Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out Commercial Partnership Agreement In The Form Of A Bill Of Sale?

Have you ever found yourself in a circumstance where you need documents for business or specific reasons almost every day.

There are numerous document templates available online, but locating those you can trust is challenging.

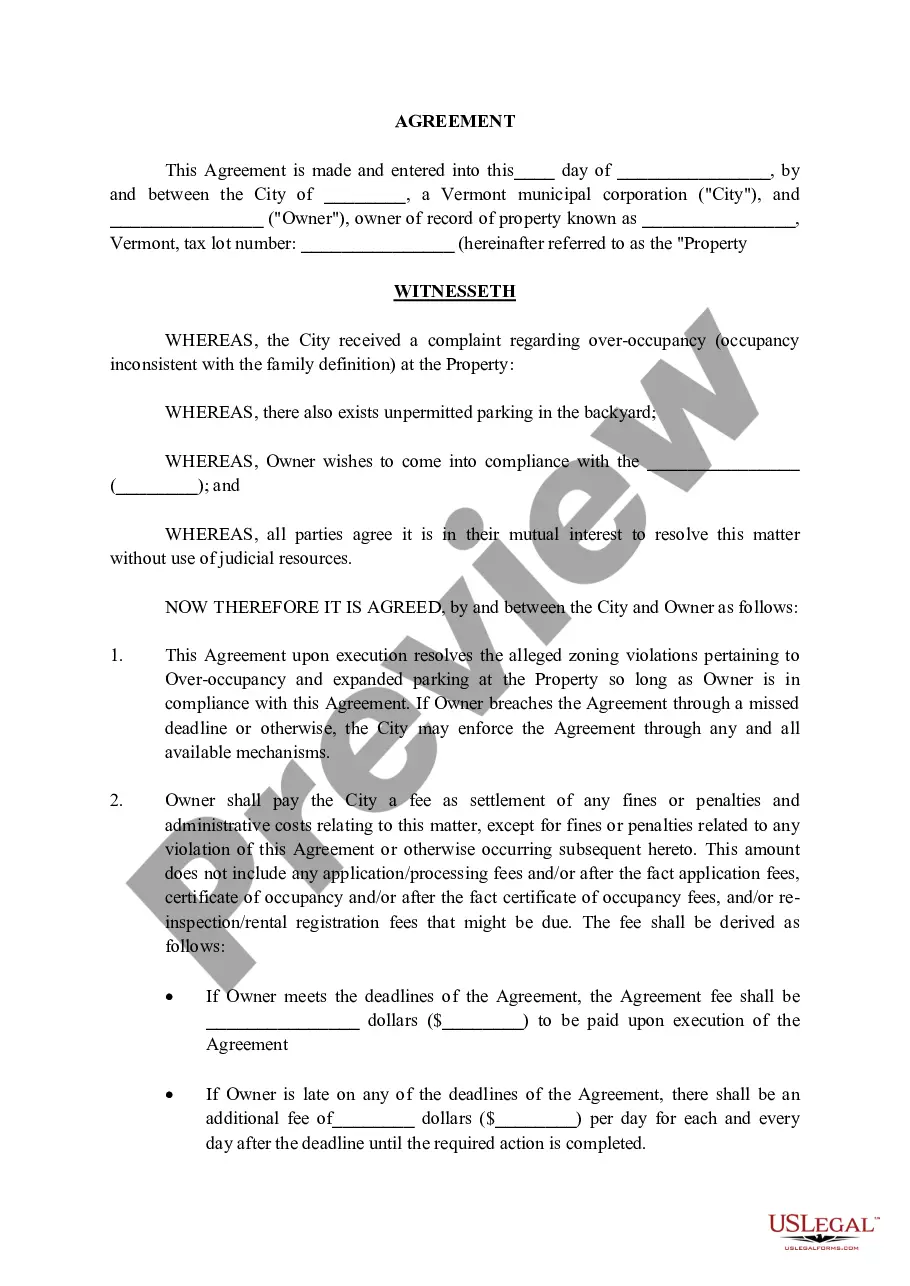

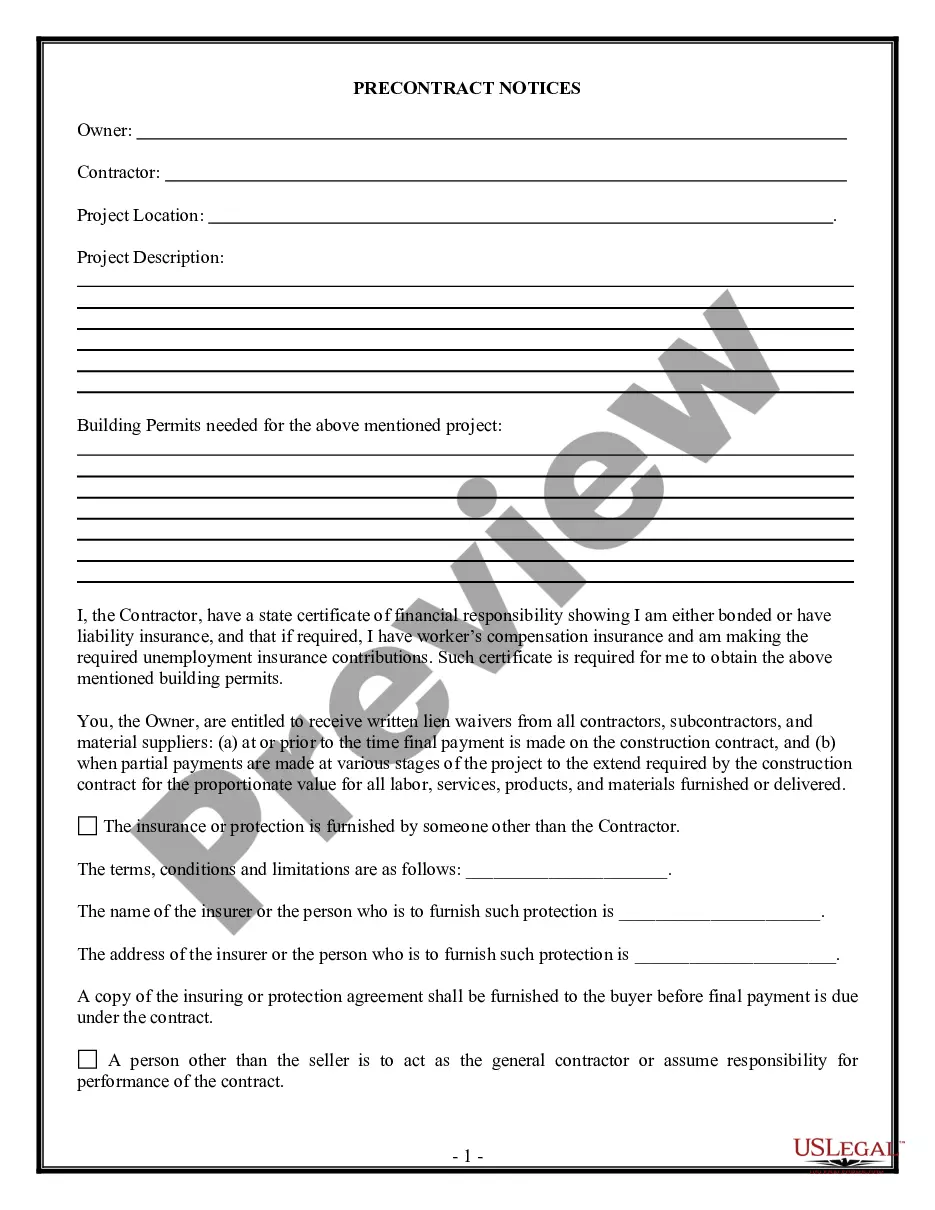

US Legal Forms offers a wide array of form templates, including the Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, designed to comply with state and federal guidelines.

Once you locate the correct form, just click Get now.

Select the payment plan you desire, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview option to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

Wyoming does not require an operating agreement for a business, but having one is highly recommended. An operating agreement helps clarify the management structure and operational procedures of a company, promoting transparency and preventing conflicts. For businesses formed through a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, a detailed operating agreement can enhance legal and operational clarity.

A Wyoming bill of sale does not need to be notarized to be valid; however, it can be beneficial. Notarization verifies the identities of the parties and provides a public record of the transaction. If you are using a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, consider notarizing it for added security and authenticity.

In Wyoming, notarization is not strictly required for a bill of sale. However, having your bill of sale notarized adds an extra layer of authenticity, especially for a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale. It helps provide proof of the transaction and can facilitate ease if you decide to register your vehicle or document the sale for other legal reasons.

Wyoming does not impose a partnership tax return like many other states do. Instead, partnerships in Wyoming report their income, losses, and deductions on the individual partners' tax returns. This feature enhances Wyoming's appeal as a location for businesses. When creating a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, understanding this tax structure is crucial for accurate financial planning.

A commercial partnership agreement is a legal document that defines the relationship between business partners. It outlines the terms of the partnership, including contributions, profit distribution, and management roles. This agreement is essential for protecting the interests of all parties involved and ensuring business operations are efficient. A Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale can serve as an excellent basis for this document.

Yes, Wyoming recognizes domestic partnerships, providing legal standing to these relationships. Domestic partnerships in Wyoming have similar rights and protections as marriages, although certain legal distinctions remain. If you are forming a commercial enterprise with a domestic partner, consider a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale for clarity and security.

Wyoming does not have a franchise tax, making it an attractive option for businesses. This absence of franchise tax means that partnerships can focus more on their operations instead of additional tax burdens. When drafting a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, this tax advantage can be a significant benefit to highlight.

Writing a partnership agreement involves several key steps. Start by identifying all partners and including their contributions, roles, and responsibilities. Clearly outline how profits and losses will be shared, how decisions will be made, and how the agreement can be modified. For anyone needing a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, using a structured template can help ensure all necessary elements are included.

Yes, Wyoming does have a state tax return, but it is known for being business-friendly. Unlike many states, Wyoming does not impose a personal income tax on its residents. However, businesses must still file for certain types of taxes. When forming a partnership and drafting a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, it's crucial to understand the tax obligations applicable to your partnership.

A legal document for a partnership is typically a partnership agreement. This document sets the terms and conditions under which the partners will operate their business together. It outlines each partner's rights, obligations, and the management structure. For those seeking a Wyoming Commercial Partnership Agreement in the Form of a Bill of Sale, using a template can simplify the process.