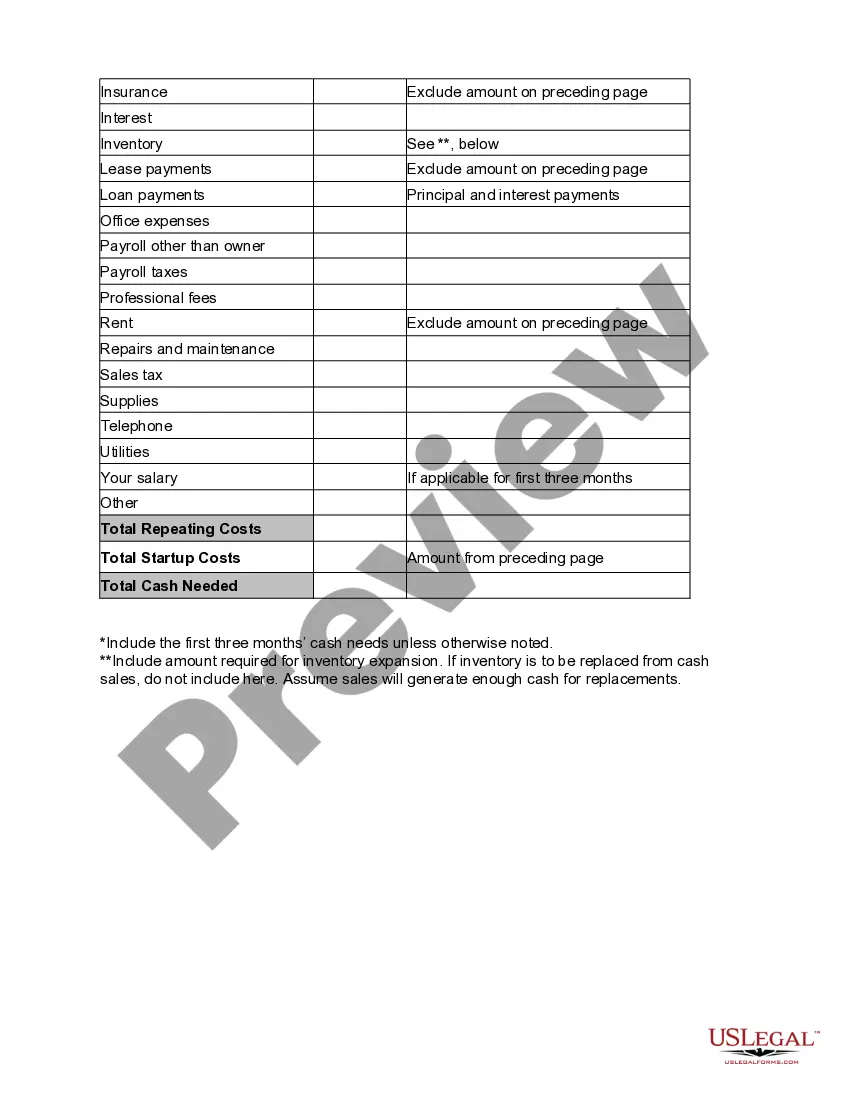

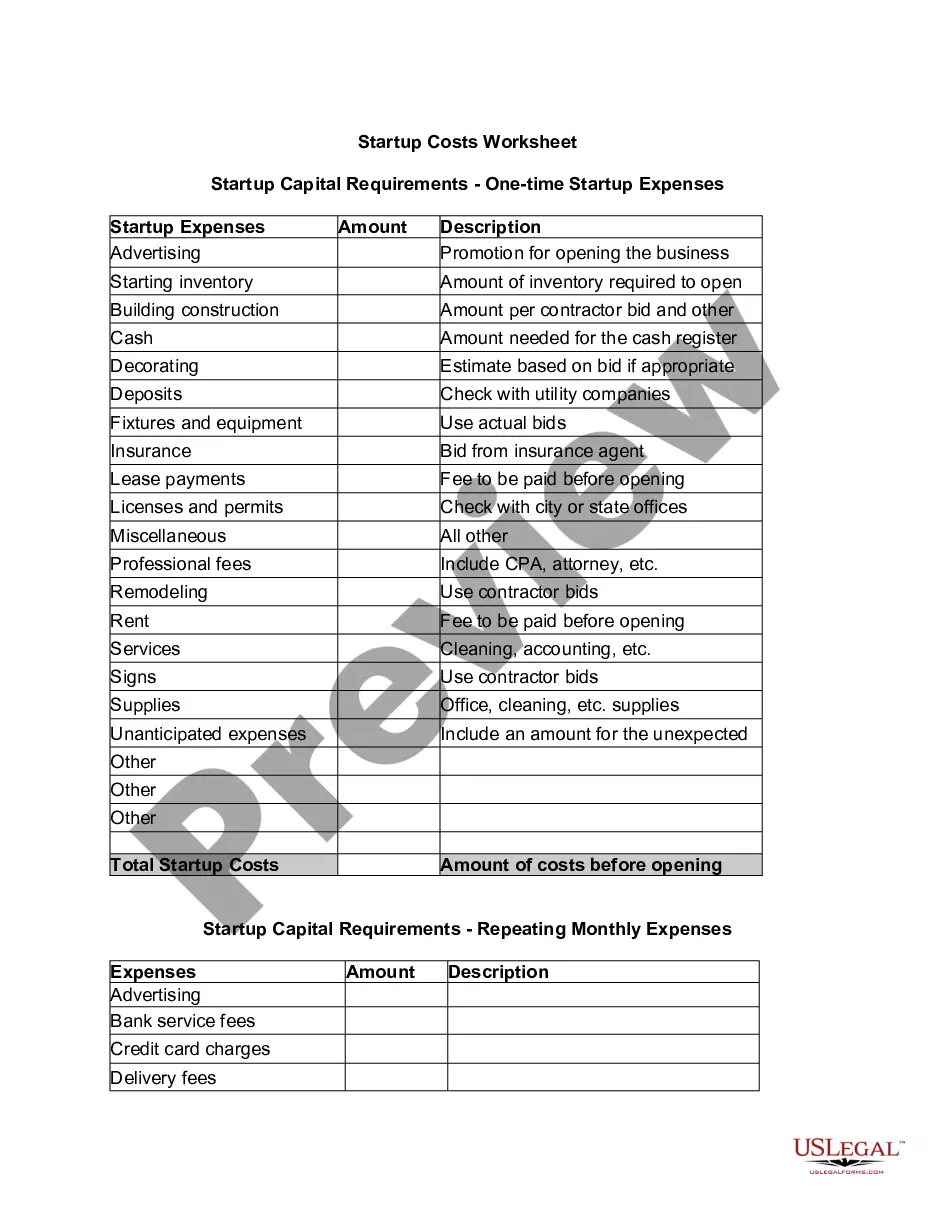

Wyoming Startup Costs Worksheet

Description

How to fill out Startup Costs Worksheet?

Selecting the appropriate legal document template can be challenging.

Clearly, there are numerous designs available on the internet, but how do you acquire the legal form you need.

Utilize the US Legal Forms website. The platform provides an extensive array of templates, including the Wyoming Startup Costs Worksheet, applicable for both business and personal use.

If the form does not meet your requirements, utilize the Search field to find the correct form.

- All documents are verified by experts and comply with state and federal regulations.

- If you are already a member, Log In to your profile and click on the Download button to retrieve the Wyoming Startup Costs Worksheet.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents section of your profile and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, verify that you have selected the correct form for your city/state. You can browse the form using the Preview button and review the form description to ensure it meets your needs.

Form popularity

FAQ

Startup costs do not include costs for interest, taxes, and research and experimentation (Sec. 195(c)(1)).

Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology. Post-opening startup costs include advertising, promotion, and employee expenses.

Compute your total startup capital. Add up capital needed prior to launch and the capital required to fund the cash deficit. This is your total startup capital.

How to calculate startup costsIdentify your expenses. Start by writing down the startup costs you've already incurred but don't stop there.Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category.Do the math.Add a cushion.Put the numbers to work.

Startup costs will include equipment, incorporation fees, insurance, taxes, and payroll. Although startup costs will vary by your business type and industry an expense for one company may not apply to another.

How to calculate startup costsIdentify your expenses. Start by writing down the startup costs you've already incurred but don't stop there.Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category.Do the math.Add a cushion.Put the numbers to work.

Start-up costs are amounts the business paid or incurred for creating an active trade or business, or investigating the creation or acquisition of an active trade or business.

Start-up costs can be capitalized and amortized if they meet both of the following tests: You could deduct the costs if you paid or incurred them to operate an existing active trade or business (in the same field), and; You pay or incur the costs before the day your active trade or business begins.

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.