Wyoming Industrial Revenue Development Bond Workform

Description

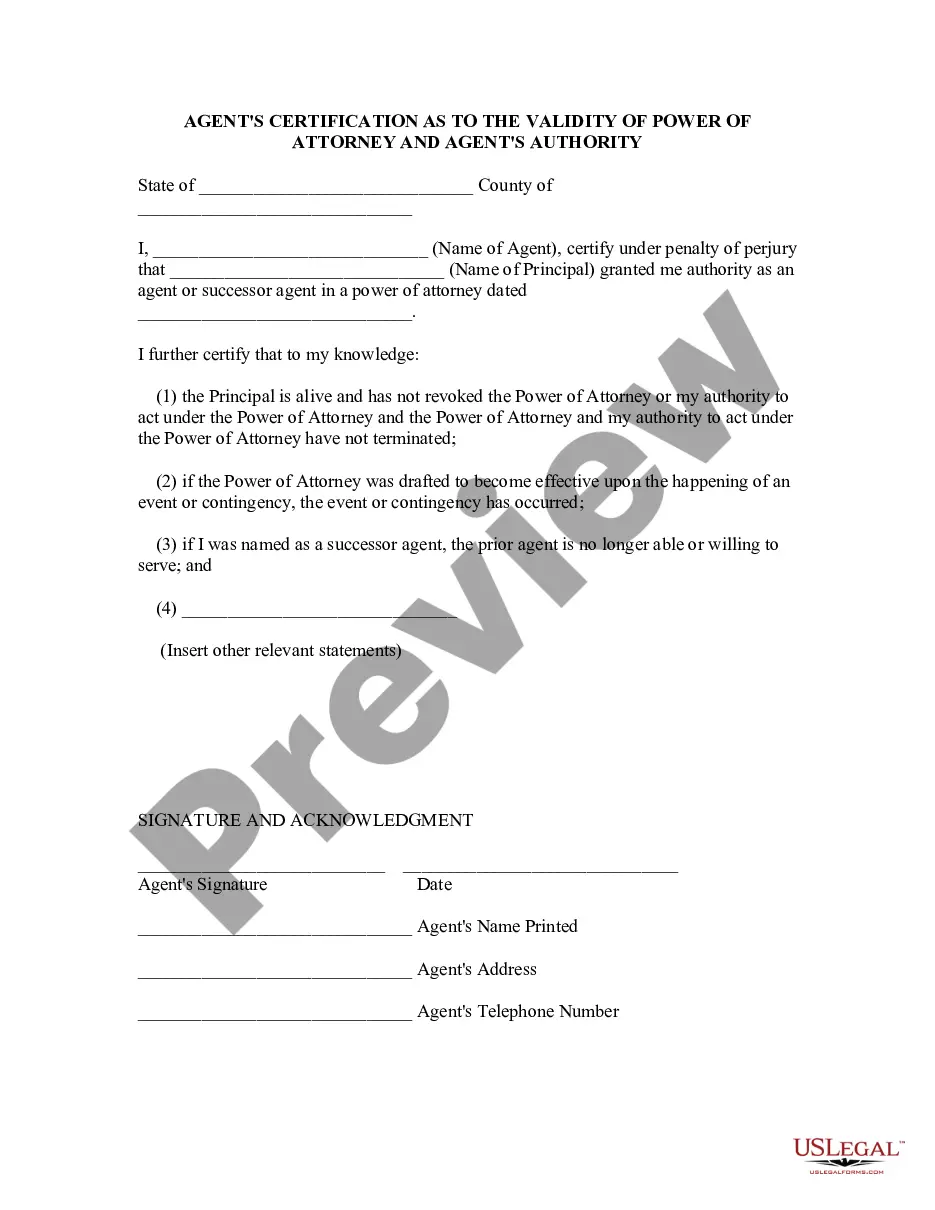

How to fill out Industrial Revenue Development Bond Workform?

US Legal Forms - one of the most significant libraries of lawful forms in the United States - gives a wide array of lawful file web templates it is possible to obtain or produce. Making use of the site, you may get thousands of forms for organization and personal uses, categorized by categories, states, or keywords and phrases.You can find the most up-to-date versions of forms just like the Wyoming Industrial Revenue Development Bond Workform in seconds.

If you currently have a registration, log in and obtain Wyoming Industrial Revenue Development Bond Workform in the US Legal Forms local library. The Down load button will appear on every develop you look at. You have accessibility to all in the past downloaded forms inside the My Forms tab of the profile.

In order to use US Legal Forms the first time, listed here are simple recommendations to help you started out:

- Be sure you have picked out the right develop for your city/region. Go through the Review button to analyze the form`s articles. Look at the develop outline to ensure that you have chosen the right develop.

- If the develop does not match your specifications, use the Research discipline towards the top of the screen to discover the one who does.

- If you are content with the shape, verify your selection by visiting the Acquire now button. Then, opt for the prices strategy you favor and give your qualifications to register on an profile.

- Method the deal. Use your Visa or Mastercard or PayPal profile to complete the deal.

- Choose the file format and obtain the shape on the system.

- Make alterations. Load, edit and produce and sign the downloaded Wyoming Industrial Revenue Development Bond Workform.

Every single web template you included with your account lacks an expiration day which is yours permanently. So, in order to obtain or produce an additional copy, just go to the My Forms segment and click on on the develop you need.

Get access to the Wyoming Industrial Revenue Development Bond Workform with US Legal Forms, the most considerable local library of lawful file web templates. Use thousands of specialist and status-distinct web templates that fulfill your business or personal requirements and specifications.

Form popularity

FAQ

Flow of Funds is a schedule of expenses and interested parties that prioritizes how payments will be made from the revenue generated by a facility financed by a municipal revenue bond.

These bonds provide long-term financing for utilities and offer several advantages, including tax-exempt status, lower interest rates, and stable cash flows. However, they also have some disadvantages, including a higher cost of issuance, a limited revenue stream, and the risk of default.

Most bonds issued by government agencies are tax-exempt. This means interest on these bonds are excluded from gross income for federal tax purposes. In addition, interest on the bonds is exempt from State of California personal income taxes.

AA RATED MUNI BONDS issuematurity rangetodaynational10 year2.90national20 year3.80national30 year4.15

The principal difference between municipal bonds and Treasury bonds, aside from the credit considerations, is that municipal bonds are tax-exempt, that is interest is exempt from federal income taxation.

A bond, issued by a state or local government, the interest on which is exempt from taxation.

Industrial revenue bonds (IRB) are municipal debt securities issued by a government agency on behalf of a private sector company and intended to build or acquire factories or other heavy equipment and tools. IRBs were formerly called Industrial Development Bonds (IDB).

Transportation revenue bonds: Transportation revenue bonds are issued to finance local public transportation projects, such as buses, subway systems, toll roads and airport systems. The bonds are repaid through the revenue earned by the transportation system.

When municipalities do borrow long-term, they generally issue debentures, a bond secured by the assets of the municipal corporation. In Canada, interest paid on those debentures is taxable income.

General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source, such as income from a toll road or sewer system.