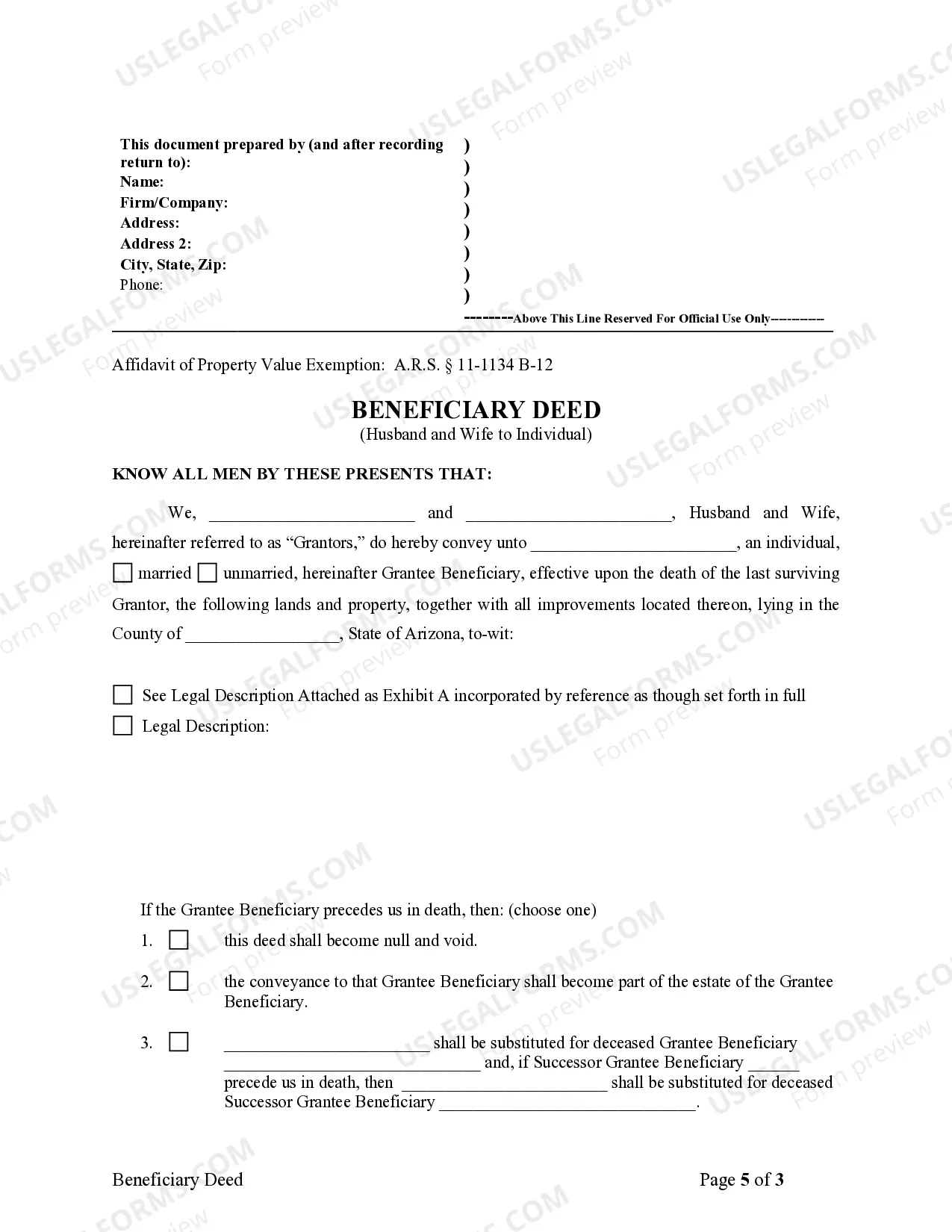

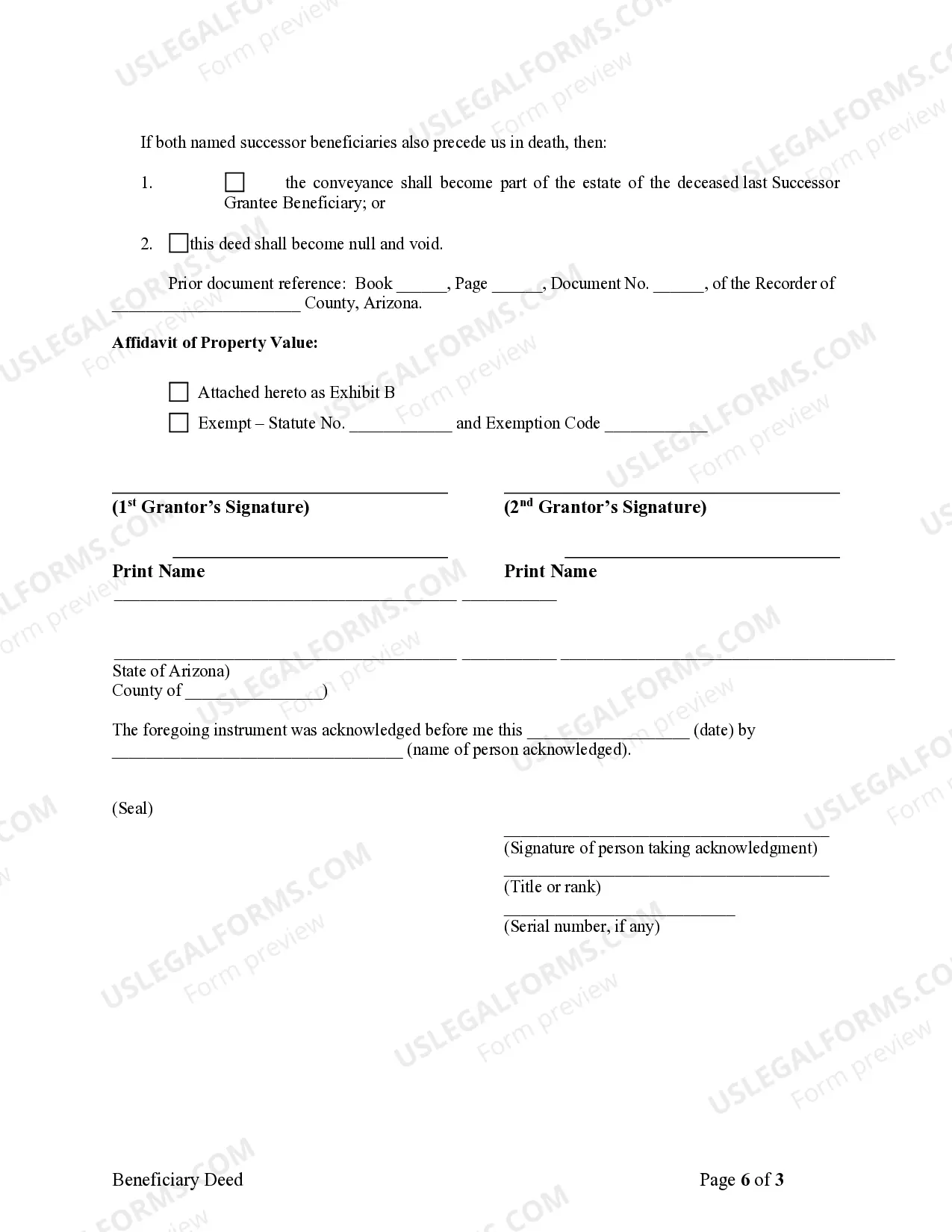

Transfer on Death Deed - Arizona - Husband and Wife to Individual: This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantors to the Grantee. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Individual?

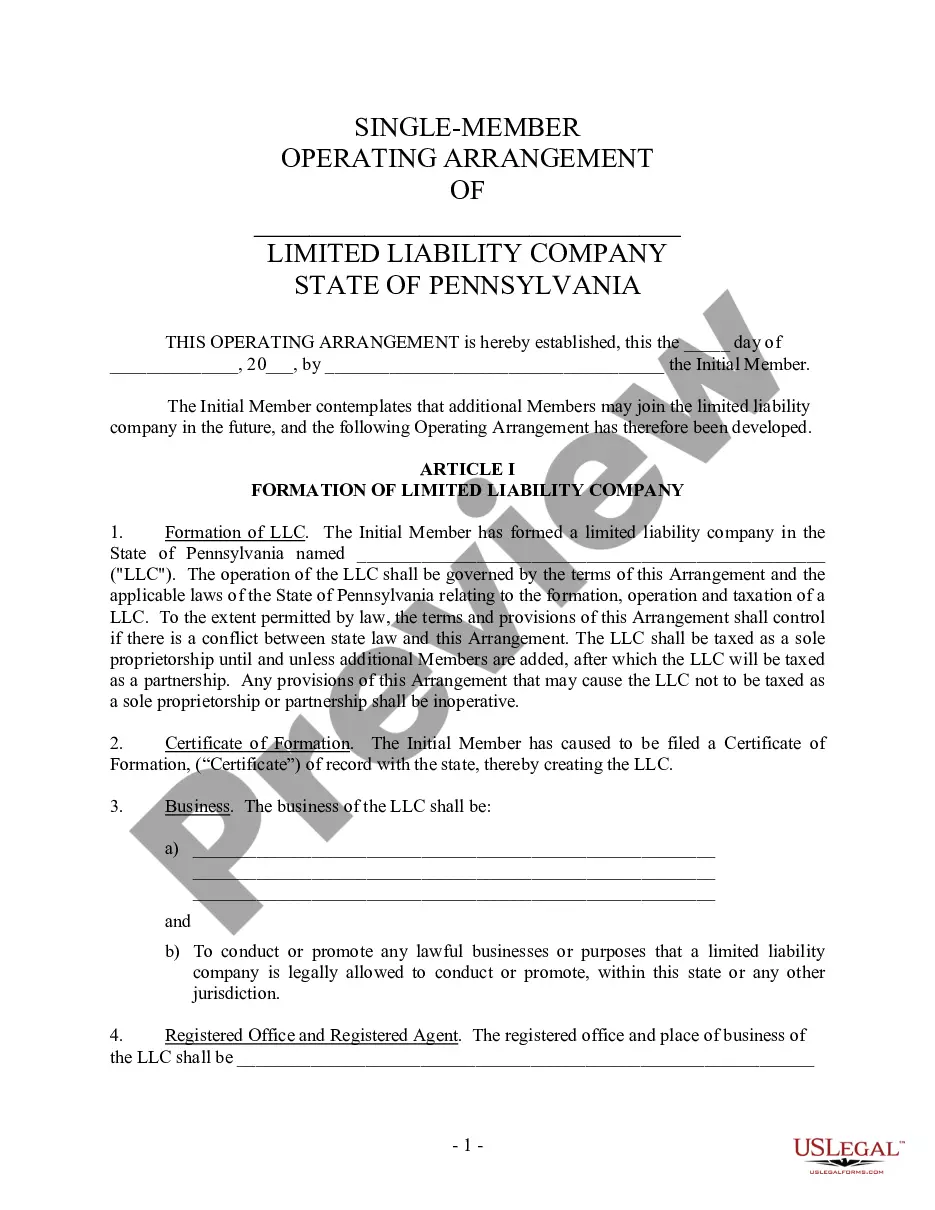

We consistently aim to reduce or avert legal harm when engaged in intricate legal or financial issues.

To achieve this, we seek attorney services that are typically very costly. However, not all legal situations are quite as intricate. Many of them can be managed by ourselves.

US Legal Forms is an online database of current DIY legal documents encompassing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Our collection allows you to take control of your matters without needing to utilize the services of an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are specific to state and region, which greatly eases the search process.

Ensure to verify if the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual complies with the laws and regulations of your state and region.

- Utilize US Legal Forms whenever you require the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual or any other form swiftly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you happen to misplace the form, you can always re-download it in the My documents tab.

- The procedure is just as simple if you’re not familiar with the website!

Form popularity

FAQ

To remove a deceased spouse from a property deed in Arizona, you will need to prepare a new deed that reflects the current ownership. You can utilize a Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual to do this. Begin by acquiring the death certificate and then file the new deed with the county recorder's office. Using resources like USLegalForms can guide you through creating and recording the necessary documents efficiently.

In Arizona, when a spouse dies, the ownership of the house generally depends on how the property is titled. If the property is held in joint tenancy, the surviving spouse will automatically receive full ownership through the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. If the property is solely in the deceased spouse's name, it may go to the surviving spouse or other heirs per the will or state law. Consulting a legal expert can clarify this process.

Yes, a beneficiary deed must be recorded in Arizona to be effective. Failing to record the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can lead to complications in transferring the property upon the death of the owner. To avoid issues, make sure you file the deed with your local county recorder's office as soon as possible. This ensures that your intentions are legally recognized.

To transfer a property deed from a deceased relative in Arizona, begin by obtaining a certified copy of the death certificate. Next, you will need to complete a Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, naming the beneficiaries. This document must then be recorded with the county recorder's office where the property is located. Utilizing platforms like USLegalForms can simplify this process, providing templates and guidance tailored to your needs.

To obtain a beneficiary deed in Arizona, you typically need to fill out the appropriate form, which can be downloaded or created through legal platforms like US Legal Forms. After completing the form, you must sign it in front of a notary public and then record it with the county recorder's office where the property is located. This process is a crucial part of establishing the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, ensuring your wishes are legally documented and honored.

Yes, a beneficiary deed in Arizona helps avoid probate. By transferring property directly to the beneficiary upon the owner's death, the property does not enter the probate process, which can be time-consuming and costly. This feature is a significant advantage of the Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. Families can gain peace of mind knowing their loved ones will inherit the property without additional legal hassles.

In Arizona, a beneficiary deed allows you to designate a beneficiary who will receive your property upon your death. This deed ensures that the property transfers directly to the named individual, avoiding the lengthy probate process. As a part of Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, this legal tool simplifies estate planning for couples. You can create this deed while you are alive, and it becomes effective only upon your passing.

Filling out a beneficiary deed in Arizona involves several key steps. Start by obtaining the appropriate form for a Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. Complete the form with accurate property and beneficiary information. Finally, sign the completed deed in front of a notary public and file it with the county recorder to ensure your wishes are legally documented.

The main difference between a beneficiary deed and a transfer on death deed lies in their function and naming conventions. A beneficiary deed specifically names an individual as the recipient of the property upon the owner’s death, much like a Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. However, it allows the original owner full control of the property during their lifetime. Hence, the deed only takes effect when the owner passes away.

To change the deed on a house after the death of a spouse in Arizona, you generally need to provide a copy of the death certificate and any existing transfer on death deed documentation. If the property had a Gilbert Arizona Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, it will facilitate the transition of ownership to the surviving spouse directly. It is advisable to consult a legal expert to ensure proper execution of the changes necessary.