West Virginia Term Sheet - Convertible Debt Financing

Description

How to fill out Term Sheet - Convertible Debt Financing?

US Legal Forms - one of the biggest libraries of lawful forms in the United States - provides a wide range of lawful file web templates it is possible to download or print out. Utilizing the site, you can find 1000s of forms for company and specific uses, sorted by groups, says, or key phrases.You can find the most recent types of forms like the West Virginia Term Sheet - Convertible Debt Financing within minutes.

If you already have a registration, log in and download West Virginia Term Sheet - Convertible Debt Financing through the US Legal Forms local library. The Down load option will appear on every single develop you see. You gain access to all formerly downloaded forms in the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are straightforward guidelines to obtain began:

- Be sure you have selected the best develop for the city/state. Click the Review option to examine the form`s information. Browse the develop information to ensure that you have selected the correct develop.

- If the develop doesn`t fit your demands, take advantage of the Research field near the top of the screen to discover the one which does.

- Should you be satisfied with the form, verify your choice by simply clicking the Buy now option. Then, choose the prices strategy you favor and offer your credentials to register for an account.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal account to complete the financial transaction.

- Choose the file format and download the form on the gadget.

- Make alterations. Load, modify and print out and sign the downloaded West Virginia Term Sheet - Convertible Debt Financing.

Every single design you added to your account lacks an expiry date and is also the one you have eternally. So, if you want to download or print out one more version, just proceed to the My Forms portion and then click in the develop you want.

Gain access to the West Virginia Term Sheet - Convertible Debt Financing with US Legal Forms, the most extensive local library of lawful file web templates. Use 1000s of expert and express-certain web templates that fulfill your small business or specific requirements and demands.

Form popularity

FAQ

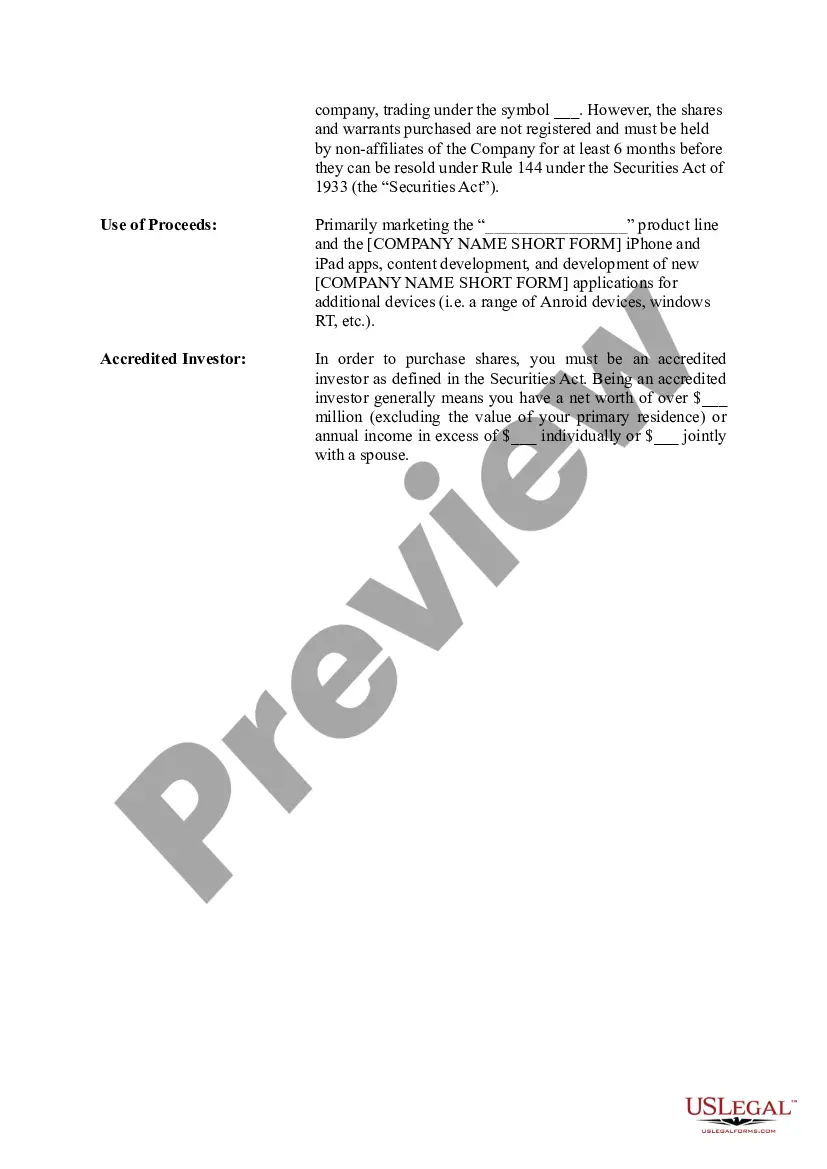

Share. Convertible debt definition. With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future. What is convertible debt? | BDC.ca BDC ? ... ? Glossary BDC ? ... ? Glossary

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

The conversion price of the convertible security is the price of the bond divided by the conversion ratio. If the bonds par value is $1000, the conversion price is calculated by dividing $1000 by 5, or $200. If the conversion ratio is 10, the conversion price drops to $100. Conversion Price: Definition and Calculation Formula Investopedia ? ... ? Investing Basics Investopedia ? ... ? Investing Basics

Value of convertible bond = independent value of straight bond + independent value of conversion option. Convertible Bond vs. Traditional Bond Valuations: What's the Difference? investopedia.com ? ask ? answers ? how-co... investopedia.com ? ask ? answers ? how-co...

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity.

Convertible debt is a debt hybrid product with an embedded option that allows the holder to convert the debt into equity in the future. The ratio is calculated by dividing the convertible security's par value by the conversion price of equity. Conversion Ratio: Definition, How It's Calculated, and Examples Investopedia ? ... ? Financial Ratios Investopedia ? ... ? Financial Ratios

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.