Wyoming Return Authorization Form

Description

How to fill out Return Authorization Form?

You can dedicate several hours online searching for the legal document template that meets both state and federal requirements you need.

US Legal Forms offers a vast collection of legal documents that have been reviewed by experts.

It's straightforward to obtain or print the Wyoming Return Authorization Form from your services.

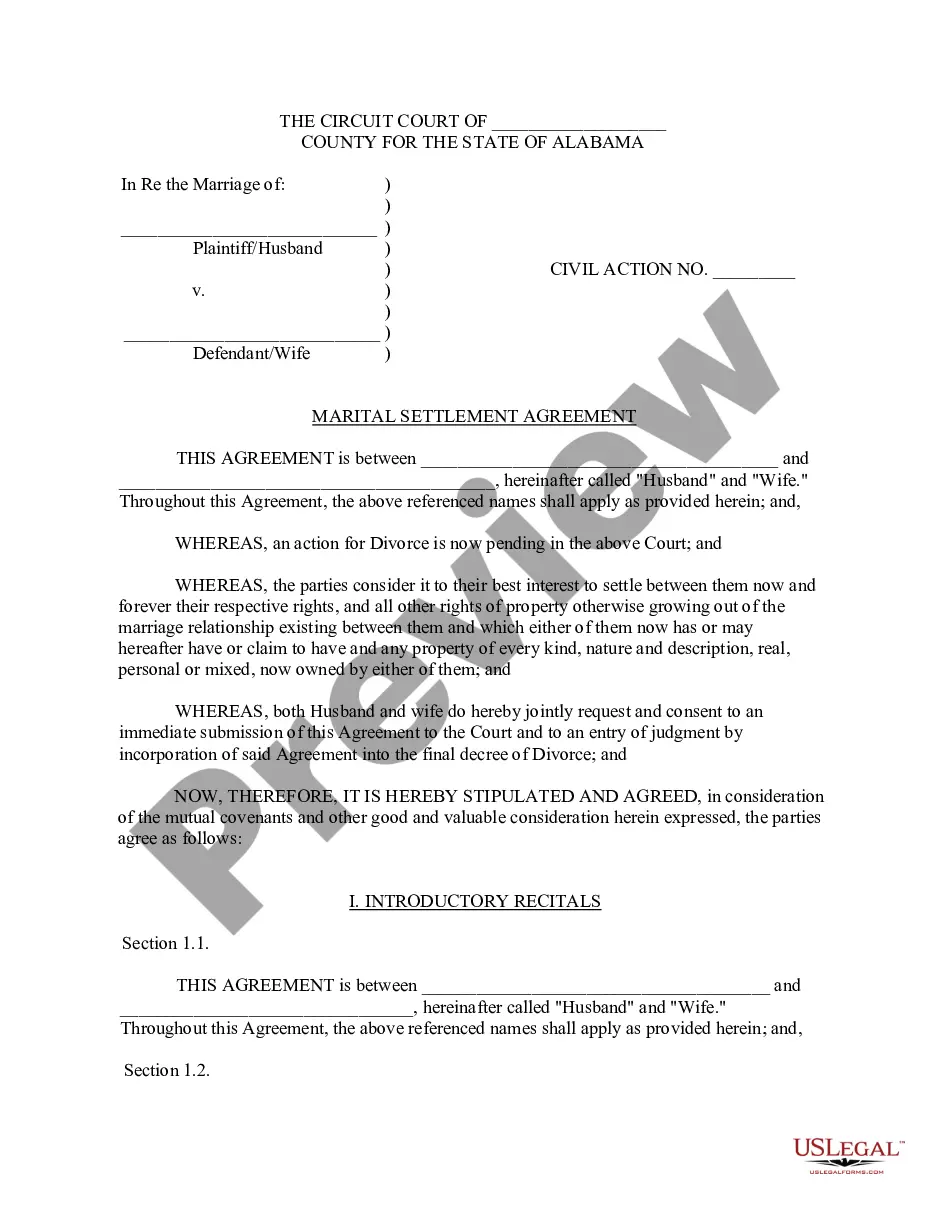

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and press the Download button.

- After that, you can complete, edit, print, or sign the Wyoming Return Authorization Form.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city you choose.

- Review the form outline to confirm you have selected the right form.

Form popularity

FAQ

To obtain an apostille in Wyoming, you need to prepare your documents and ensure they meet the state's requirements. Start by gathering the necessary paperwork, such as your Wyoming Return Authorization Form, which you may need for specific transactions. After collecting your documents, submit them to the Wyoming Secretary of State's office, along with the appropriate fees. This process ensures that your documents receive recognition outside the United States, making it easier for you to do business internationally.

To file an Annual Report in Wyoming, visit the Wyoming Secretary of State's website. You can complete the process online, ensuring that all your company details are up to date. Filing your Annual Report is essential for maintaining good standing and compliance. Consider using a Wyoming Return Authorization Form for efficient tracking of your filing status.

Certainly, forming an LLC in Wyoming without being a resident is entirely feasible. The state welcomes entrepreneurs from all over, offering a straightforward process for registration. By completing the Wyoming Return Authorization Form, you can establish your LLC with ease and enjoy the benefits of Wyoming’s favorable business environment.

Yes, your LLC must have a physical address in Wyoming for registration purposes. This address will be part of your official business records and is essential for receiving legal documents. If you don't have a local address, you can use a registered agent service, making the Wyoming Return Authorization Form a suitable tool for your needs.

Filing a Wyoming tax return depends on your business structure and income. LLCs in Wyoming generally do not face state income tax, but you must comply with federal tax requirements. To navigate any tax obligations, consider using the Wyoming Return Authorization Form for guidance.

Yes, you can open an LLC in Wyoming even if you do not reside in the state. Wyoming's business-friendly laws allow non-residents to form an LLC easily. By utilizing the Wyoming Return Authorization Form, you can manage your business regardless of your location.

In Wyoming, a DBA, or Doing Business As, is not mandatory for every business. However, if you wish to operate under a name that differs from your registered LLC or corporation name, you will need to file for a DBA. Completing this process through the Wyoming Return Authorization Form can ensure you establish your business identity effectively.

No, Wyoming does not impose a state income tax, so you do not need to file a state tax return. This tax-friendly environment makes Wyoming a popular choice for LLC formation. By using the Wyoming Return Authorization Form, you can set up your business without the burden of state income taxes.

In most cases, a Wyoming LLC does not need to file a state income tax return. However, it's important to check if you need to file federal returns or other documents. Utilizing the Wyoming Return Authorization Form streamlines the necessary processes, ensuring you remain compliant while focusing on your business.

Approval for an LLC in Wyoming can take around 2 to 5 business days. This timeframe includes processing the Wyoming Return Authorization Form by the state office. Swift approval enables businesses to operate quickly and efficiently.