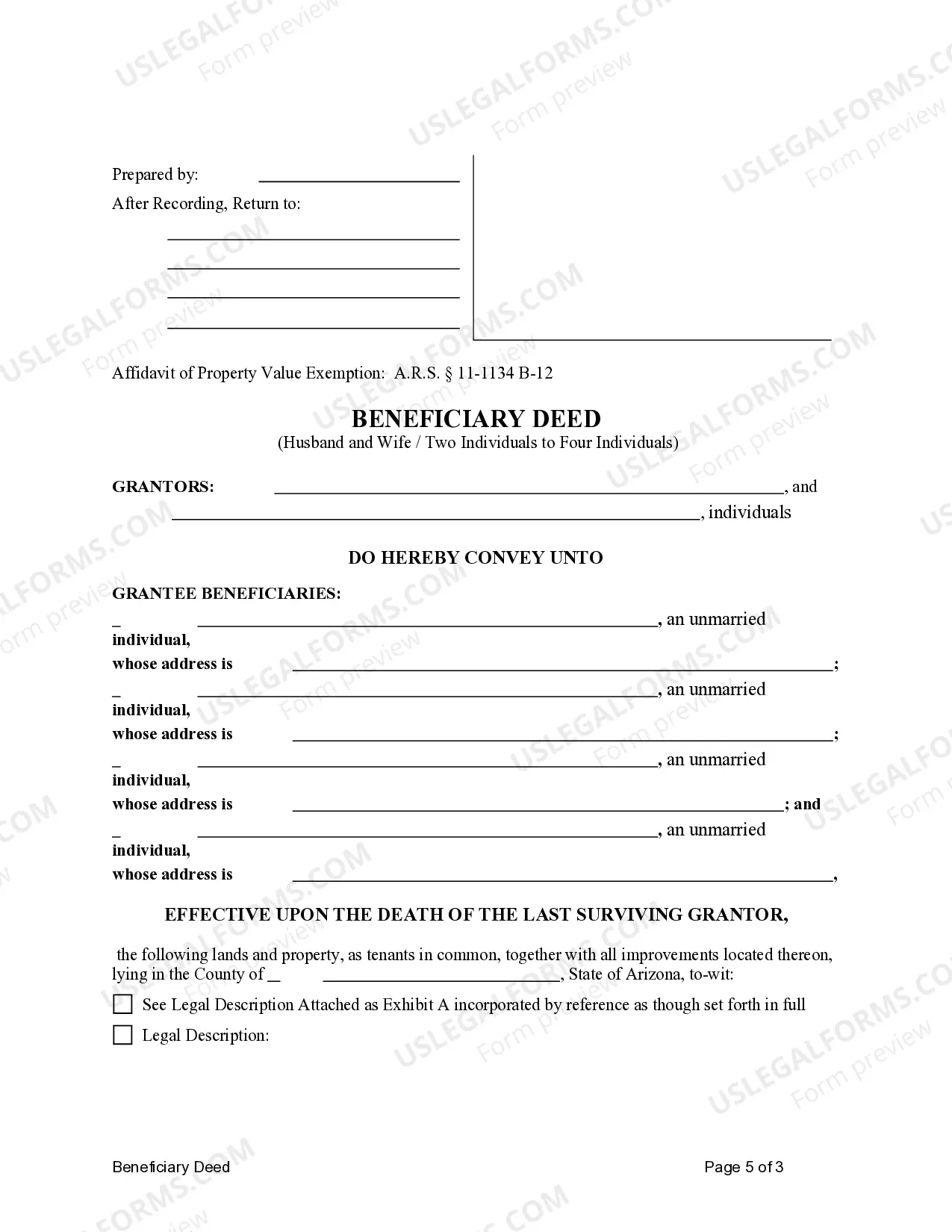

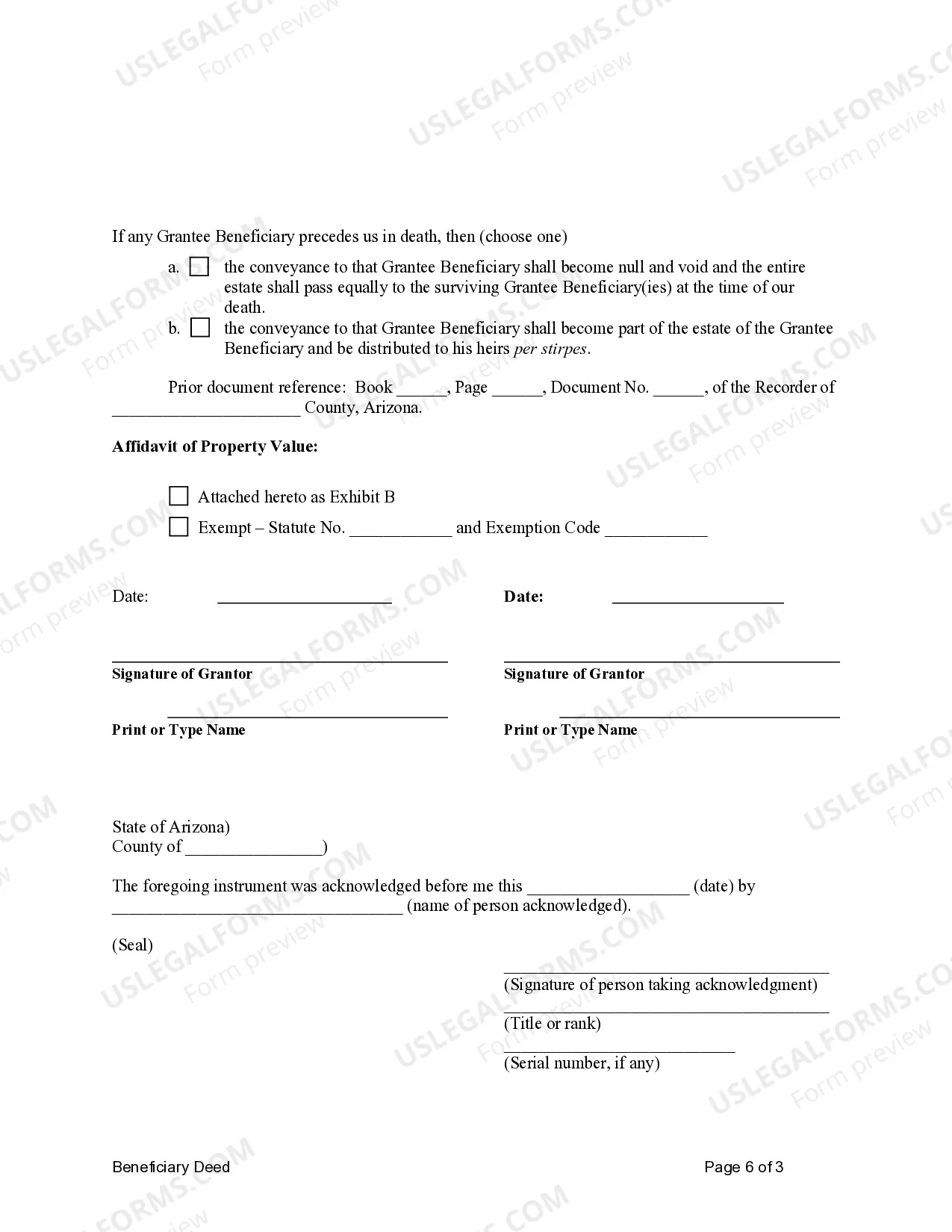

This form is a Transfer on Death Deed where the grantors are husband and wife and the grantees are four individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving grantor. The grantees take the property as tenants in common . This deed complies with all state statutory laws.

Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Four Individuals?

If you have previously utilized our service, sign in to your account and store the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to get your document.

You have indefinite access to all documents you have purchased: you can locate it in your profile under the My documents section whenever you need to access it again. Make the most of the US Legal Forms service to quickly find and save any template for your personal or business requirements!

- Ensure you’ve found the right document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it doesn’t fit, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals. Select the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

To obtain a transfer on death deed in Arizona, you need to prepare the deed form and ensure it meets state requirements. You can usually download the necessary forms from reliable legal websites like uslegalforms. Once you fill out the form correctly, sign it in front of a notary, and record it with your local county recorder's office. Utilizing the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals will simplify your planning process.

A beneficiary deed allows property to transfer directly to the named beneficiaries upon the owner's death, avoiding probate, whereas a transfer on death deed is a broader term that includes various types of deeds that follow a similar principle. In essence, the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals specifies how property ownership transitions without legal complications. Understanding these differences ensures you make informed decisions regarding estate planning.

Yes, a beneficiary deed can be contested in Arizona. If someone believes they have a valid claim to the property after the owner's death, they can challenge the deed in court. Common reasons for contesting include lack of legal capacity or undue influence on the deceased. It's essential to consult with a legal expert specializing in Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals to understand the potential outcomes.

Filling out a beneficiary deed in Arizona is a straightforward process. You need to fill in details such as the property description, the owner's name, and the names of the beneficiaries. It's important to ensure that all information is accurate and complete to avoid any legal issues later. For precise templates and assistance, our uslegalforms platform is here to help you with the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals.

In Arizona, a beneficiary deed does take precedence over a will regarding the transfer of property. This means that if a property is designated to a beneficiary deed, it will transfer directly to that beneficiary when the owner passes, regardless of what the will states. This feature can be beneficial for husbands and wives aiming to streamline asset distribution. If you need assistance, our uslegalforms platform offers detailed resources on the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals.

When you add someone to a deed in Arizona, it may have tax implications depending on the circumstances. If the change is considered a gift, the value may count towards your annual gift tax exclusion. Additionally, the property’s tax basis may be affected, which can impact capital gains tax when the property is sold. Understanding these factors can help you properly navigate the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals.

Yes, you can create a transfer on death deed in Arizona. This legal document allows property owners to designate beneficiaries who will receive the property upon the owner's death. It is a straightforward way to transfer ownership without going through probate. If you are considering this option, our platform, uslegalforms, provides easy templates and guidance for the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Four Individuals.

A beneficiary deed in Arizona works by allowing the property owner to name beneficiaries who will inherit the property upon their death. The deed must be recorded with the county recorder’s office to be effective. After the owner’s passing, the designated beneficiaries can claim the property without going through probate, utilizing the Gilbert Arizona Transfer on Death Deed or TOD – Beneficiary Deed for Husband and Wife to Four Individuals. This process provides clarity and ease in property transfer for loved ones.

Yes, Arizona allows a transfer on death deed, commonly known as a TOD deed. This deed enables property owners to designate beneficiaries who will receive their property after they pass away. By using the Gilbert Arizona Transfer on Death Deed or TOD – Beneficiary Deed for Husband and Wife to Four Individuals, you can ensure a straightforward transfer process, making estate management simpler for you and your family. It’s a secure method to plan for the future without complications.

Yes, a beneficiary deed in Arizona avoids probate. By utilizing a Gilbert Arizona Transfer on Death Deed or TOD – Beneficiary Deed for Husband and Wife to Four Individuals, property transfers directly to selected beneficiaries without the need for court intervention. This streamlines the process and helps beneficiaries inherit the property more quickly and efficiently. It's essential to correctly execute this deed to ensure that probate is bypassed seamlessly.