West Virginia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

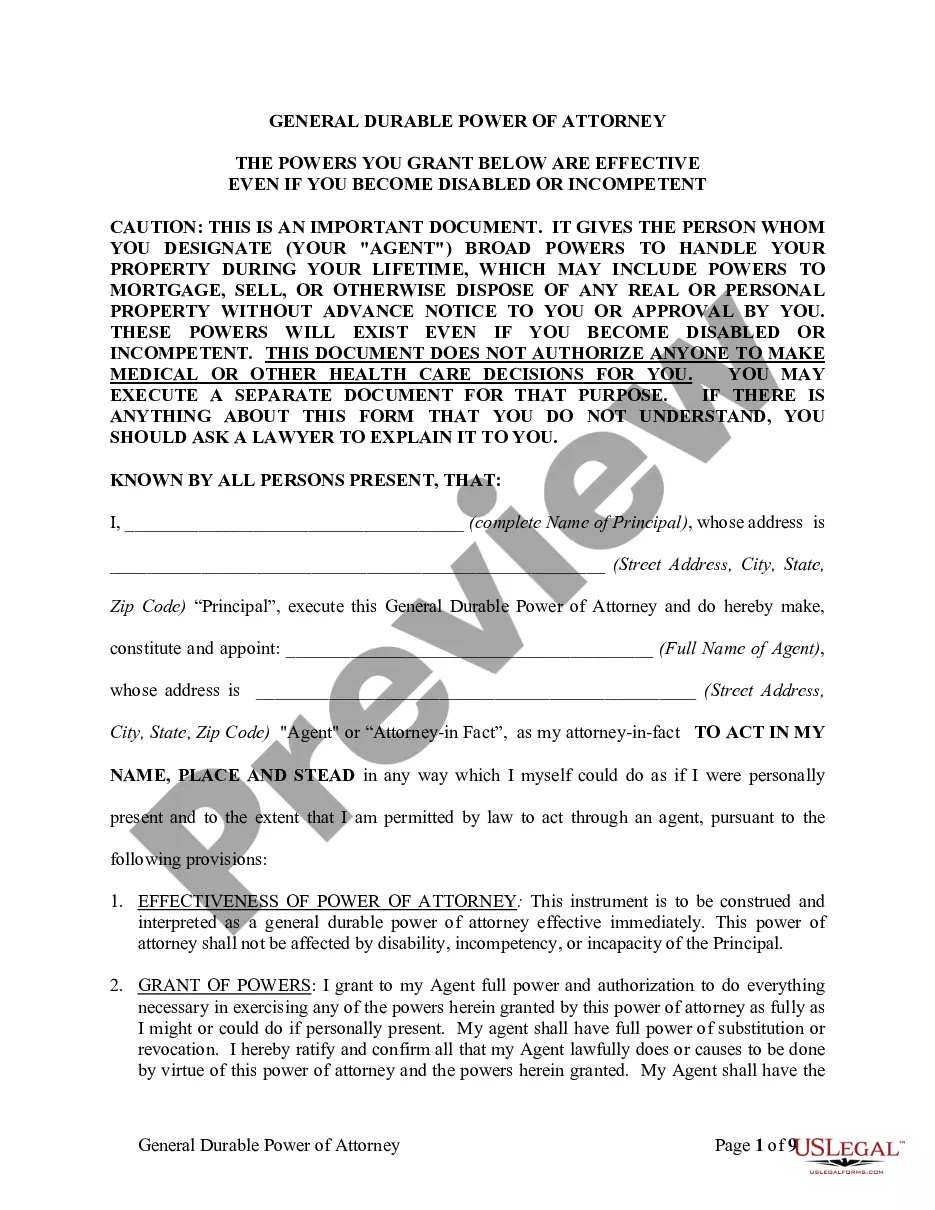

Choosing the best authorized document web template might be a struggle. Naturally, there are a variety of themes available on the Internet, but how can you get the authorized type you want? Take advantage of the US Legal Forms website. The assistance delivers a huge number of themes, for example the West Virginia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent, that can be used for business and private needs. All the varieties are checked out by professionals and fulfill state and federal demands.

When you are presently authorized, log in to your accounts and click the Down load switch to get the West Virginia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent. Make use of your accounts to look throughout the authorized varieties you have purchased earlier. Go to the My Forms tab of the accounts and have one more version of your document you want.

When you are a new end user of US Legal Forms, listed here are simple guidelines that you can adhere to:

- Very first, ensure you have chosen the appropriate type for the metropolis/county. You may look over the shape using the Review switch and study the shape explanation to guarantee this is basically the right one for you.

- In the event the type is not going to fulfill your expectations, make use of the Seach area to discover the right type.

- When you are certain the shape is acceptable, click on the Purchase now switch to get the type.

- Choose the costs prepare you need and type in the necessary details. Create your accounts and pay money for your order using your PayPal accounts or charge card.

- Pick the data file format and down load the authorized document web template to your device.

- Complete, edit and print and sign the acquired West Virginia Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

US Legal Forms is the biggest library of authorized varieties for which you can see various document themes. Take advantage of the company to down load skillfully-produced files that adhere to express demands.

Form popularity

FAQ

FHA requires that HUD's LDP (Limited Denials of Participation) and GSA (General Services Administration) list on each FHA transaction. These lists include any person(s) that has been suspended, debarred, or otherwise excluded from participation in FHA ?insured mortgage transactions.

A Specific Security Agreement, also known as a Chattel Mortgage Agreement works in similar fashion to the traditional Commercial Hire Purchase (CHP) product with similar tax deductions and flexibility surrounding its terms and balloon payments.

General security agreement?provides claims on all assets of the company (except land and buildings) Collateral mortgage?giving lenders claim to land and buildings. Personal guarantee?providing lenders access to an entrepreneur's personal assets.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

The omnibus loan agreement involves a well-defined contract between the debtor and the creditor, which outlines the necessary conditions and terms of accommodation of credit regardless of the type of loan product.

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.