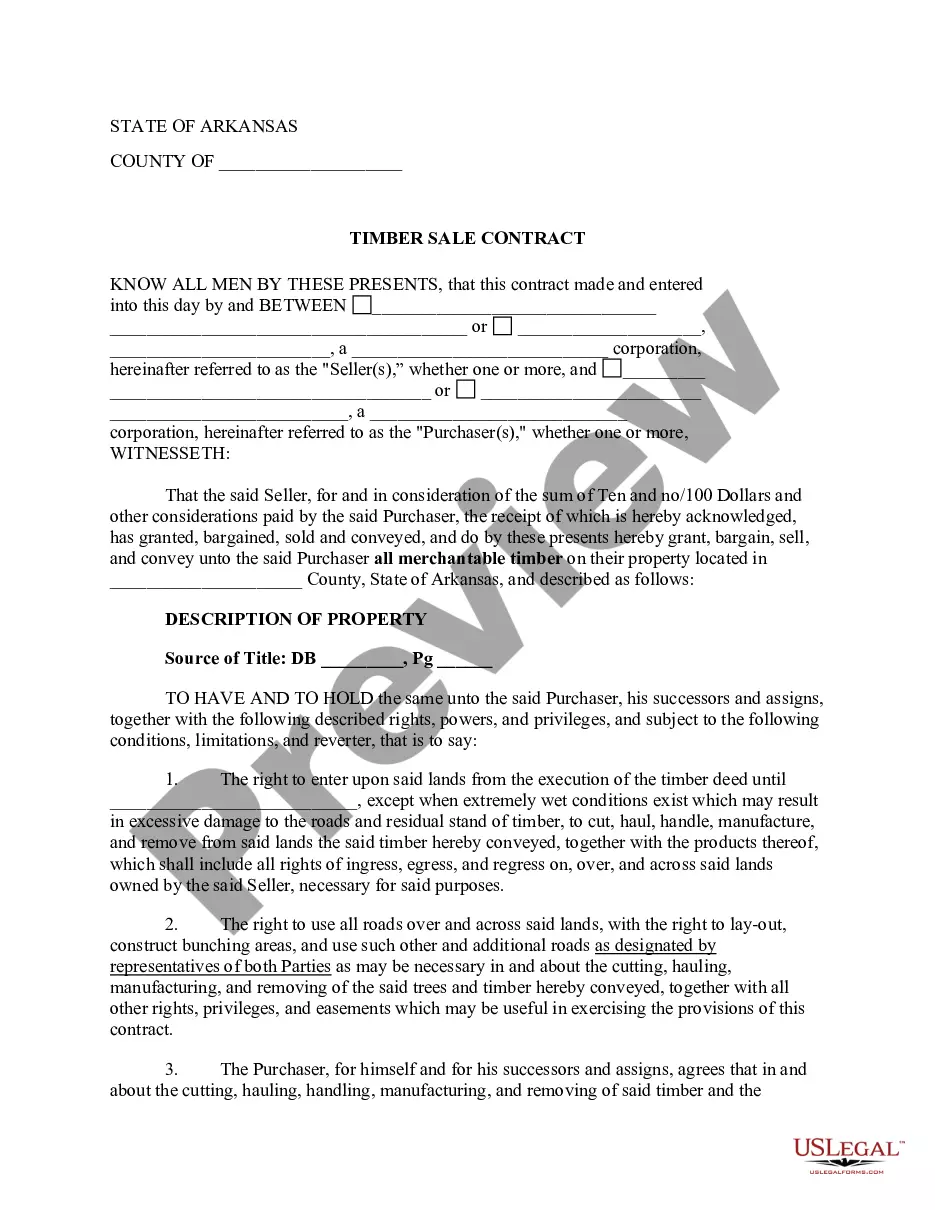

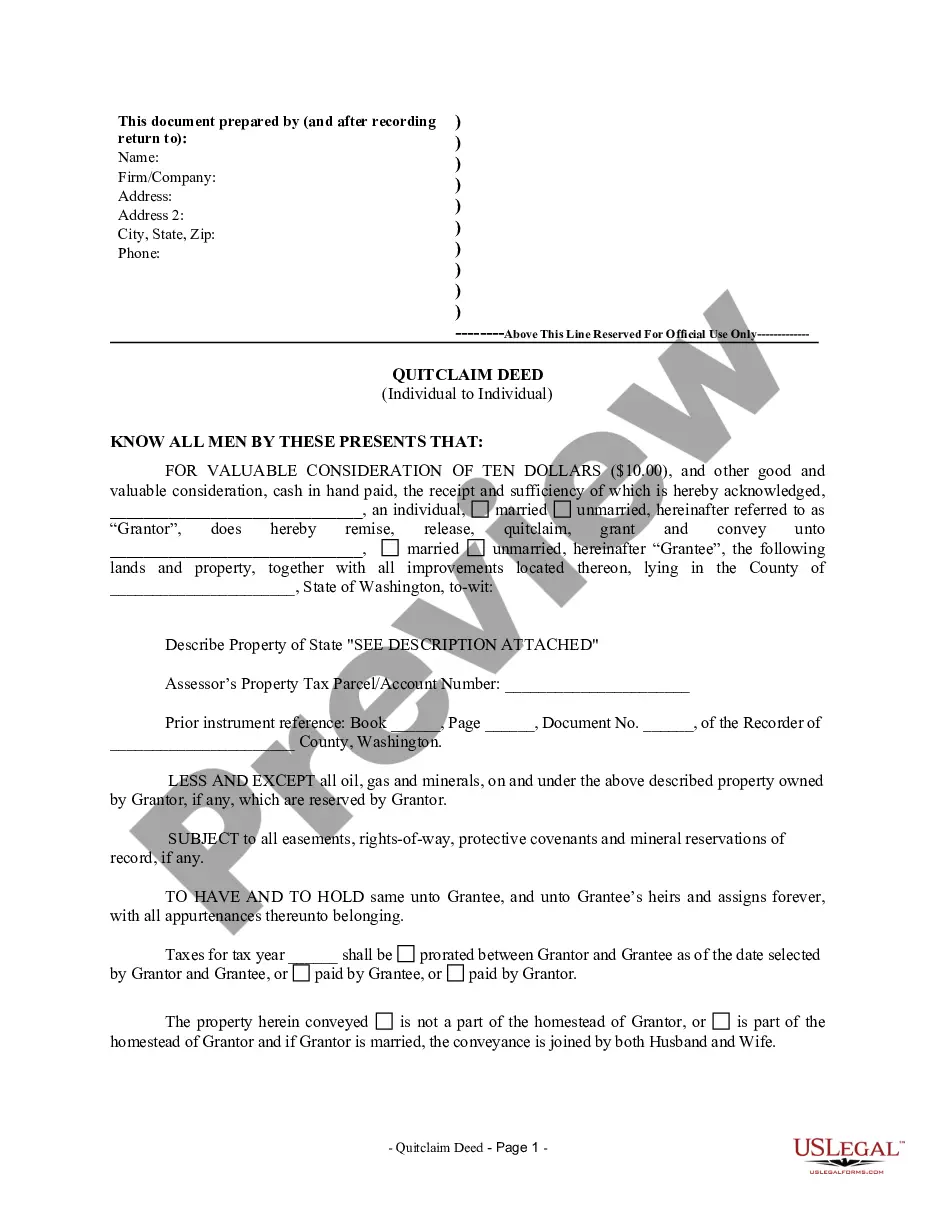

This form is a Transfer on Death Deed, or Beneficiary Deed, where the grantor is an individual and the grantees are four individuals. If one or more grantees fail to survive the grantor their interest goes to their estate or the surviving grantees. This transfer is revocable by Grantor until death and effective only if filed prior to grantor's death. This deed complies with all state statutory laws.

Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Four Individuals?

We consistently endeavor to diminish or preempt legal complications when engaging with intricate legal or financial issues.

To achieve this, we enroll in attorney services that are often quite costly.

However, not every legal complication is of the same intricacy.

Many of them can be managed independently.

Take advantage of US Legal Forms whenever you need to locate and download the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals or any other form promptly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository empowers you to take charge of your affairs without needing a lawyer.

- We provide access to legal form templates that are not always readily accessible.

- Our templates are specific to states and regions, which significantly eases the search process.

Form popularity

FAQ

In Arkansas, if a parent dies without a will, the property can still be transferred through a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals, assuming one was set up prior. If no such deed exists, you may need to follow the intestacy laws in Arkansas. These laws determine how assets are divided among heirs. To navigate this process, consider using US Legal Forms for assistance and clear documentation.

To transfer property title to a family member in Arkansas, you can use a Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals. This deed allows you to designate your family member as the beneficiary, ensuring a smooth transfer of property upon your passing. This process is straightforward and avoids the lengthy probate process, making it a smart choice for estate planning. Using reliable resources, like US Legal Forms, can provide you with the templates and guidance necessary for this transfer.

To transfer a property deed from a deceased relative in Arkansas, you typically need to locate the deceased's will and ensure that it designates the property transfer. If no will exists, Arkansas law dictates how the property is handled under intestacy laws. Utilizing the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals can aid in future planning, allowing for a smooth transfer directly to beneficiaries, bypassing probate.

Yes, Arkansas does permit the use of a transfer on death deed, also known as a beneficiary deed. This legal tool allows individuals to transfer property ownership automatically upon their death, without the hassles of probate. The Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals offers peace of mind by ensuring your property goes to your chosen beneficiaries efficiently.

A beneficiary deed in Arkansas allows property owners to designate one or more beneficiaries to receive their property after their death. This means that the property transfers directly to the named individuals without going through probate. The Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals helps simplify the process, providing clarity and saving time for your heirs.

Yes, Arkansas does recognize beneficiary deeds, such as the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals. This legal mechanism allows property owners to designate one or more beneficiaries to receive their real estate upon death without going through probate. Utilizing uslegalforms can help you draft a beneficiary deed and ensure it complies with state requirements.

TOD accounts can be a beneficial tool in estate planning, especially with the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals. They provide a simple way to transfer assets outside of probate, saving time and potentially reducing costs for your beneficiaries. However, it's essential to consider your specific situation and consult with an estate planning expert to determine if a TOD account aligns with your goals.

A Payable on Death (POD) account is similar to a beneficiary designation in the context of the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals. In both cases, the assets transfer automatically upon the death of the account holder. Yet, the terms are not interchangeable, as POD typically refers to accounts like bank accounts, while TOD pertains to various forms of ownership and assets.

While the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals provides straightforward asset distribution, there are some disadvantages. For example, creditors can still make claims against the assets in a TOD account while the account holder is alive. Additionally, the designated beneficiaries may encounter complications if they are not aware of their role or if the account holder changes their mind about beneficiaries.

A Transfer on Death (TOD) account, as part of the Little Rock Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Four Individuals, allows you to designate beneficiaries who will receive your assets upon your passing. However, until death occurs, the assets belong to you, not to the beneficiaries. Therefore, while a TOD account facilitates the transfer of funds after death, it is not legally classified as an inheritance until that point.