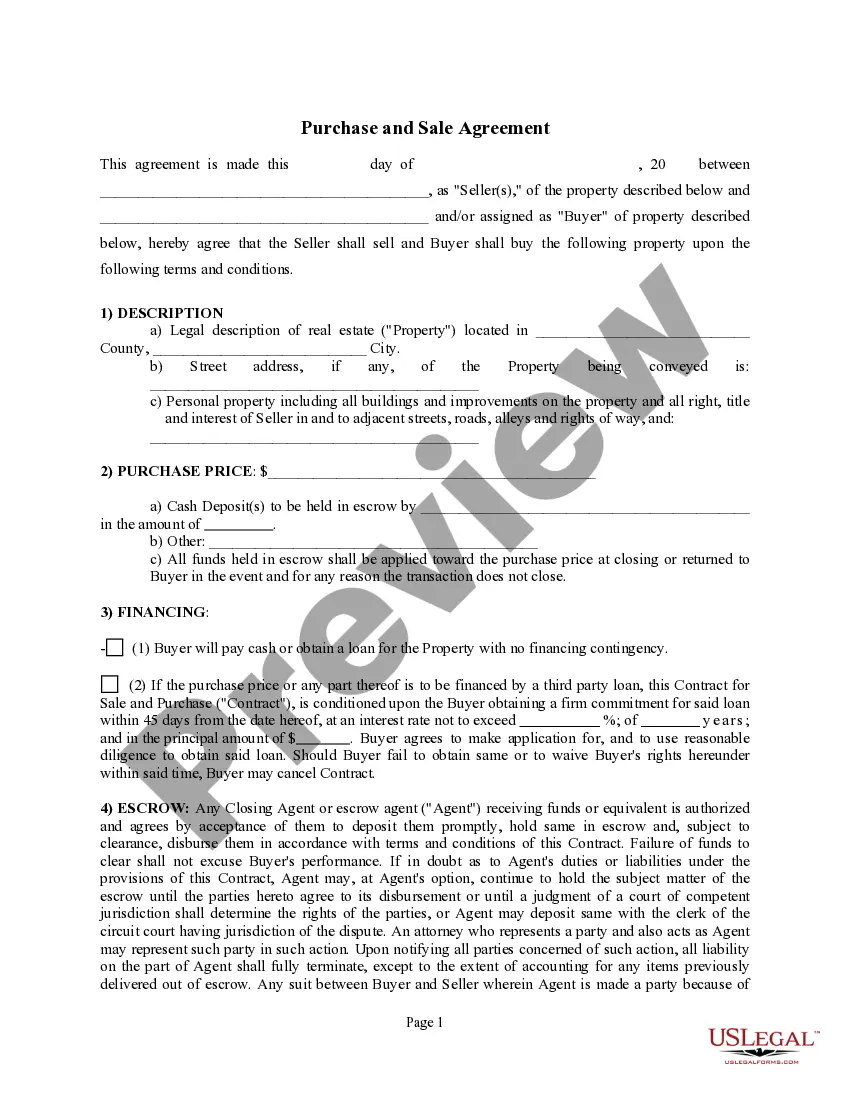

What Is a Purchase and Sales Agreement? Understand Its Importance

A Purchase and Sales Agreement, often referred to as a real estate sales contract, is a legally binding document that outlines the terms and conditions related to the purchase of a specific property. This document is crucial as it serves to formalize the transaction between the buyer and seller, detailing the agreed-upon price, payment schedule, and other essential provisions. Understanding this agreement is vital for both parties to ensure their rights and obligations are clearly defined, protecting them from potential disputes.

Key components of the form

A Purchase and Sales Agreement typically includes several key components:

- Property Description: A detailed description of the property being sold, including its legal description.

- Purchase Price: The total amount to be paid by the buyer for the property.

- Deposit: Information about the earnest money deposit, which shows the buyer's commitment.

- Closing Date: The date by which the transaction must be completed.

- Contingencies: Conditions that must be met for the sale to proceed, such as inspections or financing.

These components ensure both parties have a clear understanding of what to expect and the responsibilities they hold during the transaction.

Who should use this form

This form is typically used by individuals or entities looking to purchase real estate, whether it is residential property, commercial real estate, or land. Buyers should be well-informed about the property in question and should ideally seek legal advice before signing the agreement. Sellers, including private property owners and real estate agents, also utilize this form to ensure a legal framework for the sale of their property, safeguarding their interests and easing the transaction process.

Common mistakes to avoid when using this form

When completing a Purchase and Sales Agreement, it is essential to be mindful of potential pitfalls that could undermine the agreement:

- Incomplete Information: Failing to provide all necessary details regarding the property and transaction can lead to misunderstandings.

- Ignoring Contingencies: Not including or addressing contingencies can jeopardize the buyer's position if issues arise.

- Incorrect Dates: Misplacing closing dates or deadlines for contingencies can complicate the sale.

- Not Consulting a Professional: Individuals who do not seek advice from real estate professionals or legal experts may encounter legal issues later.

By avoiding these mistakes, both buyers and sellers can ensure a smoother transaction process.

What documents you may need alongside this one

When preparing a Purchase and Sales Agreement, various documents may be required to facilitate the transaction:

- Property Title: Proof of ownership and any liens or encumbrances affecting the property.

- Disclosure Statements: Required notices regarding the condition of the property and any known issues.

- Inspection Reports: Documents from property inspections that provide insight into the condition of the structure and its systems.

- Financing Documents: Information related to mortgage pre-approval or loan agreements when applicable.

- Identification: Government-issued identification for all parties involved in the transaction.

Gathering these documents can help streamline the purchasing process and support the terms outlined in the Purchase and Sales Agreement.

Legal use and context

A Purchase and Sales Agreement is a critical component in real estate transactions, functioning within a legal framework to protect all parties involved. The document serves as a tool to ensure transparency and set expectations, detailing each party's obligations and aiding in dispute resolution. It is essential for both buyers and sellers to understand the legal implications of this agreement, as it binds them to the terms outlined and can have repercussions if not adhered to. Consulting with legal professionals when drafting or signing this agreement can safeguard interests and ensure compliance with local laws.