Wyoming Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

Are you currently within a placement the place you need to have paperwork for possibly business or individual reasons nearly every time? There are tons of lawful file web templates available online, but discovering kinds you can depend on is not simple. US Legal Forms gives a huge number of kind web templates, just like the Wyoming Small Business Administration Loan Application Form and Checklist, which are written to satisfy federal and state needs.

In case you are previously informed about US Legal Forms web site and also have an account, simply log in. Following that, you may down load the Wyoming Small Business Administration Loan Application Form and Checklist format.

If you do not offer an bank account and would like to start using US Legal Forms, abide by these steps:

- Discover the kind you need and ensure it is to the proper city/county.

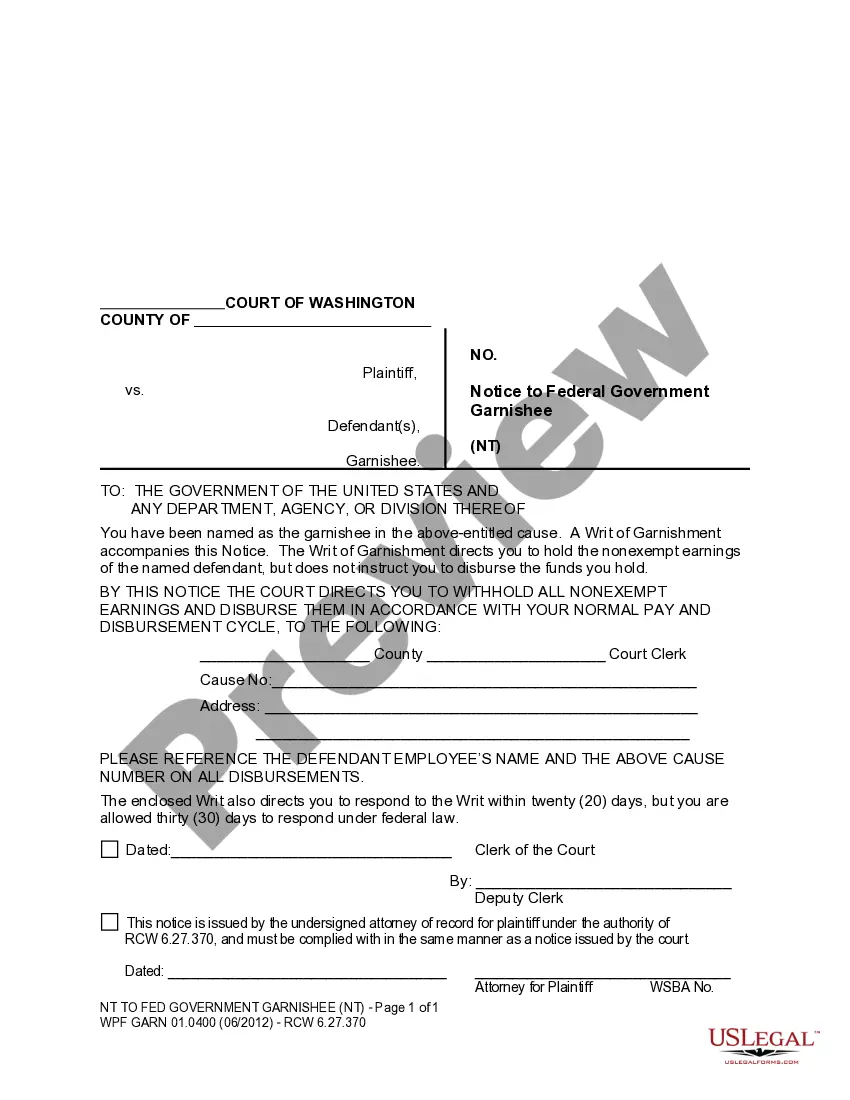

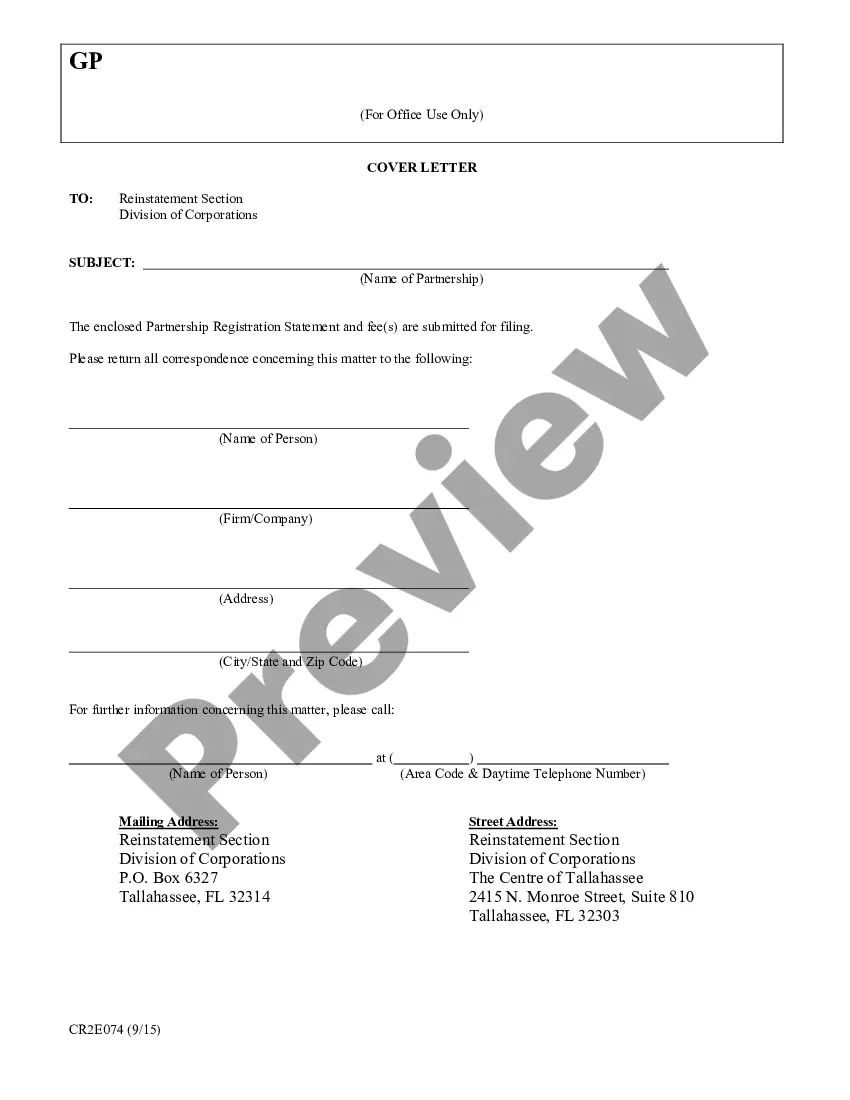

- Take advantage of the Preview option to analyze the shape.

- See the information to ensure that you have selected the correct kind.

- In the event the kind is not what you are searching for, make use of the Lookup industry to get the kind that meets your needs and needs.

- Once you get the proper kind, simply click Purchase now.

- Opt for the prices strategy you want, fill out the desired information to create your bank account, and purchase an order using your PayPal or bank card.

- Choose a practical data file formatting and down load your version.

Locate each of the file web templates you might have bought in the My Forms menu. You may get a more version of Wyoming Small Business Administration Loan Application Form and Checklist anytime, if required. Just click on the required kind to down load or print out the file format.

Use US Legal Forms, by far the most comprehensive collection of lawful forms, to save lots of efforts and prevent faults. The service gives expertly manufactured lawful file web templates that can be used for a range of reasons. Generate an account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose.

Although loan requirements will vary from lender to lender, here are some important documents to prepare when applying for a small business loan. Credit report. ... Bank statements. ... Income statement. ... Budget. ... Business plan. ... Income tax returns.

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

In most cases, SBA loans require at least one owner or stakeholder to sign an unlimited personal guarantee on their loan. However, lenders may ask that other individuals involved in the company's ownership or who have an important say in the business's operations sign a personal guarantee as well.

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.