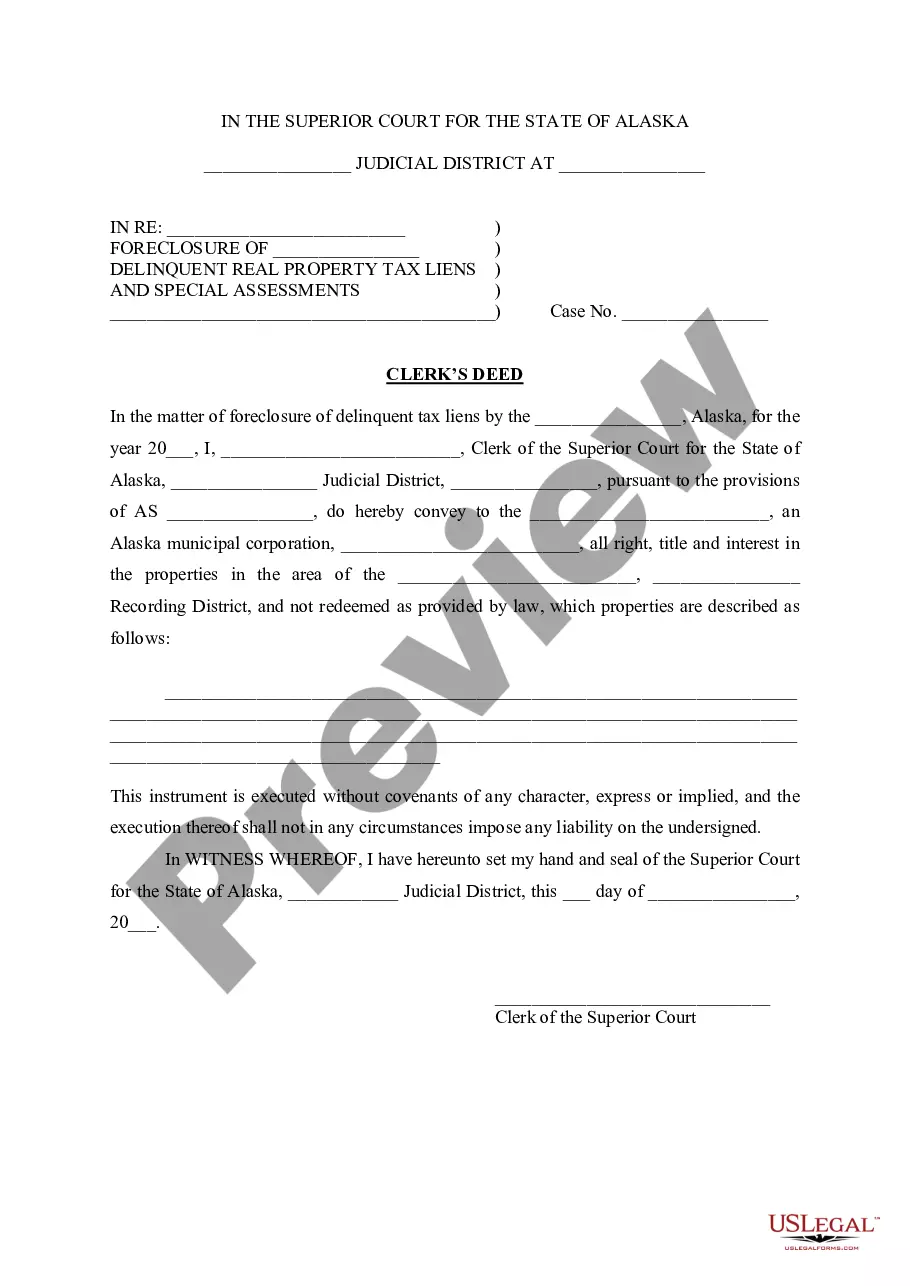

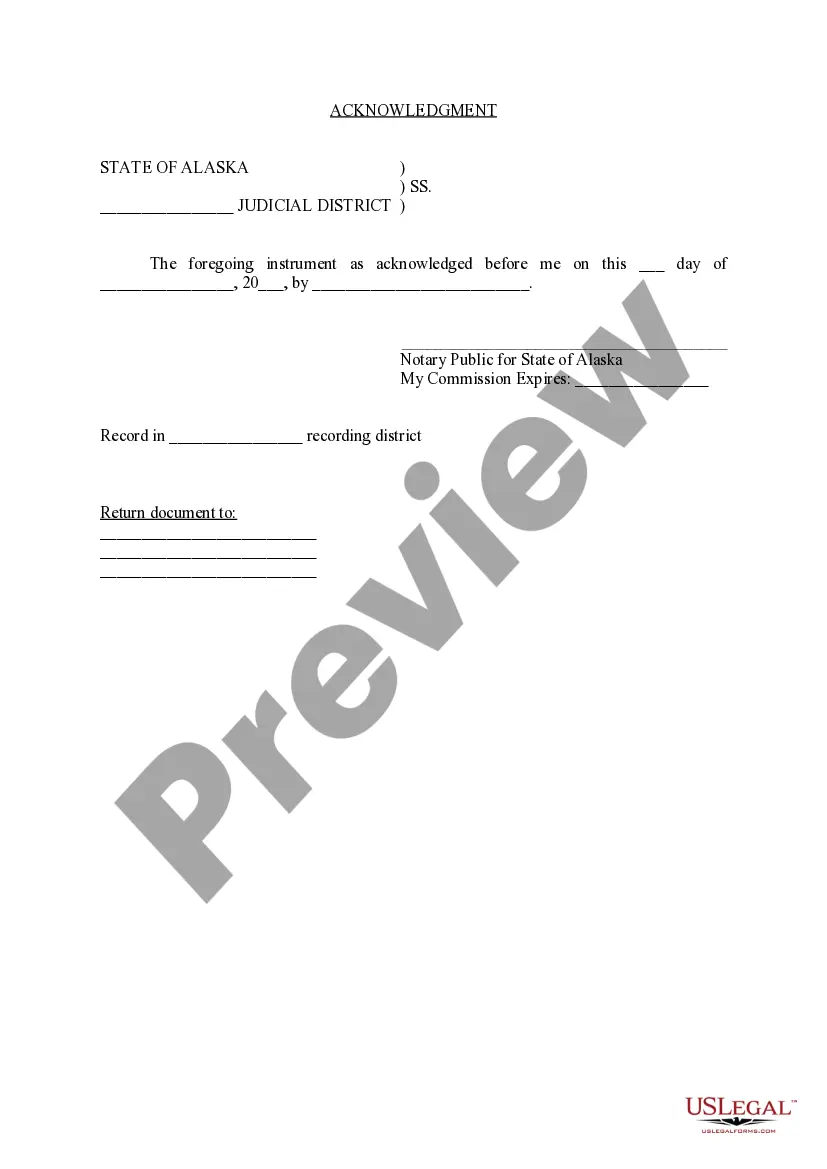

Anchorage Alaska Clerk's Deed - Foreclosure of Property for Delinquent Tax Lien

Description

How to fill out Alaska Clerk's Deed - Foreclosure Of Property For Delinquent Tax Lien?

If you are looking for a legitimate form template, it’s challenging to locate a more accessible location than the US Legal Forms site – likely the most comprehensive online collections.

With this collection, you can obtain countless form examples for business and personal needs organized by categories and states, or keywords.

Utilizing our advanced search capability, acquiring the most recent Anchorage Alaska Clerk's Deed - Foreclosure of Property for Delinquent Tax Lien is as straightforward as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the format and save it to your device. Make changes. Fill out, modify, print, and sign the obtained Anchorage Alaska Clerk's Deed - Foreclosure of Property for Delinquent Tax Lien.

- Moreover, the applicability of every document is confirmed by a team of proficient attorneys who routinely review the templates on our platform and refresh them in line with the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to access the Anchorage Alaska Clerk's Deed - Foreclosure of Property for Delinquent Tax Lien is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the directions provided below.

- Ensure you have opened the template you require. Review its details and utilize the Preview function to examine its content. If it doesn’t fulfill your needs, use the Search option at the top of the page to find the suitable record.

- Confirm your choice. Click the Buy now button. Then, choose your desired pricing plan and provide information to create an account.

Form popularity

FAQ

Tax liens are liens filed by the Internal Revenue Service for Federal taxes and the State of Oklahoma for State taxes. These are filed in the county of the real property or in the county where the taxpayer lives. These taxes can be for income tax, business tax, estate tax etc. Tax liens are filed against the taxpayer.

Alaska is classified as a tax deed state and handles tax sales through boroughs rather than counties. Every year the tax collector will issue tax lien certificates on delinquent properties and send them directly to the county for filing....Alaska Tax Deeds. Sale Type:Tax DeedState Website: more rows ?

After you become delinquent on your real property taxes in Texas, the taxing authority gets a lien on your home. It may then initiate a foreclosure by filing a lawsuit in court. The court will enter a judgment, and the property will be sold to a new owner. The proceeds from the sale pay off your tax debt.

You cannot buy a tax lien in California. A lien pays the delinquent tax for the homeowner and you receive interest for it. California sells tax deeds on properties with taxes delinquent for five or more years, or if the owner has not enrolled in the county's Five Year Payment Plan.

If you are unable to collect payment on a lien after filing the affidavit, then Texas Construction Law allows you to foreclose to enforce a lien. This action forces the sale of the property to pay creditors. Unfortunately, to foreclose a lien, a lawsuit must be filed.

In Texas, the foreclosure process can start at any time. The process can be completed in about 60 days if the foreclosure is uncontested. As we covered in How to Get Rid of Property Tax Liens in Texas, a lien is a local, state or federal government's legal claim against your property when your taxes aren't paid.

How Long Can You Go Without Paying Property Taxes in Texas? At any time after the property tax becomes delinquent, the taxing authority may start a foreclosure in court. (Tex. Tax Code § 33.41.)

The 2021 Tax Lien Sale will be held online on November 2nd - November 4th, 2022. The Tax Lien Sale Site is open for registration year-round. View Tax Sale Information for detailed instructions on how the online tax lien sale works. For any questions about Tax Lien Sales, please contact our office at (303) 795-4550.

How Can I Invest in Tax Liens? Investors can purchase property tax liens the same way actual properties can be bought and sold at auctions. The auctions are held in a physical setting or online, and investors can either bid down on the interest rate on the lien or bid up a premium they will pay for it.

Alaska is the only state in the United States where a large part of the land mass of the state is not subject to a property tax. Although property tax is the primary method of raising revenues for the majority of the larger municipalities in the state, smaller municipalities favor a sales tax.