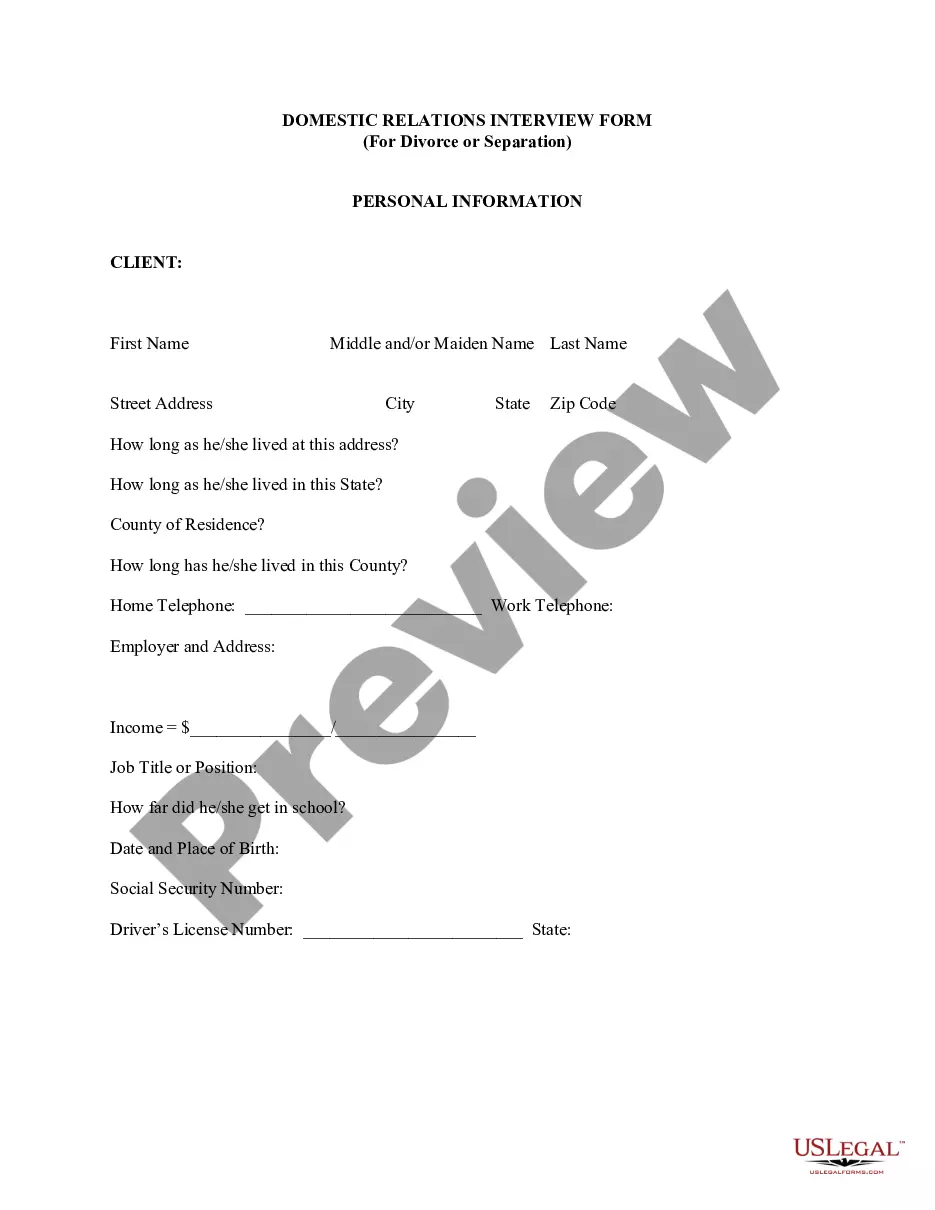

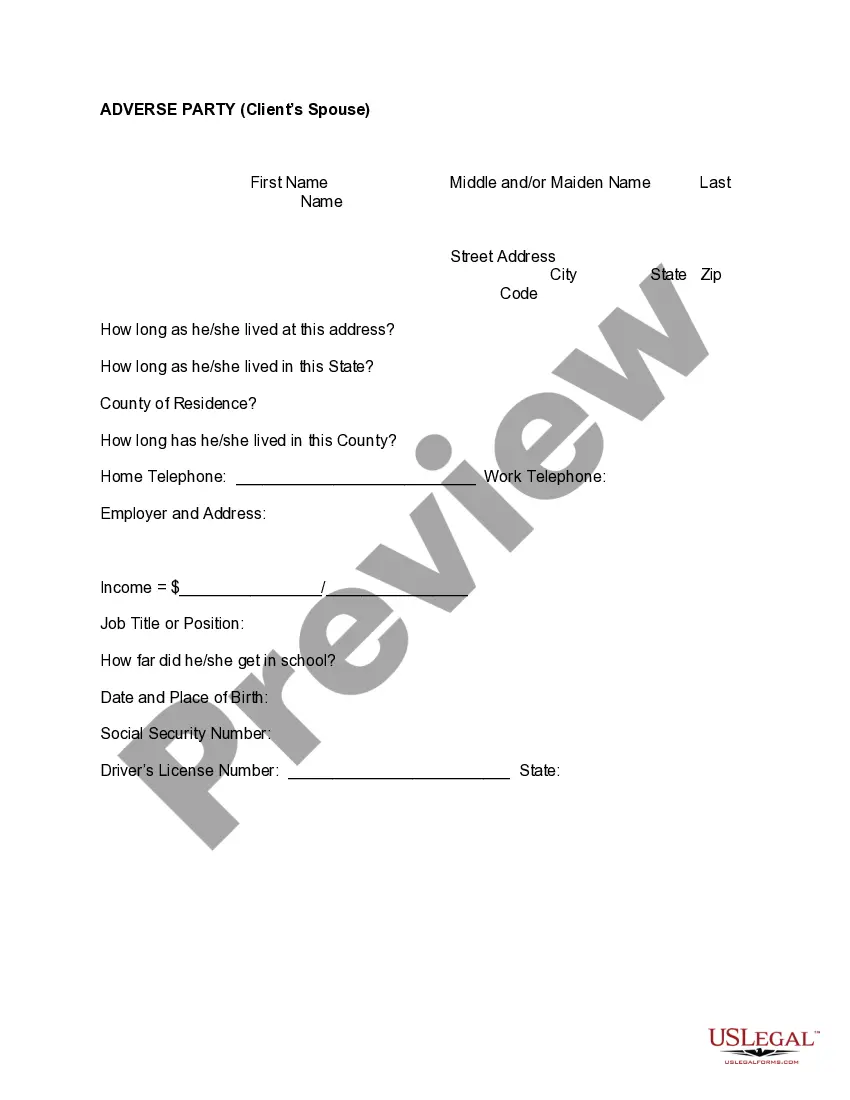

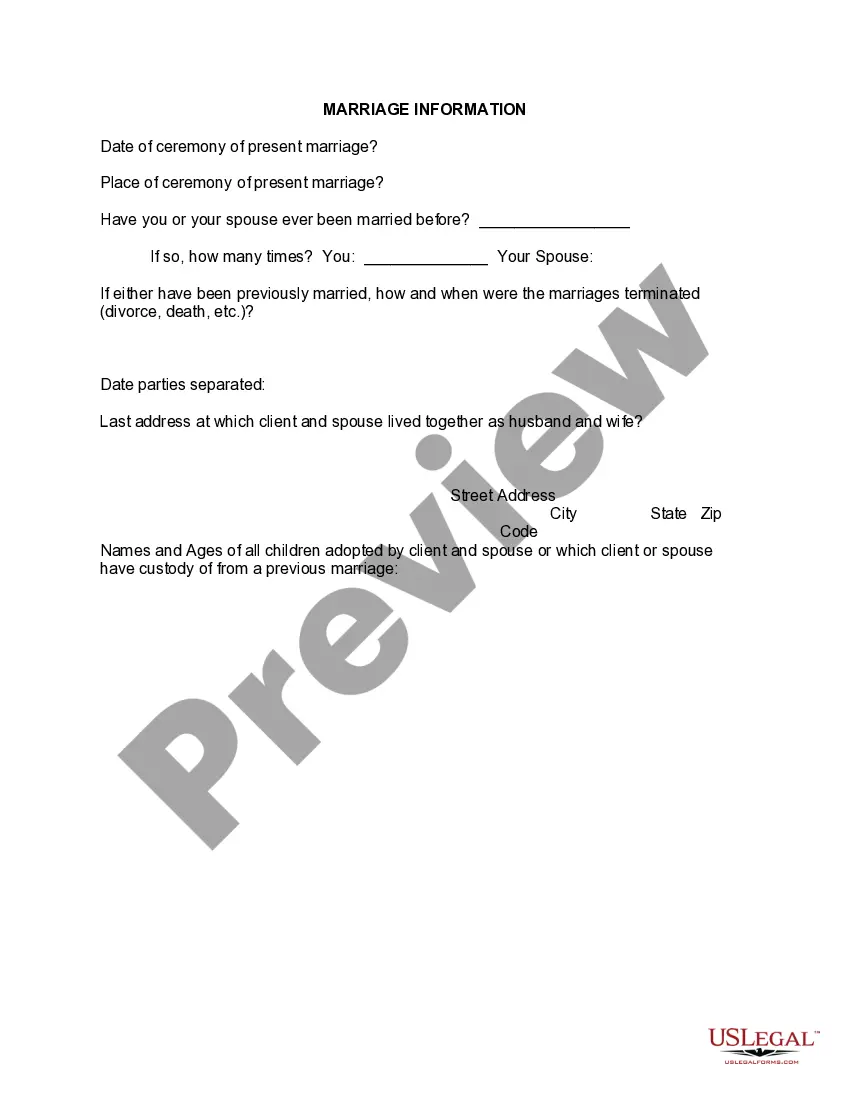

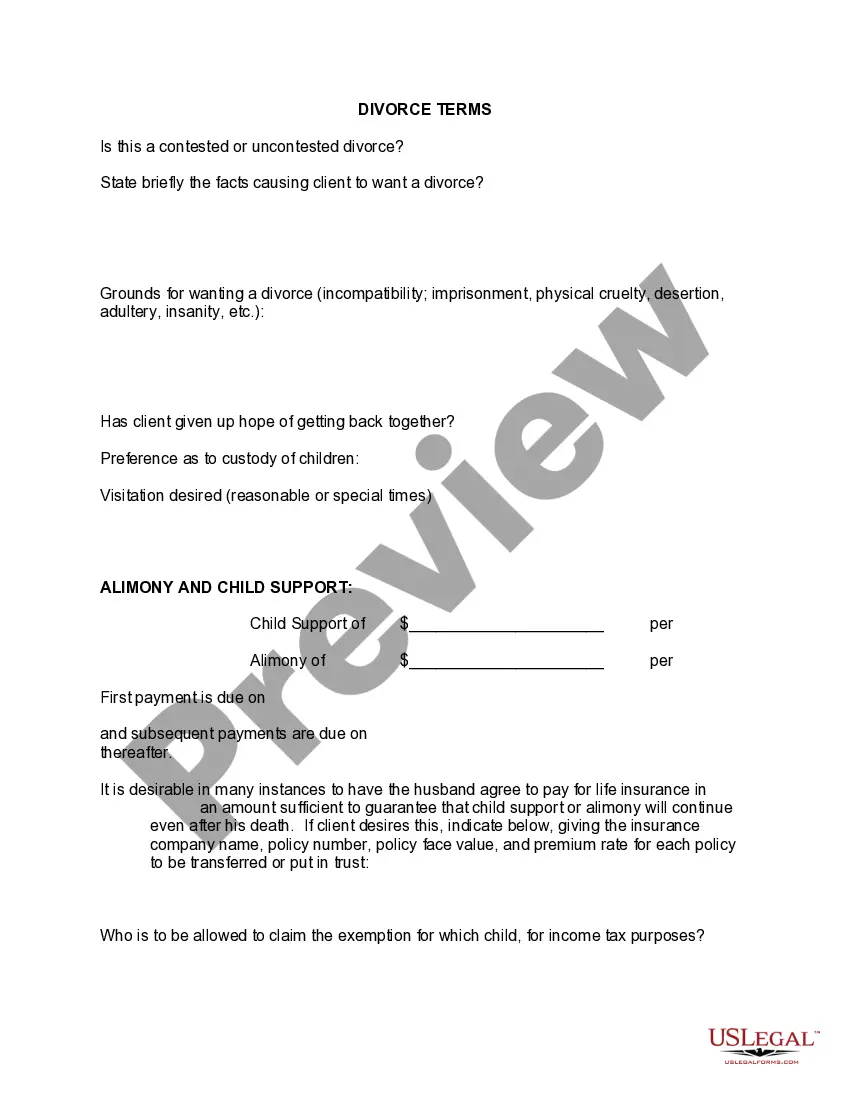

This is a sample Client Interview Form that an attorney would use to interview a new domestic relations client.

Birmingham Alabama Client Interview Form

Description

How to fill out Birmingham Alabama Client Interview Form?

We continually endeavor to minimize or avert legal harm when navigating intricate law-related or financial matters.

To achieve this, we enlist legal services that are typically exceedingly costly.

Nonetheless, not all legal issues are of equal intricacy. The majority can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it from the My documents tab.

- Our platform empowers you to manage your affairs independently without the necessity of seeking legal advice.

- We provide access to legal form templates that are not always publicly available.

- Our templates are tailored to specific states and regions, which significantly simplifies the searching process.

- Take advantage of US Legal Forms whenever you need to locate and download the Birmingham Alabama Client Interview Form or any other form conveniently and securely.

Form popularity

FAQ

A business license is an annual regulatory permit for the privilege of conducting business within City. This license is issued after a business has complied with applicable local, state and federal requirements and has paid the annual gross receipts tax, applicable fees and assessments.

Local business licenses: In addition to state or federal licenses where applicable, almost all businesses will need a license from the local government (city or county) to lawfully operate within their jurisdictions. These local licenses are typically very easy to obtain and require paying a fee.

Each employer of one or more persons must withhold an occupational tax at the rate of 1% from, gross salaries, wages, and commissions paid for work or services performed within the City of Birmingham. All employees are subject to the license tax except domestic servants employed in private homes.

Who is required to apply for a business license? Any person or entity desiring to conduct trade or provide services within the city limits of Birmingham is required to register with the City of Birmingham.

Cities including Birmingham, Bessemer, Gadsden, Irondale and Leeds charge an occupational tax. Different cities have different policies about whether to issue refunds. Birmingham charges a one percent occupational tax if you work in the city, but don't live in it. It's deducted from employee's paychecks.

9% tax on wages, compensation or self-employment income that exceeds a threshold amount (USD 250,000 if married filing jointly, USD 125,000 if married filing separately and USD 200,000 if single).

Licenses must be purchased for at least $287. There is a $50 renewal fee.

A business license is a permit issued to businesses by a government office that allows the business to operate in a particular area. They can be issued by federal, state, or local governments. There are typically different licensing requirements for different businesses and different locations.

Occupation tax is a tax the government imposes on certain trades and professions. It is usually a set amount the government levies, typically as a license fee, on doctors, lawyers, and other professionals. However, sometimes it may be a proportion of gross income.