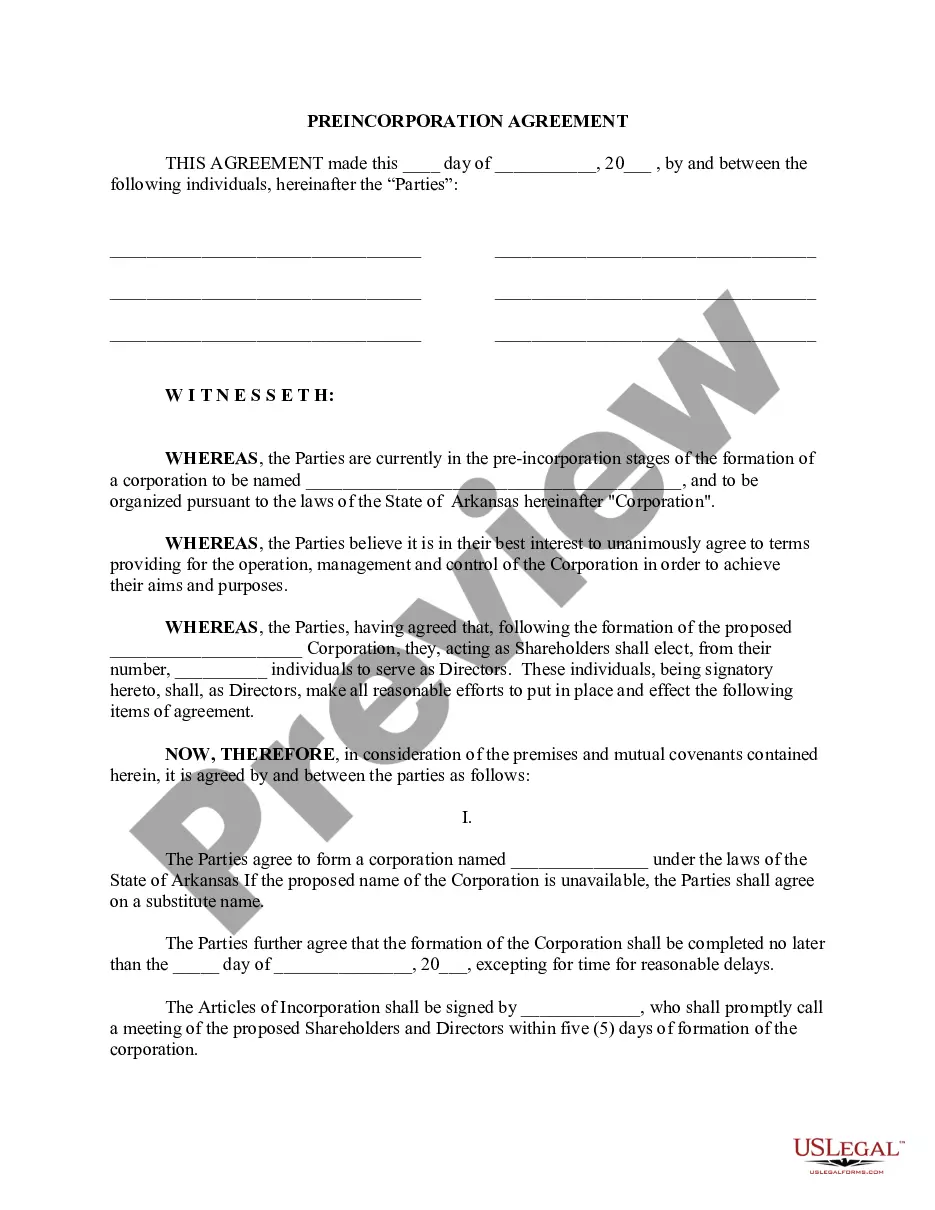

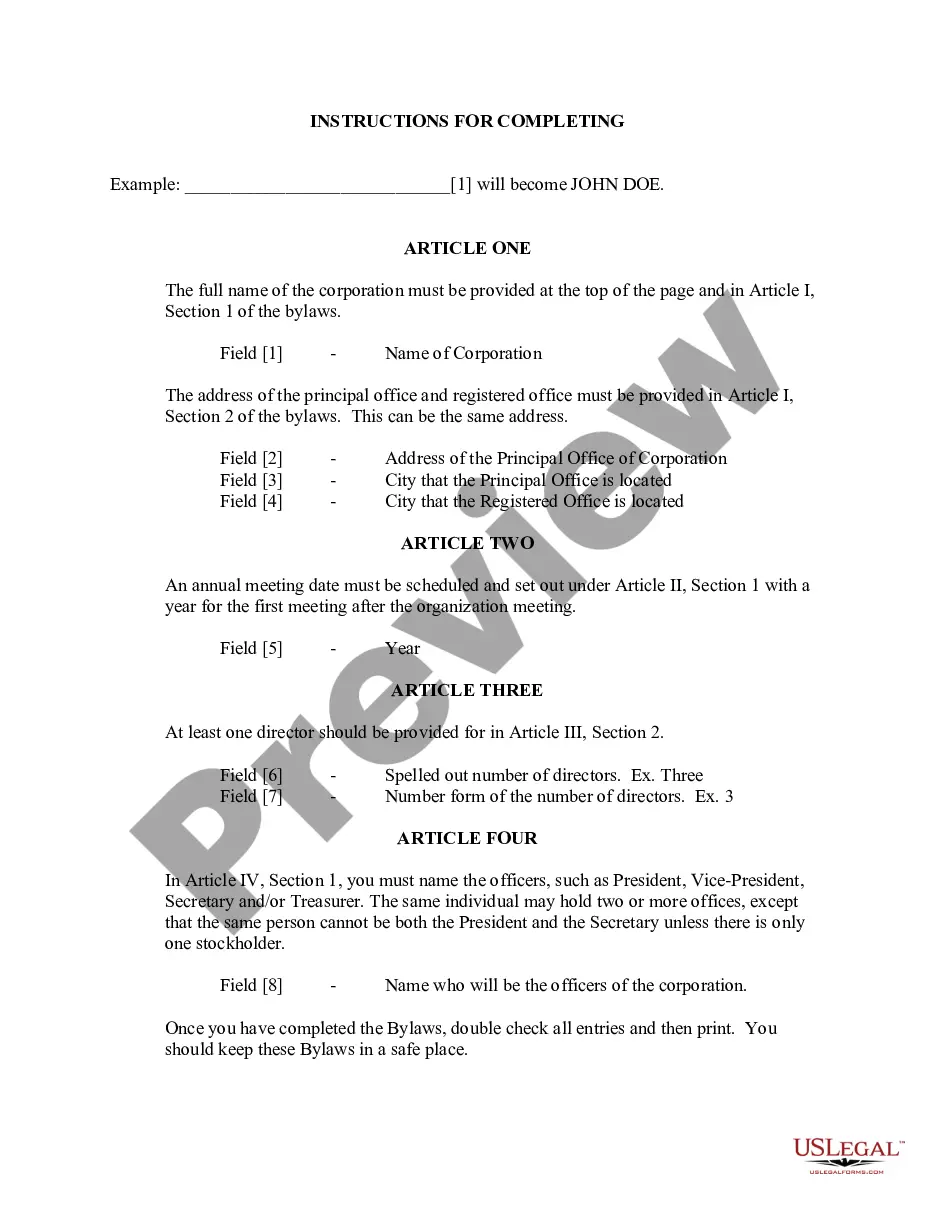

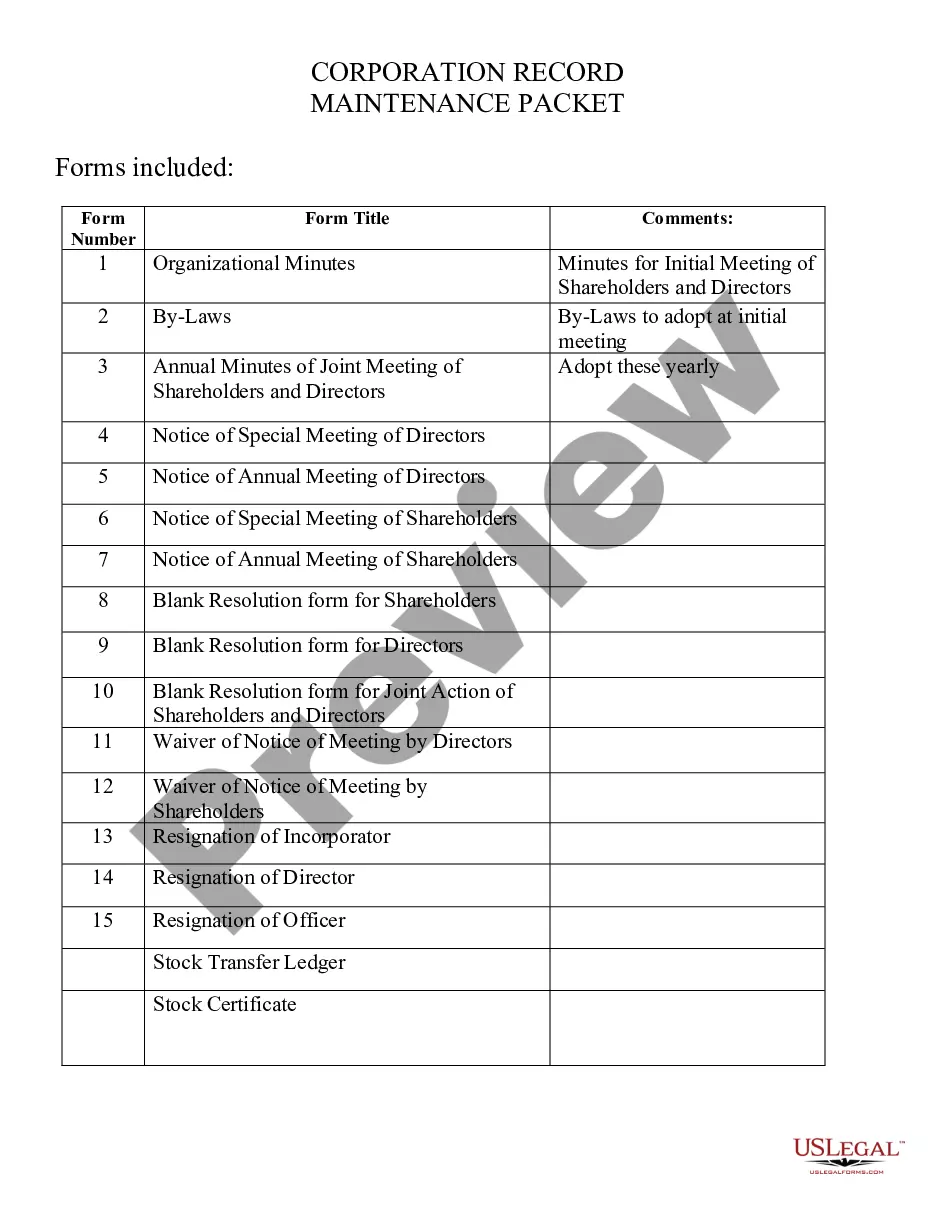

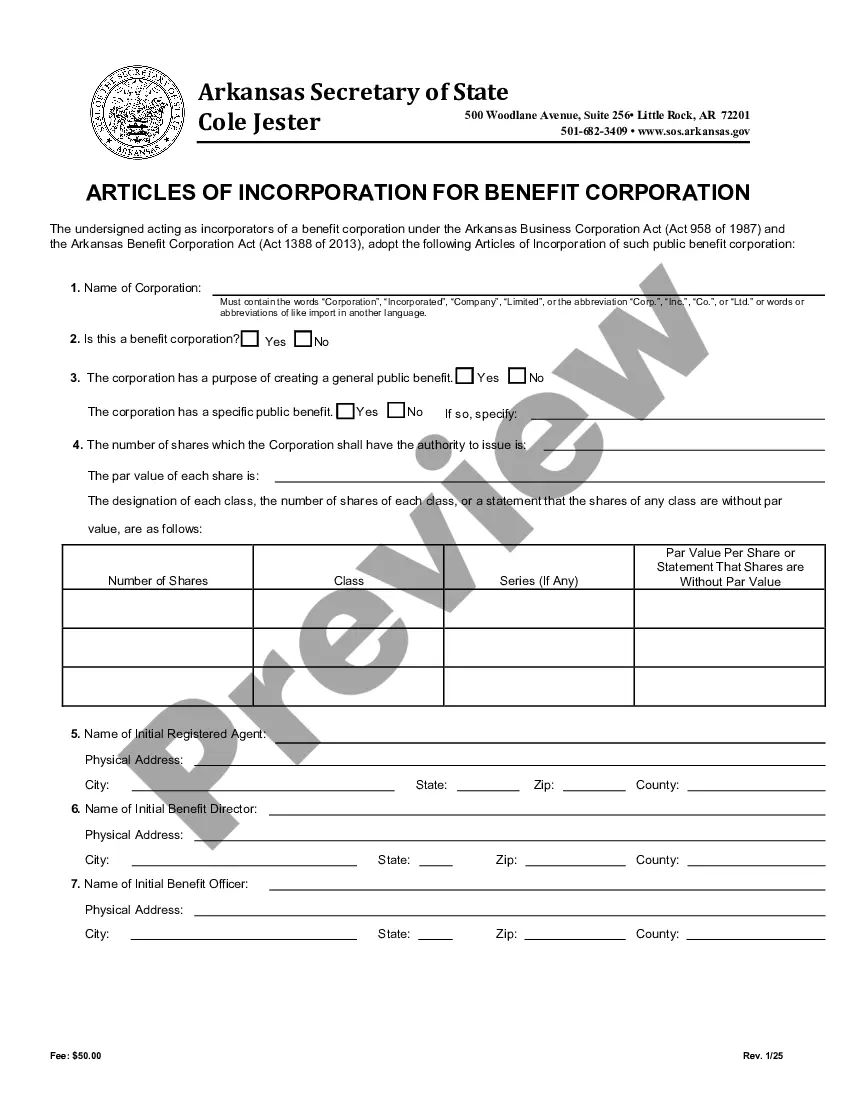

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Little Rock Arkansas Business Incorporation Package to Incorporate Corporation

Description

How to fill out Arkansas Business Incorporation Package To Incorporate Corporation?

If you are searching for an applicable form template, it’s challenging to find a superior location than the US Legal Forms website – arguably the most extensive online repositories.

With this collection, you can obtain thousands of document examples for business and personal uses categorized by types and states, or keywords.

With the top-notch search function, acquiring the latest Little Rock Arkansas Business Incorporation Package to Incorporate Corporation is as simple as 1-2-3.

Access the template. Choose the file format and download it to your device.

Make modifications. Complete, edit, print, and sign the acquired Little Rock Arkansas Business Incorporation Package to Incorporate Corporation.

- If you are already familiar with our system and possess an account, all you need to obtain the Little Rock Arkansas Business Incorporation Package to Incorporate Corporation is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions listed below.

- Ensure you have located the form you need. Review its description and use the Preview feature (if available) to examine its content. If it doesn’t satisfy your needs, use the Search option at the top of the screen to find the appropriate document.

- Verify your choice. Click the Buy now button. Then, select the desired pricing plan and provide information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Sole proprietorships must register DBA names at the county level. All other business entities must register with the Arkansas Secretary of State and then, once approved, a copy of the form will be sent back that needs to then be filed with the county clerk's office where your business's registered office is located.

By forming a corporation and electing S corp status from the IRS.... Step 1: Name Your LLC.Step 2: Choose Your Arkansas Registered Agent.Step 3: File the Arkansas LLC Certificate of Organization.Step 4: Create an LLC Operating Agreement.Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

How to Start an S Corporation in Arkansas.Choose a Business Name.Appoint a Registered Agent in Arkansas.Decide on your directors or managers.File Articles of Incorporation/Articles of Organization with the Arkansas Secretary of State.File Form 2553 to elect S Corporation status.Requirements for an Arkansas S Corp.

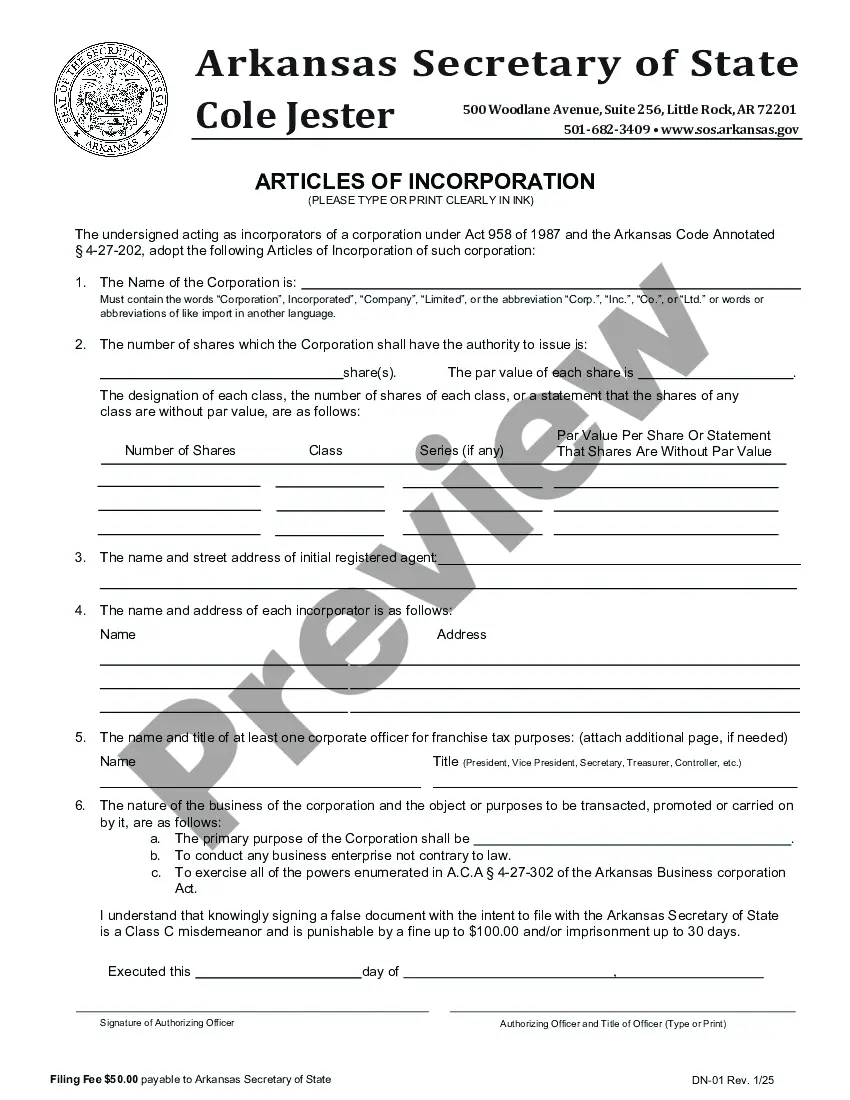

The online state filing fee for Arkansas Articles of Incorporation is $45. If you mail your Articles, the filing fee jumps to $50.

To form an Arkansas corporation, you must complete and file the Articles of Incorporation with the Arkansas Secretary of State. The online state filing fee for Arkansas Articles of Incorporation is a super affordable $45. If you mail your Articles, the filing fee jumps to $50.

To incorporate your business in Arkansas, you are required to complete and file the Articles of Incorporation. This document can be completed and submitted for filing online, or you can print the PDF and file it via mail or in person at the Arkansas Secretary of State Business and Commerce Division.

How do you form an S-corporation? To form a new S-corporation, you must first file Articles of Incorporation for an LLC or a C-corporation. Once the Articles of Incorporation are on file with the state in which the business operates, Form 2553 must be filed with the IRS in order to elect S-corporation tax status.

Delaware is the most common state to incorporate in. The State of Delaware is a leading home for both domestic and international corporations. More than 1,000,000 businesses have made Delaware their home.

Starting an Arkansas LLC and electing S corp tax status is easy.... Step 1: Name Your LLC.Step 2: Choose Your Arkansas Registered Agent.Step 3: File the Arkansas LLC Certificate of Organization.Step 4: Create an LLC Operating Agreement.Step 5: Get an EIN and Complete Form 2553 on the IRS Website.