Owner's Request for Lien Information by Corporation

Alabama Statutes

TITLE 35. PROPERTY.

CHAPTER 11. LIENS.

ARTICLE 5. LIENS OF PARTICULAR PERSONS OR CLASSES OF PERSONS.

Division 8. Mechanics and Materialmen.

Ala. Code 35-11-210 Lien declared.

Every mechanic, person, firm, or corporation who shall do or perform any work, or labor upon, or furnish any material, fixture, engine, boiler, waste disposal services and equipment, or machinery for any building or improvement on land, or for repairing, altering, or beautifying the same, under or by virtue of any contract with the owner or proprietor thereof, or his or her agent, architect, trustee, contractor, or subcontractor, upon complying with the provisions of this division, shall have a lien therefor on such building or improvements and on the land on which the same is situated, to the extent in ownership of all the right, title, and interest therein of the owner or proprietor, and to the extent in area of the entire lot or parcel of land in a city or town; or, if not in a city or town, of one acre in addition to the land upon which the building or improvement is situated; or, if employees of the contractor or persons furnishing material to him or her, the lien shall extend only to the amount of any unpaid balance due the contractor by the owner or proprietor, and the employees and materialmen shall also have a lien on the unpaid balance. But if the person, firm, or corporation, before furnishing any material, shall notify the owner or his or her agent in writing that certain specified material will be furnished by him or her to the contractor or subcontractor for use in the building or improvements on the land of the owner or proprietor at certain specified prices, unless the owner or proprietor or his or her agent objects thereto, the furnisher of the material shall have a lien for the full price thereof as specified in the notice to the owner or proprietor without regard to whether or not the amount of the claim for the material so furnished exceeds the unpaid balance due the contractor, unless on the notice herein provided for being given, the owner or proprietor or his or her agent shall notify the furnisher in writing before the material is used, that he or she will not be responsible for the price thereof. The notice may be given in the following form, which shall be sufficient:

“To __________, owner or proprietor:

“Take notice, that the undersigned is about to furnish __________, your contractor or subcontractor, certain material for the construction, or for the repairing, altering, or beautifying of a building or buildings, or improvement or improvements, on the following described property:

______________________________________________

______________________________________________

and there will become due to the undersigned on account thereof the price of the material, for the payment of which the undersigned will claim a lien.”

(Code 1876, §§3440, 3441; Code 1886, §3018; Code 1896, §2723; Code 1907, §4754; Code 1923, §8832; Code 1940, T. 33, §37; Acts 1996, 1st Ex. Sess., No. 96-26, p. 32, §1.)

Ala. Code 35-11-211 Priority of lien.

(a) Such lien as to the land and buildings or improvements thereon, shall have priority over all other liens, mortgages, or incumbrances created subsequent to the commencement of work on the building or improvement. Except to the extent provided in subsection (b) below, all liens, mortgages, and incumbrances (in this section, “mortgages and other liens”) created prior to the commencement of such work shall have priority over all liens for such work. Enforcement of such lien of a mechanic, materialman, or other person created by Section 35-11-210 (in this section, “mechanic or materialman lien”) shall not affect any prior mortgage or other lien, and the purchaser in connection with the enforcement of such mechanic or materialman lien shall take the property subject to such prior mortgages and other liens of which the purchaser has actual or constructive notice on the date of the purchase. Foreclosure of any prior mortgage or other lien shall terminate and extinguish such subordinate mechanic or materialman lien or other interest as to the land and the buildings and improvements thereon, whether or not at the time of such foreclosure such lien or interest has been perfected in accordance with the provisions of this division, and the mechanic, materialman, or other person thereafter shall have, to the extent of his lawful claim under this division, the statutory right of redemption afforded under applicable redemption laws to a judgment creditor whose judgment was recorded on the date such work was commenced and such rights in any excess proceeds received by the foreclosing lienholder as provided by law.

(b) As to liens, mortgages, or incumbrances created prior to the commencement of the work, the lien for such work shall have priority only against the building or improvement, the product of such work which is an entirety, separable from the land, building, or improvement subject of the prior lien, mortgage, or incumbrance, and which can be removed therefrom without impairing the value or security of any prior lien, mortgage or incumbrance; and the person entitled to such lien may have it enforced, at any time prior to the foreclosure of such prior lien, mortgage, or incumbrance, by a sale of such buildings or improvement under the provisions of this division and the purchaser may, within a reasonable time thereafter, remove the same. If such mechanic or materialman lien for such work is not enforced prior to such foreclosure, the mechanic or materialman lien shall be terminated and extinguished and after such foreclosure, the mechanic, materialman, or other person who held such mechanic or materialman lien thereafter shall have the statutory right of redemption and such rights in excess proceeds to the extent provided in subsection (a) above.

(c) The provisions of this section clarify and confirm the intent of the Legislature regarding existing law governing the matters contained in this section. The provisions of this section shall apply to all mortgages and other liens and to all liens of a mechanic, materialman, or other person created by Section 35-11-210 existing on February 23, 1990, and those created or arising after February 23, 1990.

(Code 1876, §3442; Code 1886, §3019; Code 1896, §2724; Code 1907, §4755; Code 1923, §8833; Acts 1933, Ex. Sess., No. 64, p. 54; Code 1940, T. 33, §38; Acts 1990, No. 90-98, p. 107.)

Ala. Code 35-11-212 Building or improvement on leased land.

(a) When the building or improvement is erected under or by virtue of any contract with a lessee in possession, and the erection thereof is not in violation of the terms or conditions of the lease, the lien shall attach to such building or improvement, and to the unexpired term of the lease, and the holder of the lien shall have the right to avoid a forfeiture of the lease by paying rent to the lessor, as it becomes due and payable, or by the performance of any other act or duty to which the lessee may be bound; and if the lien is enforced by a sale of the building or improvement, the purchaser may, at his election, become entitled to the possession of the demised premises, and to remain therein for the unexpired term, by paying rent to the lessor, or performing any other act or duty to which the lessee was bound, as if he were the assignee of the lease; or he may, within 60 days after the sale, remove such building or improvement from the premises; and if he elects to take possession and to remain therein until the expiration of the term of the lease, he may, within a reasonable time after the expiration of the term, remove such building or improvement from the premises. If, before a sale, the holder of the lien has made any payments of rent, or other pecuniary compensation to the lessor, which ought to have been paid by the lessee, he shall be reimbursed for such payments from the proceeds of the sale.

(b) When a lien attaches under subsection (a), the lessor, at any time before a sale of the property, shall have a right to discharge the same, by paying to the holder the amount secured thereby, including costs and all moneys he may have paid to the lessor to prevent a forfeiture of the lease, and, after a sale, he shall have the right to prevent the removal of the building or improvement from the premises by paying to the purchaser the value of such building or improvement; and upon such payment, either to the holder of the lien or to the purchaser, such building or improvement shall become the property of the lessor.

(Code 1876, §3443; Code 1886, §§3020, 3021; Code 1896, §§2725, 2726; Code 1907, §§4756, 4757; Code 1923, §§8834, 8835; Code 1940, T. 33, §§39, 40.)

Ala. Code 35-11-213 Verified statement – Duty to file; contents; form.

It shall be the duty of every person entitled to such lien to file in the office of the judge of probate of the county in which the property upon which the lien is sought to be established is situated, a statement in writing, verified by the oath of the person claiming the lien, or of some other person having knowledge of the facts, containing the amount of the demand secured by the lien, after all just credits have been given, a description of the property on which the lien is claimed in such a manner that same may be located or identified, a description by house number, name of street, and name of city or town being a sufficient description where the property is located in a city or town, and the name of the owner or proprietor thereof; but no error in the amount of the demand or in the name of the owner or proprietor, shall affect the lien. Unless such statement is so filed the lien shall be lost. Said verified statement may be in the following form, which shall be deemed sufficient:

State of Alabama,

County of _____

_____ files this statement in writing, verified by the oath of _____, who has personal knowledge of the facts herein set forth:

That said _____ claims a lien upon the following property, situated in _____ county, Alabama, to wit:

_________________________________

_________________________________

This lien is claimed, separately and severally, as to both the buildings and improvements thereon, and the said land.

That said lien is claimed to secure an indebtedness of $____ with interest, from to wit _____ day of _____, 19__, for ____________________

The name of the owner or proprietor of the said property is __________________________________________

_________________,

Claimant.

Before me, _____, a notary public in and for the county of _____, State of _____, personally appeared _____, who being duly sworn, doth depose and say: That he has personal knowledge of the facts set forth in the foregoing statement of lien, and that the same are true and correct to the best of his knowledge and belief.

_________________,

Affiant.

Subscribed and sworn to before me on this the _____ day of _____, 19__, by said affiant.

_________________,

Notary Public.

(Code 1876, §3444; Code 1886, §3022; Code 1896, §2727; Code 1907, §4758; Code 1923, §8836; Code 1940, T. 33, §41.)

Ala. Code 35-11-214 Verified statement – How oath administered out of state.

If the oath to such statement is made beyond this state, it may be administered by any officer authorized to take acknowledgements and proof of conveyances beyond the state.

(Code 1886, §3023; Code 1896, §2728; Code 1907, §4759; Code 1923, §8837; Code 1940, T. 33, §43.)

Ala. Code 35-11-215 Verified statement – Time for filing.

The lien declared in this division shall be deemed lost unless the statement referred to in Section 35-11-213 shall be filed by every original contractor within six months and by every journeyman and day laborer within 30 days, and by every other person entitled to such lien within four months, after the last item of work or labor has been performed or the last item of any material, fixture, engine, boiler, or machinery has been furnished for any building or improvement on land or for repairing, altering, or beautifying the same under or by virtue of any contract with the owner or proprietor thereof, or his agent, architect, trustee, contractor, or subcontractor.

(Code 1876, §§3444, 3454; Code 1886, §§3022, 3041; Code 1896, §§2727, 2746; Code 1907, §§4758, 4777; Code 1923, §§8836, 8855; Code 1940, T. 33, §42.)

Ala. Code 35-11-216 Verified statement – Indorsement by probate judge; recordation; fee.

The judge of probate shall indorse on such statement the date of its filing, and shall record the same in a book kept for that purpose, which shall be properly labeled and indexed, and note thereon the date of filing; for all of which he shall receive $.15 per 100 words, which shall be secured to the party filing the statement by such lien.

(Code 1876, §3445; Code 1886, §3024; Code 1896, §2729; Code 1907, §4760; Code 1923, §8838; Code 1940, T. 33, §44.)

Ala. Code 35-11-217 Selection of land to be charged in certain cases.

When the land on which the building or improvement is situated is not in a city or town and exceeds in area one acre, any person having a lien, or his personal representative, may at any time prior to his filing his statement in the office of the judge of probate, select one acre in addition to the land upon which the building or improvement is situated which shall also be subject to the lien; such selection to include the land surrounding the said building or improvement, and contiguous thereto, and with the land on which the building or improvement is situated to constitute but one lot or parcel. When the land on which the building or improvement is situated is in a city or town and the improvement consists of two or more buildings united together, situated on the same lot or contiguous or adjacent lots, or of separate buildings upon contiguous or adjacent lots, or where the machinery, material, fixture, engine, boiler, work, or labor has been furnished for improvements or structures which are located on separate tracts or parcels of land but operated as an entire plant or concern, and erected under one general contract, the lien for the labor, materials, fixtures, engines, boiler, or machinery, so furnished, shall attach to all such construction or improvements, together with land upon which they are situated, and it shall not be necessary to file a separate lien for each lot, building, or improvement, but the party claiming the lien may elect to file a separate lien for each lot, building, or improvement.

(Code 1886, §3025; Code 1896, §2730; Code 1907, §4761; Code 1923, §8839; Code 1940, T. 33, §45.)

Ala. Code 35-11-218 Notice of lien claimed by persons other than original contractor.

Every person, except the original contractor, who may wish to avail himself of the provisions of this division, shall before filing his statement in the office of the judge of probate, give notice in writing to the owner or proprietor, or his agent, that he claims a lien on such building or improvement, setting forth the amount thereof, for what, and from whom it is owing; and after such notice, any unpaid balance in the hands of the owner or proprietor shall be held subject to such lien. But the provisions of this section shall not apply to the case of any material furnished for such building or improvement, of which the owner was notified in advance as provided in Section 35-11-210.

(Code 1876, §3457; Code 1886, §3026; Code 1896, §2731; Code 1907, §4762; Code 1923, §8840; Code 1940, T. 33, §46.)

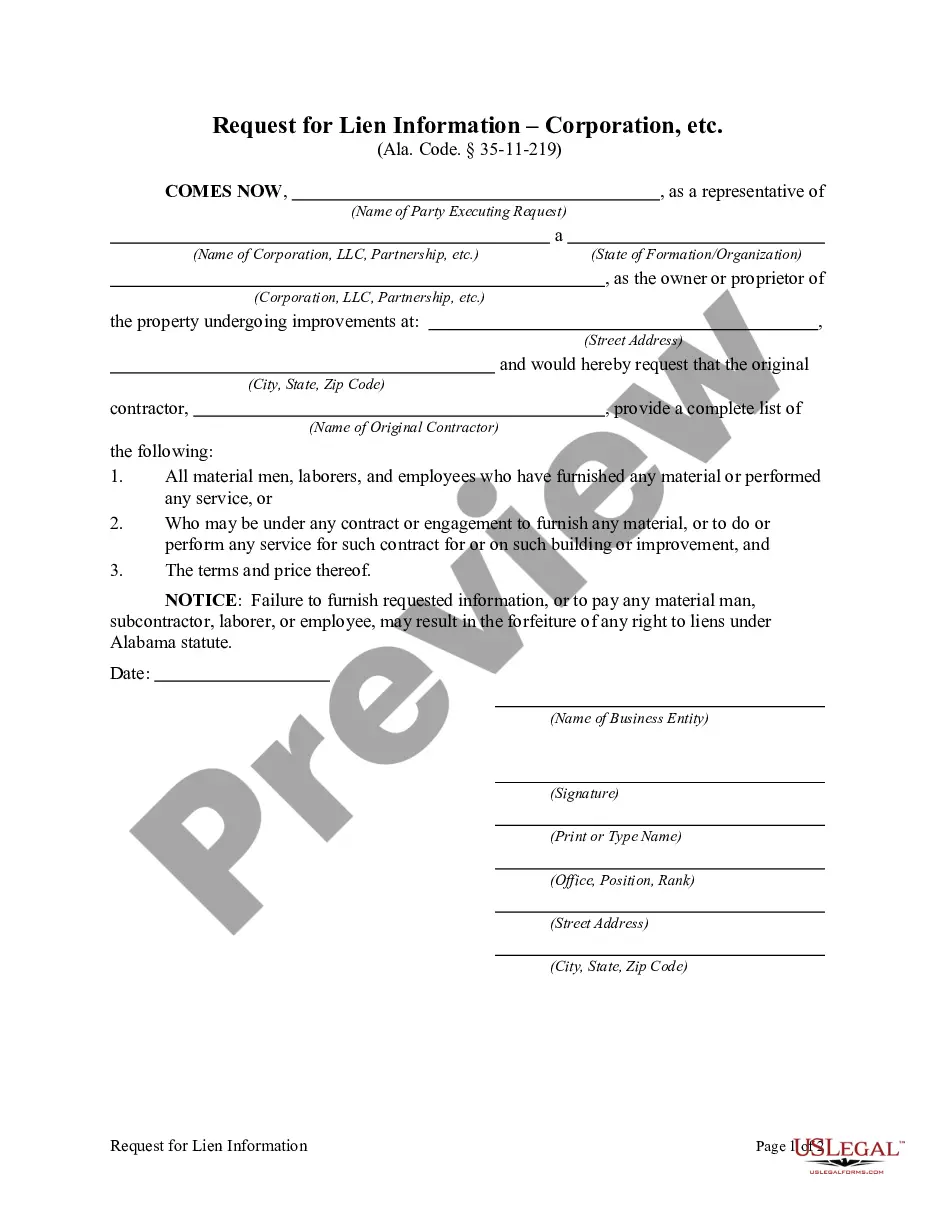

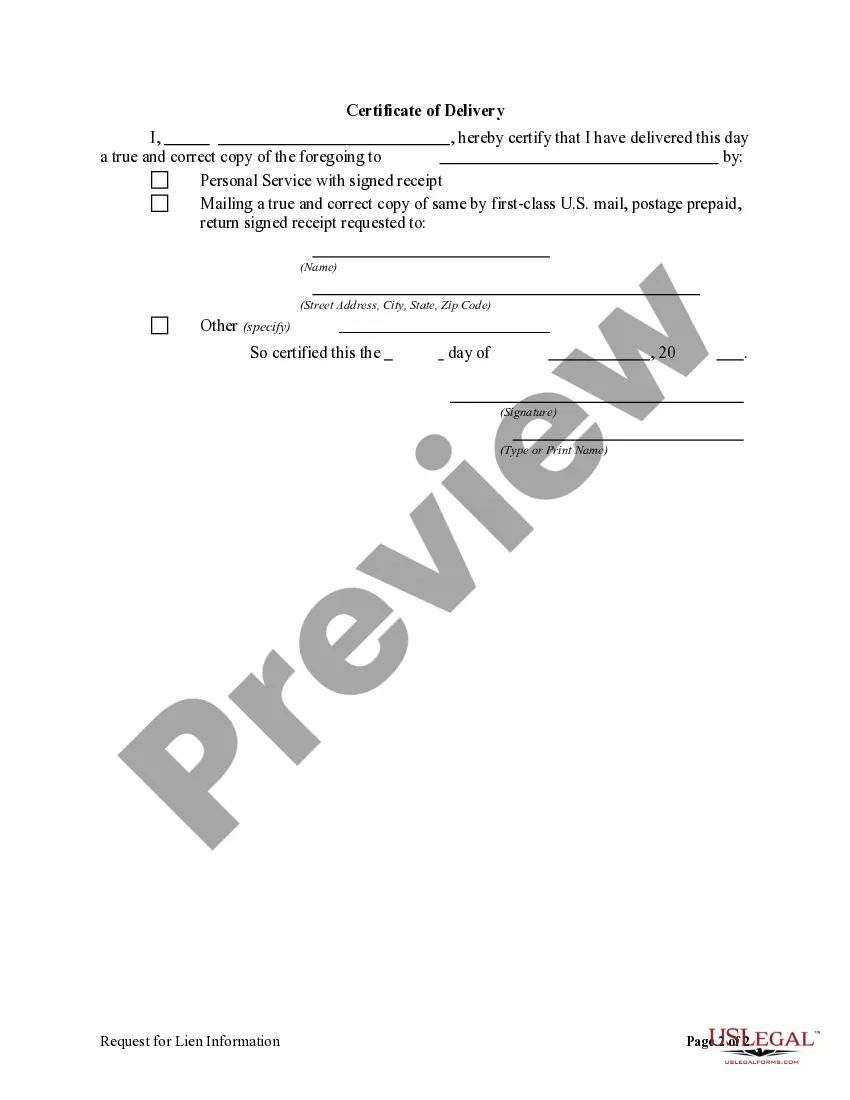

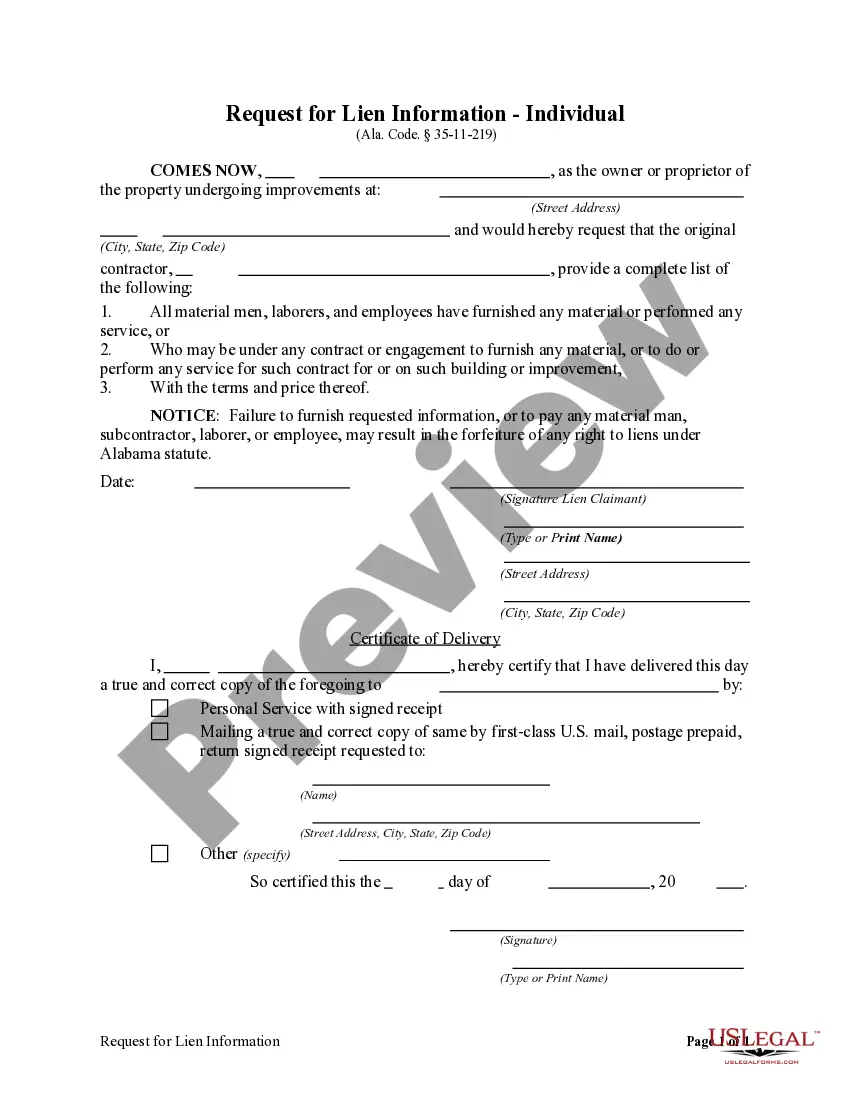

Ala. Code 35-11-219 List of materialmen, laborers, and employees; effect of failure to pay materialmen, etc.

The original contractor shall, when so required, furnish to the owner or proprietor a complete list of all materialmen, laborers, and employees who have furnished any material or have done any labor or performed any service or who may be under any contract or engagement to furnish any material, or to do or perform any service for such contractor for or on such building or improvement, with the terms and price thereof. If he fails or refuses to furnish such list or to give such information, or if he shall fail to pay any materialman, subcontractor, laborer, or employee in accordance with any special contract made with the owner or proprietor, he shall thereby forfeit his right to a lien under this division.

(Code 1876, §3458; Code 1886, §3027; Code 1896, §2732; Code 1907, §4763; Code 1923, §8841; Code 1940, T. 33, §47.)

Ala. Code 35-11-220 Jurisdiction of actions for enforcement of liens.

When the amount involved exceeds $50.00, actions for the enforcement of liens under this division may be brought in the circuit court having jurisdiction in the county in which the property is situated. In all other cases actions to enforce such liens shall be brought before the district court in the county in which the property is situated.

(Code 1886, §§3028, 3048; Code 1896, §2733; Code 1907, §4764; Code 1923, §8842; Code 1940, T. 33, §48.)

Ala. Code 35-11-221 Limitation of actions.

Any action for the enforcement of the lien declared in this division must be commenced within six months after the maturity of the entire indebtedness secured thereby, except as otherwise provided in this division.

(Code 1876, §§3444, 3454; Code 1886, §§3022, 3041; Code 1896, §§2727, 2746; Code 1907, §§4758, 4777; Code 1923, §§8836, 8855; Code 1940, T. 33, §42.)

Ala. Code 35-11-222 How action commenced; pleadings, practice, and proceedings.

Such actions, when brought in the circuit court, shall be commenced by summons and complaint. The complaint shall contain a description of the property on which the lien is claimed, and shall allege the facts necessary to entitle the plaintiff to the lien and the enforcement thereof; in all other respects, the pleadings, practice and proceedings shall be the same as in ordinary civil actions.

(Code 1876, §3446; Code 1886, §3029; Code 1896, §2734; Code 1907, §4765; Code 1923, §8843; Code 1940, T. 33, §49.)

Ala. Code 35-11-223 Parties.

(a) In such actions, all persons interested in the matter in controversy, or in the property charged with the lien, may be made parties; but such as are not made parties shall not be bound by the judgment or proceedings therein.

(b) On the death of any party to such action, his personal representative shall be made a party thereto, plaintiff or defendant, as the case may be, and it shall not be necessary to make his heirs or devisees parties; but if he has no personal representative, and it is not desired to have one appointed, his heirs or devisees may be made parties.

(Code 1876, §§3447, 3448; Code 1886, §§3030, 3031; Code 1896, §§2735, 2736; Code 1907, §§4766, 4767; Code 1923, §§8844, 8845; Code 1940, T. 33, §§50, 51.)

Ala. Code 35-11-224 Issues; finding or verdict; judgment generally.

Any defendant, by appropriate plea, may put in issue the fact of indebtedness or the existence of the lien, or both, and may interpose any other defense applicable to the action; and if the court by its finding, or the jury by their verdict, as the case may be, ascertain that the plaintiff has a lien as claimed, judgment shall be entered for the amount secured thereby, interest and costs, against the party liable for the same, and establishing the lien, and condemning the property to sale for the satisfaction thereof; but if the finding or verdict is for the plaintiff only on the issue of indebtedness, a judgment shall be entered in his favor for the amount thereof as in other cases.

(Code 1886, §3034; Code 1896, §2739; Code 1907, §4770; Code 1923, §8848; Code 1940, T. 33, §52.)

Ala. Code 35-11-225 Judgment by default.

Judgment by default may be entered against any defendant, except infants and persons non compos mentis, who, after service has been perfected on him, fails to appear within the time required by law in other cases.

(Code 1876, §3450; Code 1886, §3035; Code 1896, §2740; Code 1907, §4771; Code 1923, §8849; Code 1940, T. 33, §53.)

Ala. Code 35-11-226 Enforcement of judgments.

(a) Judgments establishing the lien, and ordering the property sold for the satisfaction thereof, may be enforced by writs of fieri facias or venditioni exponas; but if by fieri facias, the clerk shall indorse thereon the fact that the lien has been established, and a description of the property.

(b) Upon the entry of such judgment by the district court, all the papers and a certified transcript of the judgment shall be transmitted to the clerk of the circuit court; and thereupon such clerk shall enter the action on the execution docket, record the judgment, and issue a writ of fieri facias or venditioni exponas, as on judgments entered in that court.

(Code 1886, §§3036, 3037; Code 1896, §§2741, 2742; Code 1907, §§4772, 4773; Code 1923, §§8850, 8851; Code 1940, T. 33, §§54, 55.)

Ala. Code 35-11-227 Actions by employees, etc.; defense by contractor.

(a) If the action is by an employee of the contractor, or by any person who has furnished to him material for the building or improvement, the contractor shall be a necessary party defendant thereto; and in such action on motion of the plaintiff, the owner or proprietor may be cited to answer under oath how much was owing by him to the contractor on his contract with such contractor, at the time of the service on him of the notice required by Section 35-11-218; and such answer may be controverted, and proceedings had and judgment entered as in garnishment cases.

(b) When the lien is sought to be enforced by any person other than the contractor, it shall be the duty of the contractor to defend the action at his own expense; and after notice of an intention to file a statement of the lien, and pending the action, the owner or proprietor may withhold from the contractor money sufficient to cover the amount claimed, and the probable costs and expense of the action; and in case of recovery against the owner or proprietor, or his property, he shall be entitled to deduct from the amount owing by him to the contractor the amount of such judgment, costs, and expense; and if he shall have settled with the contractor, he shall be entitled to recover from the contractor the amount recovered of, and paid by him; and such recovery may be had in the same court, on motion, on three days’ notice.

(Code 1876, §3459; Code 1886, §§3038, 3039; Code 1896, §§2743, 2744; Code 1907, §§4774, 4775; Code 1923, §§8852, 8853; Code 1940, T. 33, §§56, 57.)

Ala. Code 35-11-228 Liens stand on equal footing; exception; distribution of proceeds.

All liens arising under this division, except in favor of the original contractor, shall stand on an equal footing, and be first paid out of the proceeds of the sale of the property, or money collected from the owner or proprietor; and if such proceeds and money are insufficient to satisfy such liens in full, the same shall be distributed pro rata among the holders thereof; but no person shall be entitled to participate in such distribution until he has obtained judgment establishing his lien.

(Code 1876, §3461; Code 1886, §3040; Code 1896, §2745; Code 1907, §4776; Code 1923, §8854; Code 1940, T. 33, §58.)

Ala. Code 35-11-229 Actions by personal representatives.

If any person entitled to a lien under this division shall die before the time has elapsed for filing his statement in the office of the judge of probate without filing it, his personal representative may file the same within three months after the grant of letter; and if such person shall die before commencing an action for the enforcement of his lien, and the lien is not lost at the time of his death, his personal representative may bring an action for the enforcement thereof at any time within six months after the grant of letters.

(Code 1886, §3042; Code 1896, §2747; Code 1907, §4778; Code 1923, §8856; Code 1940, T. 33, §59.)

Ala. Code 35-11-230 Actions against personal representatives.

The provisions of this Code prohibiting the bringing of actions against personal representatives within six months after the grant of letters shall not apply to actions brought under the provisions of this division.

(Code 1886, §3043; Code 1896, §2748; Code 1907, §4779; Code 1923, §8857; Code 1940, T. 33, §60.)

Ala. Code 35-11-231 Acknowledgment of satisfaction.

(a) Whenever any such lien has been fully satisfied, the holder thereof must acknowledge satisfaction of the same on the margin of the record in the office of the judge of probate.

(b) Any holder of such lien, who, after having been fully paid fails for 30 days after demand in writing to so acknowledge satisfaction thereof, shall be liable to any person thereby injured to the amount of such injury, which shall not be less than $200.00.

(Code 1876, §§3455, 3456; Code 1886, §§3044, 3045; Code 1896, §§2749, 2750; Code 1907, §§4780, 4781; Code 1923, §§8858, 8859; Code 1940, T. 33, §§61, 62.)

Ala. Code 35-11-232 “Owner or proprietor” defined.

Every person, including cestuis que trust, for whose use, benefit, or enjoyment any building or improvement shall be made, is embraced within the words “owner or proprietor, ” as used in this division.

(Code 1876, §3460; Code 1886, §3046; Code 1896, §2751; Code 1907, §4782; Code 1923, §8860; Code 1940, T. 33, §63.)

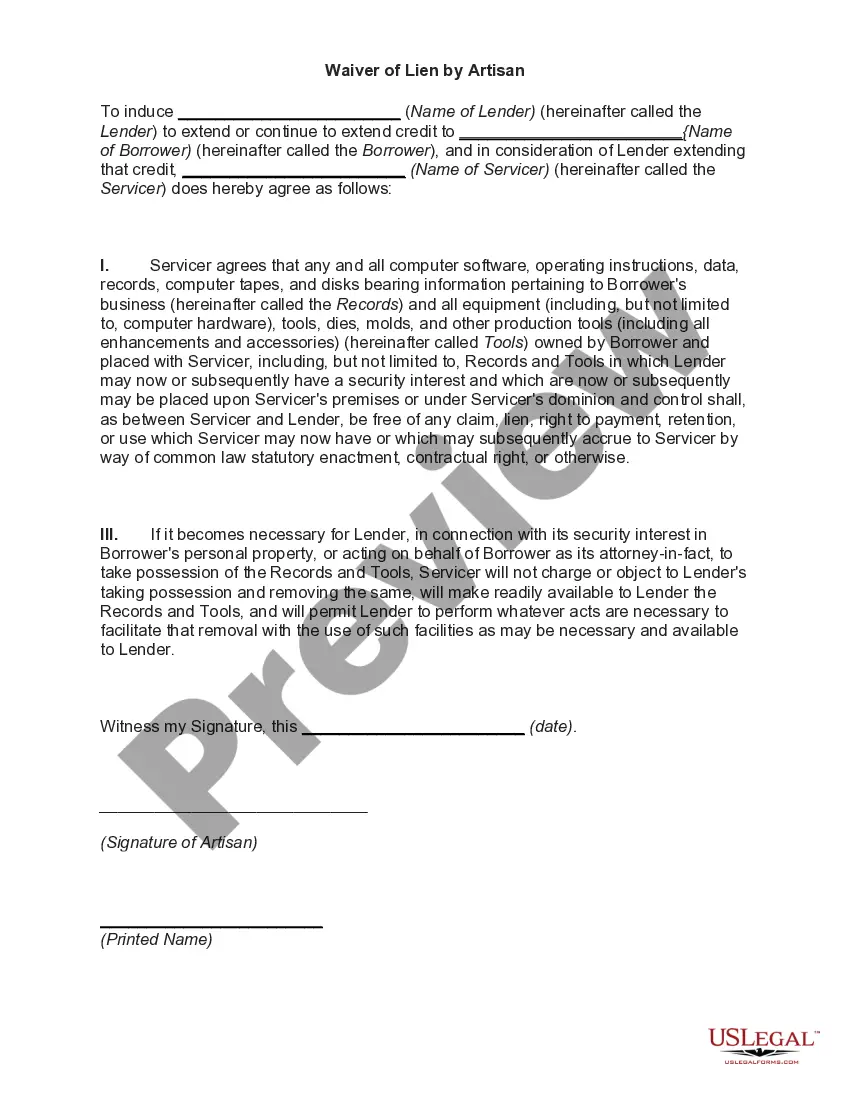

Ala. Code 35-11-233 Assignment of lien; transfer of lien on real property to other security.

(a) Any claim for which a lien is provided in this division may be assigned; and the assignee shall thereby be invested with all the rights of the original holder of the lien, and be entitled to all his remedies to enforce them. The assignee shall have the right to consolidate all such claims in one statement to be filed as herein provided; and the length of time for the filing of said claim shall be measured by the greatest length of time for the filing of any class of claims held by the assignee.

(b) Any lien claimed on real property under this division may be transferred by any person having an interest in the real property upon which the lien is imposed or the contract under which the lien is claimed, from such real property to other security by first filing with the court in which the action is brought, a copy of the lien which has been duly filed and recorded as required by law, and by either:

(1) Depositing with the court in which the action is brought a sum of money; or

(2) Filing with the court a bond executed as surety by a surety insurer licensed to do business in this state, either of which shall be in an amount equal to the amount demanded in such claim of lien plus interest thereon at eight percent per year for three years plus $100.00 to apply on any court costs which may be taxed in any proceeding to enforce said lien.

Such deposit or bond shall be conditioned to pay any judgment or decree which may be rendered for the satisfaction of the lien for which such claim of lien was recorded and costs not to exceed $100.00. Upon making such deposit or filing such bond the court shall make and record a certificate showing the transfer of the lien from the real property to the security and mail a copy thereof by registered or certified mail to the lienor named in the claim of lien so transferred at the address stated therein. Within 10 days from the date of the receipt of the said certificate, the lienor may by motion, petition the court in which the action is pending for a hearing on the sufficiency of the amount in question or on the qualifications of the surety insurer. In such an event, the ruling of the court on the said motion, shall be a final determination. Upon the expiration of the said 10 days, or in the event a petition has been filed with the court, upon the determination of the court, and upon filing the certificate of transfer in the court where the lien was filed, the real property shall thereupon be released from the lien claimed and such lien shall be transferred to said security. The court shall be entitled to a fee for making and serving the certificate in the sum of $2.00. Any number of liens may be transferred to one such security.

(c) Any excess of the security over the aggregate amount of any judgments or decrees rendered plus costs actually taxed shall be repaid to the party filing the same or his successor in interest. Any deposit of money shall be considered as paid into court and shall be subject to the provisions of law relative to payments of money into court and the disposition of same.

(d) Any party having an interest in such security or the property from which the lien was transferred may at any time, and any number of times, file a complaint in the circuit court of the county where such security is deposited for an order to require additional security, reduction of security, change or substitution of sureties, payment or discharge thereof, or any other matter affecting said security.

(e) If no proceeding to enforce a transferred lien shall be commenced within the time specified, or if it appears that the transferred lien has been satisfied of record, the court shall return said security upon request of the person depositing or filing the same, or the insurer.

(Code 1886, §3047; Code 1896, §2752; Code 1907, §4783; Code 1923, §8861; Code 1940, T. 33, §64; Acts 1980, No. 80-757, p. 1581.)

Note: This summary is not intended to be an all inclusive discussion of Alabama’s construction or mechanic’s lien laws, but does include basic provisions.

What is a construction or mechanic’s lien?

Every State permits a person who supplies labor or materials for a construction project to claim a lien against the improved property. While some states differ in their definition of improvements and some states limit lien claims to buildings or structures, most permit the filing of a document with the local court that puts parties interested in the property on notice that the party asserting the lien has a claim. States differ widely in the method and time within which a party may act on their lien. Also varying widely are the requirements of written notices between property owners, contractors, subcontractors and laborers, and in some cases lending institutions. As a general rule, these statutes serve to prevent unpleasant surprises by compelling parties who wish to assert their legal rights to put all parties who might be interested in the property on notice of a claim or the possibility of a claim. This by no means constitutes a complete discussion of construction lien law and should not be interpreted as such. Parties seeking to know more about construction laws in their State should always consult their State statutes directly.

Who can claim a lien in this State?

Alabama law states that “Every mechanic, person, firm, or corporation who shall do or perform any work, or labor upon, or furnish any material, fixture, engine, boiler, waste disposal services and equipment, or machinery for any building or improvement on land, or for repairing, altering, or beautifying the same, under or by virtue of any contract with the owner or proprietor thereof, or his or her agent, architect, trustee, contractor, or subcontractor, upon complying with the provisions of this division, shall have a lien therefor…” Ala. Code § 35-11-210.

How long does a party have to claim a lien?

A verified lien statement must be filed by original contractors within six (6) months after the last item of work, labor, or material, has been furnished. Journeymen and day laborers have thirty (30) days and every other party has four (4) months from after the last item of work, labor, or material has been provided. Ala. Code § 35-11-215.

What kind of notice is required prior to claiming a lien?

Alabama statutes have special provisions for those who furnish materials to construction projects. A furnisher of materials may only claim a lien for the unpaid balance due to the contractor from the owner unless the furnisher of materials provides the owner with a notice of furnishing materials. However, the owner may use the same notice form to object to the furnisher’s claim. If this form is properly provided without objection from the owner, the furnisher of materials is entitled to a lien for the full price of materials furnished. Ala. Code § 35-11-210.

Also, while an original contractor may simply file a verified statement to claim a lien, any other party wishing to claim a lien must, before filing a verified statement, give notice in writing to the owner or proprietor of the intention to claim a lien. The required notice will contain the amount of the lien and from whom that amount is owed. This notice requirement does not apply to parties who furnish materials and have already provided notice as set out in the paragraph above. Ala. Code § 35-11-218.

By what method is a lien filed in this State?

Alabama law requires the filing of a verified statement of lien in the office of the judge of probate in the county which the property in question is situated. The form of the statement is set out in Ala. Code § 35-11-213 and is required to be verified by the oath of the submitter. Ala. Code § 35-11-213.

How long is a lien good for?

A action to enforce a lien must be commenced within six (6) months “after the maturity of the entire indebtedness secured thereby,…” Ala. Code § 35-11-221.

Are liens assignable?

Yes. Alabama has an extensive statute providing for the transfer of a lien interest from one party to another. A filing of the original lien plus a bond in the amount of the lien may be required. Ala. Code § 35-11-233.

Does this State require or provide for a notice from the property owner to the contractor, subcontractor, or laborers?

Alabama law provides that a property owner or proprietor may demand that the contractor provide a list of materialmen, laborers, and employees as well as the amount they are owed. Failure of a contractor to provide this information may result in the forfeiture of the contractor’s right to a lien. Ala. Code § 35-11-219.

Does this State permit a person with an interest in property to deny responsibility for improvements?

Only in the instance of a party who provides a notice that they are furnishing materials for the improvement of the owner’s property. The property owner may use the same notice form to provide notice that the owner will not be held responsible for the cost of materials provided. Ala. Code § 35-11-210.

Is a notice attesting to the satisfaction of a lien provided for or required?

Yes. Ala. Code § 35-11-231 requires that any lien holder who’s lien has been satisfied must provide a written acknowledgment of satisfaction within thirty (30) days of a written request that they provide said notice. Failure to provide this notice within thirty (30) days of request will result in the lien holder being held liable for any damages that result. Ala. Code § 35-11-231.

By what method does the law of this State permit the release of a lien?

Alabama statutes have no specific provision for the release of a lien other than by expiration of the statute of limitations or through an acknowledgment of satisfaction after payment in full.

Does this State permit the use of a bond to release a lien?

Alabama law does not contain a provision under which a party could use a bond to release a lien. Under Section 35-11-233 of the Alabama Code, it expressly permits an owner to transfer the lien to cash security or a bond.