West Virginia Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

Are you currently in the placement the place you need papers for both organization or person purposes just about every time? There are tons of authorized file themes available on the net, but finding versions you can rely is not easy. US Legal Forms delivers thousands of type themes, such as the West Virginia Proposal to decrease authorized common and preferred stock, that are written to fulfill federal and state needs.

If you are previously acquainted with US Legal Forms web site and get a merchant account, just log in. After that, you are able to down load the West Virginia Proposal to decrease authorized common and preferred stock format.

If you do not have an profile and want to start using US Legal Forms, abide by these steps:

- Discover the type you need and ensure it is for that proper town/area.

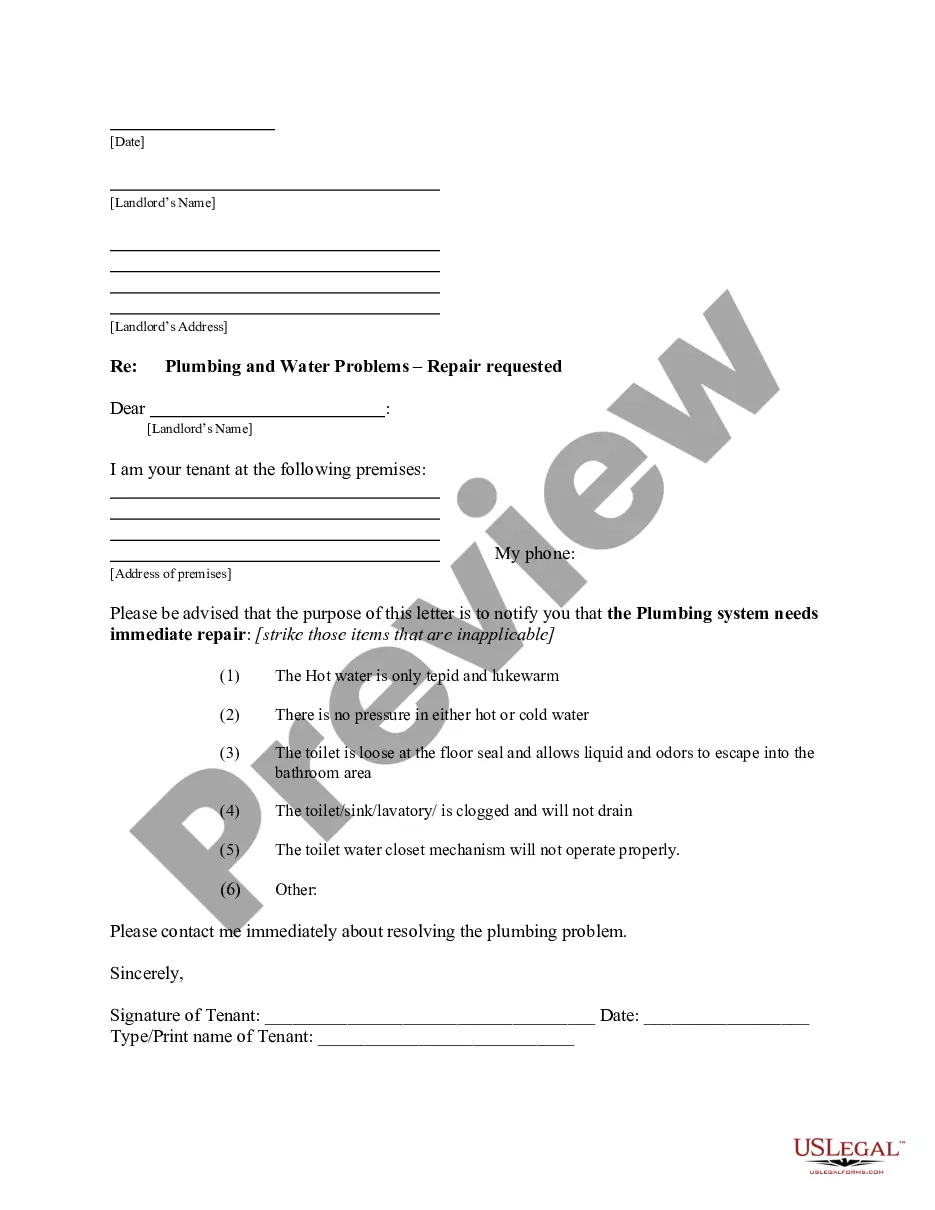

- Use the Review switch to check the shape.

- Read the outline to ensure that you have selected the appropriate type.

- In case the type is not what you are trying to find, take advantage of the Research area to obtain the type that meets your requirements and needs.

- Whenever you obtain the proper type, click Purchase now.

- Choose the rates program you desire, fill out the necessary information and facts to create your account, and buy the order with your PayPal or Visa or Mastercard.

- Select a handy paper file format and down load your duplicate.

Find all of the file themes you possess bought in the My Forms food list. You can obtain a further duplicate of West Virginia Proposal to decrease authorized common and preferred stock anytime, if needed. Just select the essential type to down load or print out the file format.

Use US Legal Forms, probably the most substantial variety of authorized forms, to save efforts and steer clear of mistakes. The service delivers skillfully produced authorized file themes that you can use for a selection of purposes. Make a merchant account on US Legal Forms and begin making your lifestyle easier.