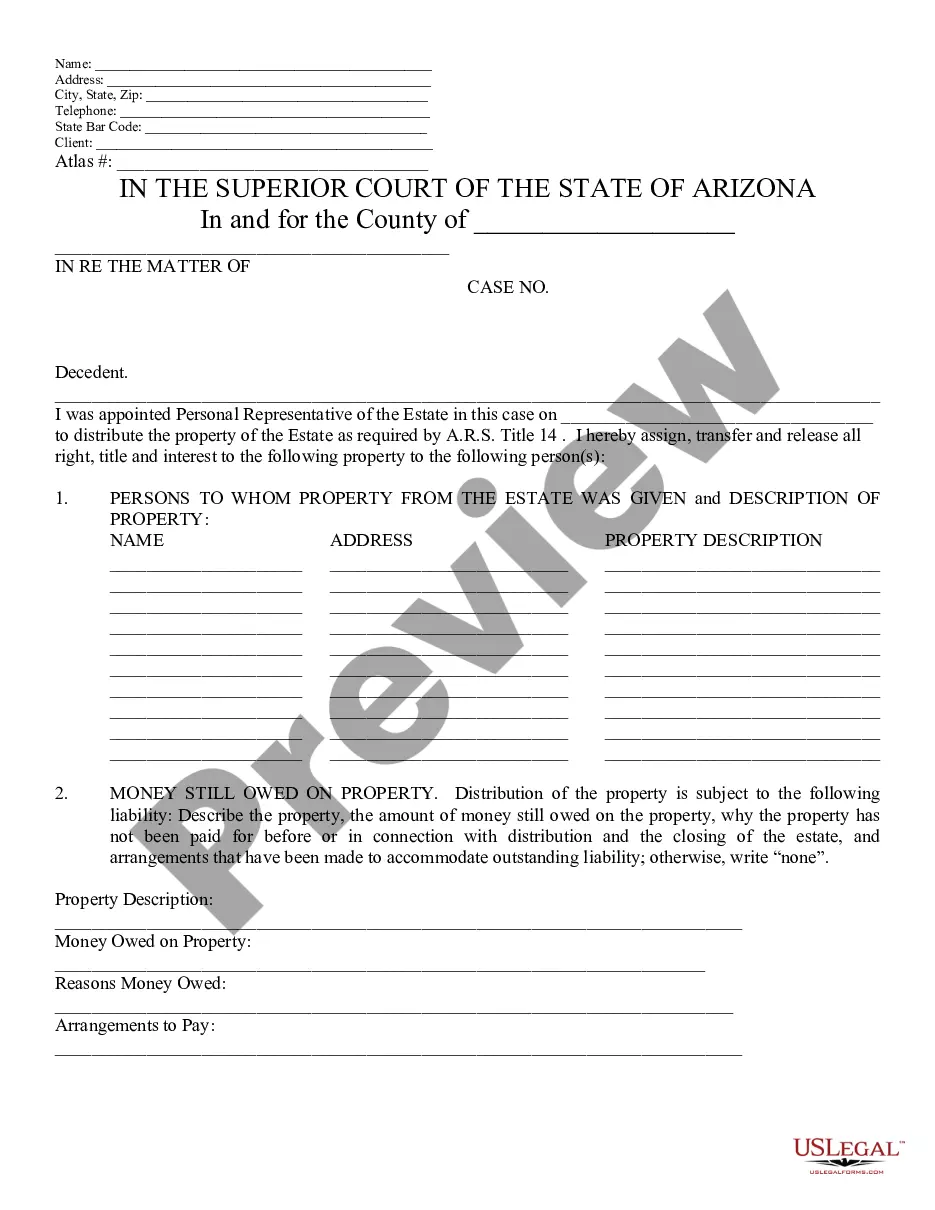

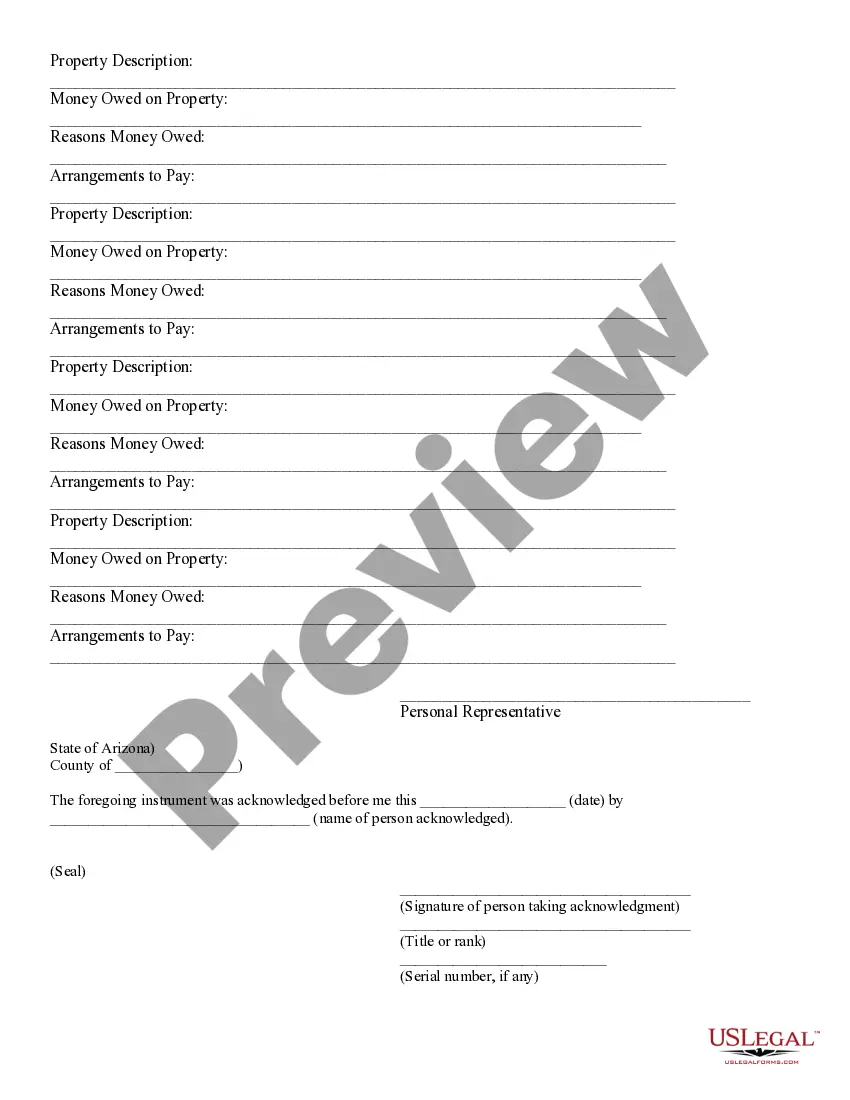

Proposed Distribution of Money and Property of Probate Estate - Schedule H - Arizona: A Proposed Distribution of Estate Property is signed by the Administrator. It fully lists all property in an estate and how he/she sugests it should be divided. It is available for download in both Word and Rich Text formats.

Mesa Arizona Proposed Distribution of Money and Property of Probate Estate - Schedule H

Description

How to fill out Mesa Arizona Proposed Distribution Of Money And Property Of Probate Estate - Schedule H?

Locating authenticated templates tailored to your regional regulations can be challenging unless you access the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both individual and business requirements, along with various real-life situations.

All the forms are properly categorized by usage area and jurisdiction, making the search for the Mesa Arizona Proposed Distribution of Money and Property of Probate Estate - Schedule H as straightforward as 1-2-3.

Maintaining organized paperwork in accordance with legal requirements is highly important. Leverage the US Legal Forms library to always have essential document templates readily available for any needs!

- Ensure you review the Preview mode and document description.

- If you notice any discrepancies, use the Search tab above to find the correct one.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan.

- Complete your transaction by entering your credit card information or utilizing your PayPal account.

- Download the Mesa Arizona Proposed Distribution of Money and Property of Probate Estate - Schedule H to save it on your device.

Form popularity

FAQ

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

How Long Does Probate Take in Arizona. According to Arizona law, probate proceedings must be kept open for at least 4 months to allow any creditors to make their claims. Informal probates typically last between 6-8 months, depending on how quickly the Personal Representative completes their required duties.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

Is Probate Required in Arizona? Probate is required in Arizona unless the decedent has a trust or listed beneficiaries for all assets. There is one exception to this rule, which is for estates with personal property valued at less than $75,000 and real property under $100,000.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

Deed of Distribution: The DEED OF DISTRIBUTION must be used to transfer any real estate/real property. After all claims have been settled and you are ready to transfer the property to someone, you need to fill out the DEED OF DISTRIBUTION and record it with the County Recorder.

The total value of the estate's personal property, including cash, bank accounts, stocks, bonds, jewelry and automobiles, cannot exceed $75,000. Additionally, the total assessed value of the estate's real property cannot exceed $100,000 after the value of liens or encumbrances has been subtracted.