Wyoming Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides an extensive variety of legal document templates that you can download or print.

By utilizing the site, you can access numerous forms for business and personal purposes, sorted by categories, states, or keywords. You can quickly obtain the most recent versions of forms like the Wyoming Direct Deposit Form for Stimulus Check.

If you already have an account, Log In and retrieve the Wyoming Direct Deposit Form for Stimulus Check from the US Legal Forms collection. The Download button will be visible on every form you view. You can access all previously downloaded forms within the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Wyoming Direct Deposit Form for Stimulus Check. Every document you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Wyoming Direct Deposit Form for Stimulus Check with US Legal Forms, one of the most comprehensive collections of legal document templates. Take advantage of a wide array of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the appropriate form for your city/region.

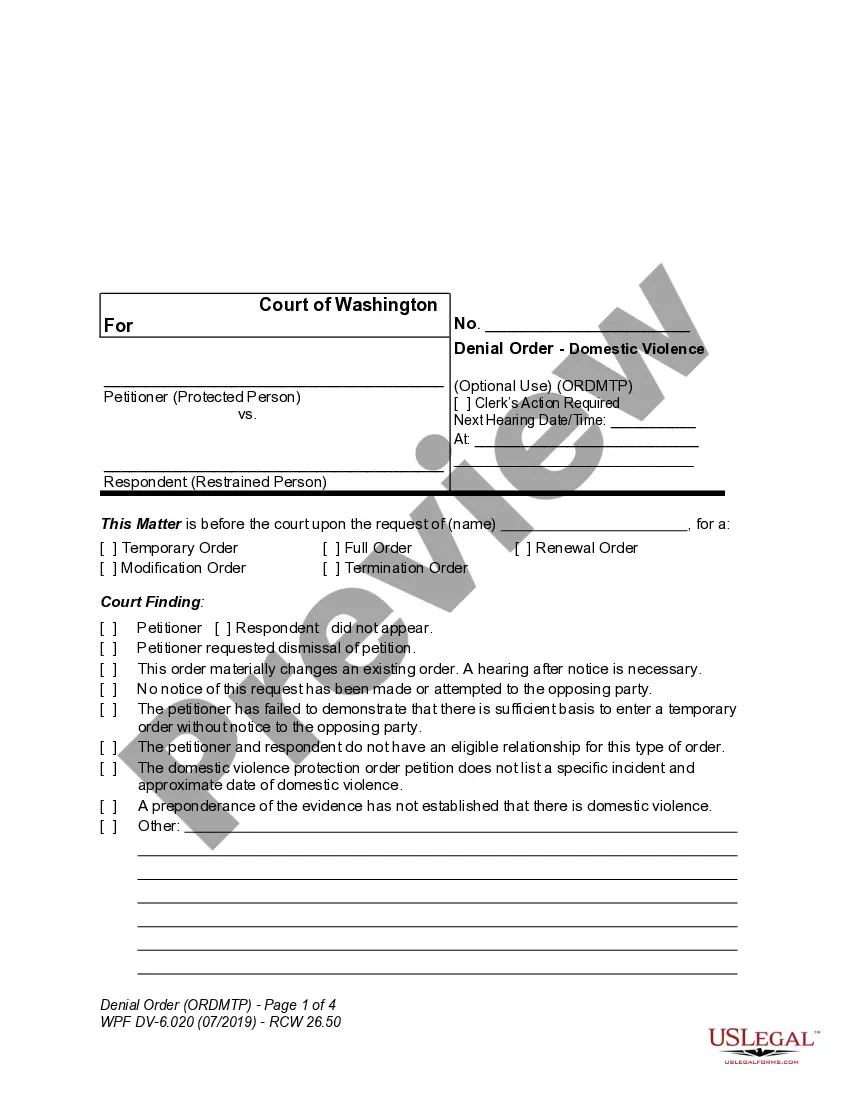

- Click the Preview button to review the content of the form.

- Examine the form details to ensure you have selected the correct document.

- If the form does not meet your specifications, use the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Eligible individuals can claim the credit on line 30 of Form 1040 or Form 1040-SR. Tax software should allow users to claim the stimulus check funds, but you will need to know how much you already received from the IRS. This can be found via bank statements for the deposit amount, or via your IRS online account.

Most people don't have to do anything to provide these details because the IRS can get them from 2018 or 2019 tax returns. But for some people, more information is needed. If you're one of them, you can fill out a simple form on the IRS website.

Once the tax return has been filed and accepted by the IRS the method or means to receive the federal tax refund cannot be changed. If your bank information is incorrect the bank will reject the direct deposit of the refund.

To get your money, you'll need to claim the 2021 Recovery Rebate Credit on your 2021 return. Filing electronically can guide you through the form. Don't claim any missing first or second stimulus payments on your 2021 return; rather, you'll need to file a 2020 return or an amended return to get these payments.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

Even if you are not owed additional money, you'll still need the letter to report any stimulus payments on your taxes. (If you have any tax questions, feel free to fill out this form, which also is below. USA TODAY will be answering top reader questions as we go through the 2022 tax season.)

You need to file federal tax form 1040 or 1040-SR for 2020 to claim your Recovery Rebate Credit. You'll also need your IRS Notice 1444, the letter the IRS should have sent to you a few days after you got your first stimulus check, and IRS Notice 1444-B, which you would have gotten after your second stimulus check.

Stimulus Checks and Direct Deposit. While Get My Payment allows you to give bank direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file.

You need to file federal tax form 1040 or 1040-SR for 2020 to claim your Recovery Rebate Credit. You'll also need your IRS Notice 1444, the letter the IRS should have sent to you a few days after you got your first stimulus check, and IRS Notice 1444-B, which you would have gotten after your second stimulus check.