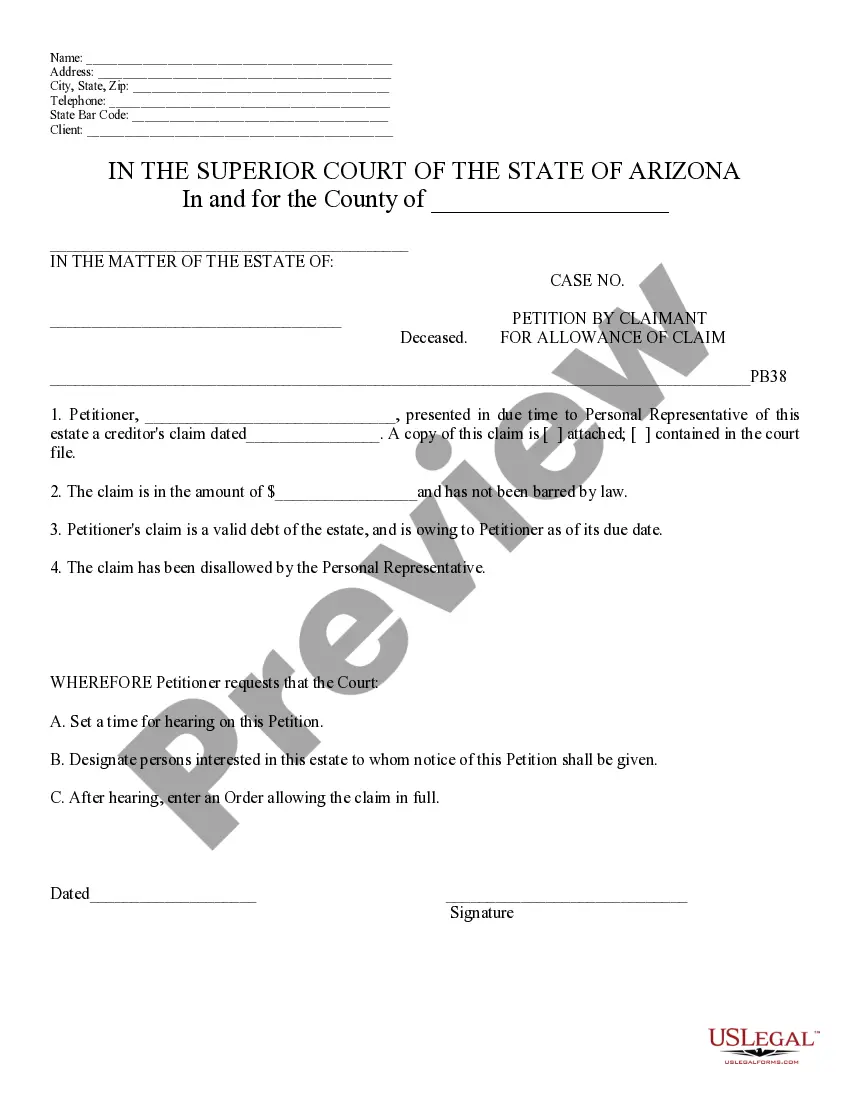

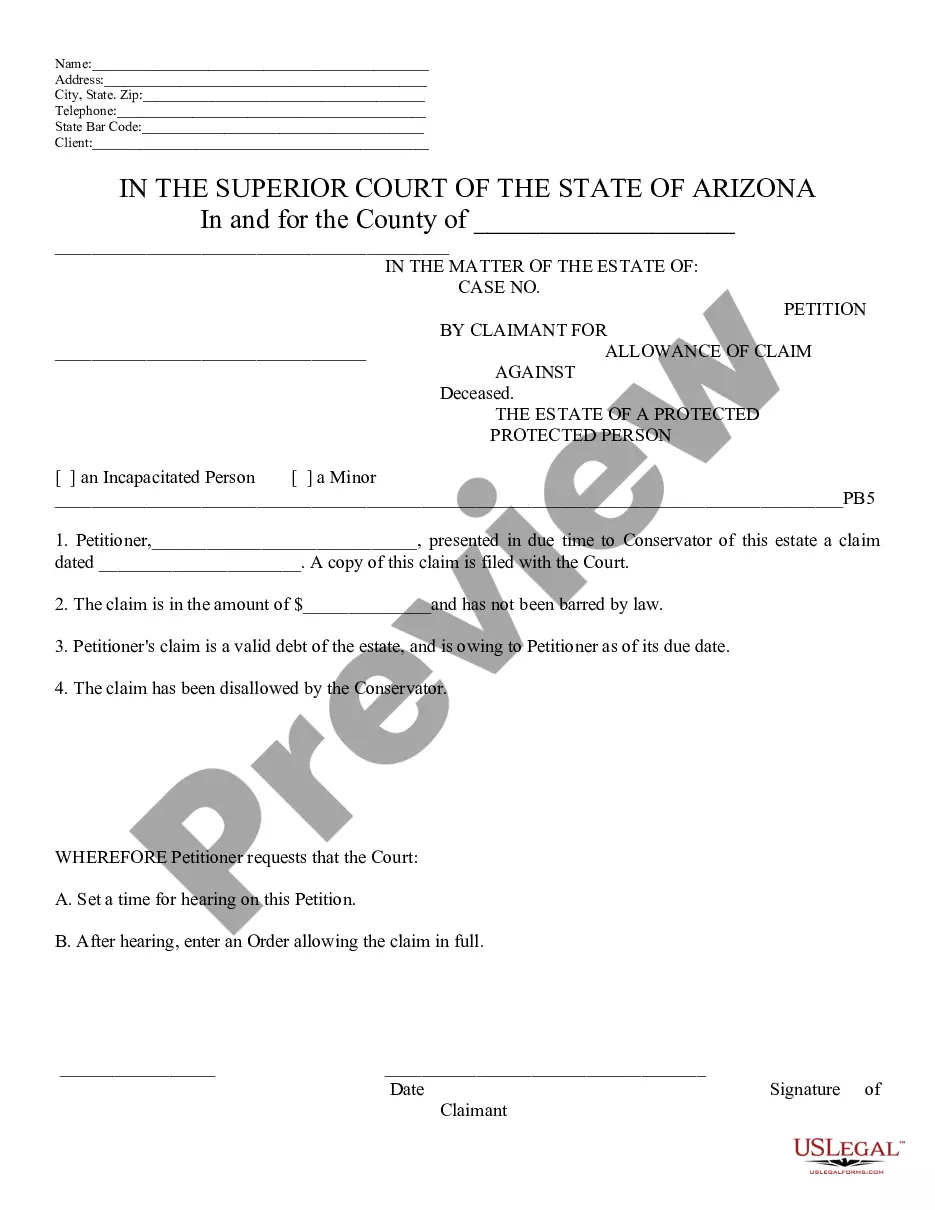

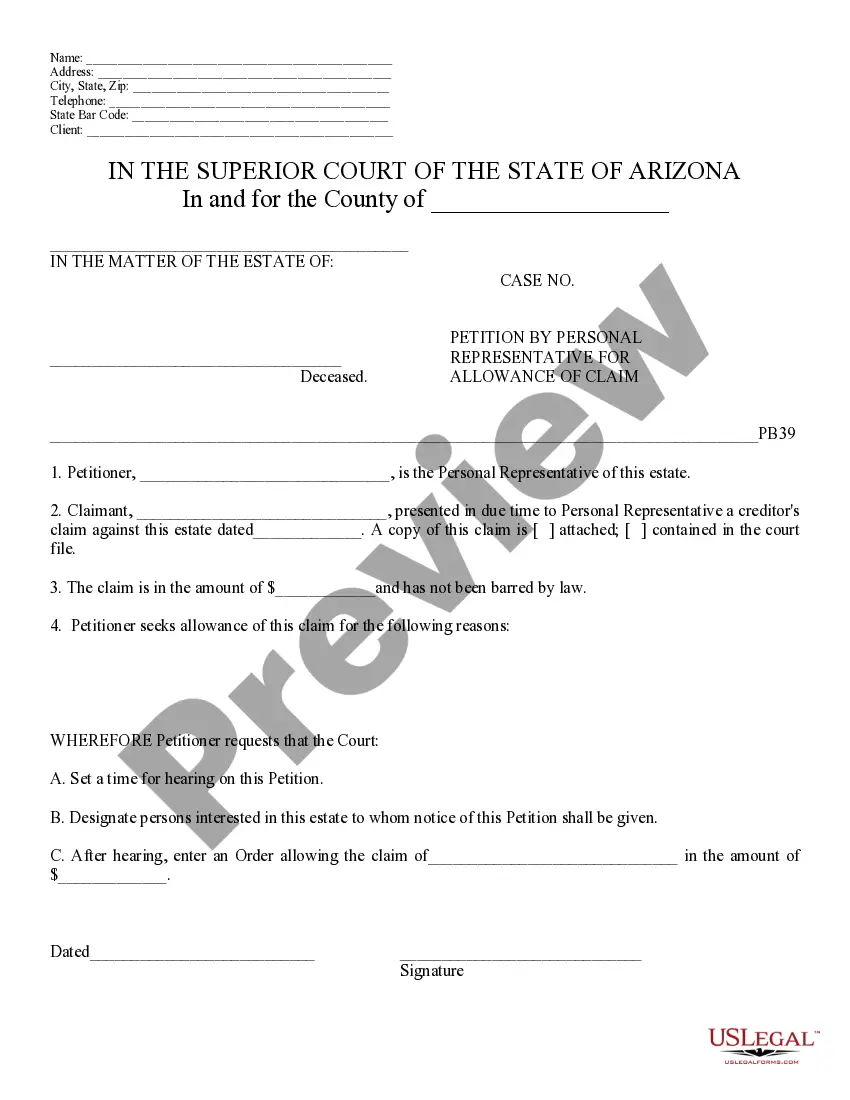

This model form, a Petition by Personal Rep. for Allowance of Claim - Arizona, is intended for use to initiate a request to the court to take the stated action. The form can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances. Available in for download now, in standard format(s).

Phoenix Arizona Petition by Personal Representative for Allowance of Claim

Description

How to fill out Arizona Petition By Personal Representative For Allowance Of Claim?

If you are looking for a legitimate form, it’s incredibly challenging to select a superior platform than the US Legal Forms website – likely the most extensive online collections.

With this collection, you can obtain numerous form examples for business and personal use by categories and states, or through keywords.

With the enhanced search feature, acquiring the latest Phoenix Arizona Petition by Personal Representative for Allowance of Claim is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Specify the format and download it to your device.

- Additionally, the relevance of each document is confirmed by a team of experienced attorneys who regularly review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Phoenix Arizona Petition by Personal Representative for Allowance of Claim is to Log In to your user profile and hit the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have selected the form you require. Review its details and utilize the Preview function (if available) to view its content. If it doesn’t fulfill your needs, use the Search field at the top of the screen to find the necessary file.

- Verify your choice. Click the Buy now button. After that, choose your desired subscription plan and provide the necessary details to create an account.

Form popularity

FAQ

According to tariff, the executor is entitled to 3.5% on the gross value of assets in an estate and 6% on income accrued and collected after the death of the deceased. It is best to discuss the fees with your family upfront so that they are aware of how the fees will be calculated.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Each minor or dependent child is given an allowance equal to $18,000 divided by the number of dependent and minor children of the decedent.

If you are appointed an executor/trustee by a Will, the general rule is that you will not be entitled to be paid for the time you spend in administering the estate. You can however recover your reasonable expenses.

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Letters of Authority: A document issued by the court evidencing the personal representative's authority to act. Nominee: The person seeking to be appointed personal representative. Personal representative: A person at least 18 years of age who has been appointed to administer the estate of the decedent.

This generally includes the following: ? Funeral expenses. ? Probate Registry fees. ? Professional fees, such as a solicitor's, surveyor's, or valuer's costs. ? Estate agency and other fees in respect of the sale of any property.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

For instance, if a personal representative (executor) wants to get paid from the estate for the services he/she provides, proper notice and disclosure must be made within 120 days of the appointment. Generally, personal representative (executor) compensation is based on a reasonable $25 to $50 hourly rate standard.