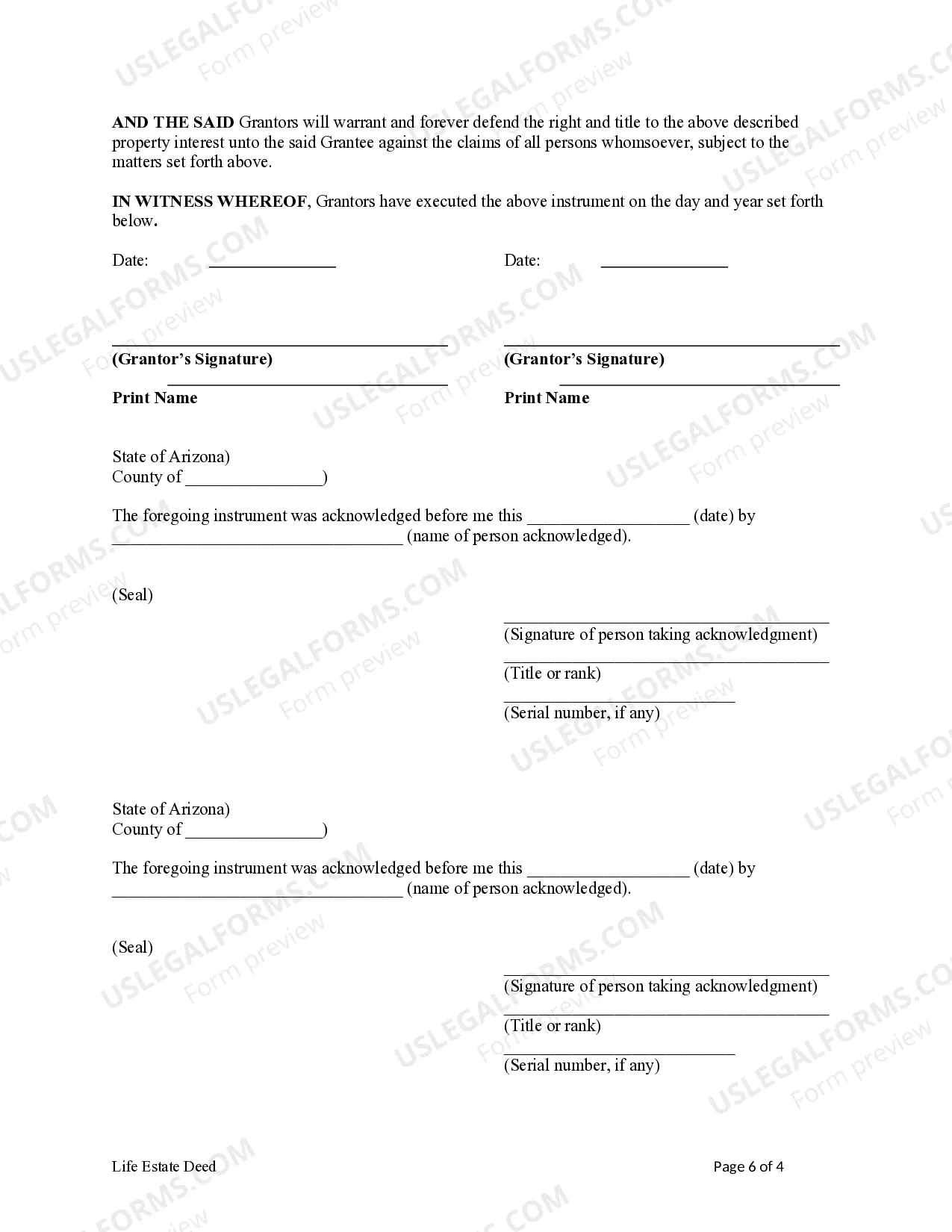

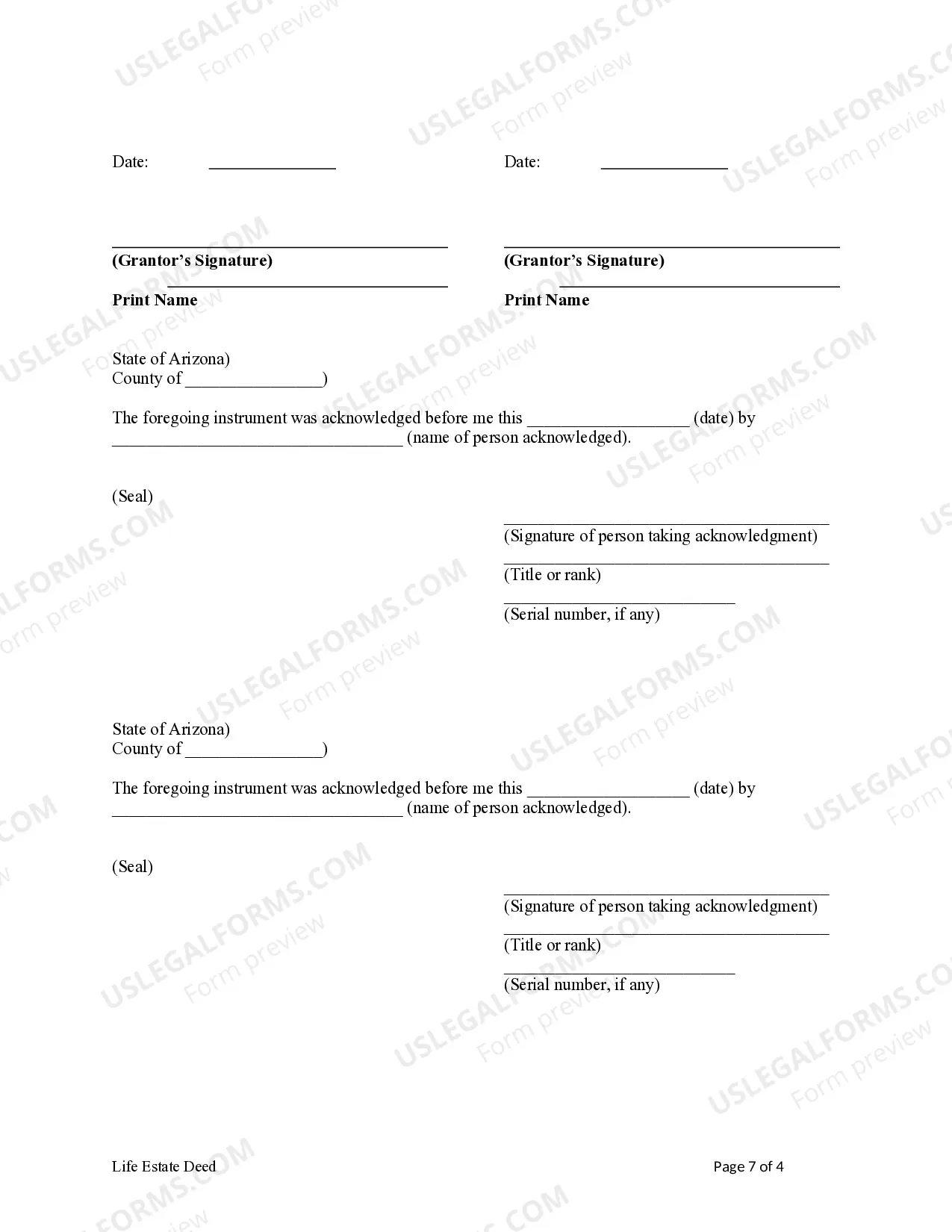

This form is a Life Estate Deed where the Grantors are two married couples and the Grantee is an individual. Grantors convey and warrant the life estate interest in the described property to the Grantee. This deed complies with all state statutory laws.

Phoenix Arizona Life Estate Deed from Two married couples to an Individual

Description

How to fill out Arizona Life Estate Deed From Two Married Couples To An Individual?

If you have previously made use of our service, sign in to your account and store the Phoenix Arizona Life Estate Deed from Two married couples to an Individual on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have unlimited access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or business needs!

- Verify you’ve found an appropriate document. Examine the description and utilize the Preview option, if available, to see if it fulfills your requirements. If it doesn’t suit you, use the Search tab above to locate the right one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Register an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Phoenix Arizona Life Estate Deed from Two married couples to an Individual. Choose the file format for your document and save it to your device.

- Finish your document. Print it or take advantage of professional online editors to complete and sign it electronically.

Form popularity

FAQ

Requirements for Arizona Beneficiary Deed Forms The deed must be recorded in the office of the county recorder of the county where the property is located before the death of the owner (or, with multiple owners, before the death of the last surviving owner).

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.

You will have to file an application to the land registry. They will require evidence of death, i.e. death certificate or a will. You will have to go to the office of revenue officer and submit an application to transfer title in the surviving co-owners name or surviving heirs name.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

Even though the transfer of ownership rights is, in theory, automatic, it makes sense to formalize the change in title. One way to accomplish this is by completing and recording an affidavit of surviving joint tenant, accompanied by an official copy of the deceased owner's death certificate.

An estate attorney may prepare a Beneficiary Deed for approximately $250 to $750. There will also be a nominal recording fee in the county where the property is located. Thomas J. Bouman provides legal counsel in the areas of estate planning, estate settlement, and asset protection.

Deeds must be signed in the presence of a notary and recorded with the county recorder's office in the county in which the property is located. Recording (A.R.S. § 11-468) ? All deeds must be filed with the County Recorder's Office.

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

In most states, you must notify the lender that your spouse has passed away. Other than this notice, you don't have to take any action. The loan will automatically become your responsibility. One exception is if your spouse had a mortgage life insurance policy.