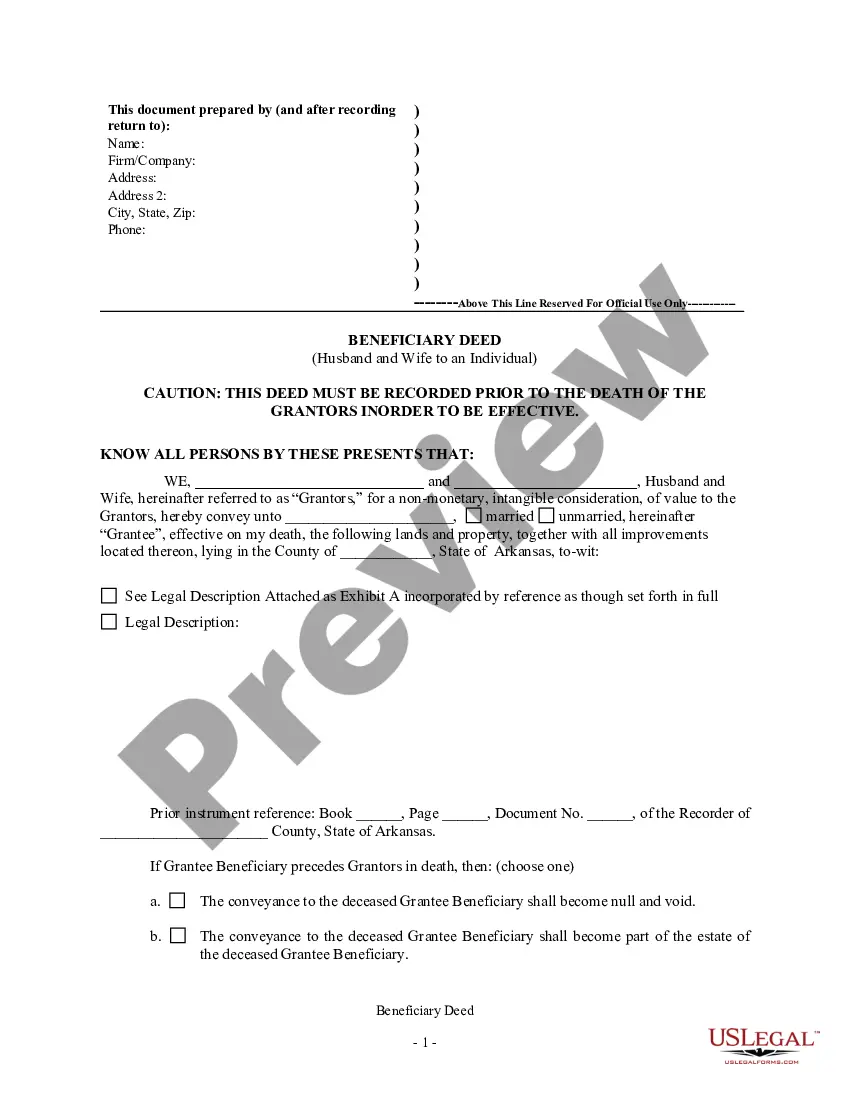

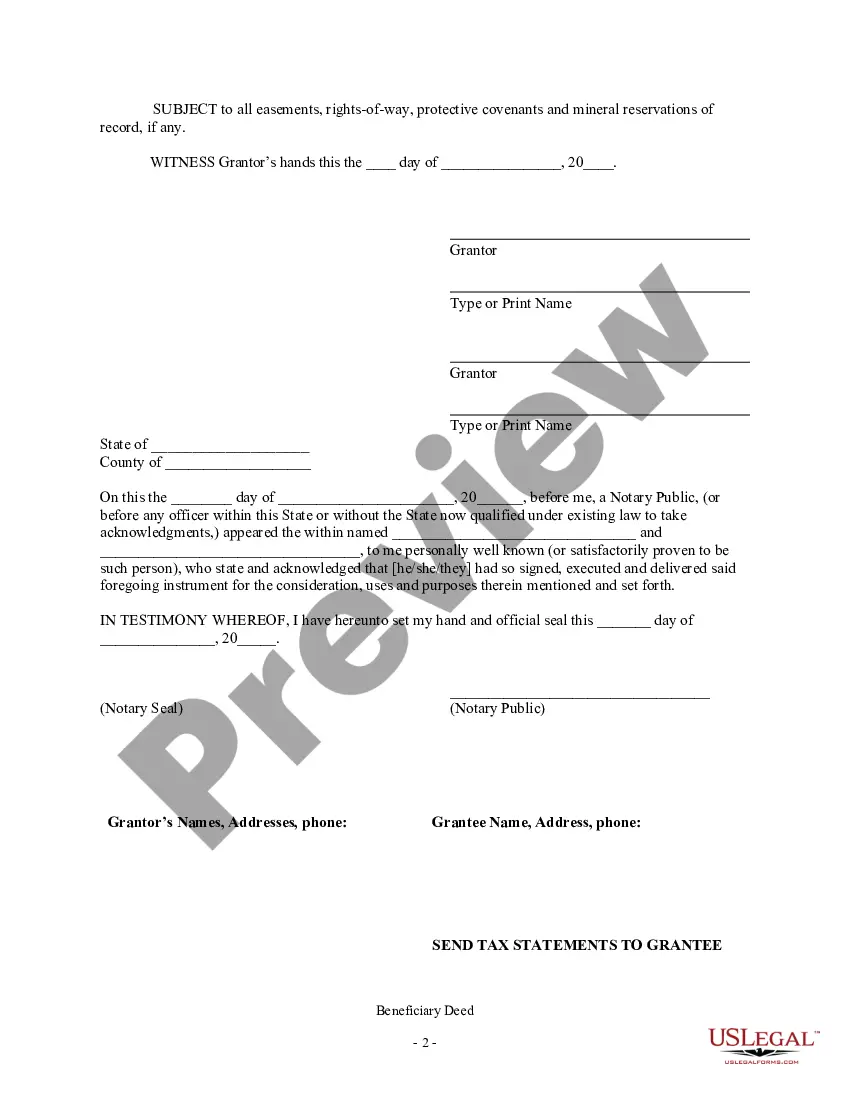

This form is a Transfer on Death Deed, or Beneficiary Deed, where the grantors are husband and wife and the grantee an individual. If grantee fails to survive the grantors their interest goes to their estate or the transfer is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to grantor's deaths. This deed complies with all state statutory laws.

Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Individual?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

This online database features over 85,000 legal forms catering to both personal and professional requirements, as well as various real-life scenarios.

All documents are appropriately categorized by usage area and jurisdiction, making it simple to find the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual.

Purchase the document. Click on the Buy Now button and choose your preferred subscription plan. You must create an account to access the library’s resources.

- For those already familiar with our service and have previously used it, acquiring the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual requires just a few clicks.

- Simply Log In to your account, select the desired document, and click Download to save it on your device.

- New users will have a few additional steps to complete this process.

- Review the Preview mode and form description. Ensure you’ve selected the appropriate one that fulfills your needs and fully aligns with your local jurisdiction regulations.

- Look for another template, if necessary. If you discover any discrepancies, use the Search tab above to find the correct one. If it meets your needs, proceed to the following step.

Form popularity

FAQ

To transfer a deed after death in Arkansas, you will need to complete and file the necessary paperwork with the local county clerk's office. If you have established a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, the process is relatively straightforward. You must provide the required information about your property and beneficiaries to ensure a smooth transition of ownership.

A TOD account is not considered an inheritance in the traditional sense since assets pass directly to the designated beneficiary outside of probate. Instead, the process allows your chosen individuals to receive their share of your assets quickly and efficiently. For those considering a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, knowing the differences in legal terminology can aid in your estate planning.

While TOD accounts simplify the transfer process, they can come with certain disadvantages. For instance, they do not provide protections against creditors or disputes that may arise. It's also essential to note that failure to update better arrangements or accounts may lead to unintended beneficiaries. Therefore, utilizing a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual allows you to tackle these concerns more effectively.

TOD accounts can provide a streamlined method for asset transfer without the complications of probate. These accounts ensure your beneficiaries receive your assets immediately after your passing, which can be particularly beneficial for a husband and wife arrangement. For individuals exploring the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, TOD accounts offer a practical solution that simplifies asset management.

A POD, or payable on death designation, serves as an arrangement that allows your assets to transfer directly to a beneficiary upon your death. While a beneficiary typically refers to any person designated to receive assets through a will or trust, a POD specifically designates funds or property to pass outside of probate. In the context of a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, understanding these terms helps clarify how property can be transferred efficiently.

To file a beneficiary deed in Arkansas, you need to complete the required form, which should include the legal description of the property and the names of the beneficiaries. After signing the deed, it must be recorded with the county clerk's office where the property is located. It's recommended to seek assistance from legal professionals or services like USLegalForms to ensure that the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual is completed correctly.

Arkansas does indeed allow the use of transfer on death deeds. These deeds provide the property owner with the ability to retain full control over their property during their lifetime. Upon their passing, the designated beneficiaries automatically inherit the property without going through the complicated probate process. The Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual offers a straightforward method for planning property transfers.

Heir property in Arkansas refers to property owned by a family but not formally titled to any one person. This often happens when properties are passed down without a will, making inheritance unclear. It's important to resolve ownership issues to avoid disputes among family members. Utilizing a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can help clarify ownership and ensure a smooth transfer to chosen beneficiaries.

Yes, Arkansas does have a transfer on death deed, also known as a TOD deed. This legal tool allows property owners to designate beneficiaries who will inherit their property upon their death, without the need for probate. It is an effective way for couples, including husbands and wives, to transfer property to individuals. The Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual simplifies the estate planning process.

To complete a quit claim deed in Arkansas, you need to prepare the deed document, which states that one party is releasing their interest in a property to another individual. This process is straightforward, especially when using a legal resource like USLegalForms, which provides templates and guides for creating these documents. After drafting the quit claim deed, both parties should sign it in front of a notary, and then file it with the county recorder's office. Remember, a quit claim deed does not guarantee that the property title is clear, so it's essential to verify any existing claims or liens.