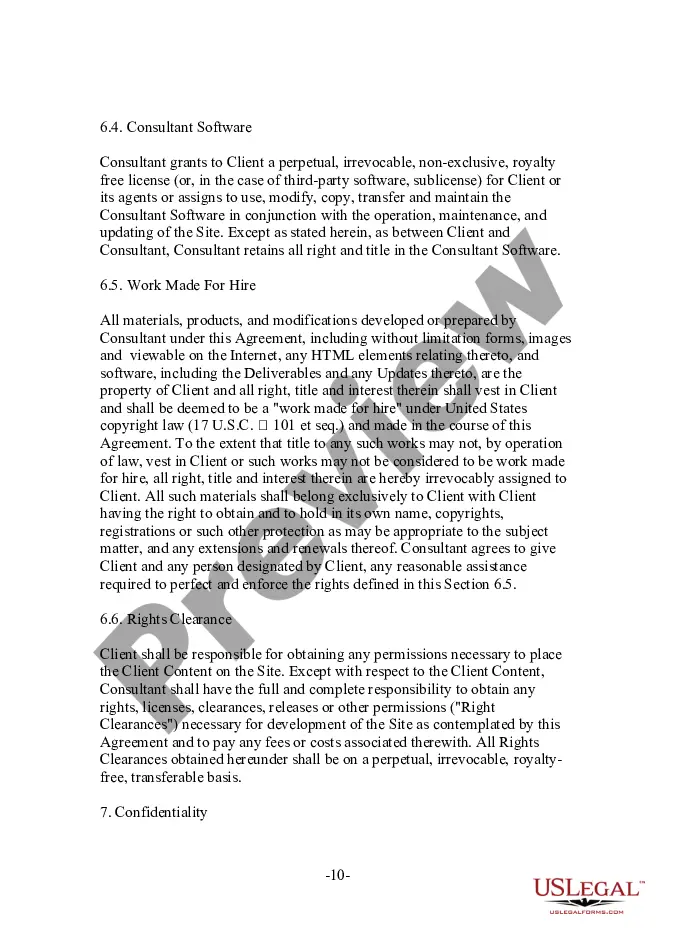

West Virginia Retail Web Site Service Agreement

Description

How to fill out Retail Web Site Service Agreement?

Are you within a place that you need to have documents for sometimes organization or personal functions just about every time? There are plenty of legal file themes available on the Internet, but getting versions you can rely isn`t effortless. US Legal Forms offers thousands of form themes, like the West Virginia Retail Web Site Service Agreement, which can be written in order to meet federal and state needs.

In case you are presently knowledgeable about US Legal Forms web site and possess a merchant account, just log in. After that, you may acquire the West Virginia Retail Web Site Service Agreement format.

If you do not have an account and need to start using US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is for that appropriate town/county.

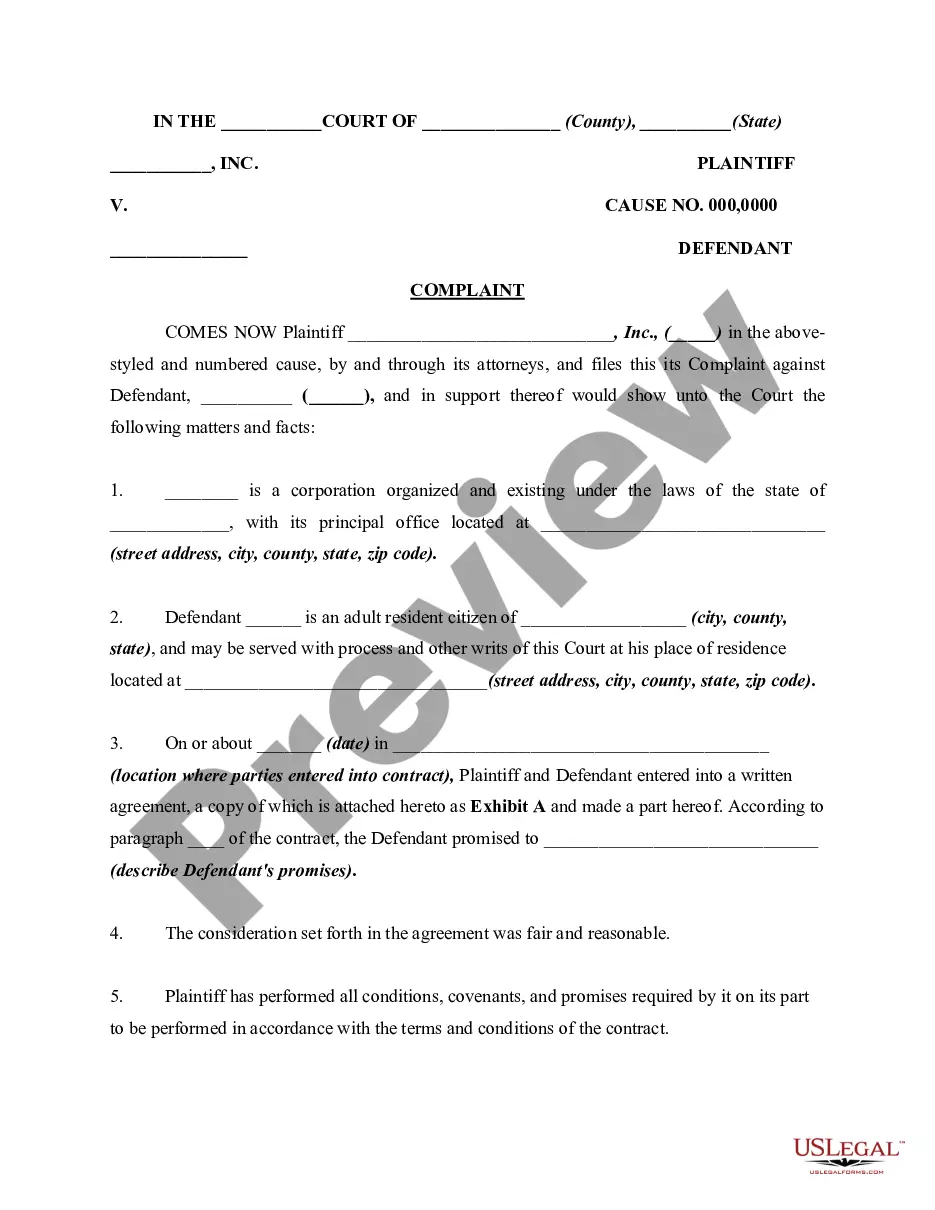

- Take advantage of the Review option to check the form.

- Read the description to actually have selected the correct form.

- When the form isn`t what you`re looking for, take advantage of the Look for area to find the form that fits your needs and needs.

- Whenever you obtain the appropriate form, click on Acquire now.

- Pick the costs prepare you need, submit the specified information and facts to create your account, and pay for your order utilizing your PayPal or charge card.

- Pick a convenient data file formatting and acquire your copy.

Locate every one of the file themes you have purchased in the My Forms menus. You can get a additional copy of West Virginia Retail Web Site Service Agreement whenever, if possible. Just select the necessary form to acquire or printing the file format.

Use US Legal Forms, by far the most substantial selection of legal varieties, to save time and avoid faults. The services offers expertly manufactured legal file themes that can be used for a variety of functions. Generate a merchant account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Better known as SaaS, these products are cloud-based software products, accessed online by customers. The definition of SaaS sometimes falls in the gray area of ?digital service.? West Virginia does tax SaaS products, but check the website to confirm that the definition firmly applies to your service.

West Virginia taxes SaaS, but virtually no other digital products or services, with the exception of streaming video. The taxability of these products depends on various factors, including the type of product, the method of delivery, and the location of the seller and the buyer.

Tax-exempt goods Examples include most textbooks, prescription drugs, and medical supplies. We recommend businesses review the laws and rules put forth by the West Virginia State Tax Department to stay up to date on which goods are taxable and which are exempt, and under what conditions.

In Which States Should You Charge Sales Tax on SaaS Subscriptions? Arizona ? SaaS is taxable in Arizona. ( ... Arkansas ? SaaS is non-taxable in Arkansas. ... California ? SaaS is non-taxable in California since there is no transfer of tangible personal property. (

Food Seller's Permit in West Virginia Any business that plans to sell tangible goods that are subject to sales tax needs a seller's permit.

Virginia does not tax any cloud, SaaS, or digital products. The state only taxes physical goods and limited, explicitly enumerated services.

All sales of goods and services are presumed subject to Sales and Use Tax unless an exemption is clearly provided. Sales Tax is imposed on the sale of goods and services by the vendor at the time of purchase.

The state of West Virginia became a full member of Streamlined Sales Tax on October 1, 2005.