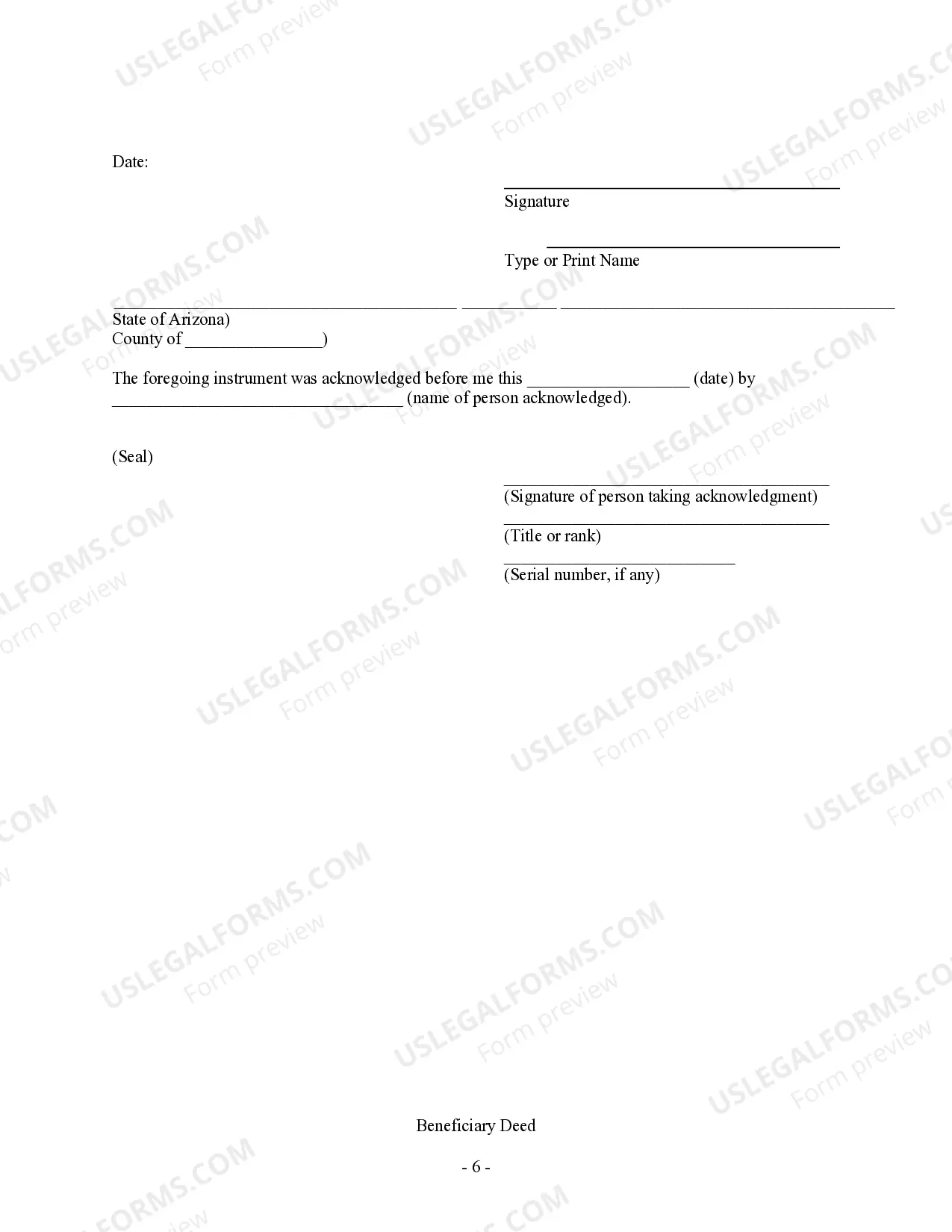

This form is a Beneficiary or Transfer on Death Deed where the grantor is an individual and the grantee is a trustee acting on behalf of the trust. This transfer is revocable until grantor's death and effective only upon the death of the grantor. This deed complies with all state statutory laws.

Mesa Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Trust?

If you have previously accessed our service, Log In to your account and retrieve the Mesa Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have unlimited access to all the documents you have acquired: you can locate them in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to swiftly find and save any template for your individual or professional requirements!

- Confirm you’ve found the correct document. Review the description and utilize the Preview function, if available, to ascertain if it fulfills your needs. If it doesn’t fit, employ the Search tab above to identify the suitable one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription option.

- Create an account and complete a payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Mesa Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust. Select the file format for your document and store it on your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

An Arizona beneficiary deed form?also known as an Arizona transfer-on-death deed form or Arizona TOD deed form?is a type of deed authorized by statute to pass Arizona real estate to designated beneficiaries on the death of an owner.

An estate attorney may prepare a Beneficiary Deed for approximately $250 to $750. There will also be a nominal recording fee in the county where the property is located. Thomas J. Bouman provides legal counsel in the areas of estate planning, estate settlement, and asset protection.

Arizona allows individuals to transfer property to a beneficiary through what is known as a beneficiary deed. A beneficiary deed is sometimes referred to as a ?transfer on death deed,? or TOD deed. It is a legal document that grants a residential property to a designated beneficiary upon the death of an individual.

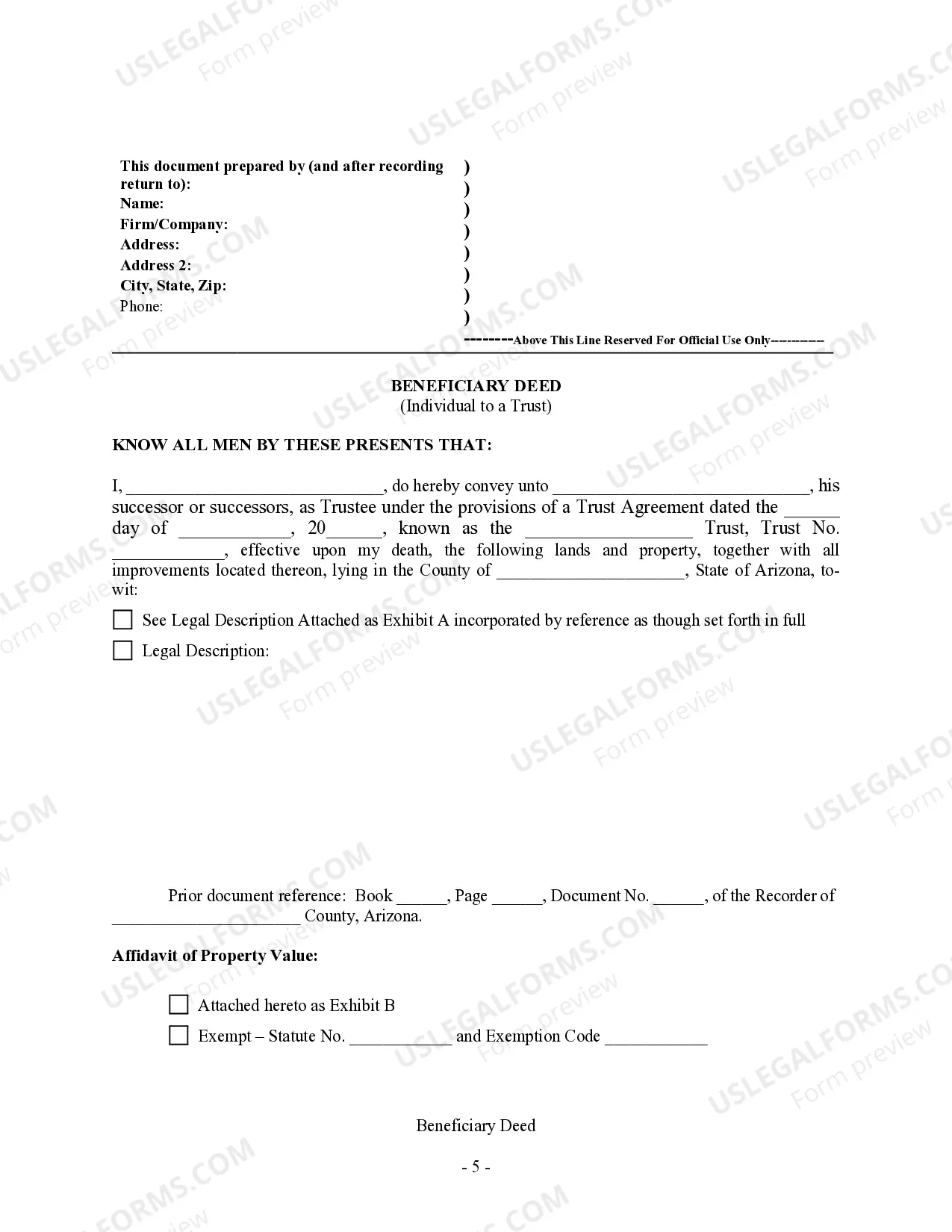

A Beneficiary Deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description. While an Arizona Beneficiary Deed has many advantages, it is not for everyone.

You may create life estates or any other form of ownership recognized in Arizona. Beneficiary deeds work well when the title will pass to a single individual or to a few individuals all of whom share a common vision of what to do with the property.

Arizona inheritance laws specify that a decedent's property passes to their spouse and/or descendants. Qualifying descendants could include: Children, including adopted children or ones conceived before marriage. Grandchildren and great-grandchildren.

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

Arizona real estate is transferred using a legal document called a deed....The process involves four general steps: Locate the Prior Deed to the Property.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.