US Legal Forms - one of the most significant libraries of lawful forms in the States - provides a wide range of lawful file web templates it is possible to down load or printing. Making use of the internet site, you will get a huge number of forms for business and person functions, categorized by classes, suggests, or keywords and phrases.You will find the most up-to-date versions of forms like the Wyoming Notice to Buyer Objecting to Confirmation of Sale made by Buyer and Denying the Existence of an Agreement in seconds.

If you already have a monthly subscription, log in and down load Wyoming Notice to Buyer Objecting to Confirmation of Sale made by Buyer and Denying the Existence of an Agreement in the US Legal Forms collection. The Download key will appear on each form you perspective. You have accessibility to all previously downloaded forms in the My Forms tab of your profile.

In order to use US Legal Forms the first time, listed here are straightforward directions to obtain began:

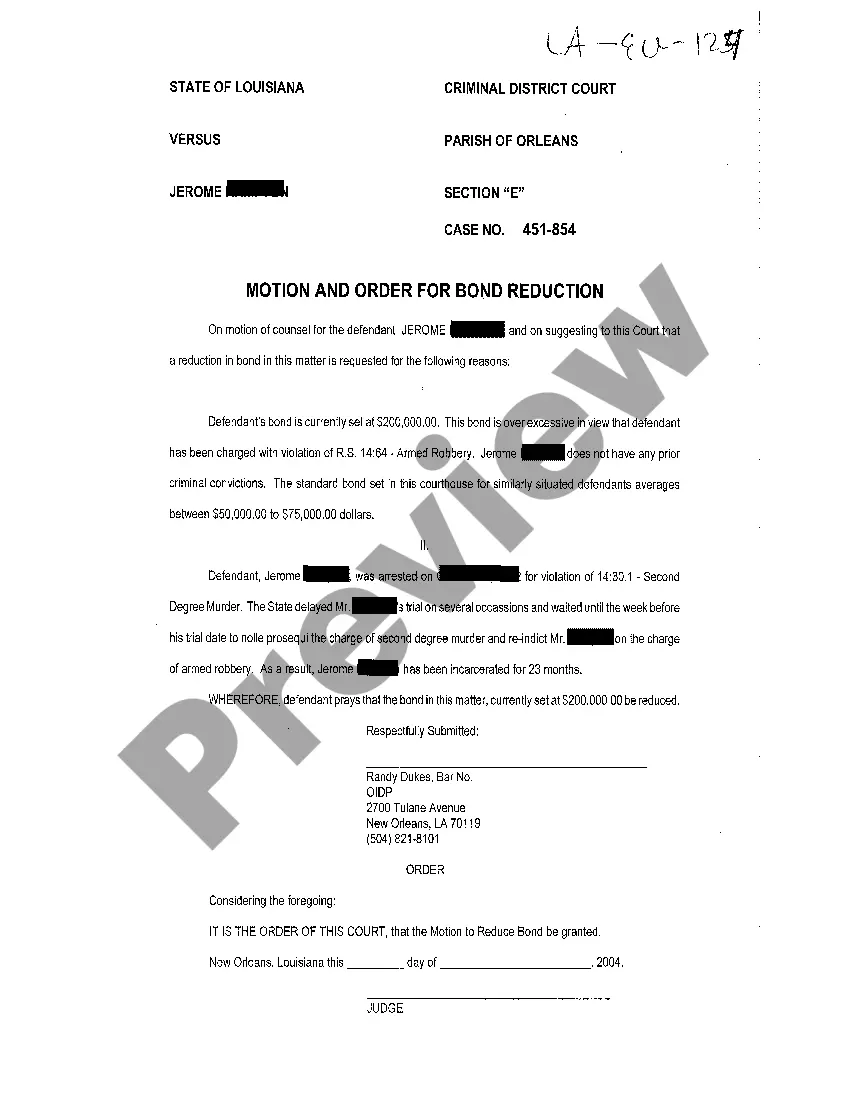

- Be sure you have selected the right form to your town/county. Click the Review key to check the form`s articles. See the form explanation to ensure that you have chosen the appropriate form.

- When the form doesn`t match your demands, use the Look for area at the top of the display to obtain the one who does.

- In case you are pleased with the shape, verify your option by visiting the Purchase now key. Then, choose the prices program you like and offer your qualifications to sign up on an profile.

- Approach the financial transaction. Utilize your credit card or PayPal profile to perform the financial transaction.

- Choose the formatting and down load the shape on your own gadget.

- Make alterations. Complete, revise and printing and indication the downloaded Wyoming Notice to Buyer Objecting to Confirmation of Sale made by Buyer and Denying the Existence of an Agreement.

Each and every format you put into your bank account lacks an expiry particular date which is your own permanently. So, if you would like down load or printing another backup, just check out the My Forms area and click on about the form you need.

Get access to the Wyoming Notice to Buyer Objecting to Confirmation of Sale made by Buyer and Denying the Existence of an Agreement with US Legal Forms, probably the most comprehensive collection of lawful file web templates. Use a huge number of skilled and express-certain web templates that meet up with your company or person needs and demands.