Wyoming Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

Are you in a circumstance where you require documentation for both business or personal purposes almost every workday.

There is a wide array of legal document templates available online, but obtaining forms you can trust is not easy.

US Legal Forms offers numerous template options, including the Wyoming Hourly Employee Evaluation, that are designed to comply with federal and state regulations.

Choose a suitable file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can acquire another copy of the Wyoming Hourly Employee Evaluation anytime you require it. Simply navigate to the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wyoming Hourly Employee Evaluation template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/area.

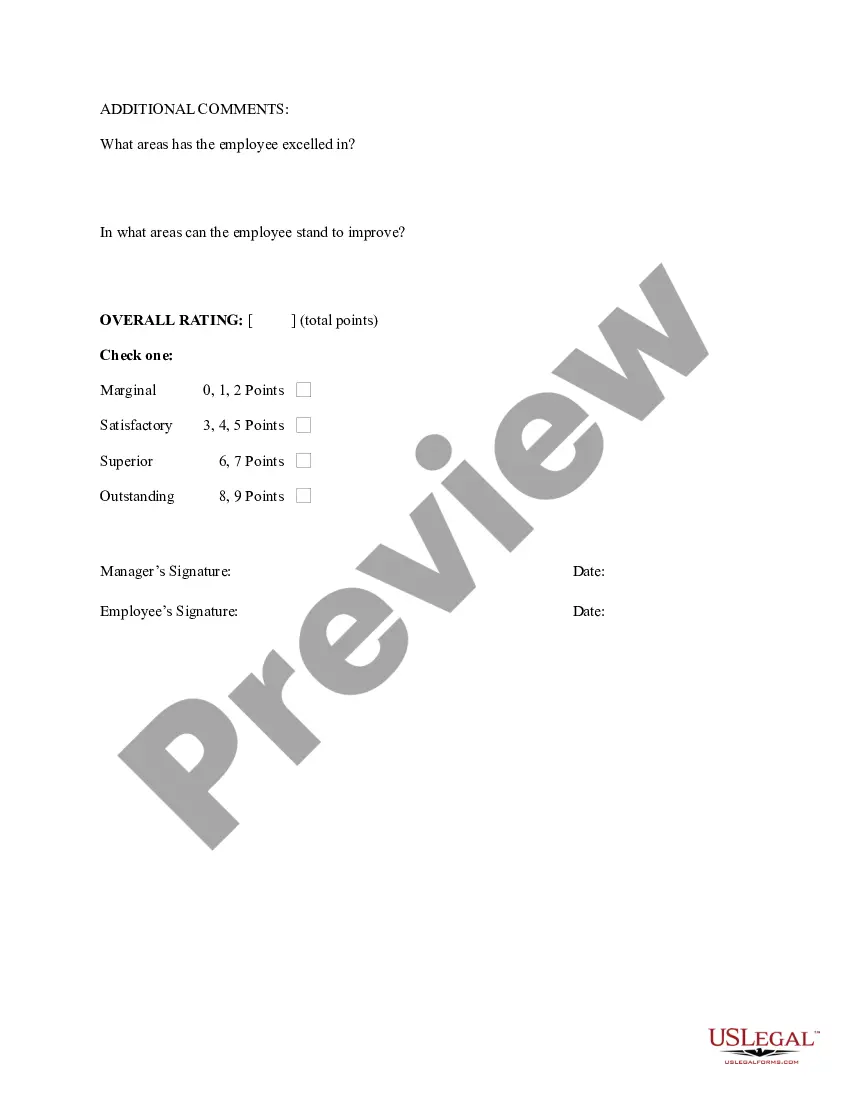

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Select the pricing plan you desire, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

Form popularity

FAQ

When determining just exactly what a budget should be for a job opening, consider this list of steps to help determine the salary:Evaluate the position.Perform wage research.Determine the minimum and maximum.Align with the human resources strategy.Define the work culture.Choose a payment method.Add benefits.More items...?

Your hourly rate is the amount of money that you receive for each hour you spend working. As an hourly employee, you should get paid for all of the hours that you work. If an employer wants more of your time, they'll have to pay you more.

Hourly: An individual who receives an hourly wage for work performed. Generally, such individuals, because of the method of payment, are classified as nonexempt and are subject to the overtime provisions of the FLSA.

This amendment to the FLSA makes it clear that tips belong to workers and no one else, says Patricia Smith, senior counsel at the National Employment Law Project (NELP) and former Obama administration solicitor of labor. Employers including managers and supervisors can never keep tips.

Under federal and Wyoming law, tips belong to the employee. An employer can never take employee tips and keep them for itself. However, an employer may be allowed to take a tip credit to count part of the tips an employee earns towards the employer's obligation to pay the minimum wage.

What is an Hourly Employee? An hourly employee is paid based on an hourly amount. Hourly employees don't have a contract under most circumstances, and they are only paid for the hours they work. The employer determines the hours for an hourly employee each week.

Eight Factors That Can Affect Your PayYears of experience. Typically, more experience results in higher pay up to a point.Education.Performance reviews.Boss.Number of reports.Professional associations and certifications.Shift differentials.Hazardous working conditions.

Managers and owners have no right to tips. The Department of Labor is firm that management has absolutely no right to take a cut of the waitstaff's tips. So, even if your manager takes a table here and there during the dinner rush, the law firmly denies them a percentage of the tips.

5 essential factors for determining compensationYears of experience and education level. It probably goes without saying, but the more experience and education a candidate has, the higher their expected compensation.Industry.Location.In-demand skill sets.Supply and demand.

In most organizations, salaries are determined by mapping roles and job descriptions with similar organizations (competitors) through a third-party compensation and benchmarking service.