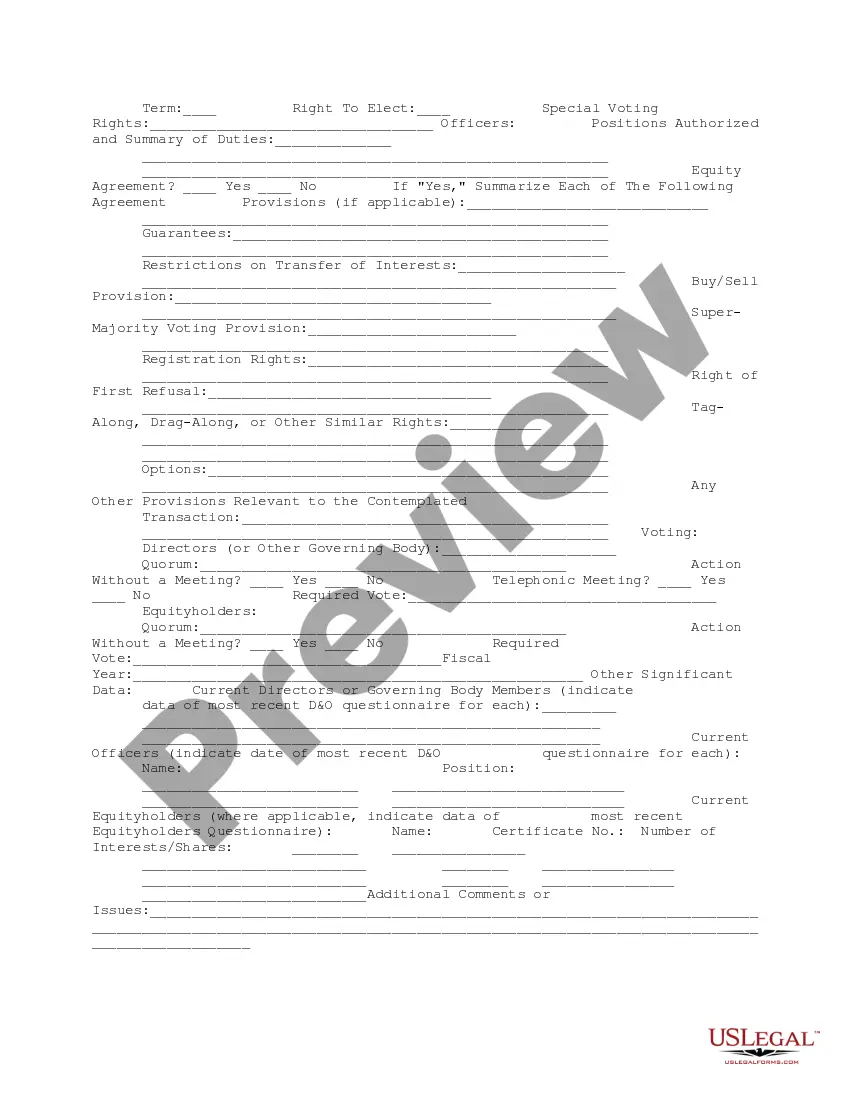

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Wyoming Company Data Summary

Description

How to fill out Company Data Summary?

You have the ability to invest hours online trying to locate the legal document template that meets the national and regional requirements you need.

US Legal Forms provides thousands of legal documents that have been evaluated by experts.

You can conveniently download or print the Wyoming Company Data Summary from our platform.

If available, utilize the Preview option to review the document template as well. If you wish to find another version of the document, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you desire, click on Acquire now to proceed. Select the pricing plan you wish, enter your credentials, and register for your account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make any necessary changes to your document. You can fill out, modify, and sign and print the Wyoming Company Data Summary. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Wyoming Company Data Summary.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased document, navigate to the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Review the document description to confirm you have chosen the correct form.

Form popularity

FAQ

Failing to file an annual report for your LLC can lead to severe repercussions, including penalties and the potential dissolution of your business. This not only disrupts operations but also affects the liability protections you depend on. Keeping your Wyoming Company Data Summary current is essential to avoid these pitfalls. Partnering with uslegalforms can help ensure your filings are managed effectively.

To file an annual report for your LLC in Wyoming, visit the Secretary of State’s website. You will need to provide key information about your business, including your current address and registered agent details. Using services like uslegalforms can simplify this process, ensuring that your Wyoming Company Data Summary is accurate and submitted on time.

If an LLC does not file its annual report, it may face penalties and fines. The state can move to dissolve the LLC, which will lead to the loss of liability protection and business operations. Maintaining accurate Wyoming Company Data Summary is crucial for compliance and avoiding such consequences. Ensuring timely filings helps sustain your business and its reputation.

To file a Wyoming LLC annual report, visit the Wyoming Secretary of State’s website and navigate to the business section. You will need to provide essential details about your company, including the Wyoming Company Data Summary, which outlines your LLC's status and key information. After completing the report, submit the required fees electronically. Keeping your annual report updated ensures compliance and helps maintain your company's good standing in Wyoming.

Yes, you can see who owns a Wyoming LLC by accessing public records maintained by the Wyoming Secretary of State. However, some ownership information may not be readily available due to privacy laws. If you need a detailed Wyoming Company Data Summary, consider using UsLegalForms, which can provide insights and professional assistance regarding ownership details.

Yes, Wyoming does have an annual report requirement for most businesses. This report helps maintain transparency and ensures your business complies with state regulations. It contains important details about your company, and submitting it on time is crucial for good standing. UsLegalForms can assist you in preparing your annual report efficiently.

To look up a business in Wyoming, you can use the Wyoming Secretary of State's online business entity database. This resource allows you to search by name or business ID, providing access to essential company information. If you require a thorough analysis or summary, including a Wyoming Company Data Summary, UsLegalForms offers tools to streamline your research.

Several states do not require annual reports, allowing business owners more flexibility. Among these states are Delaware, New Hampshire, and Nevada. Each state has its unique regulations related to company data, which can affect your decision on where to form your business. If you need clarity, UsLegalForms provides comprehensive insights into state-specific reporting requirements.

Yes, Wyoming requires LLCs to file an annual report. This annual report is essential for maintaining your company's good standing. It includes crucial information, such as your business's address and member details. For your convenience, UsLegalForms can help you prepare and submit this report accurately.

To obtain articles of incorporation in Wyoming, you can visit the Wyoming Secretary of State's website. The website offers an online application process that is both easy to navigate and efficient. You will need to provide specific information about your company, such as the name, address, and purpose. Using a service like UsLegalForms can simplify this process, guiding you step-by-step.