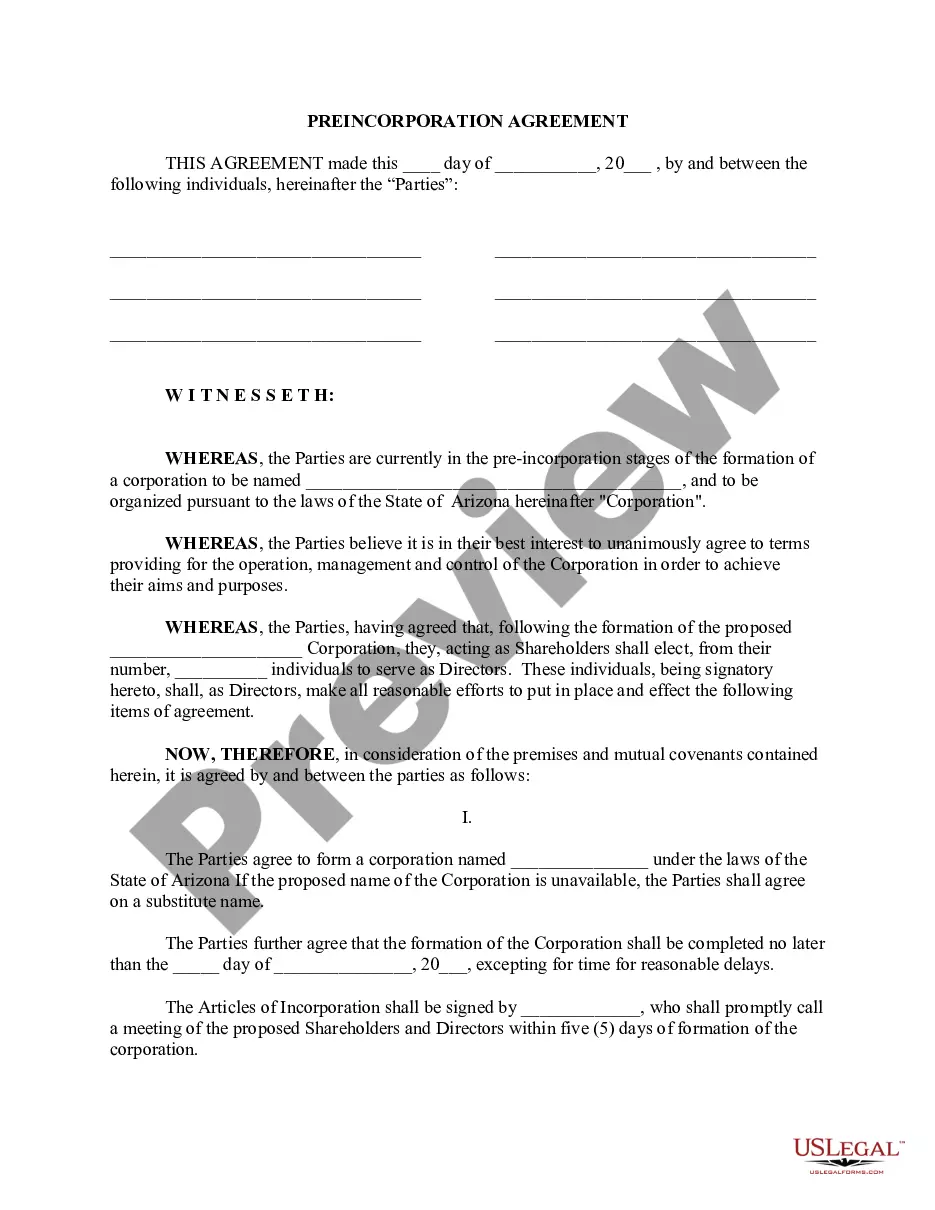

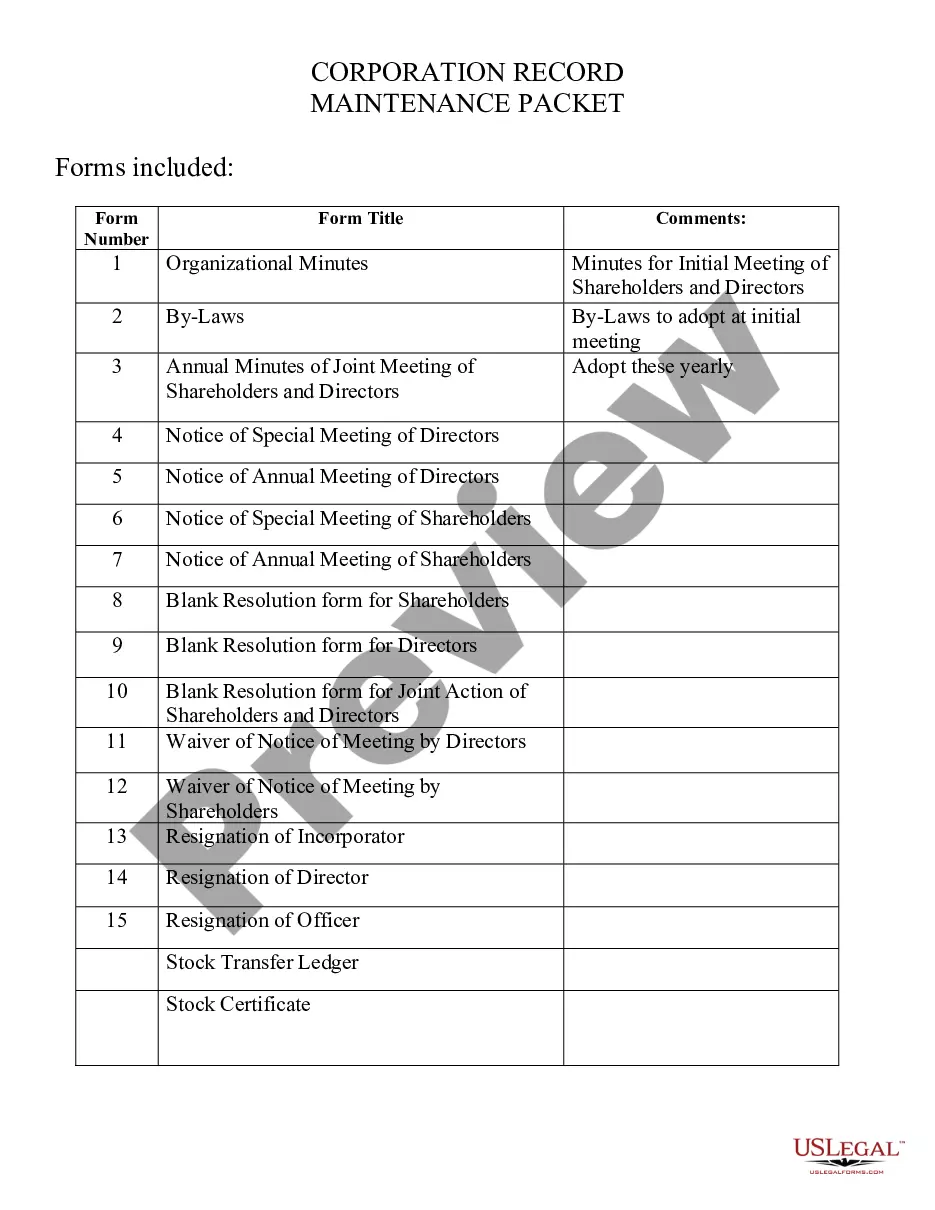

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Mesa Arizona Business Incorporation Package to Incorporate Corporation

Description

How to fill out Arizona Business Incorporation Package To Incorporate Corporation?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our advantageous platform with thousands of templates simplifies the process of locating and obtaining nearly any document sample required.

You can download, fill out, and sign the Mesa Arizona Business Incorporation Package to Incorporate Corporation in just a few minutes instead of spending hours online searching for the appropriate template.

Using our library is a great way to enhance the security of your form submissions. Our skilled attorneys frequently review all documents to guarantee that the templates are suitable for a specific jurisdiction and comply with updated laws and regulations.

If you have not yet created an account, follow these instructions.

1. Access the page with the required template. Ensure it is the form you need by checking its title and description, and use the Preview option when available. If not, use the Search field to find the necessary one.

- How can you access the Mesa Arizona Business Incorporation Package to Incorporate Corporation.

- If you possess a subscription, simply Log In to your account. The Download option will be available for all the samples you view.

- Furthermore, you can locate all your previously saved documents in the My documents section.

Form popularity

FAQ

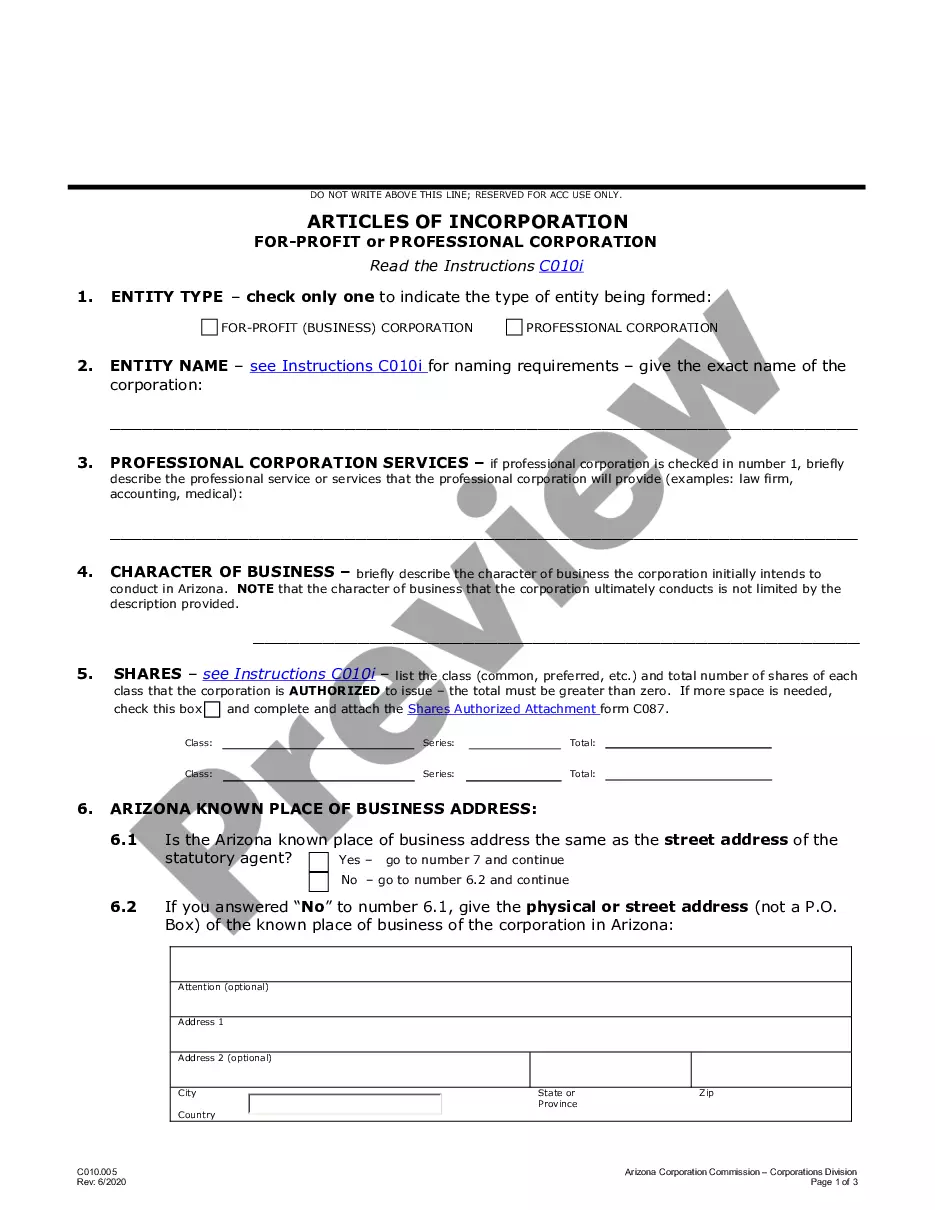

How to Start an S Corp in Arizona Choose a Business Name.Appoint a Statutory Agent in Arizona.Choose Directors or Managers.File Articles of Incorporation/Organization with the Arizona Corporation Commission.Publish Arizona State Articles of Incorporation/Organization.File Form 2553 to turn business into an S Corp.

It will cost $45 if you file online. To file your Articles of Incorporation, the Arizona Corporation Commission charges a $60 filing fee. All corporations doing business in Arizona must also file an annual report with a $45 filing fee.

Online filings take 5 business days for both LLCs and corporations. California will process business formation documents hand-delivered to its Secretary of State's Sacramento office in around 3 business days if you pay a $15 counter drop-off fee. You can also pay the state $350 for 1-day expedited processing.

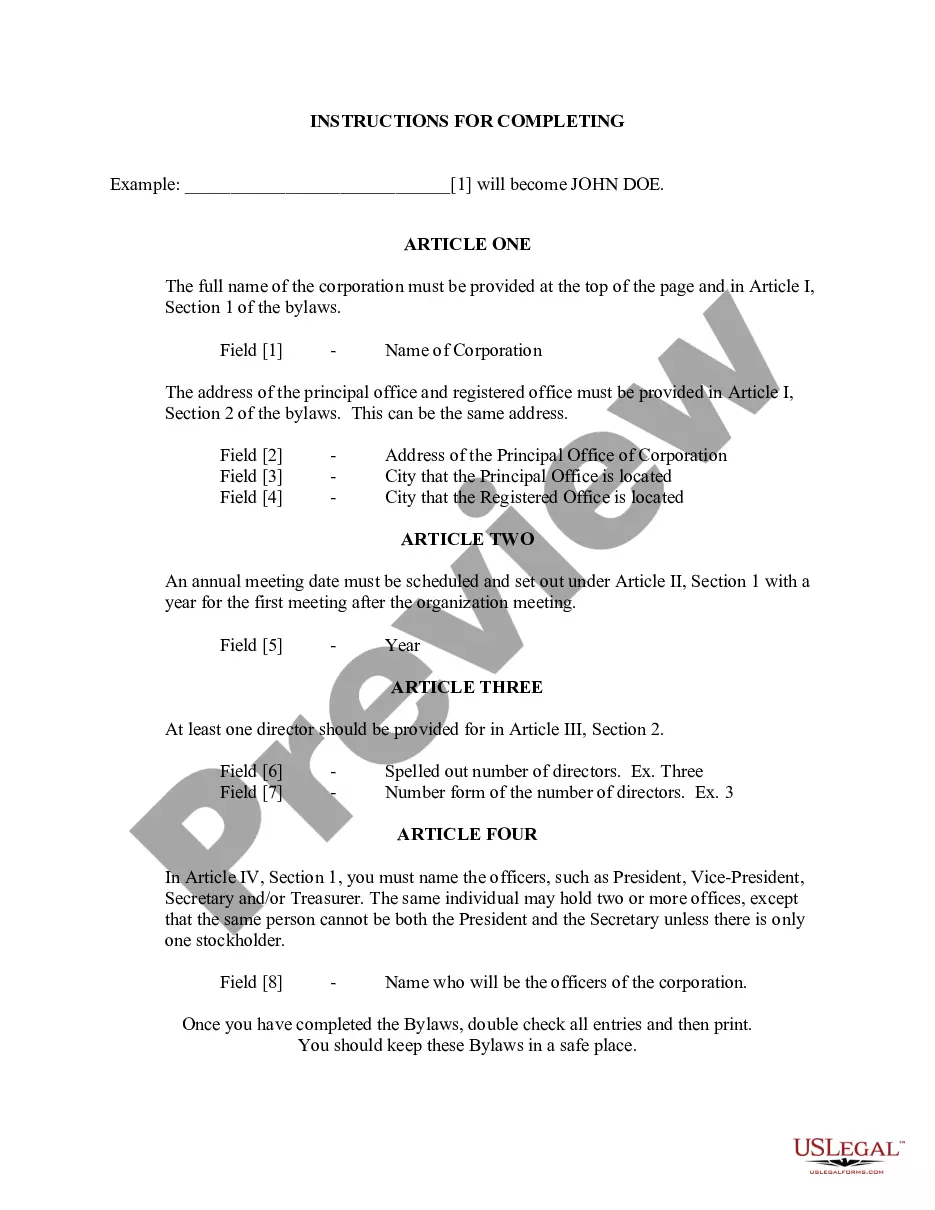

How to Form a Corporation in 11 Steps Choose a Business Name. An important first step when starting a corporation is selecting a business name.Register a DBA.Appoint Directors.File Your Articles of Incorporation.Write Your Corporate Bylaws.Draft a Shareholder Agreement.Hold Initial Board of Directors Meeting.Issue Stock.

Education CostTimeIncorporation: $60 + optional $35 expedite fee Publishing of incorporation: ~$200 Arizona state taxes: $12 per license/locationIncorporation: See state-published current processing times (usually about two months). ~7-10 business days for $35 expedite fee.

File Form 2553 to turn business into an S Corp You can turn your C Corporation or LLC into an S Corporation by filing Form 2553 with the IRS. If you start your business as an LLC, you need to file Form 8832 to designate it as a corporation before you can file Form 2553.

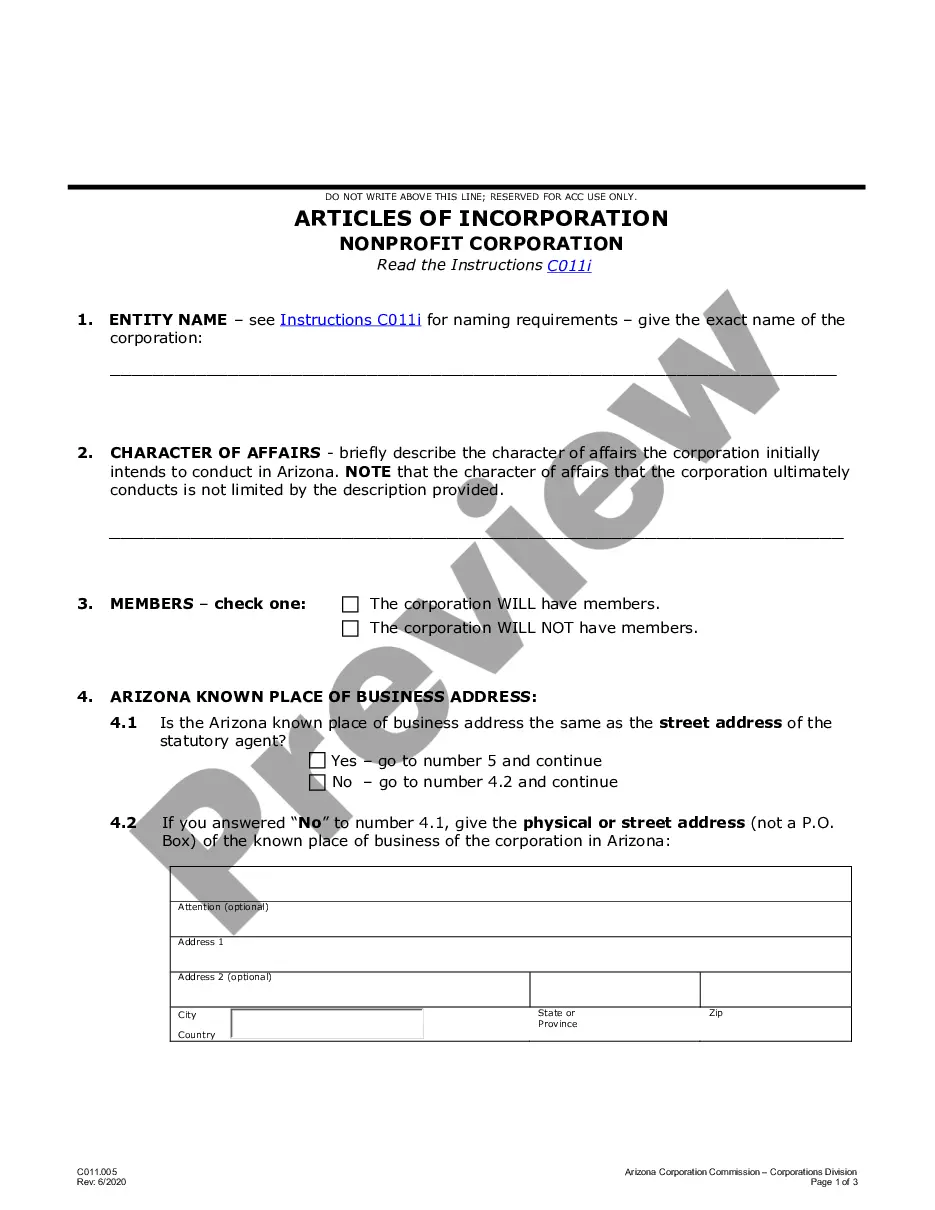

You will need to file the Arizona Articles of Incorporation to set up a corporation in Arizona. The Articles of Incorporation is the document that officially creates your Arizona corporation. You can file online with the Arizona Corporation Commission's eCorp website, file by mail, or file by fax.

Filing Requirements Required documents: The state of Arizona requires businesses to file Articles of Incorporation as well as a Certificate of Disclosure. Turnaround time: In general, turnaround time for incorporating a business in Arizona is 5-7 business days.