Wyoming Certificate of Merger of Two Delaware Limited Partnerships

Description

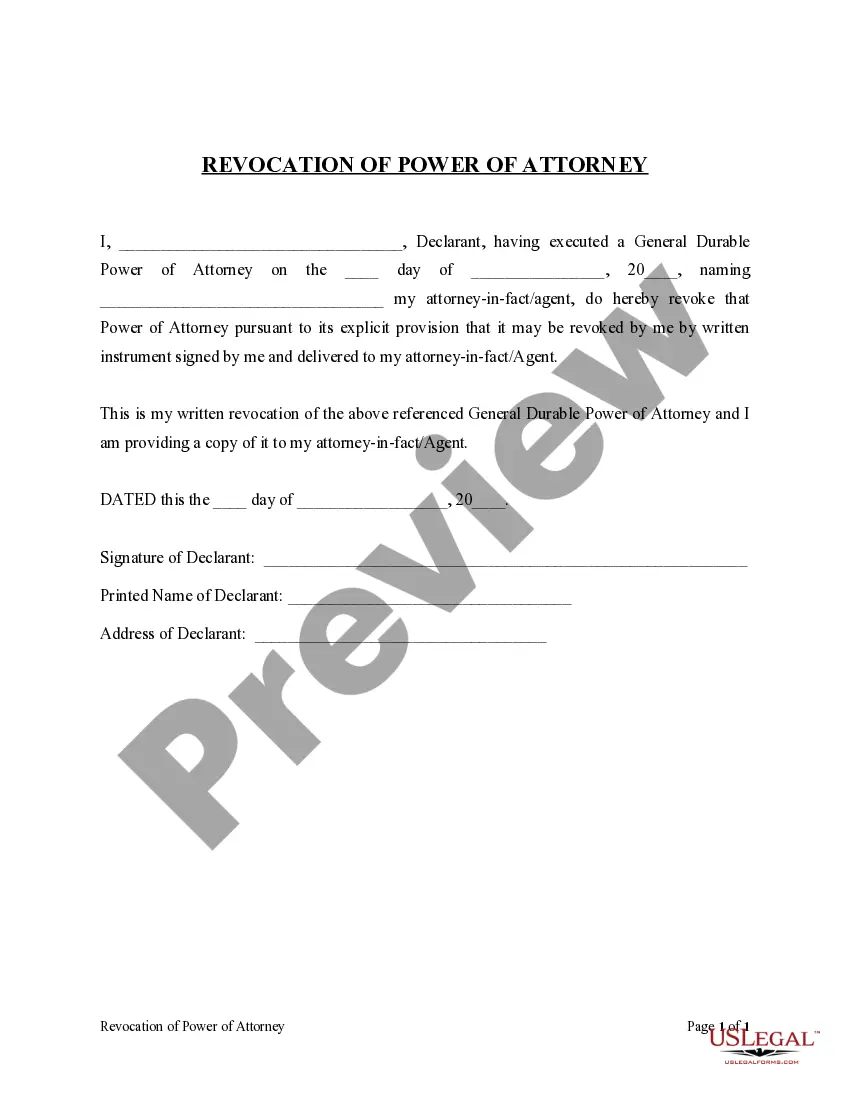

How to fill out Certificate Of Merger Of Two Delaware Limited Partnerships?

It is possible to commit several hours online looking for the authorized papers design that fits the state and federal specifications you need. US Legal Forms supplies 1000s of authorized varieties which can be reviewed by experts. It is possible to obtain or print out the Wyoming Certificate of Merger of Two Delaware Limited Partnerships from my services.

If you already have a US Legal Forms accounts, you are able to log in and click on the Acquire switch. Next, you are able to comprehensive, change, print out, or signal the Wyoming Certificate of Merger of Two Delaware Limited Partnerships. Every authorized papers design you acquire is your own for a long time. To obtain an additional copy of any acquired type, go to the My Forms tab and click on the related switch.

If you are using the US Legal Forms site for the first time, adhere to the simple directions beneath:

- First, make certain you have selected the correct papers design for that county/town of your liking. See the type information to ensure you have chosen the right type. If accessible, use the Review switch to appear from the papers design also.

- If you want to get an additional edition of the type, use the Search industry to discover the design that meets your requirements and specifications.

- Once you have identified the design you desire, just click Get now to move forward.

- Choose the rates prepare you desire, type in your references, and register for your account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal accounts to cover the authorized type.

- Choose the format of the papers and obtain it to your device.

- Make alterations to your papers if necessary. It is possible to comprehensive, change and signal and print out Wyoming Certificate of Merger of Two Delaware Limited Partnerships.

Acquire and print out 1000s of papers layouts making use of the US Legal Forms site, that offers the biggest assortment of authorized varieties. Use professional and status-certain layouts to tackle your organization or personal demands.

Form popularity

FAQ

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

Delaware LLC Formation Filing Fee: $110 The filing fee starts at $110, but if you want a certified copy of your Certificate of Formation, you'll need to pay another $50. You can pay an extra $50 and the state will process your documents within 24 hours of receiving them.

Delaware allows a domestic limited liability company to enter the conversion or merger. The process tends to be complex and requires applications to be filed with multiple government agencies. It costs $439 for a domestic entity, or $239 for a foreign entity, to file with the Delaware Department of State.

Basic Filing Fee for a Limited Liability Partnership For each additional Partner the Delaware filing is $200. Please contact us for a price quote. We check the availability of your chosen company name.

Formation Requirements A Delaware limited partnership can be formed by its partners entering into a limited partnership agreement and filing a separate certificate of limited partnership in the Office of the Delaware Secretary of State.

Section 18-217 allows a domestic Delaware limited liability company (LLC) to divide itself into two or more domestic LLCs and to allocate the assets and liabilities of the dividing LLC (the ?dividing company?) among itself (if the dividing company survives the division) and the newly formed LLCs (the ?resulting ...

The Certificate of Limited Partnership can be completed online as a PDF file and mailed to the Delaware Division of Corporations. Cost to Form an LP: The state of Delaware charges a filing fee of $200 to form a limited partnership.

(1) The dividing company shall be divided into the distinct and independent resulting companies named in the plan of division, and, if the dividing company is not a surviving company, the existence of the dividing company shall cease.

Such Divisive Merger statutes permit business entities to divide into multiple entities and to allocate liabilities and assets of the dividing entity amongst surviving entities.

All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.