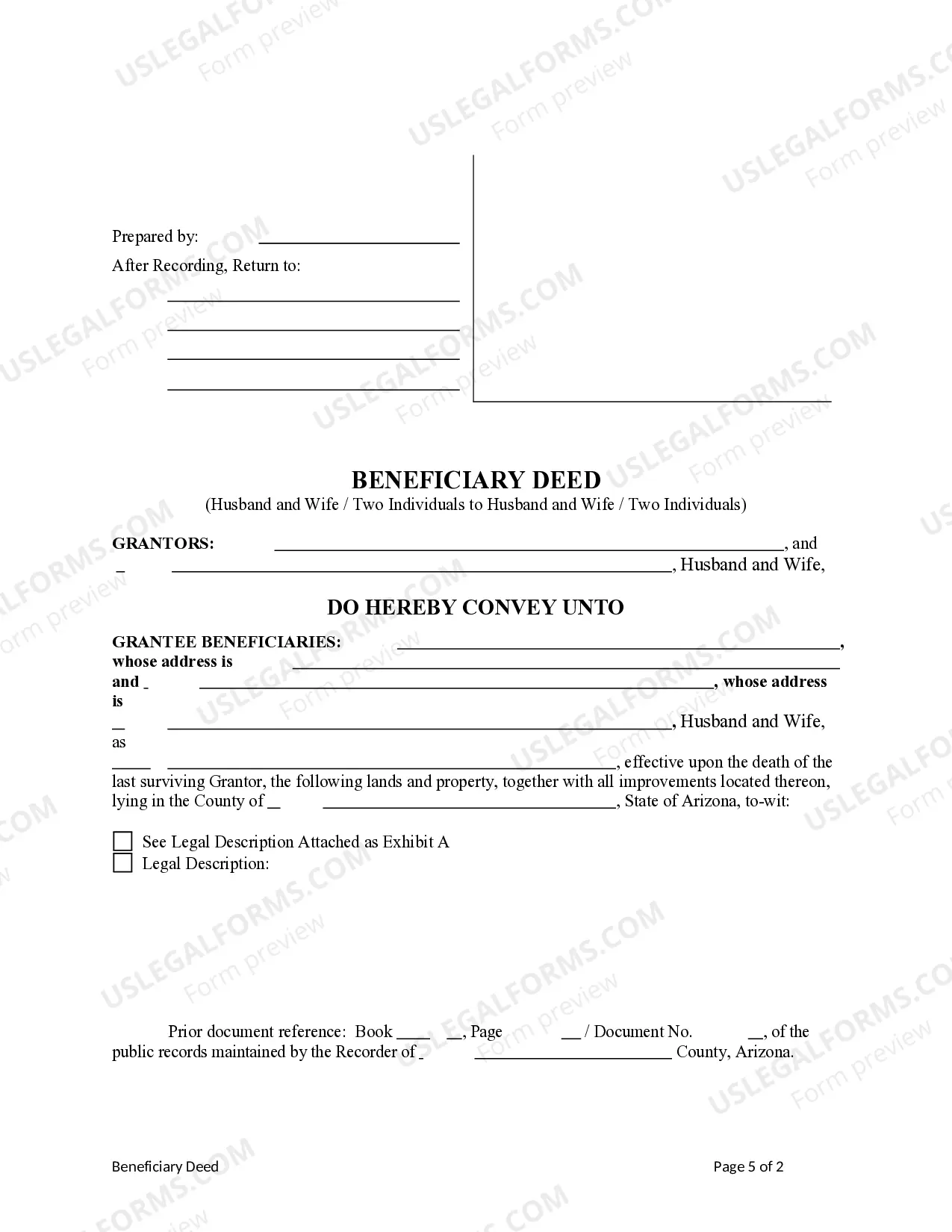

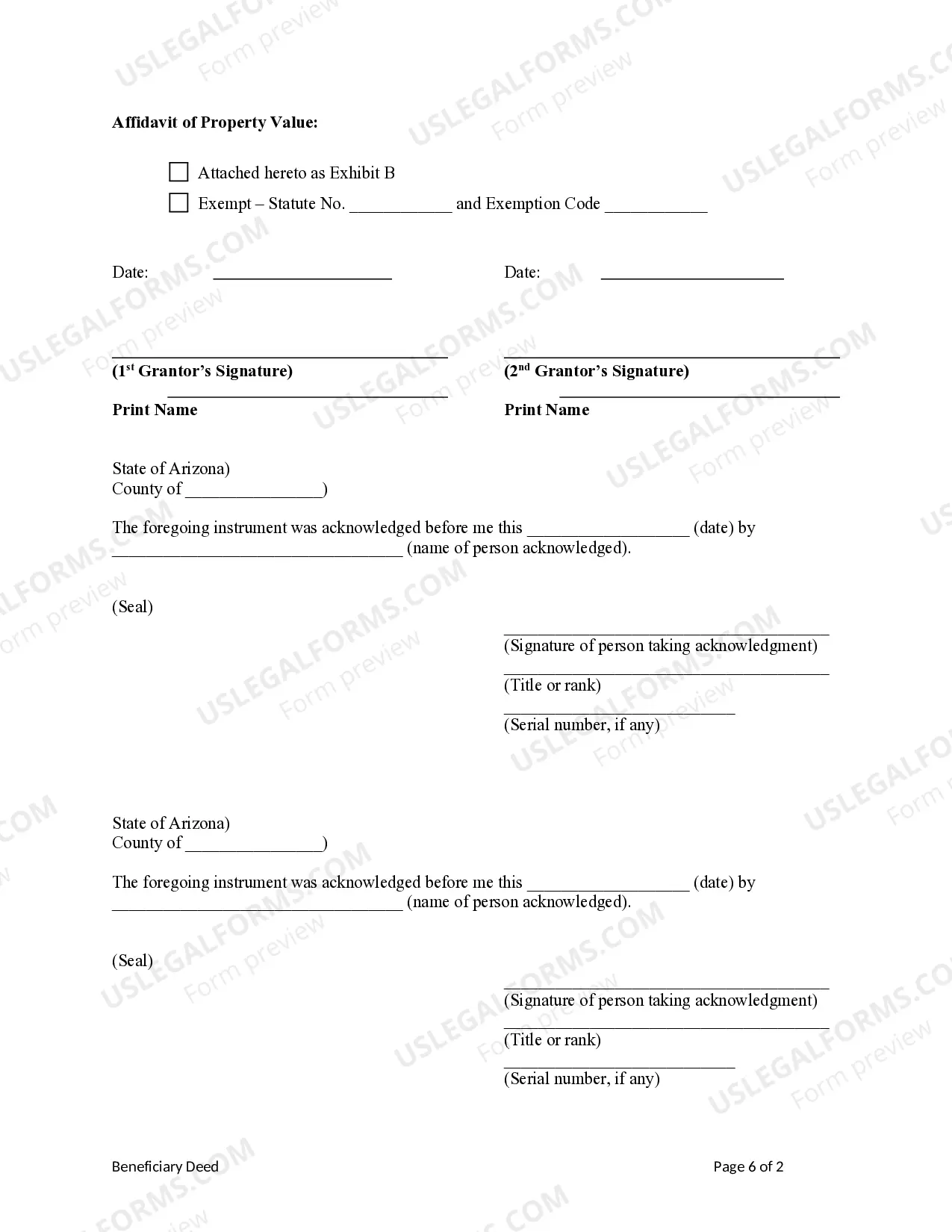

This form is a Transfer on Death Deed where the Grantors are husband and wife / two individuals and the Grantees are husband and wife / two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals

Description

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

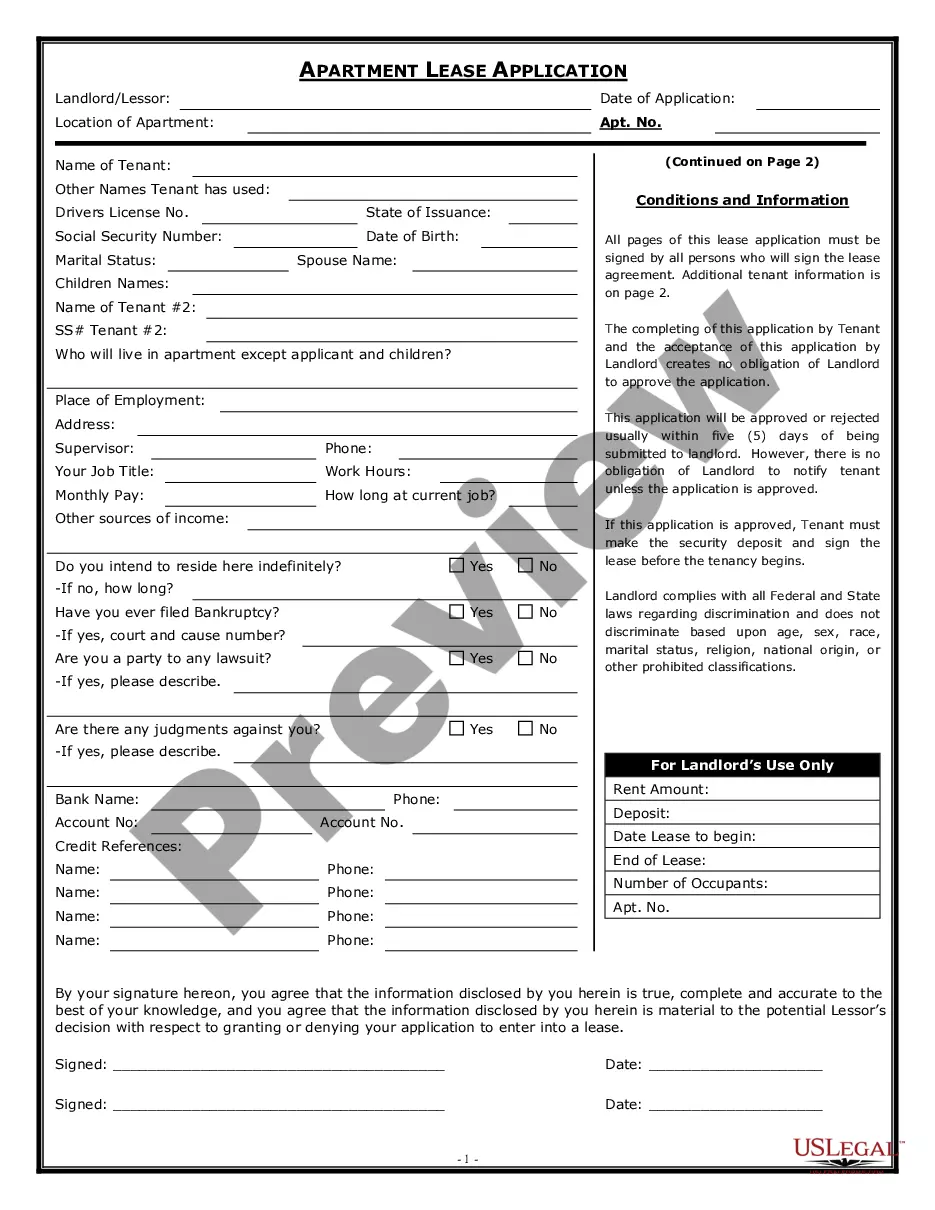

Finding authenticated templates that adhere to your local laws can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and business purposes and any real-world scenarios.

All the files are appropriately categorized by area of application and jurisdiction, making it as easy as pie to look for the Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals.

Maintaining documentation organized and compliant with legal standards is critically important. Utilize the US Legal Forms library to always have crucial document templates for any purpose readily accessible!

- For those already familiar with our service and who have used it in the past, acquiring the Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals takes only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- New users will need to follow a few more steps to complete the process.

- Review the Preview mode and form description. Ensure you’ve selected the right one that meets your needs and completely aligns with your local jurisdiction requirements.

- Search for an alternative template, if required. If you encounter any discrepancy, use the Search tab above to locate the appropriate one. If it meets your requirements, proceed to the next step.

Form popularity

FAQ

To add a beneficiary to your house deed in Arizona, you will need to create a Transfer on Death (TOD) deed. You can legally designate one or more beneficiaries to inherit your property automatically upon your passing. By recording this deed with the county recorder's office, the changes become official. If you're looking to implement a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, consider using resources like uslegalforms for guidance and assistance.

Yes, Arizona does allow Transfer on Death (TOD) deeds. This option helps you keep control of your property during your lifetime while ensuring it passes directly to your beneficiaries after your death. It can be a significant advantage for couples who want to streamline estate planning. Using a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals can simplify this process.

To transfer title on death in Arizona, you need to execute a Transfer on Death (TOD) deed. This deed directs that your property is transferred to your chosen beneficiaries when you pass away. You must sign and record the deed with your local county recorder's office for it to be legally effective. This simple process makes it easier for couples, like in a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, to manage their estates.

Many states, including Arizona, allow a Transfer on Death (TOD) deed. This option enables homeowners to seamlessly transfer property to beneficiaries upon their passing. It's crucial to check specific state laws, as some restrictions may apply to the format and execution of the deed. If you are considering a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, understanding your state’s regulations is essential.

One key downside of a Transfer of Death (TOD) deed is that it does not account for changes in the owner's circumstances. If the property is sold or the beneficiary's situation changes, the deed may become problematic. Additionally, disputes can arise if other legal documents conflict with the TOD provisions. Using a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals can help clarify your wishes but should be part of a broader estate plan.

Yes, you can designate multiple individuals on a Transfer of Death (TOD) deed in Arizona. This is particularly beneficial for couples or individuals who wish to provide for more than one heir upon their death. Having several beneficiaries can help in smoother transitions and clear intentions. When setting up a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, consider all possible beneficiaries.

Joint Transfer of Death (TOD) accounts are permitted in Arizona. This allows couples and co-owners to name multiple individuals as beneficiaries. Nonetheless, joint accounts may present challenges related to equal distribution among beneficiaries. When creating a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, it's essential to discuss your options carefully.

While Transfer of Death (TOD) deeds offer multiple benefits, they also come with disadvantages. One major drawback is that they do not provide protection against creditors. Additionally, should a beneficiary predecease the owner, the deed may become complicated. It's wise to consult with professionals about a Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals for tailored advice.

Arizona law permits multiple beneficiaries on a Transfer of Death (TOD) deed, allowing owners to include as many individuals as they choose. This option provides flexibility for estate planning, especially for families. However, it is important to clearly specify each individual's share to avoid disputes later. A Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals can facilitate this process effectively.

Yes, Arizona allows Transfer of Death (TOD) deeds. These deeds enable property owners to designate beneficiaries who will inherit the property upon the owner's death. This allows for a smoother transition of property ownership without the need for probate. A Surprise Arizona Beneficiary or Transfer of Death (TOD) Deed - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals can simplify estate planning.