Wyoming Sample Letter for Tax Deeds

Description

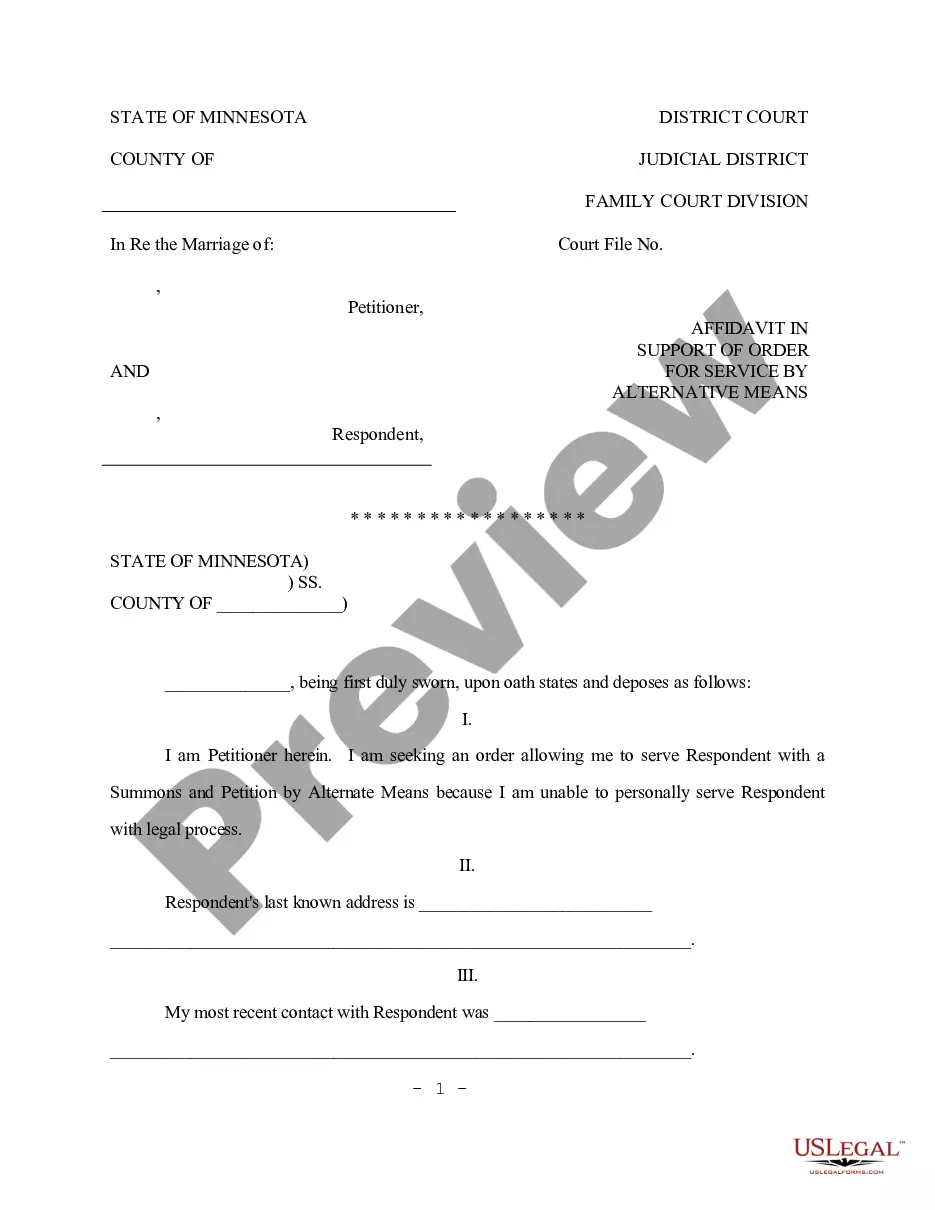

How to fill out Sample Letter For Tax Deeds?

Selecting the optimal licensed document template can be challenging. Clearly, there are numerous designs accessible online, but how can you obtain the licensed form you need? Visit the US Legal Forms website. The platform offers a vast selection of templates, including the Wyoming Sample Letter for Tax Deeds, suitable for business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already a member, sign in to your account and click on the Download button to obtain the Wyoming Sample Letter for Tax Deeds. Use your account to browse through the legal documents you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can preview the form using the Preview button and review the form summary to confirm that this is indeed suitable for you. If the form does not fulfill your needs, use the Search field to find the appropriate form. When you are confident the form is suitable, click the Download now button to acquire it. Choose the payment plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, edit, print, and sign the obtained Wyoming Sample Letter for Tax Deeds.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Utilize the platform to obtain professionally crafted documents that comply with state requirements.

- You can browse through a wide range of templates for different legal needs.

- The service ensures that all forms are vetted for accuracy and compliance.

- Access your account to manage your purchased documents easily.

- Follow straightforward steps to ensure you get the correct form for your specific situation.

Form popularity

FAQ

Property tax rates in Wyoming are dependent on the budget requests of local taxing entities. A county, city or school district will submit its budget request, which be divided by the total assessed value in that district to calculate the tax rate. The rate on a given home is the sum of all applicable rates.

Tax lien purchases can be made in person or by mail. If two tax payments for lien purchases arrive the same day in the mail; the one with the earliest postage date will be chosen. If postmarked the same day, we will put several numbers in a cup and have a random employee draw.

WHAT IS A CERTIFICATE OF PURCHASE? A Certificate of Purchase entitles the holder to a lien on the property. Following completion of the sale the County Treasurer, upon payment of the fee, will post the payment and a Certificate of Purchase will be given to CP Holder.

States With the Lowest Property Taxes in 2023 Hawaii. Hawaii has the lowest property tax rate in the U.S. at 0.27%. ... Alabama. Alabama is generally one of the more affordable states in the country. ... Nevada. ... Colorado. ... Idaho. ... Arizona. ... Utah. ... South Carolina.

There is no mortgage tax in Wyoming.

The following shall apply: (i) Taxes upon real property are a perpetual lien thereon against all persons excluding the United States and the state of Wyoming. Taxes upon personal property are a lien upon all real property owned by the person against whom the tax was assessed subject to all prior existing valid liens.

The Treasurer's office holds a tax lien sale every year in July. Any unpaid taxes are sold to the public, lottery style. The buyer then receives a Certificate of Purchase (CP) and then holds a tax lien on the property. They will hold that tax lien until such time as the property owner pays the taxes.