 4.1 is a secondary home.

Almost always, when a property is appraised in connection with a loan, the appraiser is selected by the lender, but you'll be responsible for paying the appraisal fee.

The Arizona Department of Insurance and Financial Institutions oversees the secure operation of Arizona's Real Estate Appraisal Division. The Department ensures the safety and soundness of the appraisal industry while overseeing compliance with state and applicable federal laws.

The Assessed Value is based on the Full Cash Value, and the assessment ratio for the legal class of the property. The tax rates for the county and local governmental jurisdictions in which the business operates are applied to the Assessed value.

Real and personal property that is used for residential purposes and occupied by a relative of the owner, as described in section 42-12053, as the relative's primary residence, that is not otherwise included in class one, two, four, six, seven or eight and that is valued at full cash value.

42-12004 - Class four property. 1. Real and personal property and improvements to the property that are used for residential purposes, including residential property that is owned in foreclosure by a financial institution, that is not otherwise included in another classification and that is valued at full cash value.

(See also A.R.S. 15-972(K)(2) ). A Primary Residence is defined as residential property that is used by the owner or owners as their principal or usual place of residence, or leased or rented to a qualified relative of the owner, as provided in A.R.S. 42-12053 , and used as the relative's usual and principal residence.

There are three types of property classifications in California law: community property, separate property, and quasi-community property. It is important to know the differences between them, because the definition of a property determines who has ownership and control of the property.

These individuals possess experience and knowledge to address issues unique to residential real property reviews. AI-RRS Designated members agree to adhere to the Appraisal Institute Code of Professional Ethics and Standards of Professional Practice, underscoring a commitment to sound and ethical professional practice.